Search Results For: bitcoin price

Value of Bitcoin: the digital currency’s higher price

The value of bitcoin has grown a lot in the last period, reaching its all-time high set back in 2013.

According to the CoinDesk Bitcoin Price Index, at the moment the value of bitcoin is less than $30 below the maximum ever value of $1,165.89 reached on November 30th, 2013.

This latest rise comes after bitcoin’s longest ever period at over $1,000, and a period of average volatility during the recent few months.

Also, this high might reflect the traders and investors confidence in an industry field that has been recently affected by the Chinese central bank’s plan to restrict the Chinese bitcoin exchanges environment, with the result of several of them to temporarily stop any withdrawals of the digital currency.

Click here to better understand what gives Bitcoin value with an infographic.

Another possible news to having an influence on the value of Bitcoin is the currently SEC decision on the Winklevoss brothers’ bitcoin ETF – an event that some experts explained that traders are already pricing in a potential approval.

On March 11st we could see the approval of the first bitcoin ETF within the U.S.A. market, opening the virtual currency to a larger group of investors.

However, many experts in the industry cannot see a high propension of financial regulators to approve this move.

For more charts about the Value of Bitcoin in the past, click here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Genesis of Bitcoin’s Supply

Satoshi Nakamoto, a name shrouded in digital mystery, appears to have left more for us to unravel. In a recently uncovered email, Nakamoto details the decision-making process behind the finite supply of Bitcoin, a choice described as an “educated guess.” This pivotal decision was not taken lightly, as it laid the foundation for Bitcoin’s deflationary nature.

A Deliberate Choice

The supply limit of 21 million coins, as Nakamoto explains, was chosen to create a new currency that could stand on par with existing currencies, albeit with a significant caveat – the unknown future. The email reflects a conscious effort to strike a balance, aiming for a middle ground in a landscape of uncertainties. Nakamoto writes, “It was a difficult choice, because once the network is going it’s locked in and we’re stuck with it. Pondering Bitcoin’s future, Nakamoto considered two divergent paths: one where Bitcoin remained a “small niche,” less valuable than existing currencies, and another where it became a staple in global commerce, significantly more valuable due to its limited supply. This dichotomy highlights the foresight in Bitcoin’s design, capable of scaling its value proposition in accordance with its adoption rate.

Granularity and Adaptability

Nakamoto’s email delves into the technicalities of Bitcoin’s architecture – the use of 64-bit integers and the ability to represent values up to eight decimal places, ensuring “there’s plenty of granularity if typical prices become small.” This statement underscores the meticulous thought given to Bitcoin’s future scalability and its potential role in everyday transactions.Through the lens of these emails, one can see the bedrock of Bitcoin’s philosophy: a decentralized currency, untethered from the unpredictability of fiat currencies and traditional financial institutions. Nakamoto’s decision for Bitcoin’s supply was not just a technical one; it was a philosophical stance on creating a sustainable, value-driven alternative to the existing monetary system.

Legacy and Lessons

The legacy and lessons of Satoshi Nakamoto’s creation of Bitcoin cannot be understated. As the pioneering cryptocurrency, Bitcoin has set off a financial revolution, challenging traditional banking and offering a decentralized alternative that promises greater financial inclusivity.Satoshi Nakamoto’s vision, as interpreted through various analyses, was to create a peer-to-peer electronic cash system that was free from the control of any central authority. This vision was crystallized in the wake of the 2008 financial crisis, a time when the trust in traditional financial institutions was at a significant low. Bitcoin was conceptualized as a solution to the problems inherent in trust-based financial systems, leveraging cryptography to facilitate transactions and eliminate the need for intermediaries like banks.

The introduction of Bitcoin has given rise to several benefits and revolutionary changes within the financial industry. Its decentralized nature has enabled enhanced privacy and security, making it highly resistant to censorship and fraud. Additionally, it has provided financial services to those who were previously unbanked, breaking down barriers due to geographic limitations and lack of access to banking infrastructure.Nakamoto’s implementation of blockchain as a public ledger has been a game-changer. The transparency and immutability of the blockchain ensure that all transactions are traceable and irreversible, promoting trust and integrity within the system. This technological innovation has extended its reach far beyond finance, influencing sectors like healthcare, supply chain management, and governance.

Moreover, Bitcoin’s design reflects a set of principles and philosophies that champion financial empowerment, privacy, and libertarian ideals. Nakamoto’s emphasis on anonymity and the finite supply of Bitcoin—capped at 21 million—contrasts sharply with the fluidity of fiat currency controlled by governments.The quest to uncover the true identity of Satoshi Nakamoto has been fraught with speculation and intrigue, adding to the mystique of Bitcoin’s origins. The anonymity of Nakamoto aligns with the principles of decentralization and privacy that Bitcoin itself embodies, and whether Nakamoto is an individual or a group, the impact of their creation is undeniable.

Future

The influence of Bitcoin is seen in the way it has paved the way for the proliferation of a wide array of cryptocurrencies, each building on the foundations laid by Bitcoin’s original blueprint. The disruption caused by Bitcoin has prompted a reevaluation of financial systems and sparked discussions on the potential of digital currencies to create a more inclusive and equitable global economy.

