Search Results For: dao

Bitcoin Price Analysis and SegWit

While Bitcoin price is experiencing a new growth after the almost 50% drop from its all-time high, a few analysts of the crypto market suggest that bitcoin price at $4000 is in the air.

And this moment seems to come sooner than expected.

“When added to the professed agreement for major players to work together on the Bitcoin scaling issue starting September – if it becomes a reality, the price could see between $4,000 and $5,000 before the year ends,” said an expert to Cointelegraph.

2017 has been a good year for bitcoin price, as it traded at about $950 back in January and it reached its new all-time high a few months ago in June with a value of $3011: this means that bitcoin price grew of more than 3000% in a six-months period.

Compared to the all-time high we quoted above, the current price decrease is maybe due to the uncertainty around the upcoming SegWit activation that will take place on August 1st, 2017.

For those who are unfamiliar with this, SegWit is a new upgrade to the Bitcoin blockchain that will increase the block size to support more transactions and allow a faster confirmation for transactions.

At the moment, the blockchain supports up to 2000 transactions per block in 10 minutes and SegWit will double this capacity to 4000 transactions.

Also, Segwit2x will increase the size of each block from 1MB to 2MB.

SegWit will be implemented on August 1s, while it is not sure yet if Segwit2x will be implemented too.

That said, the real reason of uncertainty is caused by the hard fork needed to implement SegWit.

This might create two different chains in a similar way to what happened to Ethereum in 2016 with the DAO and Ethereum Classic.

Not a problem for the Bitcoin price

According to many experts in the industry, while this event might create panic sell and uncertainty within the community, will not be a real problem in the next future.

Kumar Gaurav of Cashaa explained to Cointelegraph:

“When looking at 2017 so far, it still has been a good year for Bitcoin, starting just below 1000$ and now standing just below $2,000. Whether and to which extent this overall trend will continue will be seen more clearly after some crucial dates such as 1st August. If 80% of the Bitcoin community adopts the updates all should be fine. It seems most likely this will be reached, as the current signaling of intended support is at 87.8 percent, an increase from 83.28 percent in May. Comparable to when in May, following the New York agreement on SegWit2x, Bitcoin reached an all-time high of $2,160, it can reach new all-time highs after a successful activation as Bitcoin will be more attractive again and bring users of other cryptocurrencies back to Bitcoin.”

Bitcoin-based ICOs

Another reason that might be influenced the price is the growing number of Bitcoin-based ICOs or Initial Coin Offerings.

ICOs managers might have cashed out during those days and this drove the prices because a huge amount of bitcoin appeared on the market.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocurrencies 2016: Bitcoin Alternative charts

Today we want to talk about Cryptocurrencies 2016, as the just ended year has been very exciting for several digital currencies and not only for Bitcoin.

A lot of major open-source currencies, in fact, showed a good growth during 2016 and we hope to see significant expansion in 2017.

Below you’ll read charts of the excited cryptocurrencies 2016, during a period between December 27, 2015 to December 26, 2016.

Source: Coindesk.com

Bitcoin

Market Capitalization (Beginning of Year): $6,161,215,794

Market Capitalization (End of Year): $14,590,356,108

Price (Beginning of Year): $411.99

Price (End of Year): $908.17

Price (Annual High): $909.94

For sure Bitcoin is the king of cryptocurrencies 2016, if we talk about value.

It is the oldest blockchain-based asset as today (January 3rd) it celebrates its 8th anniversary: the genesis block was generated on January 3rd 2009.

While I’m writing of this article, Bitcoin price is still growing, surpassing the value of $1,000 for 1 BTC.

Bitcoin price and trading volume were supported by several global circumstances, including the Chinese yuan devaluation, the UK’s Brexit, and the election of a Donald Trump.

Ethereum

Market Capitalization (Beginning of Year): $80,339,474

Market Capitalization (End of Year): $638,041,577

Price (Beginning of Year): $2.83

Price (End of Year): $7.31

Price (Annual High): $19.59

2016 saw Ether, or the digital currencies that powers the Ethereum blockchain – become the best-performing currencies, with a more than 2,000% increase over the first six months of 2016.

The major reason for its instability was the DAO hack, the subsequent failure of the decentralized project, and the creation of ethereum classic. These factors led to a fall of nearly 50% of this altcoin value.

Anyway, Ethereum is the favorite network for possible FinTech permissioned distributed ledgers, enterprise software and Internet of Things applications, so 2017 could will probably show a capitalization increase for ether.

Litecoin

Market Capitalization (Beginning of Year): $149,142,004

Market Capitalization (End of Year): $212,469,870

Price (Beginning of Year): $3.41

Price (End of Year): $4.34

Price (Annual High): $5.55

One of the oldest bitcoin alternative, litecoin showed a stable valuation during 2016, closing $2 above its starting price for the year.

