You can’t leash the DOGE

When ideas and community purpose matter more than the last fin-tech innovation.

Dogecoin is a cryptocurrency, a form of digital money that like bitcoin, enables peer-to-peer transactions across a decentralized network.

If you’ve spent any time on the internet during the last decade, you shall have heard of the Doge meme: the iconic Shibe, barking comic sans quote like, “so scare,” “much noble,” “wow.”

At the peak of the meme’s popularity near the tail end of 2013, Palmer, an Australian marketer for one of the world’s largest tech companies, made a joke combining two of the internet’s most talked-about topics: cryptocurrency and Doge.

It was a joke taking aim at the bizarre world of crypto and at the recent coin-naming hype.

“Investing in Dogecoin,” Palmer tweeted, “pretty sure it’s the next big thing.”

And the tweet got a lot of attention.

So the joke became a true play.

He bought the Dogecoin.com domain and uploaded a photoshopped Shibe on a coin. Adding a note on the site: If you want to make Dogecoin a reality, get in touch.

And this is just the tip. So, If you are interested in knowing the greatest detail of Dogecoin history, we bet you’ll like this article by Alex Moskov published at CoinCentral.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin vs. Litecoin: What makes them different?

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

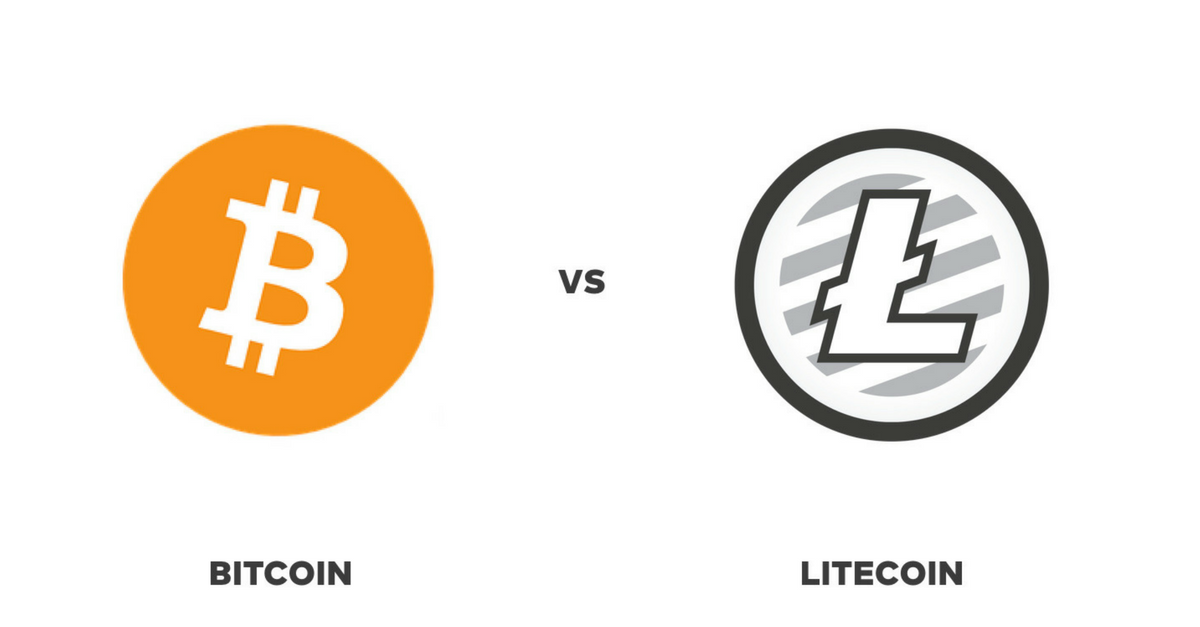

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why Telegram is so popular in the crypto community?

Bitcoin can rightly be called the “star” of the past year, since its price rise attracted the world attention to the cryptocurrency market, which becomes inexorably popular from day to day. Questions about how to become a member of the crypto community and earn from it provoked the creation of Telegram channels about cryptocurrencies, which provide users with all the information they are interested in the real-time mode.

And the lack of monetization of the application makes it attractive for both individual participants and large projects – so much attractive that many decentralized projects, digital publishers houses and even exchanges use the messenger and create the full-fledged platforms for communication and advertising. There are even whole groups of “whales” – the owners of large states in the cryptocurrency. Such public accounts can have up to 30 000 – 40 000 active users. The most famous have the talking name – Whale Club and Coin Farm. Here you can meet those who bought bitcoin only for $ 1, and sold for $ 9,000.

$ 5,000 per subscription

There are some channels, sending signals, related to the growth of exchange rates, to subscribers. At the same time, the monetization of such communities is quite successful. So, the price of joining a closed paid channel can reach $ 5,000. Many users are willing to pay such amounts, because they are sure: with one signal it is possible to multiply your asset by up to 10 times. You can be part of a speculative market, but it’s much more effective to create it yourself. This is the opinion of the pump groups subscribers, whose goal is to repeatedly increase the price of a particular currency by making a group exchange purchase by using the strategy of increasing. The final sale price is usually announced in advance and exceeds the purchase price by at least 2 times. For example, in the leading Russian-language pump channel Big Russian PUMP no less than + 200% increase is promised. Further, after the agreed sale, the rate may return to the original values. On such jumps in the token price it is easy to understand whether a coin was pumped or it’s a question of growth against the background of natural demand.

