(BITSLOG) Once upon a time there was Bitcoin

and nothing else. History was being written by Satoshi and a few

illuminated minds that posted the most interesting ideas in the

Bitcointalk forums and IRC channels. Almost every cryptocurrency idea

I’ve heard of had a seed in some of these heated online discussions.

During 2009 improving every part of Bitcoin seemed to at the reach of

the hand: changing the scripting system, the proof-of-work function, the

block format and more. Then the conservative era begun: Bitcoin value

had risen considerably and much more money was at stake. So there was no

room for destabilizing changes anymore. During 2010 ideas were still

discussed, but not implemented. But as powerful ideas cannot be

contained so during 2011 alt-coins came into existence. Apart from Namecoin,

which was something different than a mere cryptocurrency, the first

alt-coin code changes were all minor; only the economic constants, such

as the money supply, were changed (Devcoin, lxcoin, l0coin). Multicoin

allowed simultaneous management of multiple block-chains, mainly to

experiment with different economic constants. Soon other more extensive

changes appeared, such as using another proof-of-work function (Tenebrix, FairBrix, Litecoin).

All these projects changed no more than a hundred lines of the parent

Bitcoin fork. During 2012 cryptocurrencies started making deeper changes

in the code, using proof-of-stake instead of proof-of-work (PPCoin, NovaCoin, PeerCoin).

But still no cryptocurrency took more than a month of work to be

programmed, since there was no business model that could pay for the

development of entire new codebases. Pre-mining was seen as a scam

rather than an investment in the development team, since no profound

innovation had been achieved and no codebase had been started from

scratch.

The first non-Bitcoin based currencies were created during 2013 (Ripple, Nxt, MasterCoin, Counterparty). Three promising new cryptocurrencies will be launched during 2014: NimbleCoin, BitSharses and Ethereum.

With the exception of NimbleCoin, all non-Bitcoin based currencies

adopted either an IPO business model or the pre-mine business model to

pay the founders and support the development after launch. NimbleCoin

seems to be the only one that still tries to bootstrap based on an

equal opportunity for all members of the community. Some of these

currencies (often called “2.0″) add new features not related to

payments: Smart contracts, betting, prediction markets, shares,

distributed exchanges, user defined assets, contracts for difference,

dividends, Decentralized Autonomous Organizations (DAOs), distributed

storage and gaming. Innovation seems to have been primary directed to

provide a more extensible cryptocurrency and more features. Nevertheless

this may not be what users require today. To be accepted world-wide,

users will demand cryptocurrencies to satisfy their everyday needs in

term of usability. They will demand the cryptocurrency to allow them buy

some croissants in the local shop with a standard smartphone in a few

seconds so they can keep walking without even worrying about transaction

confirmation time. Also, considering the deflationary properties of

Bitcoin, and the expected rise in fees, users will soon demand lower

transaction fees, which is also strongly tied to better scalability and

lower mining energy waste. Energy efficiency will also be demanded for

ecological reasons. More experience users will demand higher transaction

privacy and more politicized users will demand higher decentralization.

As I see the ecosystem right now, these are the main improvements users

will demand, more than any new embedded financial instrument. Here is

my wish list in order of importance:

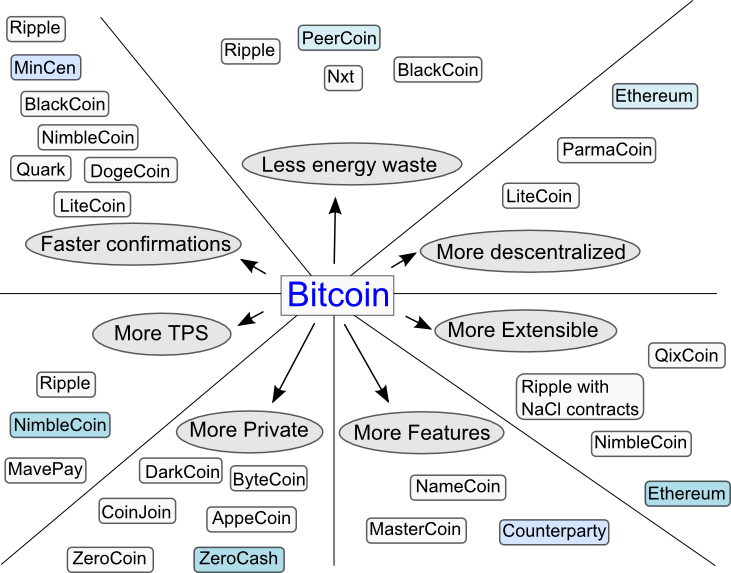

It’s interesting that the two last innovation areas, which in my

opinion are the less solicited by the general public, are the ones where

most money and time has been invested. This may be because they are the

most “geeky” and futuristic use cases. To summarize I present diagram

with the current roads to innovation in cryptocurrencies. Bitcoin it is a

very well-balanced and conservative design and it’s plotted right in

the middle. I tried to plot how the current and past cryptocurrencies

have positioned themselves in the innovation landscape. In each category

I have chosen the most innovative ones and highlighted the best

cryptocurrency (IMHO). Note that Ripple is not part of the comparison

because it still relies on private servers and so it has an unfair

advantage. If it were truly open and yet secure, it will probably win in

most categories. Also note that faster payments confirmations is not

equal to lower block intervals: certain coins with low block intervals

have greater confirmation times because of stale block rate and frequent

chain undoes (such as Quark). When comparing new features, I’m

comparing cryptocurrencies with the features built-in and supported by

the core development team. Ethereum can emulate practically every

feature, but special scripts must be developed and maintained for each

feature added, so it wasn’t chosen in that category. There is another

category I haven’t included because it has too few members, which is

“More Security”. It comprises mainly the GHOST protocol.

Open your free digital wallet here to store your cryptocurrencies in a safe place.