Search Results For: linux

IBM announces its new cloud Blockchain Security Service

Cloud Blockchain Security Service

Open your free digital wallet here to store your cryptocurrencies in a safe place.

OpenBazaar Test: how the Bitcoin Ebay works

The Bitcoin Marketplace: OpenBazaar Test

Step-by-Step OpenBazaar Test: Follow this Guide to do some Shopping

1. First of all you need to go to the OpenBazaar website and click on the Download button you can find on the right top of the page.

2. A download will start soon. If it doesn’t, you just need to select your operating system such as Linux, Windows or Mac

3. After the download is completed, click on the file (maybe you will find it in the Download file) and launch it.

4. A new window will open where you have to complete your profile with info like name, timezone, avatar and your favorite currency.

5. You can also select your favorite theme to be used as a your profile template

6. Then you will be officially into your profile where you can add other info such as your social network profiles

7. Now you can start doing some shopping.

8. As you can imagine, I just had to click on the item I wanted to purchase.

Bitcoin Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Red Hat to help blockchain related startups

How Openshift works

Red Hat with Hyperledger

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Artificial intelligence connected to the blockchain thanks to IBM

IBM invests in the Internet of Things

Previous statement

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Hitachi is studying the Blockchain

In a press release, Hitachi explained:

“By establishing the Financial Innovation Laboratory in the Silicon Valley, Hitachi will accelerate research [and] development of blockchain technology, collaborative creation with customers, and development of solutions to support business innovation in financial institutions.”

Hitachi partners with Hyperledger

This statement follows a previous company’s news related to the blockchain: in fact, in February Hitachi joined the Hyperledger Project, an advaced blockchain technology that aims at “identifying and addressing important features for a cross-industry open standard for distributed ledgers that can transform the way business transactions are conducted globally.”

The Hyperledger Project is a Linux Foundation collaborative project that stars some of the most important companies in the world, including IBM, J.P. Morgan, Fujitsu and many more.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

‘We’re All in on Blockchain’, says IBM

“We are all in on Blockchain”: these were the words of IBM Director John Wolpert during the today Blockchain Conference in San Francisco. According to Wolpert the blockchain needs a more collaborative approach, which is not always guaranteed by the blockchain developers.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

10 things you should know about Bitcoin and digital currencies

cryptocurrencies, but not all of them are.

to reach a broader demographic than Bitcoin did. As of March, more than 65 billion Dogecoins have been mined, and the production schedule of this

cryptocurrency is in production faster than most.

regulations on digital currencies, but it often warns about investment schemes and fraud. The Financial Crimes Enforcement Network (FinCEN), an agency under the Department of Treasury, took initiative and published virtual currency guidelines in 2013. Many countries are still deciding how they will tax virtual currencies. The IRS is specifically concerned with virtual currencies being used for unreported income.

outline the pros and cons of Bitcoin. The hearing ended up providing a

financial boost for the currency, because US officials talked about it as a

legitimate source of money, as opposed to only discussing its role in illegal

activities.

Wallet for Android runs on your phone or tablet. To store the Bitcoins, you have three options:

doing your own backups.

are responsible for them. Mobile apps allow you to scan a QR code or tap to

pay.

anything happens on their side or it gets hacked, you run the risk of losing

the Bitcoins, so extra backups and secure passwords are suggested.

is, Bitcoins can be stolen in huge quantities, just like money, and with no

centralized bank, there’s no way to recoup the losses. There are several types of Bitcoin ATMs, which exchange Bitcoins for flat currencies. Most machines are expensive and rare, ranging from $5,000 to $2,000. Skyhook,

a Portland, Oregon-based company, demoed a $1,000, machine at a conference this month. It is the first portable, open source ATM.

specific software, which is free and open source. The most popular is GUIMiner, which searches for the special number combination to unlock a transaction. The more powerful your PC is, the faster you can mine. In the early days, it was easy to find Bitcoins, and some people found hundreds of thousands of dollars worth of the cryptocurrency using their computers. Now, though, more expensive hardware is required to find them. Each Bitcoin blockchain is 25 Bitcoin addresses, so it takes a lot of time to find them on your own. The exact amount of time ranges depending on the hardware power, but mining all day could drive your energy bill up and only mine a tiny fraction of a Bitcoin — it may take days to mine enough to purchase anything.

security issues remain, and that will continue to be a problem. In 2013, Mt. Gox, a Japanese exchange, handled 70% of all Bitcoin transactions, but they lost some 750,000 Bitcoins in February 2014 and filed for bankruptcy, and nothing has been proven in the case. Since it’s universal, it’s useful for international transactions, and could be helpful for transactions in developing countries.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What are Bitcoin nodes and why do we need them?

peer-to-peer (P2P) network. However, what’s often lost in translation is

the sheer amount of machinery that is needed to maintain this global

infrastructure.

transactions, bitcoin requires more than a network of miners processing

transactions, it must broadcast messages across a network using ‘nodes’.

This is the first step in the transaction process that results in a

block confirmation.

network must not only provide an avenue for transactions, but also

remain secure. By using a number of randomly selected nodes, the network

can reduce the problem of double spending – when a user attempts to spend the same digital token twice.

bitcoin doesn’t just need nodes, it requires lots of fully functioning

nodes – nodes that have the bitcoin core client on a machine instance

with the complete block chain. The more nodes there are, the more secure

the network is.

