Search Results For: fees

HolyTransaction Wallet fees: a list for each crypto

There is a flat fee to cover the transaction fees for moving cryptocurrencies

out of your HolyTransaction Wallet platform.

You can check these costs in your wallet, in the “Send” tab, before

sending a transaction or below in this article.Aave withdrawal: 0.111 (AAVE) Cardano withdrawal: 0.8 (ADA) Aidcoin withdrawal: 216009.0 (AID) Aragon withdrawal: 1.51 (ANT) ApeCoin withdrawal: 6.53 (APE) Attention Token withdrawal: 43.0 (BAT) Blackcoin withdrawal: 0.3 (BLK) Binance Smart Chain withdrawal: 0.002 (BNB) Bitcoin withdrawal: 0.00020362 (BTC) Binance USD withdrawal: 1.0 (BUSD) Chiliz withdrawal: 96.0 (CHZ) Compound withdrawal: 0.176 (COMP) Creativecoin withdrawal: 0.1 (CREA) Dai Stablecoin withdrawal: 16.0 (DAI) DAI Stablecoin (BEP20) withdrawal: 1.0 (DAI-B) Dash withdrawal: 0.0016 (DASH) Decred withdrawal: 0.01 (DCR) Digibyte withdrawal: 0.2 (DGB) Dogecoin withdrawal: 1.5 (DOGE) Enjincoin withdrawal: 25.0 (ENJ) Ethereum withdrawal: 0.00016992 (ETH) Faircoin withdrawal: 10.0 (FAIR) FunFair withdrawal: 2738.0 (FUN) Flyp.me Token withdrawal: 197.0 (FYP) Gamecredits withdrawal: 1249.0 (GAME) Gridcoin withdrawal: 3.0 (GRC) Groestlcoin withdrawal: 0.01 (GRS) Liquid withdrawal: 0.00002 (LBTC) Chainlink withdrawal: 0.768 (LINK) Lightning BTC withdrawal: 0.000015 (LNX) Litecoin withdrawal: 0.001 (LTC) Decentraland withdrawal: 21.0 (MANA) Maker withdrawal: 0.00541 (MKR) Paxos Gold withdrawal: 0.00733 (PAXG) Pivx withdrawal: 0.3 (PIVX) Power Ledger withdrawal: 34.0 (POWR) Peercoin withdrawal: 0.03 (PPC) REN withdrawal: 143.0 (REN) Augur withdrawal: 17.0 (REP) SAND withdrawal: 21.0 (SAND) Storj withdrawal: 18.0 (STORJ) Syscoin withdrawal: 1.0 (SYS) TrueUSD withdrawal: 16.0 (TUSD) USD Coin withdrawal: 16.0 (USDC) USD Coin (BEP20) withdrawal: 1.0 (USDC-B) Pax Dollar withdrawal: 4.16 (USDP) Tether USD withdrawal: 16.0 (USDT) Tether USD (BEP20) withdrawal: 1.0 (USDT-B) BLOCKv withdrawal: 1701.0 (VEE) Vertcoin withdrawal: 0.3 (VTC) Wrapped Bitcoin withdrawal: 0.00021638 (WBTC) Monero withdrawal: 0.005 (XMR) Ycash withdrawal: 0.1 (YEC) Zcash withdrawal: 0.01 (ZEC) Horizen withdrawal: 0.005 (ZEN) 0x withdrawal: 16.0 (ZRX) Open your multi-currency wallet here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

