The department’s website also adds that

The department’s website also adds thatOpen your free digital wallet here to store your cryptocurrencies in a safe place.

(CoinDesk) US Senator Tom Carper yesterday called on the Commodity Futures Trading Commission (CFTC) to clarify its position on digital currencies.

Carper is a Delaware Democrat and he currently heads up the Homeland Security and Governmental Affairs Committee.

It should be noted that Delaware is home to many credit card companies

in the US, thanks to business-friendly regulations that have attracted

numerous financial institutions to the state.

According to Bloomberg,

Carper’s staff are already working on a report on digital currencies,

scheduled for release sometime in the spring. Carper’s email to the CFTC

was a response to an earlier letter from former CFTC chair Gary

Gensler. He, in turn, was responding to an inquiry on digital currencies

filed by Senator Tom Coburn of Oklahoma.

The tone of Carper’s email is

interesting: “Given that we read about a new venture in the digital

currency space nearly every day, it is important that our government

agencies respond appropriately and in a timely manner with thoughtful

policy and oversight.”

“Those willing to take risks and play by the rules should have the opportunity to thrive without the fog of uncertainty.”

It appears that Carper isn’t looking for a clampdown on digital currencies – he merely wants to eliminate any ambiguities.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

(OnBitcoin) Marco Santori is a senior associate at New York-based Nesenoff & Miltenberg, LLP,

and very familiar with the nuances of Bitcoin regulation. In a

presentation at the Inside Bitcoins conference in Las Vegas, Mr. Santori

provided a thorough overview of money transmission regulation on the

federal and state levels.

Money services businesses (MSBs) are regulated by FinCEN, whose goal is to prevent money laundering.

MSBs are required to register with FinCEN on a federal level. While

it’s a free, online process to register, there are an assortment of

requirements, such as:

In March 2013 FinCEN published regulatory guidance surrounding

Bitcoin. While this guidance left some confused, the overall takeaway

was that Bitcoin is not inherently illegal and Bitcoin companies are

fine to operate as long as they comply with applicable laws.

Santori provided examples of businesses that would be under the veil of regulation:

While it’s easy to register on the federal level, it’s another story

on the state level. There are 48 states that provide licenses for money

transmission. The states regulate money transmitters separately from the

federal government. So, for a company to operate in the United States,

they need to separately attain 48 licenses, which is a timely and costly

endeavor.

While it’s more complex to apply for licenses in 48 states, the scope

of regulation appears to be slightly less cumbersome. The states have

not adopted all of FinCEN’s categories of money transmitter.

Specifically, only these two categories are relevant:

Given the ambiguity and cost of regulation, what should a startup do?

Circle Internet Financial, a company formed by serial entrepreneur

Jeremy Allaire, publicly stated that they will be seeking licenses in

all states and raised $9 million in venture capital to fund that

initiative.

However, there are a plethora of startups that don’t have the funds

or capabilities to attain licenses. Here are some other options.

First, a company could send a “no action” or “request for ruling”

letter, which explains the nature of the business and why it should not

require a license. Drafting this letter can be costly due to legal fees

but can also result in certainty if authorities respond.

There are also avoidance strategies. You can incorporate overseas and

geofilter IP addresses to block US customers. By documenting this

process and having appropriate policies in place, a company can protect

themselves from regulatory backlash if some US customers get through.

For example, a company should check if the customer registers a US bank

account, makes transfers to US accounts or subsequently accesses the

company’s service from US IP addresses.

Santori said that most companies restructure their companies to

either fit into an exception in the regulation. Exceptions include:

If a company wants to get a state license, how long does it take to

get approved? For a regular business, just a few weeks. But for a

Bitcoin business, it’s not clear.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

