Search Results For: bank of america

Bitcoin transaction volume soon to surpass PayPal

Image Credit: screenmediadaily

CEO of Laureate Trust, Peter Tasca, explains:

“Whenever you have an instrument that trades over 300 million US dollars a day, it must be recognized; the digital currency works, bitcoin has greater volume transactions than Western Union and we anticipate it will overtake PayPal later this year.” According to Statistic Brain, PayPal processes just $315.3 million in transactions everyday, just slightly above the dollar amount of bitcoin’s daily transactions despite the digital currency still remaining at a relatively low percentage rate of consumer and merchant adoption.

The developer of the first biometrically protected bitcoin payment card, remains heavily leveraged in respect to bitcoin adoption; however, the company’s CEO, Chaya Hendrick, says that bitcoin’s sheer transaction volume will continue to rise at a staggering rate:

“In the next one or two years, Bitcoin can surpass the dollar transaction volumes of other established payment companies including Discover, and even American Express, MasterCard, and Visa.” While both Laureate and Hendrick see the number of bitcoin transactions climbing, Laureate, who currently manages a $5 billion hedge fund, predicts that along with increased volumes will come an increase in price, which he expects to be somewhere in the 50% range.

Increased Adoption

Meanwhile, SecondMarket CEO Barry Silbert, recently explained at the Core Club hosted forum in New York City that bitcoin currently remains in the “early majority” stage in which he refers to as the “venture capital stage”. However, the CEO and Bitcoin Investment Trust (BIT) founder says that “we’re probably just a few months away from Wall Street banks starting to trade bitcoin, starting to invest in bitcoin, and starting to create investment products for bitcoin.”

While bitcoin becomes an increasing threat to existing payment processors, in an interview with EcommerceBytes, CEO, John Donahoe, reffered to the digital currency as an exciting, new and emerging technology. “We think Bitcoin will play a very important role in the future. Exactly how that plays out, and how we can best take advantage of it and enable it with PayPal, that’s something we’re actively considering. It’s on our radar screen,” he said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What are Bitcoin nodes and why do we need them?

peer-to-peer (P2P) network. However, what’s often lost in translation is

the sheer amount of machinery that is needed to maintain this global

infrastructure.

transactions, bitcoin requires more than a network of miners processing

transactions, it must broadcast messages across a network using ‘nodes’.

This is the first step in the transaction process that results in a

block confirmation.

network must not only provide an avenue for transactions, but also

remain secure. By using a number of randomly selected nodes, the network

can reduce the problem of double spending – when a user attempts to spend the same digital token twice.

bitcoin doesn’t just need nodes, it requires lots of fully functioning

nodes – nodes that have the bitcoin core client on a machine instance

with the complete block chain. The more nodes there are, the more secure

the network is.