Dash

Market Capitalization (Beginning of Year): $16,081.586

Market Capitalization (End of Year): $70,675,107

Price (Beginning of Year): $2.64

Price (End of Year): $9.67

Price (Annual High): $14.42

In 2015, darkcoin decided to end its association with shadow businesses and the DarkNet by changing its name to Dash.

This re-branding seemed to work and Dash ended 2016 with pricing nearly three times, and a market capitalization close to four times.

Cryptocurrencies 2016 and their future

As we enter 2017, the future for cryptocurrencies seems bright, as the digital currency market will continue to progress and prove its worth as one of the top-performing commodities available today.

We at HolyTransaction are very happy to work with this top-rated cryptocurrencies, as our wallet can store Litecoin, Dash, Ethereum and Bitcoin within a unique login.

Needless to say, we are proud to have chosen the best and the most profitable cryptocurrencies for our multicurrency wallet you can open here for free.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft Smart Contracts: a working group to improve security

Vitalik Buterin on Microsoft Smart Contracts

Microsoft Smart Contracts: a whitepaper with Harvard

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Greatest Bitcoin Companies: TOP 30

Greatest Bitcoin Companies: which are the best?

- Blockchain.com

- BitStamp

- BitPay

- Coindesk

- Ethereum

- Bitcoin News

- Mesosphere

- Ripple

- Stock

- Consesus System

- Bitcoin Foundation

- Kraken

- Syscoin

- DAO

- Gemini

- BitFinex.com

- R3 Cev

- OkCoin

- Litecoin

- Dash

- Bitcoin Vox

- CoinScrum

- Synereo

- Tierion

- ProTip

- HolyTransaction

- Blockchain University

- AlphaPoint

- Korbit

- Vogogo

Open your free digital wallet here to store your cryptocurrencies in a safe place.

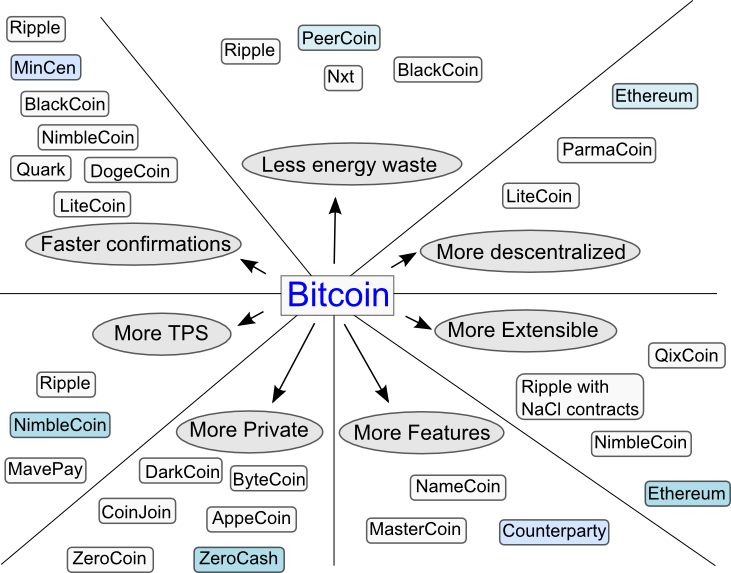

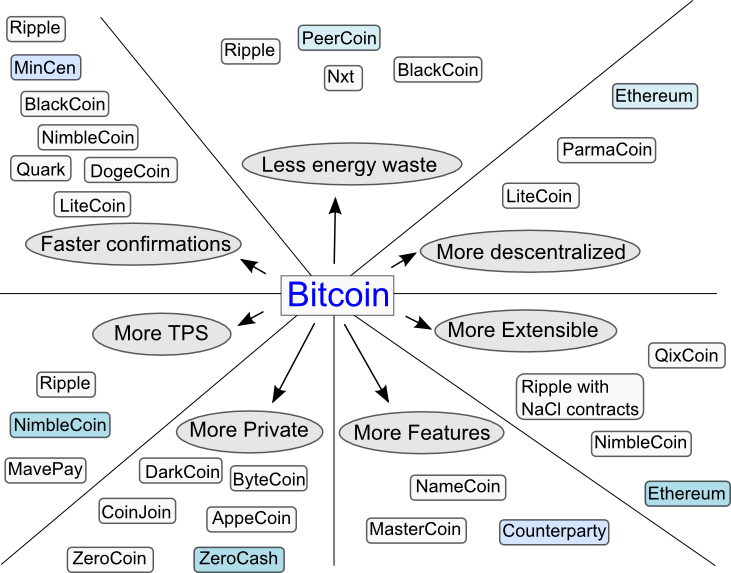

The roads to innovation in cryptocurrencies

(BITSLOG) Once upon a time there was Bitcoin

and nothing else. History was being written by Satoshi and a few

illuminated minds that posted the most interesting ideas in the

Bitcointalk forums and IRC channels. Almost every cryptocurrency idea

I’ve heard of had a seed in some of these heated online discussions.