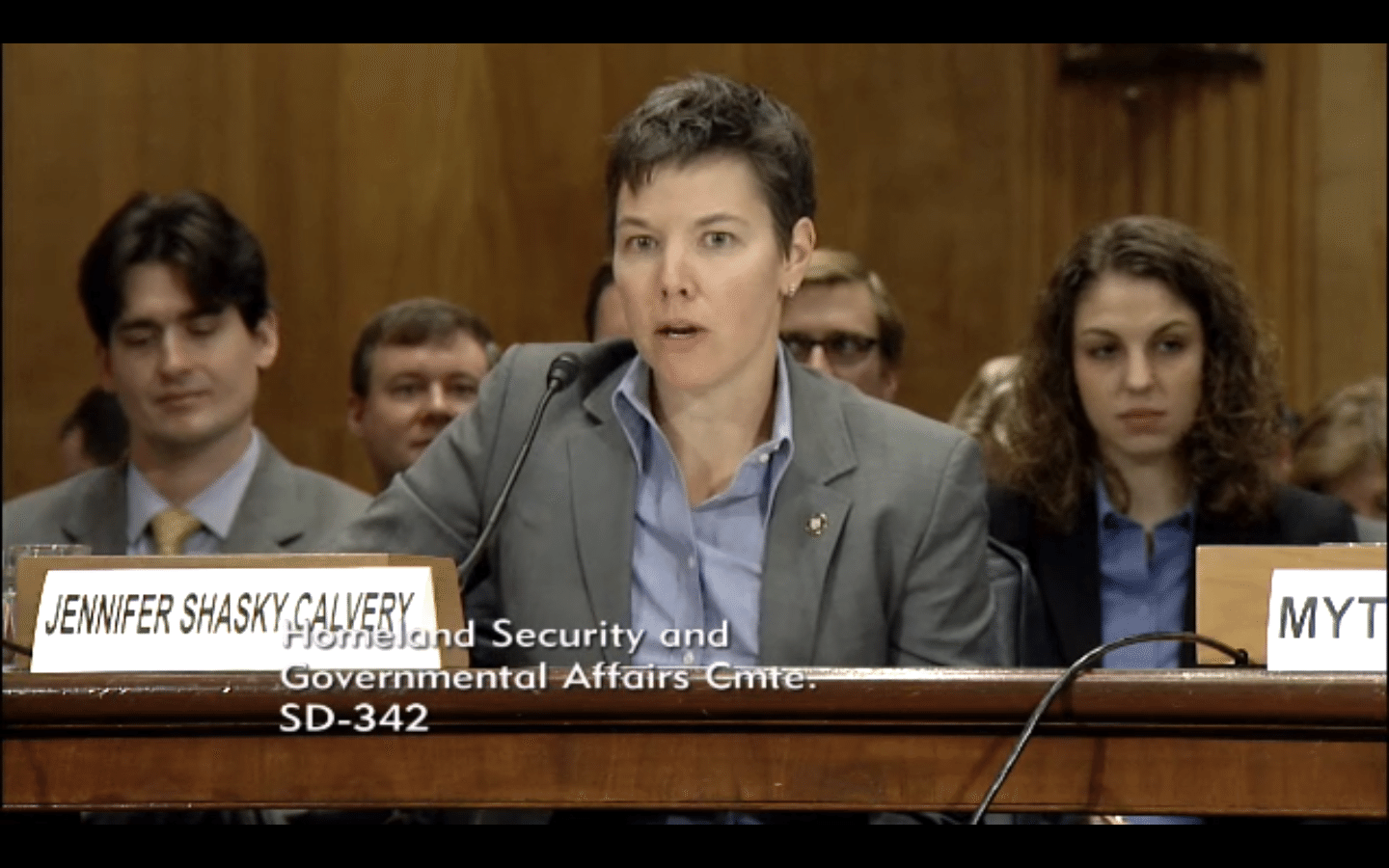

(WashingtonPost) The Senate Committee on Homeland Security and Governmental Affairs,

chaired by Sen. Tom Carper (D-Del.), is holding the first congressional

hearing on the future of Bitcoin. The first panel features senior

figures from the Obama administration. And their comments about Bitcoin

have been remarkably positive.

After the officials gave their opening statements, Carper’s first

question drew a parallel to the Internet. He pointed out that in the

early days of the Internet revolution, many people raised concerns about

illicit use of Internet technologies. Yet in the long run, he argued,

the Internet has had a hugely beneficial effect on peoples lives, making

possible previously unimagined services like Facebook and YouTube.