As we look towards the future, the principles of Bitcoin continue to guide developments within the cryptocurrency space. The lessons from Nakamoto’s creation remind us of the power of decentralized systems and the potential for technological innovation to drive significant societal change. The legacy of Bitcoin is still unfolding, and its story is far from complete, as it continues to challenge and redefine our understanding of money and finance.The impact of Satoshi Nakamoto’s vision and the legacy of Bitcoin’s creation are still prominent topics of interest, as seen in discussions and analyses across various platforms, each contributing to the rich tapestry of Bitcoin’s history and its ongoing narrative in reshaping the financial world

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Unlocking the Future: The Promise and Potential of Bitcoin ETFs in Mainstream Investment

Bitcoin ETFs: Catalyzing Institutional Participation

Following a period of subdued engagement triggered by the collapse of major crypto players like FTX during the extended crypto winter of 2022, the momentum within the crypto sector has witnessed a rejuvenation. Bitcoin, alongside various other cryptocurrencies, languished through a phase of lackluster trading as regulatory scrutiny enveloped multiple crypto exchanges. However, a transformative shift was catalyzed by the news that industry powerhouses such as BlackRock, Fidelity, and Valkyrie were vying for approval to introduce spot Bitcoin ETFs, effectively reigniting investment enthusiasm in the crypto realm

While institutional contenders had previously submitted spot Bitcoin ETF proposals to the United States Securities and Exchange Commission (SEC), these initiatives had met with varying outcomes, ranging from withdrawal to outright rejection. A milestone was marked with the SEC’s approval of the inaugural Bitcoin futures ETF, the ProShares Bitcoin Strategy ETF, in October 2021—a significant stride toward mainstream acceptance.

Institutional Entrants and the Balancing Act

The pivotal move by asset management titan BlackRock to file a spot Bitcoin ETF application with the SEC has reshaped the landscape, elevating the probability of the regulatory green light. Industry expert Eric Balchunas from Bloomberg posits a 50% likelihood of BlackRock’s spot Bitcoin ETF securing approval—an event that could be transformative for the industry. The subsequent wave of ETF filings initiated by BlackRock on June 16 spurred a cascade of similar applications from WisdomTree, Invesco, Valkyrie, and others. A total of seven institutional heavyweights have now embarked on the journey to establish spot Bitcoin ETFs.

Industry pundits predict the period spanning 2023 to 2024 to be pivotal in securing spot Bitcoin ETF approval. Chief Strategy Officer of Bitrue, Robert Quartly-Janeiro, underscores the economic backdrop marked by surging inflation, intricate money supply dynamics, and elevated interest rates—a fertile environment for cryptocurrencies to flourish. Despite market volatility, institutional faith in cryptocurrencies remains resolute. The influx of institutional investors into the crypto landscape has expanded significantly compared to a mere year ago. Even trailblazers like MicroStrategy, who temporarily suspended their Bitcoin acquisitions, have reignited their involvement, actively accumulating Bitcoin in 2023.

Balancing Risk and Reward

The Chief Technology Officer at Bitfinex, Paolo Ardoino, underscores Bitcoin’s enduring value as a safeguard against devaluation—a sentiment echoed by traditional financial institutions. The upsurge in applications for Bitcoin spot market ETFs reflects a burgeoning demand from both investors and issuers, signifying a broader institutional momentum towards embracing Bitcoin.

The reticence exhibited by institutions over the past year was partially catalyzed by events like the FTX incident and subsequent banking challenges. The evolving regulatory terrain is paving the way for institutions to reevaluate their stance and cautiously re-enter the crypto space.MicroStrategy’s unwavering commitment to Bitcoin stands as a testament to institutional leadership. CEO Michael Saylor’s resolve to continue accumulating Bitcoin, even amid price turbulence, underscores the significance of institutional conviction.

Institutional Push and Market Resurgence

The resurgence of institutional interest rekindles optimism for a potential new bull run. In the prior bullish trajectory of 2020 to 2021, institutional investments were instrumental, with companies like MicroStrategy and Tesla integrating Bitcoin into their balance sheets. The collective impact of institutional and retail interest is poised to amplify the growth of cryptocurrency market capitalization.

The potential approval of BlackRock’s ETF application introduces the prospect of doubling Bitcoin’s value. This anticipated move not only intensifies institutional interest but also augments competition among financial entities, channeling increased funds from traditional markets into the crypto domain. Alongside institutional momentum, regulatory advancements in markets like Hong Kong open avenues for broader retail participation, offering a diverse spectrum of drivers for the impending bull run.

Bitcoin Halving and Institutional Propulsion

With Bitcoin’s halving event scheduled for April 2024, institutional engagement assumes a pivotal role in shaping the future crypto landscape. Historical patterns underscore that bull runs often coincide with halving events—a phenomenon attributed to the scarcity-driven price surge as investors, both institutional and retail, seek to bolster their Bitcoin portfolios.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Heating Your Home with Bitcoin Mining Rigs: Pros, Cons and Real-Life Cases

Bitcoin mining is the process of using specialized computer hardware to validate transactions on the Bitcoin blockchain and earn rewards in the form of newly minted Bitcoins. This process requires a significant amount of energy and generates a lot of heat as a byproduct. In recent years, some individuals have started using their Bitcoin mining rigs to heat their homes as an alternative to traditional heating methods.