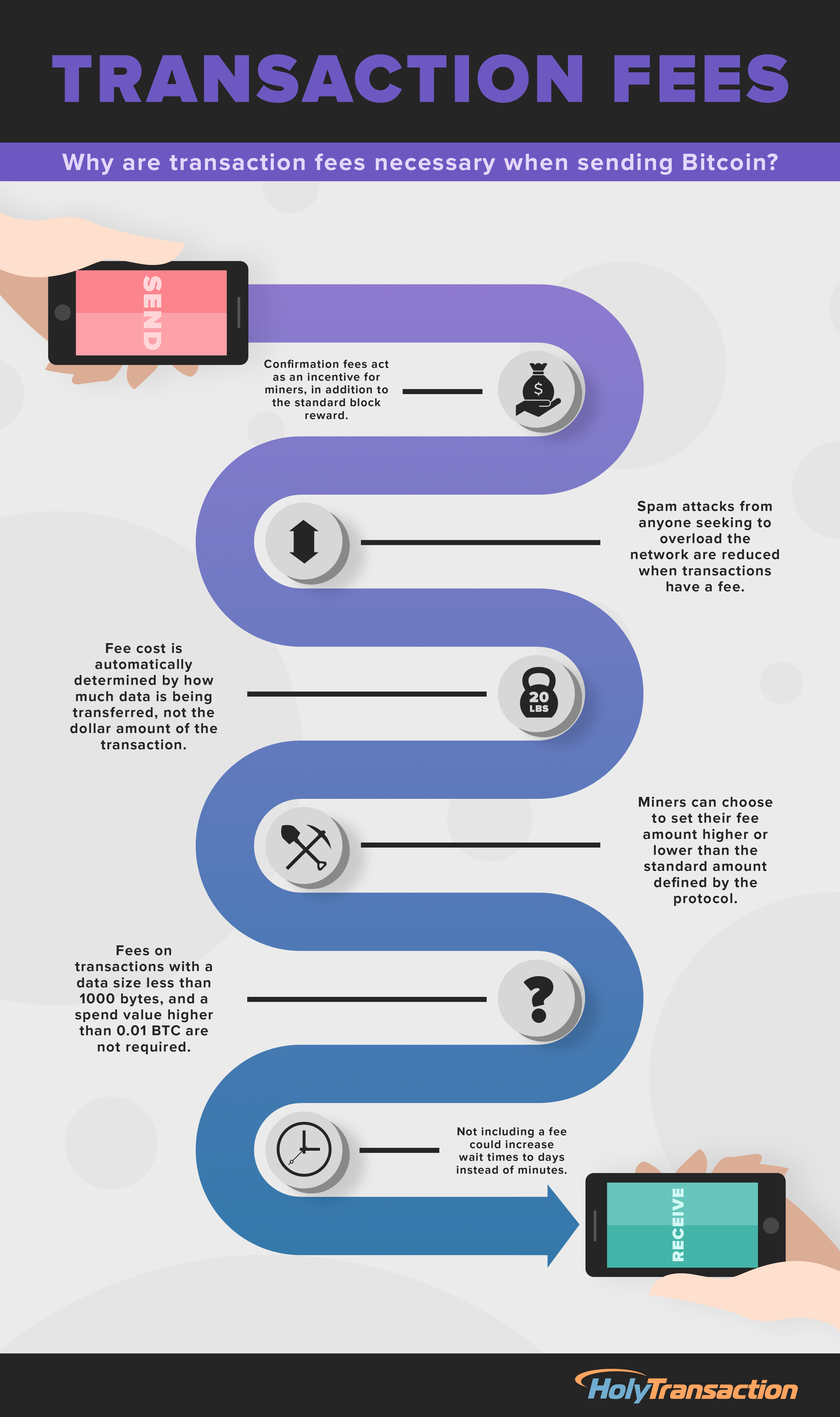

Infographic: Why are transaction fees necessary when sending Bitcoin?

Why are transaction fees necessary when sending Bitcoin?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Next Bitcoin Core Version to Include ‘Smarter’ Transaction Fees

details of new floating transaction fees to be included in the code of

the next Bitcoin Core release.

stated that the updated code will enable “smarter” fees that account

for the length of time it takes to confirm transactions on the bitcoin

network. Ultimately, the new code will determine transaction priority,

making sure that transactions confirm more efficiently.

code as the reason for the update. These complications result in

inconsistent and time-consuming confirmation periods. He wrote:

“Instead of using hard-coded rules for what fees to pay,

the [new] code observes how long transactions are taking to confirm and

then uses that data to estimate the right fee to pay so the transaction

confirms quickly – or decides that the transaction has a high enough

priority to be sent for free but still confirm quickly.”

how much priority they want their transaction to receive. In some cases,

users may opt to have as many as six blocks pass before the first

confirmation is received.

Systemic fee problems addressed

send large bitcoin transactions. As Andresen explained, the new code

eliminates some of the hurdles that slowed down transactions in excess

of 1,000 bytes in size.

framework. The code that determines priority for free transactions

automatically places them at a disadvantage in the network. This results

in a significant increase in confirmation times.

