Search Results For: bitcoin price

Bitcoin vs. Litecoin: What makes them different?

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

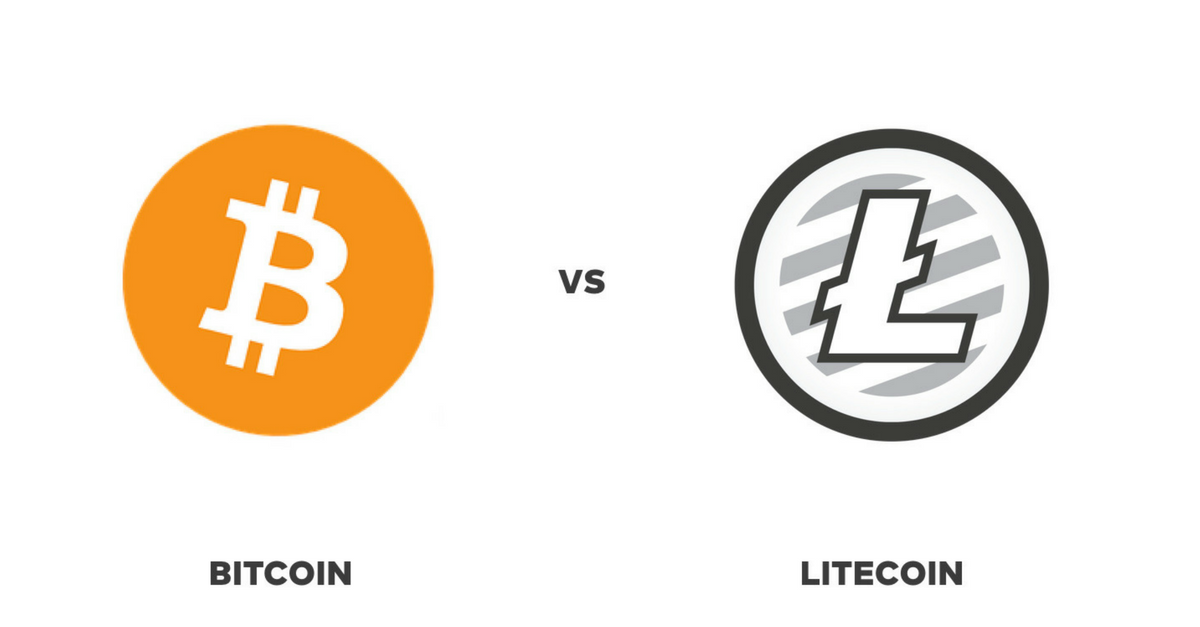

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ten Years Of The World With Bitcoin Living in a crazy-crazy crypto world.

Bitcoin rose from unknown to mainstream recognition largely thanks the incredulous surge in value it saw in 2017. But then the price went down, sparking yet another heated discussion about the volatile unpredictability of the bitcoin.

Nowadays, discussions are all at their all time hype, but worth just as long as the participants know what they are talking about; and the audience has at least some grasp of the matter. But it rarely happens, as the vast majority of experts are as clueless about the intricacies of the crypto markets as is the general audience.

The infographic below, provided by our friends at BitcoinPlay, will not make us all marketing gurus but will give you a much better understanding about the driving forces behind the world’s first cryptocurrency, how it came to be, who embraced it first and how countries are handling it.

Here’s a selection of our favourite ones:

- On May 22 2010 two Pizzas cost 10k bitcoins.

- In 2013 FBI made $48 million by selling on auction one seized 144,000 Bitcoins.

- 100$ invested in July 2010 is now 18.8 million.

- Since april 2017 Bitcoin is legal payment method in Japan.

- Blockchain ledger technology when used by top10 investment bank could save $8-$12 billions.

- Chinese Mining Pool control approximately 81% of the Bitcoin network’s collective hashrate.

- Overstock, Dell, Expedia, Dish and Microsoft accept Bitcoin payments.