Waning support

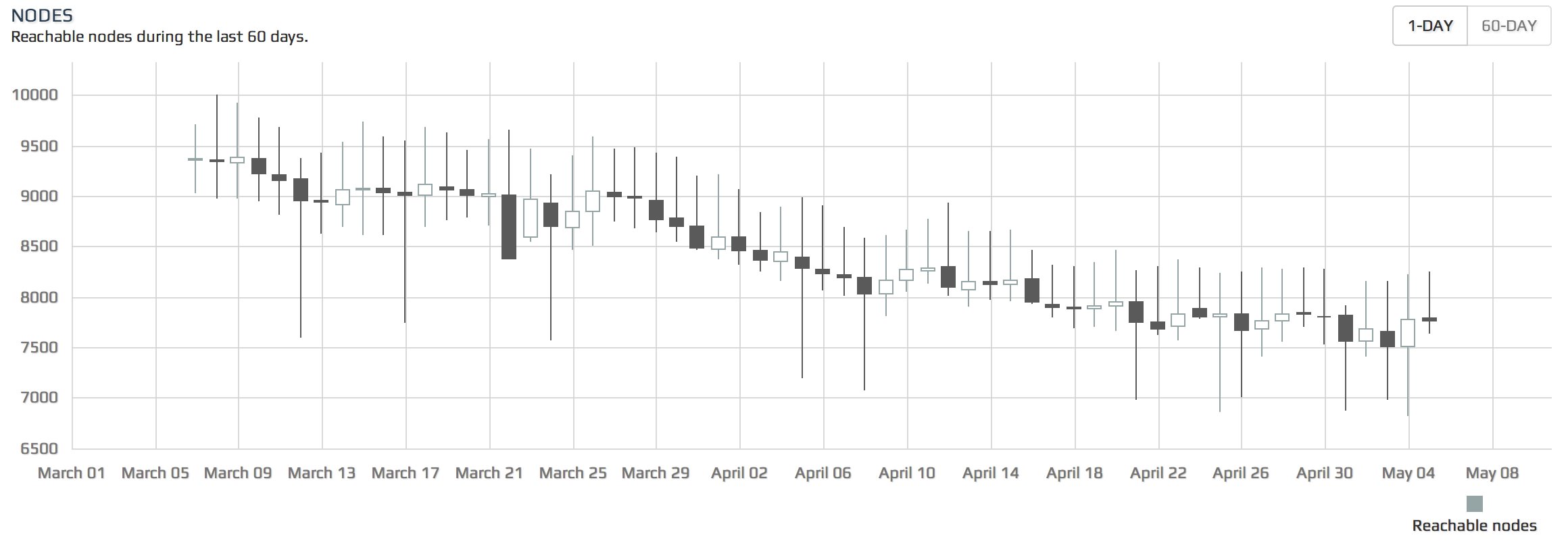

at a 60-day chart of bitcoin nodes shows that the number has gone down

significantly. It went from 10,000 reachable nodes in early March to

below 8,000 at the beginning of May.

|

|

Source: Bitnodes |

interesting is that during a recent 24-hour period, the number of

reachable nodes went down from 8,200 to 7,600 and back to 8,200 again.

This suggests that a portion of users running nodes are turning off

their machines at night, meaning that this contingent of nodes are being

run on desktops or laptops.

|

|

Source: Bitnodes |

|

|

A map based on Bitnodes data. Source: Coinviz |

Lack of incentive

running a bitcoin node does not provide any incentive. The only benefit

for someone to run a node is to help protect the network, and based on

the Bitnodes data, the number of people interested in supporting the

network with a full node is waning.

Centralization of mining

terms of supporting the bitcoin network, it used to be a lot easier for

the average user to participate. However, the advent of massive ASIC

data centres has weakened the consensual nature of mining, and by

extension providing nodes, for many people.

“As

bitcoin grows, so does the network and the computing power behind the

scenes required to run it. The majority of bitcoiners won’t be able to

support their own nodes and will be taken over by companies like KnC.”

pushing bitcoin towards a more centralized future. McKelvie also

believes that major technology companies that take interest in bitcoin

will have to put their computing resources behind the digital currency:

“I

wouldn’t be surprised if we see large tech companies like Google and

Amazon throwing resources at bitcoin as they adopt the currency.”

Feedback from nodes

sees the issue of nodes dropping from 10,000 down to under 7,000 as a

significant problem. To Hearn, the core of the issue is disinterest in

both expending computing resources and electricity toward something that

may have diminishing value.

Hearn has proposed added functionality that would allow communications

between nodes and the developers to better understand why so many are

dropping out.

is because their number will continue to decline no matter what – and

they appear to only be working when users are awake during the day.

“It

makes [the bitcoin network] ‘seem’ bigger, more robust and more

decentralised, because there are more people uniting to run it. So

there’s a psychological benefit.”