Advantages of using a Bitcoin mining rig for heating

Cost savings

One of the main advantages of using a Bitcoin mining rig for heating is the cost savings. Bitcoin mining can be a profitable endeavor, and the heat generated by the rig can be used to offset the cost of heating the home. Additionally, using a mining rig for heat can also help to reduce the overall carbon footprint of the home, as it eliminates the need for fossil fuels or other non-renewable sources of heat.

Flexibility

Another advantage of using a mining rig for heat is the flexibility it offers. Many mining rigs can be easily moved from room to room or even from house to house, allowing individuals to easily adjust the heating in their home as needed. Additionally, some mining rigs can be controlled remotely, allowing individuals to turn the heat on or off and adjust the temperature from anywhere using a smartphone or computer.

Real-life examples of using a Bitcoin mining rig for heating

Qarnot Computing’s QH-80 heating system

One real-life example of using a Bitcoin mining rig for heating is a company based in the United States called Qarnot Computing. They have created a heating system called “QH-80” that is specifically designed for this purpose, it’s a small, plug-and-play device that can be used to heat a room or small apartment. The device is equipped with several high-performance computing chips that can be used for both mining and heating, with the heat being distributed through a series of built-in radiators. The company claims that the device can heat a room of about 150 square feet for roughly $30 per month, which is significantly less than the cost of traditional heating methods.

Kristoffer Koch’s home in Norway

A third example is a man from Norway named “Kristoffer Koch” who became a millionaire by investing in Bitcoin early on. He invested 150 kroner ($26.60) in 5,000 bitcoins in 2009 and forgot about it. When he rediscovered his investment in 2013, the value of his bitcoins had grown to $886,000, he decided to use a part of his fortune to install a heating system in his house that runs on Bitcoin mining. He claims that it’s cheaper and more environmentally friendly than the traditional heating methods.

Heat4Mine: Bitcoin Mining for Heating in the Netherlands

Heat4Mine is a Dutch company that provides a solution for using the heat generated by Bitcoin mining rigs to heat homes. They have developed a system that captures the heat generated by mining rigs and uses it to heat water, which is then distributed through a building’s heating system. This allows homeowners to offset the cost of heating their home with the profits generated from mining Bitcoin. The company claims that their system is a more sustainable and eco-friendly alternative to traditional heating methods, as it reduces the need for fossil fuels. According to their website, they have been providing this service since 2017.

Disadvantages of using a Bitcoin mining rig for heating

Initial cost of setting up the rig

Despite these advantages, using a Bitcoin mining rig for heating does have some drawbacks. One of the main disadvantages is the initial cost of setting up the rig. Mining rigs can be quite expensive, and the cost may not be worth it for those who only plan to use it for heating. Additionally, the noise and heat generated by the rig can be quite substantial, which may not be suitable for some individuals.

Regular maintenance and reliability issues

Another potential drawback is the fact that the mining rig will require regular maintenance, which can be time-consuming and costly. Additionally, mining rigs are not always reliable and may break down or malfunction, which can be a major inconvenience for those who rely on them for heat.

Conclusion

Despite these drawbacks, using a Bitcoin mining rig for heating is becoming an increasingly popular option for those looking for an alternative to traditional heating methods. As the price of Bitcoin continues to rise, the profitability of mining also increases, making it a more viable option for those looking to offset the cost of heating their home. Additionally, as the world continues to focus on reducing carbon emissions and becoming more energy efficient, using a mining rig for heat may become a more appealing option for those looking to reduce their environmental impact.

It’s important to note that the profitability and cost-effectiveness of using a mining rig for heat will depend on several factors, including the cost of electricity, the current price of Bitcoin, and the efficiency of the rig itself. Additionally, it’s also important to consider the noise and heat generated, and maintenance requirements before making a decision. It’s also important to note that while this is a potential use case, it’s not yet widely adopted or popular. It’s still a niche application of the technology.

In conclusion, using a Bitcoin mining rig for heating can be a cost-effective and energy-efficient alternative to traditional heating methods. It can also help reduce carbon footprint and offer flexibility to adjust heating as per need. However, it’s important to weigh in the initial costs, maintenance requirements, noise and heat generated and the overall profitability before making a decision. As with any technology, it’s important to keep in mind that it may not be suitable for everyone, but for those who it does work for, it can be a great way to save money and reduce their environmental impact.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

El Salvador’s “Adopting Bitcoin” Conference as a Key Moment for the Bitcoin Industry

Emerging at the forefront of Bitcoin innovation, El Salvador is working toward achieving a level of financial independence and openness independent from a centralised banking system. El Salvador has paved the way for other nations to follow in its footsteps by becoming the first nation in the world to recognise Bitcoin as a legitimate currency.

