When the digital currency industry has Apple and PayPal as competitors, those two firms might be the reason for a Bitcoin regulation in the US.

Apple and PayPal joined a group together with Google, Amazon and Intuit in Washington in order to push for more reforms related to the financial system innovation. As we know, in fact, a core subject on their agenda is the creation of a federal money transmission license that would supplant the current state-by-state regime.

Also, last month Financial Innovation Now (FIN), the group that represents these five companies, sent a letter to the Senate Banking Committee proposing new recommendations that ask for the creation of a national money transmission requirement that would be managed by the Treasury Department.

“Consumer protection is a critical part of payments regulation, but it makes no sense for different states to regulate digital money differently from one state to another,” they explained.

The executive director of FIN, Brian Peters, said to CoinDesk the group is taking the money transmission problem very seriously and is looking for a legislative solution.

“This is a top priority for us. We’re proactive pushing for it and we are serious about legislating this.”

Bitcoin regulation benefits

FIN argues that it has no interest in supporting Bitcoin regulation or its industry, but it knows that the development of a transmitter issue is a common benefit.

“None of our priorities really actually delve into bitcoin or the other cryptocurrencies specifically. However, a lot of what we are pushing for does connect to the work many in that community are doing. The main reason we are pursuing it is because our companies have encountered a significant amount of friction and delay in the state-by-state money transmission licensing process. It’s the delay and the friction that’s really a hindrance to the ability to deliver products and services to the market in a way that is consistent with the pace of innovation in the modern economy.”

In addition to the costs to comply regulations, there are a few issues in states where government hasn’t still decide whether digital currencies should be considered as money or be exempted from regulation itself.

A federal licensing system would allow digital currency- related companies to elude state regimes and this could have an exponential growth effect on Bitcoin industry, as explained by the director of research at Coin Center, Peter Van Valkenburgh.

“For people in the US who want to build a business using these technologies, by far the biggest impediment they face is state-by-state transmission regulations. There’s pretty much no question about that. Anything that [FIN] is going to ask for – assuming it’s in line with a federal money transmission license – is exactly what our industry needs.”

So, having a federal option would provide a few benefits related, for example, to the cut of compliance costs for companies and new startups.

“For startups, it’s the biggest thing,” he said. “Right now, you can’t start your business unless you have millions to spend on compliance. And to get venture capital financing, you need to convince your venture capitalists that it’s OK that the majority of their funding is going to lawyers.”

While there have been a lot of efforts with the aim of creating a federal money transmission framework, they have fallen due to a lack of money, leadership, political clout, etc.

But, FIN shouldn’t face these problems, commented Carol Van Cleef, a digital currency attorney with BakerHostetler in Washington.

“I have long said that we’ll get a national money transmitter license when these companies come together. They’re the ones that have the resources necessary to launch the kind of legislative campaign that’s essential to get this through Congress. This kind of initiative requires money and lots of it, solid executive branch and congressional relationships and experience working legislative issues.”