Carper wanted to know if the witnesses saw Bitcoin in the same light.

Jennifer Calvery, director of the Financial Crimes Enforcement

Jennifer Calvery, director of the Financial Crimes Enforcement

Network, agreed with Carper. “Innovation is a very important part of our

economy. It’s something for us to be proud of,” she said.

“We are attuned to the criminal use,” added Mythili Raman of the

Justice Department. But “there are many legitimate uses. These virtual

currencies are not in and of themselves illegal.”

“There is good reason for us to remain watchful” about Bitcoin being

used for illicit purposes, Raman added. “But we also intend to balance

that against the need for legitimate users” to use the technology.

Later in the same panel, Edward Lowery of the Secret Service

testified that cyber criminals “have not by and large gravitated toward

peer-to-peer cryptocurrencies.” Rather, they “have by and large

gravitated toward centralized digital currencies that are based in a

locale that may have less regulatory guidelines and less aggressive law

enforcement.”

That’s been the tenor of the entire hearing so far. All three Obama

administration officials expressed concern about Bitcoin being used for

illicit uses. But they also stressed that Bitcoin has important

legitimate uses and that regulators need to be careful not to stifle

innovation in virtual currencies. And they seemed to believe that the

situation was under control, and none asked for new regulatory powers to

crack down on illicit uses of the currency.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

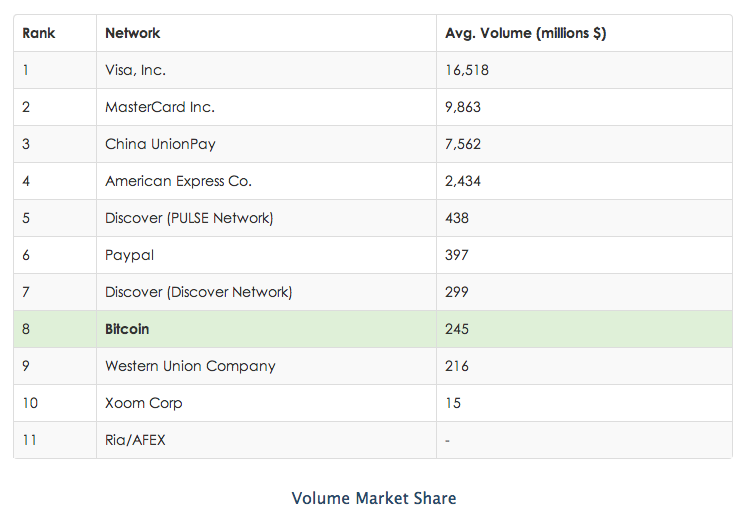

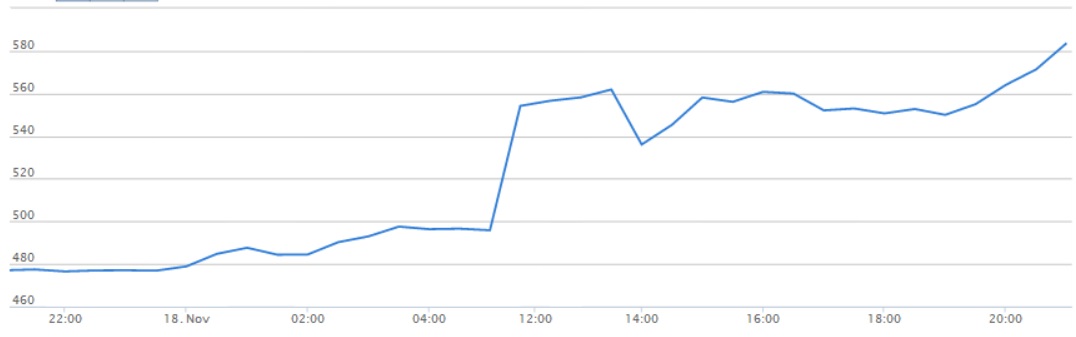

(CoinDesk) The price of bitcoin spiked dramatically last night and the

transaction volume on the Bitcoin protocol (in USD) eclipsed that of

Western Union.