- University of Nicosia, Cyprus was the first University to accept tuition to be paid in Bitcoin.

- Bitcoin is vat free in Switzerland.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bic Camera: new merchants accept Bitcoin in Japan

A new electronics retailer decided to start accepting bitcoin in Japan as one of the available payment methods in all its shops within the country.

It is Bic Camera that began to accept bitcoin at several shops back in April, and that is now it is looking to expand this payment after seeing huge levels of demand from its customers.

The retailer is taking payments in the digital currency thanks to a partnership with the domestic bitcoin exchange called bitFlyer, so they can convert bitcoin into yen right after the acceptance.

Bic Camera sells a wide range of products, including cameras, computers and home appliances like fridges and washing machines.

News that Bic Camera is accepting bitcoin at more locations came after the Japanese government’s new regulations around digital currencies and the exchange services. Among those, for example, there is a legal definition for bitcoin as a kind of payment instrument and the decision to eliminate bitcoin taxation.

Also, this could be one reason why we might aspect a new growth in the bitcoin price in the next days.

Read more about Bitcoin in Japan here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin all time high: Read here the possible reasons

Today, on June 6th, a new Bitcoin all time high has been hit.

According to CoinMarketcap, in fact, the bitcoin price reached a value of $2,911.86, surpassing the previous bitcoin all time high of $2,791.69 set less than a month ago on May 25th.

Bitcoin began June with a price of about $2,500, trading at $2,300 on June 1st.

What are the reasons for this new bitcoin all time high?

As always in these events, many are the possible causes for this recent growth in the bitcoin price.

Here a quick report on what is happening in the bitcoin industry during these days.

Click on the link below to read more about that specific topic.

- Bitcoin regulation in Japan that lead more merchants to accept the digital currency;

- Uncertain administration by Donald Trump. A dubious politic always lead investors to take their money in a “Safe Heaven”;

- Growing demand in Asia;

- ICOs used as a faster way to raise funds

Do you think there are more reasons for this bitcoin all time high?

Comment the news with us!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin demand in Asia is more active than in the US

Back on May 31st, one the major Bitcoin exchanges in China called OKCoin returned to help improving the Bitcoin demand withing the Chinese exchanges after a period of suspension of transactions.

As a result, more bitcoin investors are recovering their interest in bitcoin and they are driving the demand for the digital currency.

So, thanks to the activation of withdrawals, bitcoin is now trading at a premium rate in China.

Also, the Chinese press that talks about bitcoin as digital gold is pushing the recent growth of the bitcoin demand for local traders.

On Friday, bitcoin price was about $2,340 in China. A value that was $50 higher than the US rate.

Of course, there are several other major factors that are driving bitcoin price. For example the legalization of the digital currency in Japan, and the use of ICOs in raising funds.

Experts believe that the increasing demand in Asia is pushing the recent growth in the bitcoin price.

South Korea

In South Korea, Bitcoin price increases up to $3,100 when the price on the US exchanges was about $2,400, so $300 higher than the US.

A few startups are also using bitcoin for sending remittances since it works better and faster than traditional money.

For example, one of these startups is called Bluepan, located in South Korea. This company provides an easy way to send money from overseas workers to their families.

In 2 years, Bluepan has processed payments worth $65 mln and for the past year, they recorded a five-time increase in transactions.

Why in Asia?

That said, it is clear that Bitcoin demand in Asia is increasing and its driving prices, while North America shares only a small amount of all users in any sector.

For example, there are fewer customers in North America who use money transfers than in Asia.

This is maybe due to the fact that the worldwide financial system is based on the US dollar, so remittance transactions are easier between dollars and non-dollar currencies compared with transactions that involve two non-dollar currencies.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Would you ever trust people who said “Bet on Bitcoin” in 2010?

If you had bet on bitcoin in 2010, now you would be a millionaire.