To encourage worldwide collaboration and proliferate networking avenues for Bitcoin enthusiasts, El Salvador hosted the “Adopting Bitcoin” Conference over 3 days, between November 15 and 17. The event took place in San Salvador and at Bitcoin Beach and brought together members of the Bitcoin ecosystem from a multitude of states.

Uncovering the Objectives of the “Adopting Bitcoin” Conference

More than 110 speakers from over 30 countries discussed the most recent breakthroughs throughout the whole range of Bitcoin-related disciplines, including those pertaining to technology as well as economics.

In this setting, the presentation of the Bitcoin core engineer Jon Atack was a significant highlight, focused on technology and development, while the presentation of Mexican senator Indira Kempis will be the most famous name in the track focused on economics. The multi-stage event will be held in English, with Spanish translations provided in real-time for the most critical phases.

Bitfinex Pledges to Support El Salvador in Future Bitcoin Ventures

Paolo Ardoino, the Chief Technical Officer of Bitfinex, is one of the attendees at the crypto conference in El Salvador who gained the greatest notoriety. Arduino said in his statement that his company “would redouble its efforts to establish a free, unstoppable, robust, and open Bitcoin and technological infrastructure for El Salvador.”

Overall, Bitfinex has committed to working closely with the government of El Salvador, which is currently mired in debt and is governed by President Nayib Bukele, to devise an appropriate regulatory framework for the cryptocurrency market and other digital assets in the nation. Ifinex, the parent company of Bitfinex, has agreed with the government of El Salvador to work together on developing a regulatory framework for digital assets and securities.

Adverse Circumstances are Met with Further Commitments by Bitcoin Supporters

While adverse market dynamics hindered the optimism around the event, there is a suite of conclusions that indicate the ongoing commitment of Bitcoin leaders and pioneering nations like El Salvador to still pursue the broader adoption of Bitcoin as a payment medium.

As the blockchain industry, as well as all the other financial sectors, witnessed in 2022, the price of Bitcoin and other cryptocurrencies declined primarily due to the Federal Reserve’s strategy of dramatically raising interest rates to curb rising inflation in the United States, which caused the cost of money to increase. Subsequently, the remainder of the decline was caused by a succession of events, including the bankruptcy of organisations involved in cryptocurrency trading and the collapse of currencies such as Terra USD. Large investors sold out these high-risk assets, precipitating a precipitous value decline.

“One Bitcoin Per Day” Plan Proposed by El Salvador’s President

El Salvador’s President, Nayib Bukele, announced that the nation would begin buying one Bitcoin each day starting with November 17, 2022. The use of dollar-cost-averaging (DCA) in Bitcoin transactions is widespread among the community, yet it is unprecedented for a nation-state. When Bukele’s proclamation was made, the nation possessed a Bitcoin treasury that included 2,381 BTC and had a worth of more than $39 million.

So far, Bukele has made it a pattern in the past to acquire a significant quantity of Bitcoin during periods of market instability and to “buy the dip.” This action would signal the end of a nearly five-month pause amid severe bear market circumstances and the collapse of Sam Bankman-massive Fried’s $32 billion FTX enterprise.

According to NayibTracker, Bukele made his most recent purchase of Bitcoin on June 30, 2022. At that time, he paid $1.52 million for 80 Bitcoins (worth around $1.33 million), which works out to an average price of $19,000 per coin.

Bottom Line

Overall, El Salvador’s “Adopting Bitcoin” conference serves as a reminder of the ongoing commitment of crypto pioneers and their belief in the long-term potential of this cutting-edge technological revolution.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Has The Crypto Market Bottomed After Bitcoin’s 50% Collapse?

The second half of 2019 was really difficult for Bitcoin. According to independent experts, the total volume of public digital assets has decreased by more than 50% – from $388 billion to $166 billion. However, there is other evidence. Yes, the cryptocurrency market really fell to the bottom if you look at these statistics, but let’s not forget that market conditions are dynamic. And the factor that means failure today may well mean success tomorrow.

Another Side of the Coin

There were periods of stabilization of the exchange rate, but for a long time cryptocurrency lost much in price. At one time, panic even started on the market, and Bitcoin was predicted to soon fall to zero. Against this background, the results of the year sounded quite unexpectedly: cryptocurrency turned out to be the most profitable investment. The coin rate rose from $4035 to $ 7344, providing investment growth by 82%.

Crypto Market and Bitcoin in Modern Political and Economic Conditions – What to Expect in 2020?

This year will be great for Bitcoin, Wall Street analyst and Fundstrat founder Tom Lee suggested. The destabilization of relations between Iran and the United States is one of the reasons.

Plus, modern realities make it possible to add a supposedly modern coronavirus epidemic to these factors. However, at the moment there is no consensus among experts on how the coronavirus will affect the Bitcoin exchange rate. It is still unclear whether we are dealing with a real threat to people’s lives or is this another hype, a political company, or an attempt to distract investors from other, more important issues.

However, even those experts who believe that the disease can affect the main digital coin explain that this will happen only if the outbreak develops into a full-fledged epidemic.