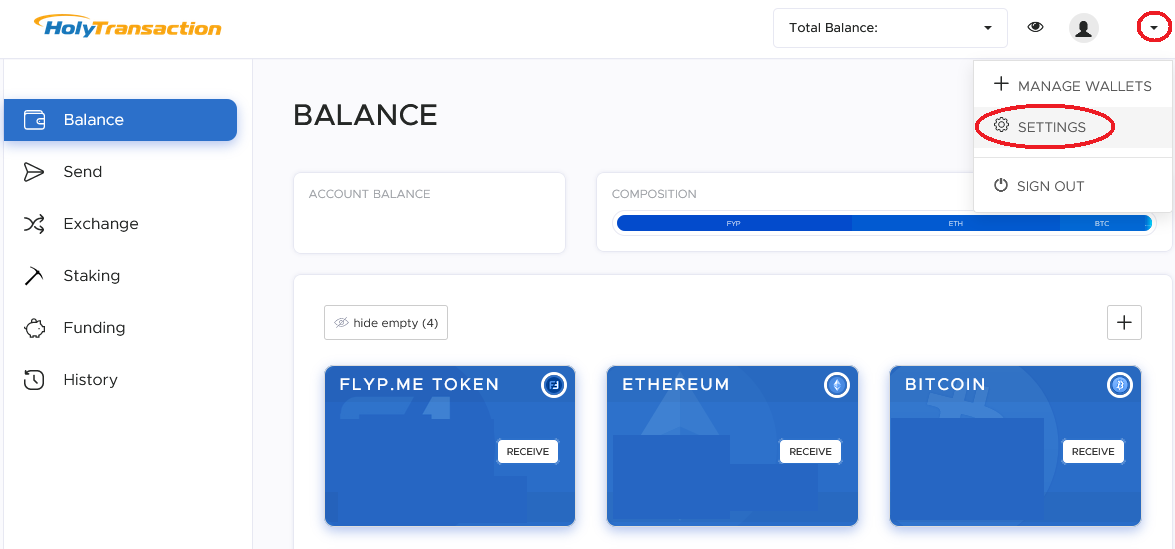

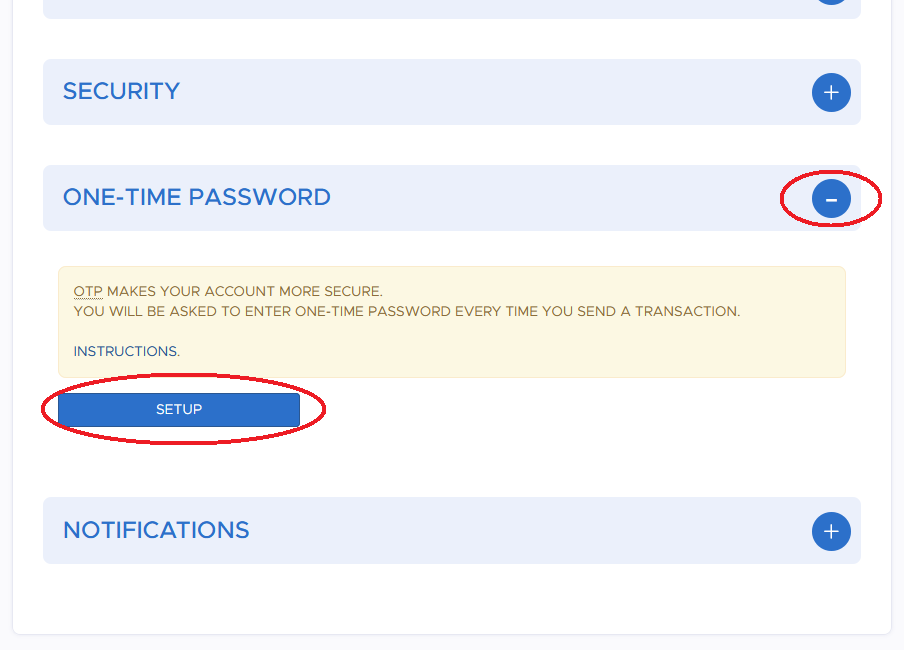

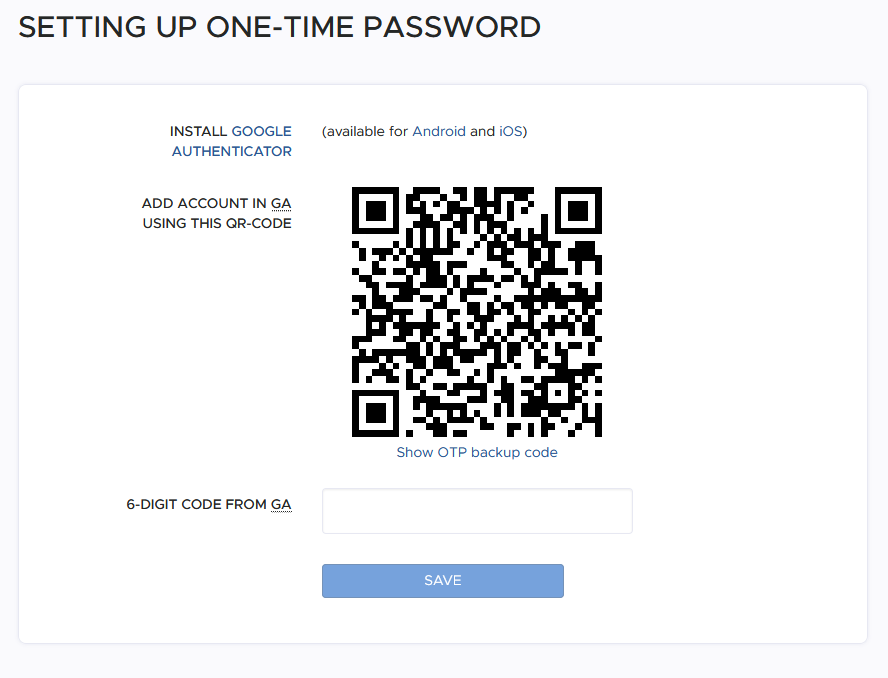

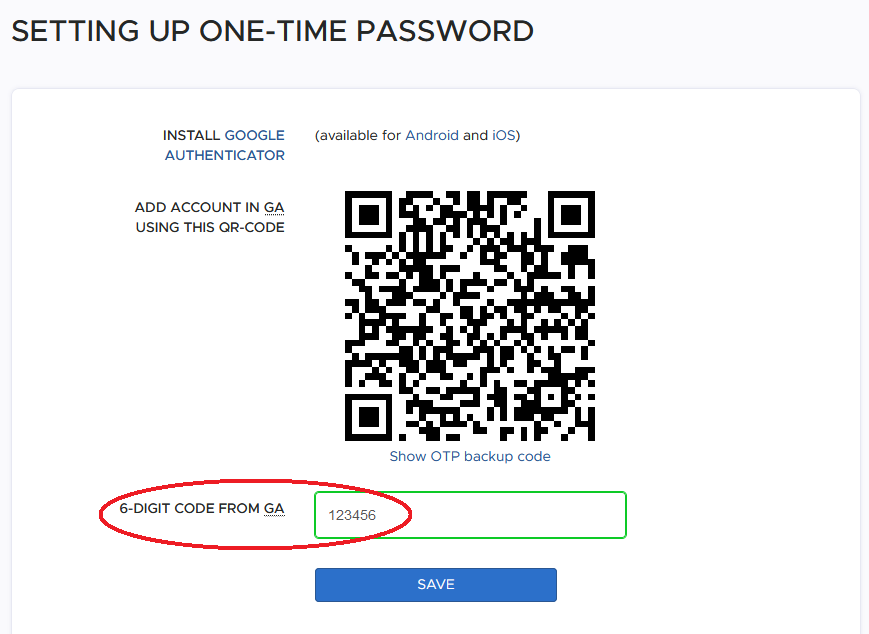

Open your free digital wallet here to store your cryptocurrencies in a safe place.

After reaching a value of $1,840, Bitcoin price is currently stable around $1,820 while I’m writing this article.

After reaching a value of $1,840, Bitcoin price is currently stable around $1,820 while I’m writing this article.

LuxTrust, together with a Massachusetts-based startup and the support of the Luxembourg government, is building a new Blockchain ID platform.

LuxTrust, together with a Massachusetts-based startup and the support of the Luxembourg government, is building a new Blockchain ID platform.