“The current situation is even worse for free,

high-priority transactions: the hard-coded ‘high-priority’ constant is

much too low, so transactions sent for free can take a very long time to

confirm.”

more effective transaction fee determinations within the bitcoin

network.

Future updates possible

fees, citing the behavior of miners – and their preference for high-fee

transactions – as reasons to avoid such an approach. Notably, he said

there was no desire within the bitcoin development community to

institute fixed fees.

“I expect to see transaction fees rise until a good

solution for optimizing the propagation of blocks across the network is

deployed, because I expect transaction volume to increase and I don’t

think miners will include more transactions in their blocks until

somebody fixes the ‘bigger blocks take longer to broadcast’ problem.”

develop new code that enables a more efficient and healthy transaction

process.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Revolutionizing Bitcoin: An In-depth Exploration of the Runes Protocol

Introduction to Bitcoin Runes

Bitcoin Runes represents an innovative step forward in the evolution of the Bitcoin blockchain, offering a new protocol for fungible tokens. Developed by Casey Rodarmor, the mind behind the Ordinals protocol, Runes aims to streamline the process of token creation and management within Bitcoin’s existing framework.

The Underlying Technology of Runes

Runes utilize the Unspent Transaction Output (UTXO) model of Bitcoin, differing from the account-based systems used by other blockchain protocols like Ethereum. This choice leverages Bitcoin’s native data structures for enhanced efficiency and simplicity in token transactions. Unlike other token standards that might require off-chain data or depend on separate native tokens, Runes operates entirely on-chain, integrating with the OP_RETURN opcode to record transaction details directly on the blockchain.

Key Features of Bitcoin Runes

One of the standout features of Runes is its approach to minting tokens, which can be configured as either open or closed systems. This flexibility allows developers to set specific conditions for how tokens are generated, whether freely by the community or under more controlled circumstances. Additionally, the protocol is designed to handle issues like blockchain bloat efficiently by ensuring that only valid transactions contribute to the network’s data load.

Preparing for Runes

As the anticipation for Runes builds, potential users and developers are advised to prepare by setting up Bitcoin wallets that support the protocol, staying informed about updates, and perhaps most crucially, securing some Bitcoin to handle transaction fees once Runes goes live.

Integration with Bitcoin’s Ecosystem

Bitcoin Runes not only introduces a new token standard but also integrates deeply with Bitcoin’s existing systems, such as the Lightning Network. This integration allows Runes to utilize Lightning for faster and cheaper transactions, bypassing the usual congestion and high fees associated with the Bitcoin network. The compatibility with Lightning showcases Runes’ potential to enhance Bitcoin’s scalability by leveraging second-layer solutions. This feature is particularly appealing to developers and users who are looking for efficient transaction methods without compromising the security and decentralization that Bitcoin offers. The seamless integration of Runes with Bitcoin’s broader ecosystem could lead to increased adoption of both Runes and the Lightning Network, further solidifying Bitcoin’s position as a versatile and robust platform for financial innovation.

Future Prospects and Community Involvement

The launch of Runes is set against the backdrop of a growing trend towards tokenization on the Bitcoin blockchain, highlighted by the surge in popularity of the Ordinals protocol earlier. Runes takes this a step further by offering a fungible token standard that could potentially host a variety of digital assets, including memecoins and utility tokens. The community’s role in shaping the future of Runes is crucial, as evidenced by the protocol’s design that allows for open minting processes where the community can actively participate in the creation of new tokens. This aspect fosters a more inclusive and dynamic development environment, encouraging innovation and engagement from a broad spectrum of users. Looking forward, the ability of Runes to attract a diverse range of projects and maintain high levels of community engagement will be key indicators of its long-term viability and success within the cryptocurrency ecosystem.

Market Impact and Adoption

Before its official launch, which is timed with Bitcoin’s halving event in 2024, Runes has already garnered significant attention. Various projects have begun building around the Runes ecosystem, and its introduction is expected to reinvigorate interest in Bitcoin by providing new avenues for creating and trading digital assets. This development aligns with the broader trend of integrating more complex functionalities like tokenization into Bitcoin, which has historically been seen primarily as a value transfer system.