Venture capitalist Tim Draper is also confident in the long-term growth in Bitcoin value. In an interview with FOX Business, he advised millennials to invest in cryptocurrencies, as they are on the verge of a new financial revolution. However, the explosion of the financial revolution will slow down due to the influence of the values of older generations and the obsolescence of the current banking system.

Conclusion

Bitcoin exchange rates are very unstable. Cryptocurrencies have already shown that it can rapidly fall and take off at a breakneck pace. Due to this state of affairs, bitcoin does not inspire confidence among many investors who would be happy to invest big money in the development of the blockchain, but fear for their savings. In 2020, we are unlikely to have to observe the strong influence of this factor, but we should not forget about it.

About the author: Gregory is passionate about researching new technologies in both mobile, web and WordPress. Also, he works on Best Writers Online the best writing services reviews. Gregory in love with stories and facts, so Gregory always tries to get the best of both worlds.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Basic terminology for beginners in regards to Bitcoin trading

For those interested in digital currencies, It has changed the way we do business and the way investors invest in a company. Employers are offering crypto as pay and others, such as music artists, are accepting them in exchange for singles. The attention crypto has attracted made it popular among many. One the biggest reason why many are attracted to crypto is that many of them sit on a decentralised network. This means an organisation or a government does not control them, unlike Fiat currency. Ther is also no physical form of cryptocurrency, but it can be converted into the more familiar notes and coins we know and love.

The introduction of Bitcoin brought with it new technology such a blockchain. The nature of blockchain makes it a secure way of working, and we will go into more detail about it below. It is essential to mention, however, that not all countries share standard consensus o what crypto is. Some view Bitcoin as exchange tokens. Others view crypto in the same light as hard cash. These anomalies in the crypto world mean taxes for Bitcoin differ from country to country which why before investing, purchasing or dealing with crypto, it would be wise to find out the countries views on it.

A big part of making an investment in Bitcoin and other cryptocurrencies and being successful at it means learning the lingo. Here are some of the underlying crypto trading terms that are commonly used. Knowing these terms will help you navigate your way through the world of crypto in ease.

Blockchain

Blockchain is a decentralised and distributed public ledger which means it is a database that is validated by a vast community of people rather than a central authority. In most cases, blockchain refers to the bitcoin blockchain, which is made up of blocks. It allows data to be stored globally on thousands of servers and lets individuals enter the networks to see all the entries in real-time. By doing this, it makes it hard for users to gain control of the system. The immense reach of blockchain makes it harder to hack as all transactions are transparent for all to see. Falsifying a single record in the chain means you would need to forge the entire chain. Bitcoin transactions sit on a blockchain.

Wallet

A wallet is a secure digital wallet that is used to store, send and receive digital currency like bitcoin. It is typically a string of numbers and letters. Many official coins like bitcoin have official wallets, but you can find wallets which hold different types of currencies in one place.

To use a crypto wallet users will usually be given an ID as a way to identify the wallet along with its own private key which will help to authenticate and prove possession of the wallet by the person who owns it.

Private Key

To carry out a transaction with digital currency, you will need two things. The first is a wallet which acts as your address and a private key. The private key is a string of random numbers, but unlike address, the private key must be kept secret. The private key gives users authority to digitally sign and authorise different actions that are done by the digital identity when used with the public key.

The main priority when dealing with cryptocurrencies is to keep the private key secure. It the key gets lost or stolen; there is no means to recover it.

Order Book

The order book displays current prices with volumes in real-time of current order from buyers and sellers.

Bid Price

The price at which a person is trying to sell an asset is known as the Bid Price.

Ask Price

The ask price is the price individuals are trying to buy an asset for.

Bull Market

A period during which asset prices consistently keep rising is known as a Bull Market. To get the most out of investments, users are likely to enter the market at the beginning or just before the start of a Bull market. This is so the assets they buy become more valuable.

Bear Market

In the flip side to the Bull market, a bear market is a period during which the prices of assets consistently fall. The silver lining to this si that the drop in prices means that entering the market becomes cheaper, and it becomes possible to buy the same amount of assets for a lower price. Generally, Bear markets are not specific to cryptocurrencies, and any tradeable asset can go through the same life cycle.

Spread

Spread is referred to as the price difference between the buy price and the sell price of an asset. The exchange between the individuals defines them.

Buy order

When an individual wants to purchase an asset at a designated price, buy order or bids are created. When an individual wants to sell an asset at a selected amount, sell orders, or asks are created.

High and Low

In a 24-hour trading cycle, high means the peak price Bitcoin or other assets have reached in 24 hours. And so low means the lowest price the particular assets has become in the 24-hour trading cycle.

Slippage

The difference between the price a trader expects and the trade to execute at, and the price it eventually executes at known as Slippage.

Execution

The official completion of a trading process is known as Execution.

Cold storage

Storing digital money in an offline wallet is known as cold storage and usually stored on a platform that has no connection to the internet. There are many Blockchain smartphones which now have cold storage capabilities.

Satoshi

Satoshi, named after the creator of Bitcoin, is the smallest unit of Bitcoin (BTC) recorded on the blockchain.

Confirmation

The act of a transaction which is included in a single block within the Bitcoin blockchain is known as confirmation.