During 2009 improving every part of Bitcoin seemed to at the reach of

the hand: changing the scripting system, the proof-of-work function, the

block format and more. Then the conservative era begun: Bitcoin value

had risen considerably and much more money was at stake. So there was no

room for destabilizing changes anymore. During 2010 ideas were still

discussed, but not implemented. But as powerful ideas cannot be

contained so during 2011 alt-coins came into existence. Apart from Namecoin,

which was something different than a mere cryptocurrency, the first

alt-coin code changes were all minor; only the economic constants, such

as the money supply, were changed (Devcoin, lxcoin, l0coin). Multicoin

allowed simultaneous management of multiple block-chains, mainly to

experiment with different economic constants. Soon other more extensive

changes appeared, such as using another proof-of-work function (Tenebrix, FairBrix, Litecoin).

All these projects changed no more than a hundred lines of the parent

Bitcoin fork. During 2012 cryptocurrencies started making deeper changes

in the code, using proof-of-stake instead of proof-of-work (PPCoin, NovaCoin, PeerCoin).

But still no cryptocurrency took more than a month of work to be

programmed, since there was no business model that could pay for the

development of entire new codebases. Pre-mining was seen as a scam

rather than an investment in the development team, since no profound

innovation had been achieved and no codebase had been started from

scratch.

The first non-Bitcoin based currencies were created during 2013 (Ripple, Nxt, MasterCoin, Counterparty). Three promising new cryptocurrencies will be launched during 2014: NimbleCoin, BitSharses and Ethereum.

With the exception of NimbleCoin, all non-Bitcoin based currencies

adopted either an IPO business model or the pre-mine business model to

pay the founders and support the development after launch. NimbleCoin

seems to be the only one that still tries to bootstrap based on an

equal opportunity for all members of the community. Some of these

currencies (often called “2.0″) add new features not related to

payments: Smart contracts, betting, prediction markets, shares,

distributed exchanges, user defined assets, contracts for difference,

dividends, Decentralized Autonomous Organizations (DAOs), distributed

storage and gaming. Innovation seems to have been primary directed to

provide a more extensible cryptocurrency and more features. Nevertheless

this may not be what users require today. To be accepted world-wide,

users will demand cryptocurrencies to satisfy their everyday needs in

term of usability. They will demand the cryptocurrency to allow them buy

some croissants in the local shop with a standard smartphone in a few

seconds so they can keep walking without even worrying about transaction

confirmation time. Also, considering the deflationary properties of

Bitcoin, and the expected rise in fees, users will soon demand lower

transaction fees, which is also strongly tied to better scalability and

lower mining energy waste. Energy efficiency will also be demanded for

ecological reasons. More experience users will demand higher transaction

privacy and more politicized users will demand higher decentralization.

As I see the ecosystem right now, these are the main improvements users

will demand, more than any new embedded financial instrument. Here is

my wish list in order of importance:

- More merchants accepting the coins (specially retail stores)

- Lower price volatility

- Faster payment confirmations

- Lower fees (more transactions per second)

- Less energy waste in mining

- More decentralized

- More private

- More features

- More extensible

It’s interesting that the two last innovation areas, which in my

opinion are the less solicited by the general public, are the ones where

most money and time has been invested. This may be because they are the

most “geeky” and futuristic use cases. To summarize I present diagram

with the current roads to innovation in cryptocurrencies. Bitcoin it is a

very well-balanced and conservative design and it’s plotted right in

the middle. I tried to plot how the current and past cryptocurrencies

have positioned themselves in the innovation landscape. In each category

I have chosen the most innovative ones and highlighted the best

cryptocurrency (IMHO). Note that Ripple is not part of the comparison

because it still relies on private servers and so it has an unfair

advantage. If it were truly open and yet secure, it will probably win in

most categories. Also note that faster payments confirmations is not

equal to lower block intervals: certain coins with low block intervals

have greater confirmation times because of stale block rate and frequent

chain undoes (such as Quark). When comparing new features, I’m

comparing cryptocurrencies with the features built-in and supported by

the core development team. Ethereum can emulate practically every

feature, but special scripts must be developed and maintained for each

feature added, so it wasn’t chosen in that category. There is another

category I haven’t included because it has too few members, which is

“More Security”. It comprises mainly the GHOST protocol.

Open your free digital wallet here to store your cryptocurrencies in a safe place.