The spike took place after Jerry Brito, Patrick

Murck and Jeremy Allaire presented their testimonies on bitcoin and the

future of virtual currencies to the Homeland Security and Governmental

affairs committee in the US senate at the Senate hearing titled Beyond Silk Road: Potential Risks, Threats and Promises of Virtual Currencies.

The CoinDesk BPI read $650 on conclusion of the hearings, with Mt. Gox reporting a jump to $750 and, later, BTC China reaching a record high of 6,989 CNY (approximately $1,147) before crashing to almost 60% of this value in seconds, and then recovering to about $850. At the time of writing, the CoinDesk BPI puts the price at $602.

The

senate hearing is being hailed as an historic moment for bitcoin, with

even Ben Bernanke, current chairman of the Federal Reserve remarking

that virtual currencies “may hold long term promise” in an open letter

to Senator Thomas Carper (D) published 12th November.

At the

hearing, Senator Carper listened to commentary, criticism and praise of

bitcoin with a temperament that left many in the bitcoin community

impressed and even delighted, whilst Jennifer Shaskey Calvery from

FinCEN was measured in her analysis and assessment of the promises and

threats that virtual currencies present.

This morning, data analysis website Coinometrics reported

that bitcoin passed Western Union in daily transaction volume,

transacting an average of $245m compared with Western Union’s estimated

$216m but is still behind on the average number of daily transactions at

approximately 62,000, with Western Union clocking up approximately

633,000 transactions per day by comparison.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

(DailyDot) The Department of Justice and Securities and Exchange Commission told senators that bitcoins are “legitimate financial instruments,” Bloomberg reports. The news comes just three days ahead of a U.S. Senate Committee on Homeland Security and Governmental Affairs hearing on Bitcoins,

Almost immediately following the article publication at 12:01am ET, the

average price of Bitcoins jumped over $50, from $495 to $554, sprinting

past the $500 milestone. It has continued to climb to a $583 average in the hours since. At Mt. Gox, the largest Bitcoin exchange, the currency is already selling for $630.

The Senate committee, which was scheduled immediately following the fall of the Deep Web black market Silk Road, aims “to explore potential promises and risks related to virtual currency for the federal government and society at large.”

“The FBI’s approach to virtual currencies is guided by a recognition

that online payment systems, both centralized and decentralized, offer

legitimate financial services,” Peter Kadzik, principal deputy assistant

attorney general, wrote according to Bloomberg.

“Like any financial service, virtual currency systems of either type

can be exploited by malicious actors, but centralized and decentralized

online payment systems can vary significantly in the types and degrees

of illicit financial risk they pose.”

Ben Bernanke, the chairman of the Federal Reserve, said he had no plans

to regulate the currency. In fact, Bernanke isn’t sure if the Fed even

has the authority to do so.

In an article on Sunday, Time reported that the Senate hearings were “just the beginning.”

“Honestly, the environment seems to be a game of hot potato where no

politician wants to be caught being pro or anti bitcoin,” Charles

Hoskinson, director of the Bitcoin Education Project, told the magazine.

“Once the market cap gets to around $10 billion or so, then expect real

hearings and a lot of lobbying.”

At nearly $7 billion and triple what it was just two weeks ago, the cap is closing in fast on Hoskinson’s milestone.

The reaction in the Bitcoin world has been ecstatic. After similar reports of Chinese authorities saying the government has no plans to

regulate the digital currency, news that the U.S. is following suit is

exactly what Bitcoin-backers had hoped for. Around the Internet, bitcoin

enthusiasts talked about the adrenaline they felt watching the price

surge this morning.

There is already widespread speculation in the community that the currency will soon enough reach $1,000—and beyond.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“In bitcoin,” Austin Craig repeated to the young woman behind the

counter at the Lean Crust Pizza parlor in the Fort Greene neighborhood

of Brooklyn, N.Y. “Can we pay in bitcoin?”

“In what?” came the reply.

Mr. Craig, 30

years old, was struggling to convince Nadia Alamgir of the existence of

the virtual currency that has gained traction across the world, and

whose value—after months of wild swings—on Wednesday reached records

around $400 per bitcoin.