Runes represents a significant technological advancement within the Bitcoin ecosystem, promising to introduce a new layer of functionality that supports the creation and management of fungible tokens directly on the blockchain. By optimizing the UTXO model and eliminating the need for off-chain data, Runes could set a new standard for efficiency and simplicity in blockchain token systems. The community’s response, as seen through engagements and project developments, suggests a strong future for this protocol.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Big Four of Bitcoin’s L2 Ecosystem: Unleashing Innovation and Efficiency

The Big Four of Bitcoin’s L2 Ecosystem: Unleashing Innovation and Efficiency

As the cryptocurrency landscape evolves, Bitcoin’s Layer 2 (L2) ecosystem emerges as a beacon of innovation, promising to redefine the scalability, speed, and efficiency of transactions. Among the burgeoning projects within this space, four stand out for their unique contributions and potential to shape the future of Bitcoin: the Lightning Network, Stacks, Liquid, and Rootstock. Each project brings its own set of capabilities and innovations to the table, collectively enriching the Bitcoin ecosystem with new functionalities and applications.

Lightning Network: Speed and Micropayments Revolution

The Lightning Network is perhaps the most well-known of the L2 solutions, designed to enable instant, low-cost transactions. By creating a network of payment channels operating off the main Bitcoin blockchain, it significantly reduces transaction times and fees, making Bitcoin practical for everyday transactions and microtransactions. This innovation is not only crucial for scaling the network but also for facilitating new use cases, such as micropayments, that were previously impractical due to high transaction costs and slow confirmation times.

Stacks: Building Smart Contracts on Bitcoin

Stacks, formerly known as Blockstack, takes a different approach to enhancing Bitcoin’s functionality. By enabling smart contracts and decentralized applications (DApps) on Bitcoin, Stacks introduces the capabilities of Ethereum-like platforms without compromising the security and stability of Bitcoin. This opens up a new realm of possibilities for developers to build on Bitcoin’s robust network, offering a unique blend of innovation without sacrificing the core principles that make Bitcoin the gold standard of cryptocurrencies.

Liquid: Enhanced Privacy and Efficiency

The Liquid Network focuses on improving the privacy and efficiency of Bitcoin transactions, especially for traders and exchanges. As a sidechain solution, Liquid allows for faster settlements, enhanced confidentiality through confidential transactions, and the issuance of digital assets. Its role is particularly pivotal in the context of institutional and professional trading environments where speed and privacy are of the essence. Liquid’s contributions to the Bitcoin ecosystem highlight the growing need for scalable and confidential transaction solutions that cater to a diverse range of user needs.

Rootstock (RSK): Smart Contracts Meet Bitcoin Security

Rootstock (RSK) adds yet another layer of functionality to Bitcoin by integrating smart contracts into the network. Similar to Stacks, RSK aims to leverage Bitcoin’s unmatched security by allowing developers to create smart contracts and DApps within the Bitcoin ecosystem. However, RSK operates as a sidechain that is merge-mined with Bitcoin, providing a unique blend of smart contract functionality with the security and decentralization of the Bitcoin network. This makes it a compelling option for developers looking to deploy secure and interoperable DApps.

Synergies and the Future of Bitcoin’s L2 Ecosystem

The synergy between these four projects exemplifies the potential of Layer 2 solutions to not only alleviate the scalability concerns associated with Bitcoin but also to introduce a wide array of functionalities that extend beyond simple transactions. From enabling microtransactions with the Lightning Network to fostering new applications through Stacks and Rootstock, and enhancing privacy and efficiency with Liquid, the L2 ecosystem is at the forefront of Bitcoin innovation.

The future of Bitcoin’s L2 ecosystem lies in its ability to harmoniously integrate these solutions, fostering an environment where efficiency, scalability, and functionality coexist. As these projects continue to evolve and mature, the Bitcoin network stands to benefit from increased adoption and utility, further cementing its position as the cornerstone of the cryptocurrency world.

Moreover, the success of Bitcoin’s L2 projects offers valuable insights into the potential of Layer 2 solutions across the broader cryptocurrency ecosystem. By addressing the inherent limitations of blockchain technology, such as scalability and transaction speed, without compromising on security or decentralization, L2 solutions represent a pivotal step towards achieving the mass adoption of cryptocurrencies.