Waning support

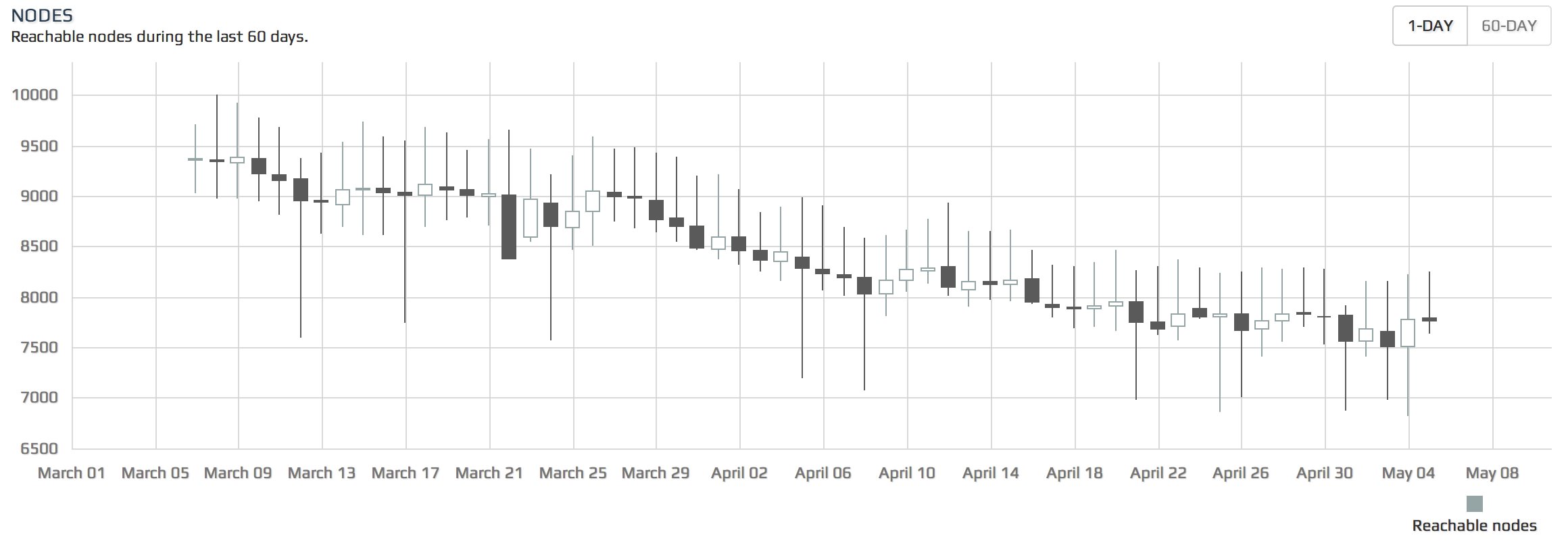

at a 60-day chart of bitcoin nodes shows that the number has gone down

significantly. It went from 10,000 reachable nodes in early March to

below 8,000 at the beginning of May.

|

|

Source: Bitnodes |

interesting is that during a recent 24-hour period, the number of

reachable nodes went down from 8,200 to 7,600 and back to 8,200 again.

This suggests that a portion of users running nodes are turning off

their machines at night, meaning that this contingent of nodes are being

run on desktops or laptops.

|

|

Source: Bitnodes |

|

|

A map based on Bitnodes data. Source: Coinviz |

Lack of incentive

running a bitcoin node does not provide any incentive. The only benefit

for someone to run a node is to help protect the network, and based on

the Bitnodes data, the number of people interested in supporting the

network with a full node is waning.

Centralization of mining

terms of supporting the bitcoin network, it used to be a lot easier for

the average user to participate. However, the advent of massive ASIC

data centres has weakened the consensual nature of mining, and by

extension providing nodes, for many people.

“As

bitcoin grows, so does the network and the computing power behind the

scenes required to run it. The majority of bitcoiners won’t be able to

support their own nodes and will be taken over by companies like KnC.”

pushing bitcoin towards a more centralized future. McKelvie also

believes that major technology companies that take interest in bitcoin

will have to put their computing resources behind the digital currency:

“I

wouldn’t be surprised if we see large tech companies like Google and

Amazon throwing resources at bitcoin as they adopt the currency.”

Feedback from nodes

sees the issue of nodes dropping from 10,000 down to under 7,000 as a

significant problem. To Hearn, the core of the issue is disinterest in

both expending computing resources and electricity toward something that

may have diminishing value.

Hearn has proposed added functionality that would allow communications

between nodes and the developers to better understand why so many are

dropping out.

is because their number will continue to decline no matter what – and

they appear to only be working when users are awake during the day.

“It

makes [the bitcoin network] ‘seem’ bigger, more robust and more

decentralised, because there are more people uniting to run it. So

there’s a psychological benefit.”

Moving forward

believes that community attention to the lack of nodes supporting the

network is what the industry needs in order to boost numbers:

“I agree we need more full nodes. I’ve long been a proponent of such calls for more nodes.”

such calls for voluntary support might not be enough motivation for

people to do so, though, so, one logical idea that has been floated is

to give nodes some sort of incentive.

feasible right now: over the past six months, miners have been

averaging a daily reward of 15.98 BTC per day, according to Blockchain.

bitcoin prices would peg that value at around $7,040 per day for the

entire network – and the growth in transaction fees has been incredibly

flat over the past six months. As a result, miners would likely be

reluctant to concede any revenue to bitcoin nodes, which don’t require

pricey ASIC hardware to run.

|

|

Transaction fees on the network for past six months. Source: Blockchain |

of the bitcoin community seem to be losing interest in hosting full

nodes. And it’s something to pay attention to, because over time it

might mean that the major companies in the industry may have to pick up

the slack.

the network as full nodes, though, it continues to lessen the amount of

decentralization the network has at an infrastructure level.

is all down to circumstances surrounding bitcoin sentiment – the rise of

ASICs, the selloffs in China and complete collapse of Mt. Gox – plus

little in the way of incentives for someone to run a node.

Open your free digital wallet here to store your cryptocurrencies in a safe place.