Moving forward

believes that community attention to the lack of nodes supporting the

network is what the industry needs in order to boost numbers:

“I agree we need more full nodes. I’ve long been a proponent of such calls for more nodes.”

such calls for voluntary support might not be enough motivation for

people to do so, though, so, one logical idea that has been floated is

to give nodes some sort of incentive.

feasible right now: over the past six months, miners have been

averaging a daily reward of 15.98 BTC per day, according to Blockchain.

bitcoin prices would peg that value at around $7,040 per day for the

entire network – and the growth in transaction fees has been incredibly

flat over the past six months. As a result, miners would likely be

reluctant to concede any revenue to bitcoin nodes, which don’t require

pricey ASIC hardware to run.

|

|

Transaction fees on the network for past six months. Source: Blockchain |

of the bitcoin community seem to be losing interest in hosting full

nodes. And it’s something to pay attention to, because over time it

might mean that the major companies in the industry may have to pick up

the slack.

the network as full nodes, though, it continues to lessen the amount of

decentralization the network has at an infrastructure level.

is all down to circumstances surrounding bitcoin sentiment – the rise of

ASICs, the selloffs in China and complete collapse of Mt. Gox – plus

little in the way of incentives for someone to run a node.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Marc Andreessen: In 20 years, we’ll talk about Bitcoin like we talk about the Internet today

(WashingtonPost) The investor and Web browser pioneer Marc Andreessen thinks we’ll

all look back in 20 years and conclude that Bitcoin was as influential a

platform for innovation as the Internet itself was. He says that tech

companies think their meetings with President Obama on privacy are a

waste of time. And he calls net neutrality a “lose-lose.” In a

wide-ranging interview with The Washington Post this week, Andreessen

painted a picture of a future that’s distributed, messy and fraught

with tension. Here’s an edited transcript of our conversation.

Is there anything that Washington has built a wall against in terms of progress?

Well, the big thing right now for the tech industry is the Snowden

revelations, and the consequences of that for the American tech

industry. Specifically, in two areas: One is that the level of trust

that customers have [in] American tech companies has been seriously

damaged. And that is especially — but not exclusively — true outside the

United States. Every time another revelation comes out, like the one

this weekend about hijacking the routers on their way out of the country, or the one about hacking into the Internet companies’ backbone networks — every time one of these shoes drops, and apparently there is just an unlimited

number of shoes — every time one of these things happens, it’s a

serious blow to the credibility of these companies, especially outside

the U.S. And so there’s a really big, I mean very, very, very high level

of concern in the Valley that the American tech industry is in trouble

outside the U.S.

And then, two is this balkanization of the Internet that’s happening

now. As more revelations happen, more and more countries are saying:

“Okay, if we can’t trust the Internet, if the NSA is going to watch

everybody on the Internet all the time, we’re going to have to break off

and have our own Internet. Have our own firewalls, do what the Chinese

do, have our own private Internet or whatever the hell it’s going to

be.” This issue is being used as political cover for what these countries want to do anyway.

That brings us to, “Okay, how is the American government getting in

front of this?” And the answer is, “Not even a little bit.” The view in

the Valley is that the White House has hung the NSA out to dry. Just

like, “You’re on your own.” And there’s basically no effective

communication right now that I’m aware of between the American

government, especially the administration and American tech companies,

on like, “Okay, what happens now?”

There isn’t?

No.

Those meetings that occurred, that’s just for show?

Yeah, people come back, and they’re like, “Nothing happened.” The

Obama administration does not seem to have any real — they don’t seem to

have a plan. They seem to be in the mode of they kinda hope that it

goes away. And they hope that if they get face time with the execs they

can just mollify everybody and over time, the issue will just dissipate.

But I’m not aware of any substance that’s come out of those meetings.

I’m not aware of anybody who’s come back from those meetings saying:

“Okay, now there’s a plan. Now we know what’s going to happen.” It’s

been the opposite. It’s been people saying, “I don’t even know why I

went.”

Is there anything tech companies can do, whether on the Snowden stuff, or culturally?