Conclusion

The “Big Four” of Bitcoin’s Layer 2 ecosystem—Lightning Network, Stacks, Liquid, and Rootstock—symbolize a significant leap forward in the quest for a more scalable, efficient, and functional Bitcoin. Through their individual and collective contributions, these projects are not only enhancing the capabilities of the Bitcoin network but also paving the way for a future where digital currencies are seamlessly integrated into everyday life. As the cryptocurrency landscape continues to evolve, the innovations stemming from Bitcoin’s L2 ecosystem will undoubtedly play a critical role in shaping its trajectory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ethereum’s Dencun Deployment: Revolutionizing Scalability and Efficiency

Introduction: Embracing a New Chapter in Ethereum’s Evolution

Ethereum’s blockchain technology has taken a significant stride forward with the deployment of the Dencun upgrade on the Goerli testnet. This pivotal development is a testament to Ethereum’s commitment to evolving and addressing the growing demands for scalability and efficiency in the blockchain sphere.

Dencun, marked by the introduction of Ephemeral Data Blobs and EIP-4844 or “proto-danksharding”, aims to revolutionize the way Ethereum handles transactions. This upgrade promises to significantly reduce Layer 2 transaction fees, a move that will enhance Ethereum’s utility and attractiveness to a broader user base, including developers and end-users.

Overcoming Challenges: The Goerli Testnet as a Proving Ground

The deployment journey on the Goerli testnet was not without its challenges. Initial issues with validators’ synchronization posed a significant hurdle. However, the effective resolution of these issues underscored the robustness of Ethereum’s infrastructure and the dedication of its development community to ensuring a stable and reliable network.

Adopting a phased approach, Ethereum is meticulously deploying Dencun across different testnets, starting with Goerli, followed by Sepolia and Holesky. This careful rollout is crucial for identifying and addressing potential issues, thereby safeguarding the network’s stability and security ahead of the mainnet launch.

Preparing for the Mainnet Launch: Setting the Stage for Widespread Adoption

With the successful deployment on the Goerli testnet, the focus now shifts to the upcoming implementations on other testnets and the much-anticipated mainnet release in Q1 2024. This final step will mark a significant milestone in Ethereum’s journey towards a more scalable and efficient blockchain network.

The introduction of Ephemeral Data Blobs is set to alleviate the persistent issue of high transaction costs on Ethereum. By enabling Ethereum nodes to temporarily store and access off-chain data, the Dencun upgrade aims to streamline transaction processing and reduce network congestion. Post-Dencun, Ethereum is expected to become more accessible and efficient for both existing and new users. This upgrade will likely attract more decentralized applications (dApps) and Layer 2 solutions, fostering innovation and growth within the Ethereum ecosystem.

Ethereum’s Relentless Pursuit of Innovation and Growth

The Dencun upgrade on the Goerli testnet is a clear indicator of Ethereum’s relentless pursuit of technological excellence. By continuously innovating and adapting to the ever-evolving blockchain landscape, Ethereum reaffirms its position as a leading blockchain platform committed to scalability, efficiency, and inclusivity.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Layer 2 Solutions in 2024: Paving the Way for a Scalable and Efficient Blockchain Future

In 2024, Layer 2 solutions in the cryptocurrency space have become an essential tool for addressing the limitations inherent in traditional blockchain networks, particularly scalability issues. These solutions, built atop existing blockchains (Layer 1), offer a way to handle transactions more efficiently without compromising the underlying network’s security and integrity.

Understanding Layer 2 Solutions

The concept of Layer 2 solutions arises from the need to improve blockchain efficiency. The primary blockchain, also known as Layer 1, can only process a limited number of transactions within a given time frame. This limitation leads to congestion, slower transaction times, and higher fees, especially on networks like Ethereum, which hosts a multitude of decentralized applications and smart contracts.

Layer 2 solutions are akin to creating express lanes alongside a busy highway. While the main road (Layer 1) remains intact, these new lanes (Layer 2) allow for faster and more efficient travel of data. By handling transactions off the main chain but still anchored to it for security, Layer 2 solutions enhance transaction speed and reduce costs, offering a more scalable approach for blockchain networks.

Lightning Network and Bitcoin

The Lightning Network stands out as a prime example of a Layer 2 solution, primarily associated with Bitcoin. It enables quick, low-cost transactions by creating off-chain payment channels between parties. This system is revolutionary for Bitcoin, pivoting its use from a store of value (“digital gold”) to a practical medium for everyday transactions.