Digital signature

Like a fingerprint, a digital signature is an e-signature which is created by using the Publick Key Cryptography (PKC). The digital signature associates securely, a signatory with a document in a recorded transaction. Every transaction has a different digital signature that depends on the users private key.

Transaction Fee

Each Bitcoin transaction incurs a fee. It is processed by a miner who is paid for their services, and the Bitcoin network confirms the results.

Author: Yasmita Kumar

A little bit about me: I am a writer and have been writing about various topics over many years now. I enjoy writing about my hobbies which include technology and its impact on our everyday life. Professionally I write about Technology, Health and Fashion and previously worked for the NHS.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What Are the Investment Returns on Bitcoin Mining

You know about Bitcoin: The original digital currency based on blockchain. Every transaction is written to a shared ledger and verified by the rest of the network. Each set of approved transactions is a “block” added to the chain.

But you may have missed the buzz on Bitcoin mining. It’s not just for web geeks or digital currency traders. There are thousands of people around the world looking to profit in this way.

What is Bitcoin Mining?

Participants try to guess a random number generated by the system. Those who get the answer “own” the next block of transactions and collect a reward; currently 12.5 bitcoins. If you manage this, you can also collect fees on transactions in the block you created.

This number comes from a complex equation. In the early days it was handled by ordinary computers, and then GPUs (graphics processing units), which were better suited to the task. Over the years the equation has evolved in difficulty to regulate the rate of discovery.

Technology

Bitcoin miners now rely on hardware-intensive systems known as ASICs (Application-Specific Integrated Circuit), which appeared in 2013. If you own or can get access to such a system, you stand to guess a fair amount of numbers on the blocks constantly taking shape.

If this sounds like an easy way to profit, it is. Many people have joined the ranks of digital currency miners. However, with so much competition, the big question is whether there are still decent profits to be made.

Can You Still Make Money?

The more computers that are trying to capture the number, the harder the equation becomes and the fewer numbers you get.

But Bitcoins also tend to go up in value. It was a price spike in 2013 that launched mining as a popular investment option. Speculators agree that the value of Bitcoin should continue rising as its popularity grows.

Investments Required

To maximize your return on Bitcoin mining, you need an ASIC system. These computing solutions utilize high-end hardware that generates a lot of heat. Such a setup requires state-of-the-art cooling and ventilation systems along with higher utility bills to operate all of this.

Without an ASIC of your own, your odds of scoring aren’t good. It is possible to save some money by leasing an ASIC rather than buying one outright.

Other Options

Fortunately for the smaller investor, recent years have seen the rise of cloud mining, or cloud hashing. This response to growing demand is basically another cloud service where you get to lease a portion of someone else’s ASCI-enabled data center.

A cheaper option, albeit with smaller potential rewards, is a mining pool. This is a third-party service that uses investor funds to do their own mining and shares out the profits. The upside of this is that you don’t need technical or financial knowledge at all; you just need to come up the minimum investment required by the service.

Profit Potential

You can join some of these investment pools for as little as $500. Some of these third-party services state that you could earn your investment back in as little as two months or so, and start seeing profit after three. When these claims are legit, or even close to it, you’re seeing a remarkable and fairly consistent ROI better than most forms of investment.

However, transaction fees are currently voluntary on the part of individual users of Bitcoin, as is whether the transaction should even be included in a block. This is encouraged as the transaction is more quickly verified if it’s part of a block. Even so, your profit depends on the current value of Bitcoin, the number and size of transaction fees involved, and the number of people sharing the rewards.

Federal Regulation

In 2015 the Commodity Futures Trading Commission (CFTC) declared that digital currency trading is legal and subject to fair trading laws. However, this doesn’t guarantee that you’re protected. Prudent investors always do the homework: Know who you’re dealing with and determine realistic expectations.

Risks in Bitcoin Mining

The Bitcoin reward is halved every 210,000 blocks, or about four years. As the reward approaches zero, it may not be profitable at all unless transaction fees are increased and enforced. And while the general trend is up, there’s also fluctuation in Bitcoin value.

There’s also a question of integrity. As more cloud services spring up, you’ll have a widely varying scenario of payouts, contract stipulations, and the potential for dishonest reporting; even outright fraud. Also, on the downside: The IRS says that mining profits may be taxed as individual investment gains!

Is Bitcoin mining still a good investment? At the present time, yes, and hopefully for years to come with appropriate changes. Are you ready to sit back and let the computers make you bitcoins?

Jen McKenzie is a writer at Assignyourwriter company (https://assignyourwriter.co.uk/team/jen-mckenzie/) and an independent business consultant from New York. She writes extensively on business, education and human resource topics. When Jennifer is not at her desk working, you can usually find her hiking or taking a road trip with her two dogs. You can reach Jennifer (https://twitter.com/jenmcknzie) @jenmcknzie (https://twitter.com/jenmcknzie)

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Correlation Between Gold and Bitcoin

The digital age embraces new technology and adapts to it very quickly. Nowadays, investors have an opportunity to diversify their portfolio with digital assets and not just physical ones. However, while digital assets have risen in fame in the last few years, their volatility and unpredictability have investors question whether or not these types of investments are actually safe. On the other hand, gold has always been a “safe bet” among investors.