These technologies escalate the power of government, but they also

escalate the power of business, and they also escalate the power of

individuals. So everyone’s been upgraded. And it’s a recalibration of

who can do what, and everybody can do new things, so everybody’s uneasy

about it. Governments are very worried about what citizens are going to

be able to do with these new technologies. Citizens are very worried

about what governments are going to do, and everybody’s worried about

what businesses are going to do. It’s this three-way dynamic that’s

playing out. And so for any of these individual issues, it’s not just

“What is one leg of this triangle going to be doing?” It’s, “What are all three of them going to be doing, and how will the tension resolve itself?”

Any thoughts on all these mergers that are being announced?

Not specifically on the mergers.

Or net neutrality?

So, I think the net neutrality issue is very difficult. I think it’s a

lose-lose. It’s a good idea in theory because it basically appeals to

this very powerful idea of permissionless innovation. But at the same

time, I think that a pure net neutrality view is difficult to sustain if

you also want to have continued investment in broadband networks. If

you’re a large telco right now, you spend on the order of $20 billion a

year on capex. You need to know how you’re going to get a return on that

investment. If you have these pure net neutrality rules where you can

never charge a company like Netflix anything, you’re not ever going to

get a return on continued network investment — which means you’ll stop

investing in the network. And I would not want to be sitting here 10 or

20 years from now with the same broadband speeds we’re getting today. So

the challenge, I think, is to accommodate both of those goals, which is

a very difficult thing to do. And I don’t envy the FCC and the

complexity of what they’re trying to do.

The ultimate answer would be if you had three or four or five

broadband providers to every house. And I think you actually have the

potential for that depending on how things play out from here. You’ve

got the cable companies; you’ve got the telcos. Google Fiber is

expanding very fast, and I think it’s going to be a very serious

nationwide and maybe ultimately worldwide effort. I think that’s going

to be a much bigger scale in five years.

So, you can imagine a world in which there are five competitors to

every home for broadband: telcos, cable, Google Fiber, mobile carriers

and unlicensed spectrum. In that world, net neutrality is a much less

central issue, because if you’ve got competition, if one of your

providers started to screw with you, you’d just switch to another one of

your providers.

There’s more and more integration between Bitcoin and the

financial services sector. But a lot of people who support Bitcoin

supported it because it was sort of disconnected from the infrastructure represented by government and everything else.

So we sort of have a theory on this, on where really disruptive

technologies come from. So the really new disruptive technologies come

from the fringe. This was true of PCs. Steve Jobs was, like, a

hippie. Internet came from the fringe. No big technology company thought

the Internet was going to be important, right up until basically 1995

or 1996.

Bitcoin is the classic instance of that. Bitcoin didn’t come from

Citibank; it didn’t come from the Federal Reserve; it didn’t come from

Visa. It came from the fringe. And now Bitcoin is in the early stages of

mainstreaming today. And the signs that it’s in the early stages of

mainstreaming are mainstream venture capital firms funding mainstream

startups, employing mainstream engineers to build services that’ll be

used by mainstream people. You’ve got big companies that are not yet

doing a lot with it, but are looking very seriously at it. So every big

bank has people that are trying to figure out what to do with Bitcoin;

every big e-commerce company has people that are trying to figure out

Bitcoin. You have mainstream regulators figuring it out; you’ve got

people at the Federal Reserve, and the Treasury Department and IRS that

are figuring it out. At the state level, people are engaged on it. And

so, it’s in the early stages of mainstreaming.

It’s already happening.

Anybody who thinks Bitcoin makes it easier to do transactions that aren’t

tracked by the government is 100 percent wrong. The transactions all

happen in public view. Anybody can look at the entire ledger and verify

who owns what. So if you’re a law enforcement agency or an intelligence

agency, this is a much easier way to track the flow of money than cash.

So I think actually law enforcement and intelligence agencies are going

to wind up being pro-Bitcoin, and libertarians are going to wind up

being anti-Bitcoin.