Ethereum’s Rollups

Ethereum, known for its smart contracts, has actively embraced Layer 2 solutions, particularly through the implementation of rollups. These rollups work by bundling multiple transactions into a single one that is processed on the main chain. This innovation significantly speeds up the transaction process while reducing Ethereum’s notorious gas fees, making transactions more user-friendly.

Arbitrum and Optimistic Rollups

Arbitrum, a Layer 2 solution using optimistic rollups, has garnered significant attention within the crypto community. It offers scalable, efficient transaction processing and has become a hub for decentralized finance (DeFi) projects due to its user-friendly infrastructure. With a robust Total Value Locked (TVL) and a growing user base, Arbitrum represents a major advancement in Layer 2 technology.

BASE by Coinbase

BASE, developed by Coinbase, is another Layer 2 solution that has witnessed remarkable growth. Leveraging Coinbase’s reputation and reach, BASE has attracted a significant number of users, reflected in its high transaction volumes and position in the TVL rankings. While BASE continues to evolve, it represents a significant step in the wider adoption of Layer 2 solutions.

Challenges and Future Prospects

Despite the numerous advantages, Layer 2 solutions also face challenges, primarily relating to interoperability and maintaining the decentralized ethos of blockchain technology. Ensuring seamless integration with various Layer 1 networks and other Layer 2 solutions, while preserving security and decentralization, remains a key area of development.

Looking ahead, Layer 2 solutions are poised to play a critical role in the broader adoption and utility of blockchain technology. By addressing scalability and efficiency issues, they open up new possibilities for complex and interactive decentralized applications, fostering innovation in fields like DeFi and NFTs.

The Impact on the Crypto Ecosystem

The introduction and evolution of Layer 2 solutions have profound implications for the cryptocurrency ecosystem. They enhance the user experience by reducing transaction fees and waiting times, crucial for mainstream adoption. Moreover, Layer 2 solutions pave the way for more sophisticated and practical applications of blockchain technology, extending its reach beyond traditional financial transactions to areas like gaming, supply chain management, and more.

In summary, the development and integration of Layer 2 solutions in 2024 mark a significant milestone in the evolution of blockchain technology. They offer a practical and scalable way to overcome the limitations of Layer 1 networks, paving the way for a more efficient, user-friendly, and diverse blockchain ecosystem.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Shanghai Upgrade: Enhancing Ethereum’s Performance and Preparing for the Future

Ethereum has come a long way since its inception in 2015. The blockchain platform has gone through several upgrades to improve its performance, security, and scalability. The latest upgrade, known as the Shanghai upgrade, is expected to further enhance the network’s capabilities and pave the way for the much-awaited Ethereum 2.0.

The Shanghai upgrade is named after the Ethereum community’s conference held in Shanghai in 2019. The upgrade is also referred to as the “London Hard Fork” since it introduce several new features and improvements that require a hard fork. A hard fork is a significant change to the protocol that is not backward compatible with older versions. This means that all nodes and users need to upgrade to the latest version of the software to continue using the Ethereum network.

Reducing Transaction Fees with EIP-1559

One of the primary objectives of the Shanghai upgrade is to reduce transaction fees on the Ethereum network. Ethereum’s transaction fees have been a major concern for users and developers, especially during periods of high network congestion. The upgrade introduce a new fee structure that make it cheaper to transact on the network. Instead of the current gas limit, which sets a maximum fee for each block, the Shanghai upgrade introduce a new mechanism called “EIP-1559,” which allow users to bid on transaction fees. This make it easier to estimate the transaction fees, and it is expected to reduce the average cost of transactions.

Delaying the Difficulty Bomb and Optimizing Gas Costs

Another significant improvement introduced by the Shanghai upgrade is the “Difficulty Bomb Delay.” The difficulty bomb is a feature in Ethereum’s protocol that increases the difficulty of mining over time, making it more challenging to mine new blocks. This is done to encourage miners to switch to the new Proof of Stake (PoS) consensus mechanism that be introduced in Ethereum 2.0. However, the difficulty bomb also makes it more challenging to mine blocks on the current Ethereum network, which can slow down transaction processing times. The Shanghai upgrade delay the difficulty bomb for another 12 months, giving the Ethereum community more time to transition to PoS.