The main reason is that gold is an excellent hedge against inflation, global instability and economic crisis. As for Bitcoin, many people have claimed that it’s the digital gold, but so far, Bitcoin was unable to provide the same level of investment security as gold. Many people still wonder if Bitcoin and gold are correlated. When comparing prices, the Bitcoin price is certainly very volatile, while gold pretty much retains its price with slight variations. Here’s more insight into the correlation between gold and Bitcoin.

Difference of investment

As mentioned before, investors have an opportunity to opt for digital assets instead of just physical ones. The rise of Bitcoin’s price in 2017 that was alongside a price increase in gold made people believe these two assets are correlated. However, people who invested in Bitcoin did so mainly because this digital asset was unregulated by governments and they intended to reap the benefits of that situation.

On the other hand, people investing in gold were looking for a safe investment to secure their funds, as gold is usually used for that. In other words, the cryptocurrency market was explored by investors who were speculating on the outcome, while gold was sought after by investors looking to secure their funds. Simply put, there was no direct correlation other than the investors’ interest in both assets during the same period.

Different assets

The difference between the assets upholds their lack of correlation. Gold is a physical asset, which means its use and properties are much more flexible than Bitcoin which is purely a digital asset. Gold has inherent value, it can be used in various industries and has cultural value as well. That means that gold is, and will always be highly sought after and on high demand. That’s why the gold price has remained steady throughout the years compared to Bitcoin prices that experience extreme volatility. For instance, Bitcoin reached its top price of $17.900 on December 22, 2017.

On the 5th of February, 2018, the price of Bitcoin fell to $6.200, which is more than 50% decrease in less than two months. The price of gold is determined by the global economic situation and demand, whereas digital assets are unregulated and their prices are uncertain at best. For example, gold prices go up whenever there are fluctuations in the stock market. Investors prefer an asset that can secure their funds or even yield a profit as opposed to an asset that’s too risky.

Market dynamics

The gold market is more mature and well-developed, as well as regulated. On the other hand, the crypto market is fairly new and still in the process of adjusting. The increased popularity of digital assets also leads to the adoption of more cryptocurrencies. Aside from Bitcoin, there are over a thousand different currencies on the market. However, not all currencies are sought after or have the potential to become investments. That’s why the crypto market still cannot correlate with gold, but that doesn’t mean digital assets won’t experience more stability in the future.

Even though the idea behind Bitcoin and blockchain technology was originally to be unregulated by officials and decentralized from a banking system, it seems that it does require a bit of regulation in order to stabilize and operate on an optimal level. The lack of security and safety does force investors to tread carefully when investing in cryptocurrencies, whereas gold can provide certain security even in the worst of scenarios.

Relationship between assets

So far, experts have been arguing about the existing or nonexistent correlation between gold and Bitcoin. Regardless of the current situation, there’s undeniably a relationship between the two. Both assets are considered hedges against inflation and global economic difficulties. However, gold is still perceived as a more stable investment than digital assets.

The fact of the matter is that whenever cryptocurrency value decreases, gold prices go up, as investors return to their “safe haven” investment. The main reason is digital asset volatility. Increased volatility means greater risks and investors would prefer not to risk it, making investments that are meant to secure their funds. With that in mind, when the digital currency market stabilizes, the relationship between these two assets may improve and there may even be more correlation between them as well.

Whether there’s a correlation between gold and Bitcoin is still debatable. Where one party sees a correlation, others see coincidence. That’s why it’s difficult to determine the relationship between these two assets. As for now, gold is considered a less risky and a more flexible investment, whereas Bitcoin, although perceived as a hedge, is considered too volatile to overtake gold. From an investor’s point of view, gold and digital assets are two very different assets.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