In fact, according to a recent video shared by the CNBC, if you purchased $100 in bitcoin back in 2010 now y0u would have something like $75 mln.

During a relatively short period of 7 years, bitcoin price rose from $0.003 to its all-time high of $2392, so return of 796,000%.

The greatest part of mainstream media experts argues that bitcoin price is speculative because investors purchase bitcoin only because they expect a massive return in the next future.However, as Cointelegraph previously reported, prominent investors including GoldSilver.com founder Mike Maloney are encouraging investors to hold Bitcoin as a mandatory asset to hedge against inevitable global economic uncertainty and financial instability, not just as a large return investment.

However, as Cointelegraph previously reported, major investors suggest people hold bitcoin as a mandatory asset to hedge against inevitable global economic uncertainty and financial instability, so not just because of a large return investment.

Bitcoin is digital cash

In Japan bitcoin finally became a legal method of payment with more and more retailers and airlines that are starting to accept the digital currencies for payments.

Maybe it is for this reason that Japan is becoming the first country to invest in bitcoin, increasing the demand for the digital currency and driving its price.

On the other hand, bitcoin is seen as a “risky investment” because of its non-traditional nature by a few important magazines and media including the Washington Post.

Bet on bitcoin as a “Safe haven”

As revealed by a recent study published by Cointelegraph, a $10,000 investment in bitcoin back in 2010 is now worth $200 mln, while the same investment in gold led to a negative return of $9,900.

That said, I suggest to dedicate much effort to building a time machine, so we would be able to buy bitcoin at $0.003.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin Airlines: Japanese Peach to accept the digital currency

Peach Aviation is going to become the first Japan’s airline to accept bitcoin for buying any flight.

This move comes after the Japanese decision to regulate bitcoin as currency, becoming a legal method of payment back in April 1st, 2017.

During a recent interview with CEO Shinichi Inoue, he said:

“Now you can travel without your wallet. I think this is innovation; we’ll put all our energy into it.”

Peach is a budget domestic flights company that operates in Korea, China and Thailand.

The firm announced that they will accept bitcoin payments by the end of 2017; also, the firm is looking to install Bitcoin ATMs at airports.

“This is a real first step in partnerships for Japan and we are aiming for more company and service tie-ups,” said Inoue in an interview conducted by Bloomberg.

“We want to encourage visitors from overseas and the revitalization of Japan’s regions.”

Several major retailers and merchants are starting to accept bitcoin in Japan thanks to the recent law on digital currencies, as you can read here.

And this is maybe one of the prominent reason why bitcoin price is growing so much during the latest period.

Also, Japanese traders are driving bitcoin prices as they transacted huge amounts on the exchanges: recent studies revealed that Yen is the major fiat currency being exchanged for bitcoin.

Bitcoin airlines worldwide

There are a few other bitcoin airlines in the world and also several ways to book a flight with digital currencies.

For example, CheapAir and BtcTrip are the first platforms that accept this disruptive method of payment.

Also, Latvia-based airline and Virgin Galactic began accepting bitcoin since 2013/2014, while if you want to book a private jet, you can do it through JetVizor.

More bitcoin airlines to suggest? Write us a message in the comments! We would be happy to add new companies.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin all time high: more than $2000

While I’m writing this article the bitcoin all time high reached a value of $2,019 for the first time in its history.

By reaching a value of more than $2,000, bitcoin’s price grown of about 100% this year and nearly 125% since the annual low of $891.51 bitcoin hit back in March.

Experts agreed that bitcoin’s price recent growth could lead to reaching significant attention from the media and maybe also major financial media outlet would cover bitcoin.

Google Trends data showed that the search for “bitcoin” have still not reached its all-time high they set back in December 2013, but it is getting closer (right now it has a score of 85/100).

That said, the reasons that drove the bitcoin all time high are difficult to identify.

Growing interest by investors

Surely, one reason is the increase in interest from investors and traders, as reported by the major exchange platforms.