The Shanghai upgrade also introduce several new Ethereum Improvement Proposals (EIPs) that further enhance the network’s functionality. These include EIP-3198, which reduce the amount of data stored on the blockchain by compressing transaction receipts. This reduce the size of the blockchain, making it easier to synchronize nodes and improve network performance. EIP-3529 is another proposal that optimize the gas cost of certain operations on the Ethereum network, making it more efficient and cost-effective.

Paving the Way for Ethereum 2.0 with PoS and Reduced Block Rewards

The Shanghai upgrade is also expected to pave the way for Ethereum 2.0, which is a significant upgrade that introduce several new features and improvements to the network. Ethereum 2.0 transition from the current Proof of Work (PoW) consensus mechanism to PoS, which is more energy-efficient and secure. PoS also enable the network to process more transactions per second, making it more scalable. The Shanghai upgrade introduce some of the necessary changes to prepare the network for PoS, such as reducing the block rewards for miners.

In conclusion, the Shanghai upgrade is an essential step towards improving the Ethereum network’s performance, security, and scalability. The upgrade introduce several new features and improvements that make it easier and cheaper to transact on the network. It also delay the difficulty bomb and pave the way for Ethereum 2.0, which is expected to take the network to the next level. As with any major upgrade, there is always some risk involved, and users are advised to take the necessary precautions to ensure their funds are safe. Nevertheless, the Shanghai upgrade is a significant milestone for the Ethereum community and a testament to the network’s resilience and innovation.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Role of Cryptocurrency in the Unbanking of the World

Introduction: The Financial Revolution of Cryptocurrency

The world is undergoing a transformative financial revolution, driven by the rapid rise of cryptocurrency. More and more people are beginning to question the traditional banking system’s ability to meet their financial needs, and they are turning to cryptocurrency as an alternative. With its decentralized and transparent nature, cryptocurrency has the potential to unbank the world and provide a more inclusive and autonomous financial system.

Autonomy and Control: Cryptocurrency’s Appeal over Traditional Banking

One of the primary reasons individuals are flocking towards cryptocurrency is the level of autonomy and control it offers. Unlike traditional banking, where transactions are intermediated by banks, cryptocurrency transactions are peer-to-peer, eliminating the need for intermediaries. This means that individuals have complete control over their funds without having to rely on a centralized institution. This is particularly valuable for those residing in countries with unstable or corrupt governments, where traditional banking systems may be unreliable or untrustworthy. Cryptocurrency empowers individuals by giving them full ownership and control over their finances.

Transparency and Financial Inclusion: Cryptocurrency’s Impact on Corruption and Accessibility

Transparency is another significant advantage of cryptocurrency. All transactions made on the blockchain are recorded and publicly visible, ensuring a high level of transparency. In contrast, traditional banking systems often operate behind closed doors, making it difficult for individuals to track and verify their transactions. The increased transparency facilitated by cryptocurrency has the potential to reduce corruption and increase financial inclusion by creating a level playing field where transactions can be easily audited and verified.

Financial inclusion is a critical aspect of the cryptocurrency revolution. According to the World Bank, over 1.7 billion adults globally lack access to formal financial services. Cryptocurrency offers a viable solution for these unbanked and underbanked individuals. It doesn’t require a traditional bank account or credit history, enabling even those excluded from the traditional banking system to participate in financial activities such as savings and investments. By leveraging cryptocurrency, individuals who were previously financially excluded can now access the benefits of a global financial system.

Cost Efficiency and Accessibility: Cryptocurrency’s Advantages for Underbanked Individuals

Moreover, cryptocurrency has the potential to provide financial services in a more cost-effective and efficient manner compared to traditional banking. Transactions conducted through cryptocurrency networks are typically faster and have lower transaction costs compared to traditional banking channels. This is especially crucial for individuals living in remote or underdeveloped areas with limited access to banking services. Cryptocurrency can bridge the gap by providing a means for these individuals to participate in the global economy without incurring exorbitant fees or enduring lengthy transaction times.