It was midway through a tricontinental

odyssey taken with his wife, Beccy Bingham-Craig, 29, and a film crew

documenting their travails, which started in Provo, Utah. Their mission:

to live on bitcoin alone.

“It’s been consistently inconvenient

and occasionally frustrating,” Mr. Craig said outside Lean Crust, “but

never impossible.” Lean Crust advertised itself as bitcoin-friendly but

hadn’t seen much virtual foot traffic. Ms. Alamgir eventually contacted

the store’s owner, who arrived and processed the transaction, allowing

Mr. Craig to munch on several slices.

Lean Crust, though, is one

of a tiny but growing number of stores, travel agents and online

merchants starting to accept the once-obscure digital currency as a

means of payment. Bitcoin doesn’t exist, except in the virtual world,

and can only be passed from one person to another electronically. Its

origins are murky: Conventional wisdom says a man or group of people

going by the name Satoshi Nakamoto created bitcoin in 2009, stoking

demand by making it obtainable only through complicated algorithmic

searches by powerful computers.

But in the past 12 months, the

bitcoin zeitgeist has taken on a life of its own. The currency is

discussed at investing conferences now. The Winklevoss twins, known for

their fight with Facebook Inc. founder Mark Zuckerberg, have started a

bitcoin fund. It also has gained the attention of regulators who worry

it can be used to launder money.

For the Craigs, bitcoin represented a chance at adventure—and an underground movie career.

They

began their trek in October by driving east from Provo in Ms.

Bingham-Craig’s 2004 Volkswagen Jetta. After arriving in New York on

Oct 17, they flew to Stockholm, Berlin and Singapore before eventually

returning to Provo. In the end, they lasted 101 days, from July 23 to

Nov 1.

The Craigs weren’t part of the bitcoin underground when

they began the project. Mr. Craig said he first heard of the currency in

2011 and then came up with the plan to live and travel solely on

bitcoin.

“I’m really excited about bitcoin and its future,” Mr. Craig said. “It’s a reimagining of money.”

Starting

July 23, the day they returned from their honeymoon, the Craigs paid

for everything with bitcoin, from rent to food to gas. At that time, one

bitcoin was worth about $98, based on trading at the Tokyo-based Mt.

Gox exchange, a primary exchange bitcoin enthusiasts have tracked.

“In the end,” Mr. James said, “it hasn’t been as much of

an inconvenience as I thought it would be.” While he hasn’t become a

convert, he did say he thought the experiment sounded like fun and was

“happy to be a part of it.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

(CoinDesk) With the US Senate setting 18th November as the start date for its committee hearings into bitcoin, it’s time to

take a look at some of the more significant events in bitcoin’s short but colorful legal history.

The early Bitcoin timeline featured hacks, heists, drugs, demands for refunds and the first appeals to law enforcement, but 2013 saw official scrutiny rise almost as quickly as bitcoin’s value.

Whether or not bitcoin requires, or should seek, regulatory approval is a major source of heated debate on bitcoin discussion forums, but the regulation issue will remain prominent as long as significant amounts of wealth are at stake.

FinCEN issued guidelines that bitcoin-related businesses counted as “Money Service Businesses” (MSBs) under US law.

This meant bitcoin businesses were now officially required to provide authorities with information about potentially suspicious transactions and introduce policies to prevent money laundering. These regulations also affect the more centralized virtual currencies and point systems used in social networks and online games, including Facebook and Second Life. Lack of a centralized authority meant bitcoin itself could not comply, but any business associated with its use would need to — including individual miners, if they converted their bitcoin to fiat currency.

In something of a rare public compliment for bitcoin from the world of traditional finance, François R. Velde, senior economist of the Federal Reserve in Chicago wrote a glowing paper titled “Bitcoin: A Primer” in which he wrote bitcoin was a “remarkable conceptual and technical achievement, which may well be used by existing financial institutions.” He further described bitcoin as an “elegant solution” to the digital currency problem and claimed its value derived from certain beliefs about the nature and function of money, and the amounts of fiat currencies traded for it.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.