Where is Lambo?

Which messenger still can boast of having the games-bots? Of course, there is no sense to expect a wow effect from them, but they can help to spent some time while transit.

Well, finally, no hype is done without memes, especially when it comes to millions of dollars. If you know the crypto market for a long time, then, for sure, you are familiar with the phrase “When moon?”, which means waiting for the coin to grow. We have collected the top 5 phrases and memes, which any self-respecting crypto trader should know:

1st place – To the moon

The growth of each single coin on crypto market is accompanied with the image of a rocket flying to the moon. Originally for bitcoin, the “cosmic” growth was a figure of $ 1000, then it reached 2000, and now, to fly to the moon, it must overcome the barrier of $ 50,000. In general, for altcoins this distance is much less.

2nd place – When lambo?

Along with cosmic symbolism, the sign of the crypto trader’ success is Lamborghini, or, as it was fixed in the community, “lambo”. Why is this car, and not Ferrari or Tesla, is unknown. But you can always count how many coins you need to buy this sport car. For example, according to https://crypto-to-lambo.com/, the bitcoin owner will need only 36 coins.

3 place – Just HODL

Being just some typos, the word hodl (instead of hold – hold), actively spread in the cryptocurrency community’ circles. However, later, it acquired its own meaning: «HODL», Hold on for dear life

4th place – Mr Trader

Judging by the diversity of this set of stickers, the popular Mr. Trader went through all the charms of crypto market.

5th place – Cryptolamb

When it comes to the falling market, no one wants to be known as a “cryptolamb”. This slang characterizes an inexperienced trader who buys the currency at the last stages of growth, often during the pump, without discouraging initial costs.

And, at last, we will be honest, Telegram gives only those mailings on which the user is subscribed. There is no place to spam. The only weighty drawback is the number of channels in the phone of the cryptocurrency community member, which quickly grows to a very significant one, making it difficult to use the messenger for its intended purpose and turning it into a clogged news line.

This Article was provided by our friend Christopher Owen

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ten Years Of The World With Bitcoin Living in a crazy-crazy crypto world.

Bitcoin rose from unknown to mainstream recognition largely thanks the incredulous surge in value it saw in 2017. But then the price went down, sparking yet another heated discussion about the volatile unpredictability of the bitcoin.

Nowadays, discussions are all at their all time hype, but worth just as long as the participants know what they are talking about; and the audience has at least some grasp of the matter. But it rarely happens, as the vast majority of experts are as clueless about the intricacies of the crypto markets as is the general audience.

The infographic below, provided by our friends at BitcoinPlay, will not make us all marketing gurus but will give you a much better understanding about the driving forces behind the world’s first cryptocurrency, how it came to be, who embraced it first and how countries are handling it.

Here’s a selection of our favourite ones:

- On May 22 2010 two Pizzas cost 10k bitcoins.

- In 2013 FBI made $48 million by selling on auction one seized 144,000 Bitcoins.

- 100$ invested in July 2010 is now 18.8 million.

- Since april 2017 Bitcoin is legal payment method in Japan.

- Blockchain ledger technology when used by top10 investment bank could save $8-$12 billions.

- Chinese Mining Pool control approximately 81% of the Bitcoin network’s collective hashrate.

- Overstock, Dell, Expedia, Dish and Microsoft accept Bitcoin payments.

- University of Nicosia, Cyprus was the first University to accept tuition to be paid in Bitcoin.

- Bitcoin is vat free in Switzerland.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Blockchain: the future of accounting?

Scrolling through this brief and meaningful infographic, provided by our fellows from Maryville University, we can get a glance of the immense and still unexploited potential of blockchain technology in Traditional Business contexts. One for all, Accounting.

Indeed the blockchain creates a decentralized ledger of all transactions where all records are updates and accessible to everyone in real-time.

And as everyone can perceive, this is a paradigm shift when it comes to subject like accounting.

This technology completely changes how monetary transaction are made, logged and given accessibility to. So its value for the Future of accounting is absolutely undeniable.

Some of the greatest possibilities which the blockchain empowers are:

1 smart contracting

2 consolidated bookkeeping

3 standardization in auditing

4 Security and Trust

5 Less Paperwork for accountant

Today, blockchain technologies outside of cryptocurrency and digitalized accounting systems are still in their infancy. And the best course of action for a smart professional is to brace for disruption and stay ahed of digital trends.

We are all witnesses in this era of revolution. But witnessing is not what counts.

Infographic from Maryville University Online Bachelor of Accounting Program

Open your free digital wallet here to store your cryptocurrencies in a safe place.