A More Inclusive Society: Cryptocurrency’s Role in Shaping Financial Autonomy

As cryptocurrency continues to gain momentum, it plays a pivotal role in unbanking the world and creating a more inclusive society. Its decentralized nature and borderless accessibility enable individuals to exercise greater financial autonomy and control. By circumventing the limitations of traditional banking systems, cryptocurrency empowers individuals to take charge of their financial futures.The unbanking movement facilitated by cryptocurrency not only empowers individuals but also has the potential to reshape the global financial landscape. As more people adopt cryptocurrency, the traditional banking system faces a significant disruption. The shift towards cryptocurrency challenges the established norms, providing an alternative financial system that is more inclusive, transparent, and accessible to all.

To conclude, the financial revolution brought about by cryptocurrency is unbanking the world and redefining the way we perceive and engage with money. With its decentralised nature, transparent transactions, and borderless accessibility, cryptocurrency offers autonomy and control to individuals, especially those in regions with unreliable traditional banking systems. Additionally, it promotes financial inclusion by providing services to the unbanked and underbanked populations while offering cost efficiency and global connectivity. The future holds immense potential for cryptocurrency to create a more inclusive society, fostering financial autonomy and enabling individuals to participate in the global economy on their own terms.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

ZeroSync and Blockstream Partnership: Broadcasting Bitcoin Zero-Knowledge Proofs from Space for Secure Transactions

ZeroSync and Blockstream have announced a new partnership to broadcast Bitcoin zero-knowledge proofs from space, marking a major milestone in the world of cryptocurrency. The two companies have joined forces to create a satellite network that will transmit zero-knowledge proofs, which allow for secure and private transactions without revealing any sensitive information.

What are Zero-Knowledge Proofs and Why Are They Important for Bitcoin?

The ZeroSync Association, a newly formed organization that focuses on advancing zero-knowledge proof technology in the Bitcoin ecosystem, will oversee the project. The association is made up of several leading Bitcoin developers, including those from Blockstream, and is dedicated to exploring and implementing innovative solutions to improve the security and privacy of Bitcoin transactions.

The Benefits of Broadcasting Zero-Knowledge Proofs from Satellites

Zero-knowledge proofs are a cryptographic technique that allows one party to prove to another that they possess certain knowledge or information, without revealing that knowledge or information itself. This technique can be used to verify that a transaction has taken place without revealing any details about the transaction itself, such as the amount involved or the identities of the parties involved.

The Role of ZeroSync Association in Advancing Zero-Knowledge Proof Technology

The use of zero-knowledge proofs has been touted as a key solution for improving the privacy and security of Bitcoin transactions, which are currently visible to anyone who has access to the blockchain. By using zero-knowledge proofs, transactions can be made private, preventing anyone from accessing information about the transaction without the necessary keys.

The partnership between ZeroSync and Blockstream aims to take this one step further by broadcasting zero-knowledge proofs from space. The use of satellites to transmit these proofs will provide an added layer of security, as it will make it much more difficult for hackers or other malicious actors to intercept the transmissions.Aside from the security advantages, the use of satellites has the potential to improve the speed and dependability of Bitcoin transactions. Transactions can currently take several minutes or even hours to confirm, depending on network congestion and fees paid. Transactions may be confirmed considerably more quickly by employing satellites to broadcast zero-knowledge proofs, making Bitcoin more practical for everyday use.

The Future of Bitcoin and Cryptocurrencies with Innovative Partnerships

The partnership between ZeroSync and Blockstream has already garnered a lot of attention within the cryptocurrency community, with many experts praising the move as a significant step forward for Bitcoin. However, some have also raised concerns about the potential cost and complexity of the project, as well as the potential for regulatory issues. Despite of these concerns, it appears evident that the usage of zero-knowledge proofs and satellite technology will play a growing role in the future of Bitcoin and cryptocurrencies in general. As the world grows more digital and networked, it is more critical than ever to protect the security, privacy, and dependability of our financial transactions.

In conclusion, the partnership between ZeroSync and Blockstream to broadcast Bitcoin zero-knowledge proofs from space is an exciting development for the cryptocurrency industry. By using zero-knowledge proofs and satellite technology, transactions can be made more private, secure, and efficient, paving the way for a more practical and widely adopted cryptocurrency. While there are still challenges to overcome, the future of Bitcoin looks brighter than ever thanks to innovative partnerships like this one.

Open your free digital wallet here to store your cryptocurrencies in a safe place.