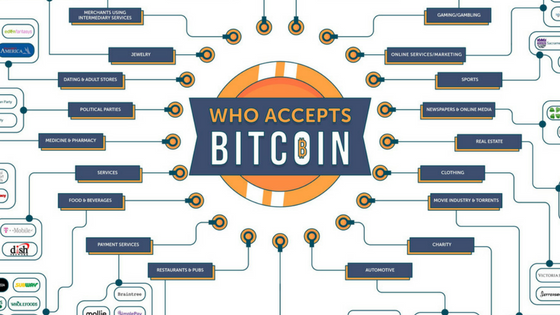

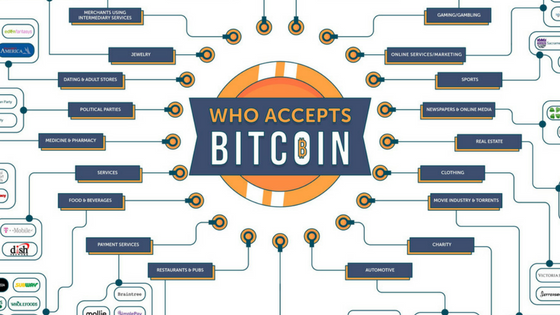

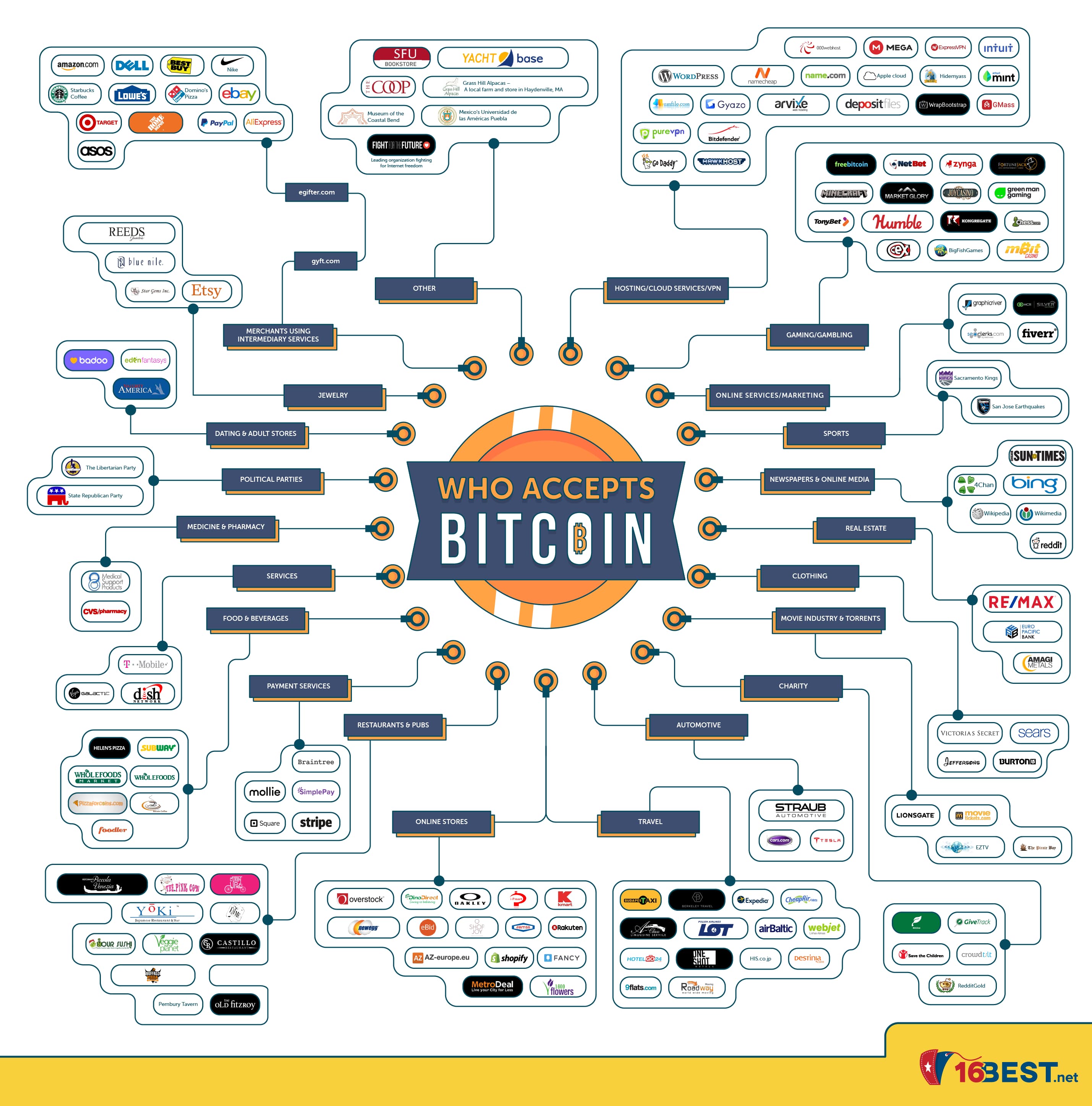

Bitcoin payments, who accepts them?

BTC Accepted here

A short infographic on industry acceptance of BTC

Cryptocurrencies skyrocked in 2017.

Everybody has heard for sure some friends speaking about it or read news about blockchain revolutionary potential.

The topics mostrly discussed are the highs and lows of crypto prices, the volatility of it, the mindblowing innovation and projects, the best places where buy cryptos or authority’s point of view on them.

But here’s one of the most interesting topics, that sometimes is left unexplored:

Who is actually accepting Bitcoin payments?

This is a very good question which can give a more thoroughful perspective on how companies look at the crypto-world; and that can help everyone understanding the potential spread of the blockchain philosophy.

In fact companies like Shopify, Subway, and Tesla have fully accepted Bitcoin payments, and you can pay for any of their products or services with them. However, even if a company doesn’t support Bitcoin, there are some creative ways to buy their best products with it. For example, Gyft.com will help you buy Nike shoes with Bitcoin, while Expedia has embraced this cryptocurrency altogether.

To better understand who accepts bitcoin payments, we are happy to share with you this amazing infographic provided by our friends of 16Best.net

Enjoy the reading

Open your free digital wallet here to store your cryptocurrencies in a safe place.