(

CoinDesk) What is Ripple? Well, it is both a digital currency and a payments protocol, and it is the latter that has got people excited.

Ripple has been hitting the news recently, with banks saying

it has promise, and even for the first time

starting to use it for services. But many people don’t understand it, so how does it work, exactly?

A good parallel is the

hawala network –

a traditional, non-digital way of sending money from city to

city. Hawala has its roots in medieval Arabia, and is still in use today

in places where banks won’t or can’t operate.

A medieval banking system

Hawala

is best described as money transmission without money movement,

providing the appearance of instant remittance between separate

locations; for example, sending money between different cities or

countries.

In the basic case, say Alex wants to send money to Beth:

- Alex goes to his local hawala agent and gives him some cash and a password, which he and Beth share.

- The agent telephones Beth’s local agent and tells him to release funds to someone who can provide the password.

- Beth walks in to her agent, says the password, and receives cash. Commissions can be taken from either or both agents.

Note

that money has been transmitted from Alex to Beth, but the physical

notes have not moved. We are left in a situation where Alex’s agent owes

Beth’s agent money.

They can either settle the debt later, or

hope that there may be reverse transactions if other clients want to

move money in the opposite direction.

Also note that trust is involved. In this scenario, there are three trust relationships:

- Alex has to trust that his agent will do the right thing, as he is handing over cash.

- Beth has to trust that her agent will do the right thing, as she is expecting to receive cash.

- The agents need to trust each other over the repayment of the debt (IOUs).

Moving to Ripple

Now

we can have websites or shops that perform the function of agents, and

instead of agents phoning each other, we can communicate the IOUs

electronically.

This is how Ripple works: Alex logs on to his

preferred Ripple gateway, deposits money to it, and instructs them to

release funds to Beth via her gateway. Beth collects her funds.

You now understand Ripple. Simple eh?

Not just cash

In the example above, we talked about cash. Now this can also work with physical gold.

So

long as both gateways are prepared to accept and hand out the precious

metal, and the gateways have a trust relationship that allows the IOUs

of gold (as opposed to IOUs of cash in the first example), the network

still works, and you can transmit gold.

Alex gives gold, Beth receives gold, and Alex’s agent owes Beth’s agent gold.

You now understand that Ripple can work for gold, not just money.

Anything goes

Now replace the word ‘gold’ with ‘anything’.

Now, you can transmit anything without moving it, so long as both gateways are set up to deal in it.

This

works best for non-perishable, fungible goods (cash is good, gold is

OK, as are cryptocurrencies, but can also be extended to beer and

flowers, if the gateways want to deal in them.

You now understand that Ripple can transfer anything.

Conversion of goods

If

either gateway is prepared to exchange cash with gold (ie: act as a

gold trader, or ‘market maker’ in Ripple terminology), then Alex can put

cash in at his gateway and Beth can get gold out at hers.

You now understand that Ripple can also morph stuff.

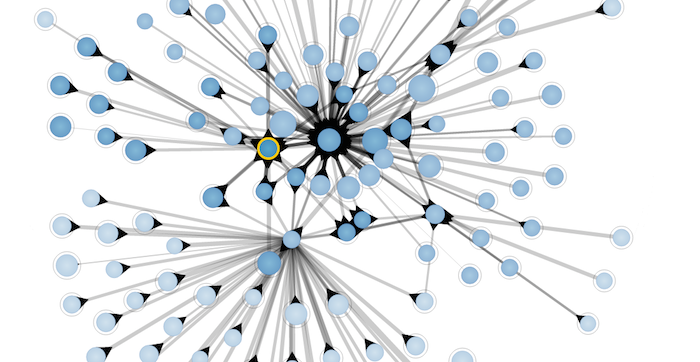

No direct trust? Find a chain

What if Alex’s gateway doesn’t have a trust relationship with Beth’s gateway?

So

long as there are intermediary gateways who can form a chain of trust

for the object being passed (cash, or gold, or whatever), the

transaction will work.

The Ripple algorithm tries to find the

shortest trust path between the gateways. So, thinking back to hawala,

Alex’s agent may not trust Beth’s agent, but there may be a third agent

who trusts the other two. So there will be two IOUs: Alex’s agent owes

the third agent, who owes Beth’s agent.

No chain of trust? Use ripples.

What if the network can’t find any chain of trust between the two gateways at all for the cash or goods in question?

This is where ‘ripples’ (XRP) come in. XRP is the ‘currency of last resort’ for the ripple network.

All

gateways provide a price in XRP of anything they deal in (for example: a

dollar is 200 XRP; 1 oz of gold might be 260,000 XRP).

You could say, USD is the currency of last resort in the USA – that is, everything has a price in USD.

This

means, within the Ripple network, you can convert anything to a number

of XRPs, transfer the XRPs via the trust chains, then convert back at

the end gateway, if needed.

XRP is not just a currency of last resort

As well as being a ‘bridging currency’ or a ‘currency of last resort’, XRP also has other notable benefits.

Firstly,

XRP as a currency settles immediately, so when it’s sent on the

Ripple network, the ownership of the actual asset changes – so it’s

final and trustless.

This is in contrast to IOUs, which, although

transferred instantly, still need to be redeemed from a gateway. This

gives rise to counterparty credit risk, as it needs you to trust that

the gateway will fulfill its obligations.

Secondly, transfers of XRPs over ripple incur fewer and smaller transaction fees, as there are fewer intermediaries needed.

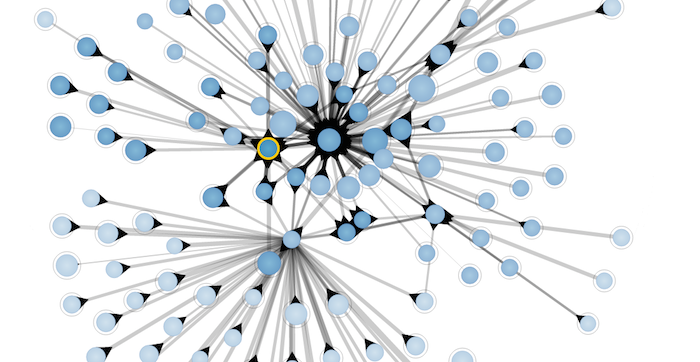

Who owes who?

Who

is keeping track of all the IOUs? In the hawala system, each agent

keeps their own ledger, and they are reconciled periodically within

their network of trust.

In Ripple, a public ledger of accounts,

balances, and IOUs are kept updated by everyone simultaneously in the

Ripple network, which is a distributed collection of servers around the

world.

The servers agree on changes by consensus (effectively: “Do

we all agree this transaction can take place?”). There is no central

‘authority’ who says yes or no to transactions, and anyone can be a

server by running free software on their computer.

That’s just the beginning

There

is more here, and as you dig, you’ll learn about market makers, who

provide prices at which they are prepared to trade between goods (for

example, cash for gold, gold for silver, silver for XRP, XRP for GBP,

and so on).

You’ll start to understand why every transaction costs

a small number of XRP (a 1/1000 of a cent, to stop transaction spam),

and that the network is pre-lubricated with 100 billion XRPs.

You’ll

discover the elegance of confirmation via consensus. You’ll learn that

transactions based on cryptography on a distributed network with public

ledgers is faster, cheaper, lower risk, and much, much better in almost

every way possible than centralised pre-Internet correspondent banking

messaging networks such as SWIFT, that some financial institutions

currently operate on. You’ll learn much, much more.

Open your free digital wallet here to store your cryptocurrencies in a safe place.