For [journalists], the big challenge has been explaining what

Bitcoin is to people. And I think we’ve always explained it as a

currency, but does that — now that people know about it in terms of a

currency, does that prevent them from [grasping Bitcoin’s full

potential]?

I have a lot of friends who are programmers. The programmers have always gone like, “Those [Bitcoin] guys are crazy.”

And then, almost 100 percent of the time, they sit down, read the paper,

read the code — it takes them a couple weeks — and they come out the

other side. And they’re like: “Oh my god, this is it. This is the big

breakthrough. This is the thing we’ve been waiting for. He solved all

the problems. Whoever he is should get the Nobel prize — he’s a genius.

This is the thing! This is the distributed trust network that the

Internet always needed and never had.”

So, one of the challenges is you take people who aren’t

professional programmers or mathematicians and then you expect them to

understand it from a standing start. And it’s daunting. And so then it

gets a word attached to it, like “currency” or whatever you want to call

it, and then people think that it is something it isn’t. And you have a

sense of this, but it’s a much deeper concept than currency. It’s the

idea of distributed trust.

So the business opportunity posed by this “distributed trust

network” — as an investor, what do you see that you could potentially —

Hundreds or thousands of applications and companies that could get built on top.

Is this, like, a billions-of-dollars kind of industry?

Yeah.

Trillions…?

Yeah! (Laughs, steeples his fingers Mr. Burns-style). Yeeeah… (Laughs) I have the haircut, I can do it.

Digital stocks. Digital equities. Digital fundraising for companies.

Digital bonds. Digital contracts, digital keys, digital title, who owns

what — digital title to your house, to your car. Like for example, you

get a digital title on a car, attached to a digital key, where you own

your car on the Bitcoin blockchain and on your smartphone. The key for

opening your car and starting your car is tied to that title. And if I

sell you my car, automatically you get title, and you get the key that

lets you operate the car, and it’s all digital, and it’s all unique, and

it can’t be cracked. You’ve got digital voting, digital contracts,

digital signatures. You’ve got unique pieces of digital content. If you

guys wanted to know exactly who had every piece of content you ever

made, you can track that. It’s this long list. And then every aspect of

financial services: insurance contracts, insurance derivatives, currency

exchange, remittance — on and on and on. It gives you a chance to

basically go after this very broad category of online business in a new

way. And, by the way, if we had had this technology 20 years ago, we

would’ve built it into the browser.

E-commerce would’ve gotten built on top of this, instead of getting

built on top of the credit card network. We knew we were missing this;

we just didn’t know what it was. There is no reason on earth for anybody

to be on the Internet today to be typing in a credit card number to buy

something. It’s insane, because — which is why you have all these

security problems, the Target hack and all this crazy…. And these high

fees, this high fraud rate. It doesn’t make sense online to have a

payment mechanism that requires you to hand over your credentials to

make a payment. That’s just an invitation to fraud and identity theft.

It’s just stupid.

But we didn’t have the better way of doing it. So we didn’t know what

else to do, and now we have the better way of doing it. Now, it’s going

to take time. We’re quite confident that when we’re sitting here in 20

years, we’ll be talking about Bitcoin the way we talk about the Internet

today. We just need time for it to play out.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Lawsky says New York will adapt money transfer rules for Bitcoin

“We do not have to throw out all of our existing rules for money transmitters or banks, which have generally served consumers well when vigorously enforced,” Lawsky said in a statement delivered to a New America Foundation forum on Bitcoin. “Indeed, certain aspects of virtual currency could dovetail with existing regulations.”

New York will “likely have to proceed with issuing some form of specially tailored BitLicense that adapts those rules to the world of virtual currency,” Lawsky said.

The Treasury Department’s Financial Crimes Enforcement Network said in March that virtual currency businesses may be regulated as money transmitters. Since states license such companies, the decision set off a scramble by states to decide how to treat the embryonic industry.

Open your free digital wallet here to store your cryptocurrencies in a safe place.