Another factor that helped bitcoin to reach its current all-time high is the growing influence of Japan, a country where the technology is now regulated: from April 1st, in fact, bitcoin became a legal method of payment.

The Japanese yen is the single largest currency being exchanged for bitcoin, accounting for more than 45% of the money flow into bitcoin at the time of the report, according to CryptoCompare data.

The Japanese yen is the greatest currency being exchanged for bitcoin: currently, almost 45% of the money flow into bitcoin.

After the yen, there is US dollar that makes up 30% of the money flowing into bitcoin.

Block size debate

Bitcoin price grew in spite of the current block size debate, an issue related to the transaction capacity and the blockchain speed to validate a transaction.

Bitcoin developers are talking about this issue in order to address it and there are a few proposals such as the so-called SegWit or Segregated Witness that would increase blocks capacity.

Read here why you should hold Bitcoin and how.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ether Price passes $100: how to store Ethereum

Ether price, or the digital currency that fuels the world’s second-greatest blockchain network – Ethereum – reached a value of $100 today.

This means that Ether price hits its new all-time high today.

With a growth of more than 25% over one day only, the Ether price has now increased more than 1,000% during the last year: on January 1st, in fact, it was trading at about $8.

At the moment, while I’m writing this article, the digital currency has a market cap of about $9bn, according to data provided by Coinmarketcap.

Why Ether price is growing

This new all time high comes now when the Ethereum blockchain is fast gaining interest by open-source innovators and financial firms worldwide.

Ethereum became important as the main blockchain used for initial coin offerings (ICO, a process by which people working on blockchain-related projects can sell tokens with the goal of raising funding), while major companies such as JP Morgan and Bank of America are developing a few projects on private versions of the Ethereum blockchain.

On the markets point of view, the development comes also thanks to a strong and continued demand for the Ethereum token.

Ether volume registered 20% of the total digital currency market volumes, below bitcoin (46%) and ahead of litecoin (11.38%).

How to store, buy and sell Ethereum

While the digital currency is gaining more and more interest, reaching new all time highs, you may ask yourself: “How should I buy, sell and store my Ether tokens?”

Well, HolyTransaction provides a safe place where you can store, buy and sell your Ether tokens in a user-friendly platform.

You can exchange Ethereum in a few minutes by using more than 10 digital currencies we support on our HolyTransaction multicurrency wallet.

Click here to know more about our Ethereum wallet and exchange.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Litecoin Segwit: how it is driving the prices

Maybe because of the recent Litecoin Segwit support, this digital currency price set a new high yesterday, reaching a value of $11.42, its highest price since May 2014.

We cannot define it a cryptocurrency pump, but the market seems to answer to the technical changes in the network.

This price growth, in fact, could be explained thanks to the almost reached the 75% support level needed in order to activatate the Litecoin Segwit (Segregated Witness), or a scaling solution that will improve blocks capacity.

Right now, in fact, just over 70% of miners were giving their support for the Litecoin Segwit.

Even if at press time, Litecoin price declined of about 67%, litecoin traded as high as $11.32 today up nearly 40% in one day, according to CoinMarketCap.

On March 30th, litecoin price increased of about 70% and, always according to Coinmarketcap data, its 24-hour volume passed $250m today.

Litecoin SegWit support

These important new Litecoin highs have coincided with the almost reached support level needed for activating the Litecoin SegWit.

First designed to be used on the Bitcoin blockchain, SegWit would increase the block capacity by modifying how transaction data is stored by the blockchain itself.

Once reached, the support level will have to remain at or above the 75% threshold level for 8,064 blocks (almost two weeks) before SegWit can officially be activated.

The litecoin price reached $50 in late 2013, but it has traded below $20 since early 2014.

Click here to read more about SegWit and a new Bitcoin potential fork.

Open your free digital wallet here to store your cryptocurrencies in a safe place.