Search Results For: japan

Japan’s ruling party says won’t regulate bitcoin for now

| A man walks past a building where Mt. Gox, a digital marketplace operator, is housed in Tokyo February 25, 2014. |

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Japan to monitor Bitcoin rather than regulate it

(CoinReport) Japan’s involvement with bitcoin has taken a massive blow due to all of the negative press surrounding the Japanese failed bitcoin exchange, Mt. Gox. Since then, warnings of the risks involved with dealing in the digital currency have been spread throughout the world by regulators and critics alike.

Japan Will Monitor Bitcoin

However, rather than placing specific laws or regulations attached to how the country should be allowed to use bitcoin, it will just monitor it instead. On Tuesday, the Japanese government claimed that regulating bitcoin wasn’t under their jurisdiction. Sources say that Japan’s Ministry of Economy, Trade and Industry is devising a plan to make it easier to monitor illegal bitcoin activity. Prime Minister Shinzo Abe and his administration identify bitcoin as not being a form of currency. They do identify it as being an electronic payment method.

As most government officials and regulators do, Japan’s warn the public of bitcoin’s potential dangers, such as its uses in money laundering and drug trafficking.

Regulators Warn of Bitcoin

While Japan has no plans to enforce rules over bitcoin, other regulators feel that regulation over the digital currency is the only way for it to be safe enough for investors to get into. On the other hand, some feel bitcoin isn’t safe enough to implement into our economy, but for those that want in, they should do their homework first. Indiana Secretary of State, Connie Lawson claims that:

“The value of virtual currencies is highly volatile, and the concept behind the currency is difficult to understand even for sophisticated financial experts.”

Though this may be true in some cases, that doesn’t mean people can’t figure it out for themselves. Bitcoin was foreign to every enthusiast at one point in time. Like with all new concepts and innovations, time is needed to get acquainted with the technology. Once upon a time, even the Internet sounded dangerous and ludicrous idea. Regulators, whether in Japan or the U.S., need to stop putting fear in people and let bitcoin have an organic chance at success.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Governor says Bank of Japan is “very interested” in cryptocurrency

(BitcoinExaminer) The governor of the Bank of Japan recently said that the institution is “very interested” in Bitcoin. Haruhiko Kuroda talked about cryptocurrency during a news conference, according to the site Jiji Press.

(BitcoinExaminer) The governor of the Bank of Japan recently said that the institution is “very interested” in Bitcoin. Haruhiko Kuroda talked about cryptocurrency during a news conference, according to the site Jiji Press.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Square Enix to Launch Gamified Art Collecting Experience on Polygon Network

Square Enix, the Japanese video game publisher behind iconic titles like Final Fantasy and Tomb Raider, has announced a collaboration with Polygon, a major Ethereum-based blockchain platform, to create an NFT art project. The collaboration will investigate the convergence of blockchain technology, gaming, and digital art, showcasing the potential for novel applications in the fast growing blockchain ecosystem.

The cooperation will result in the creation of one-of-a-kind NFTs based on original artwork from Square Enix’s games, which will be minted on the Polygon blockchain. Polygon was selected as a partner because of its scalability and cheap transaction fees, making it a perfect platform for producing and trading NFTs.

Non-fungible tokens, or NFTs, are one-of-a-kind digital assets that may be bought and sold on a blockchain. They can represent several types of digital content, such as artwork, music, and video games. As a means of proving ownership and authenticity in the digital realm, NFTs are gaining popularity as a new way for artists and producers to commercialise their work.

The collaboration between Square Enix and Polygon is not the first of its kind; other gaming firms and blockchain platforms have also investigated the convergence of gaming and NFTs. The relationship is noteworthy, though, because of Square Enix’s standing in the game business, with the company having a vast and committed fanbase worldwide.

In addition to investigating the possibilities of NFTs, the collaboration will explore the usage of blockchain technology in gaming. Blockchain technology has the potential to revolutionize the gaming business by enabling new types of games such as decentralized gaming and player-owned economies.

Square Enix and Polygon’s collaboration demonstrates the growing interest in blockchain technology among established firms and industries. We should expect more collaborations between traditional firms and blockchain startups as the promise of blockchain technology becomes more publicly recognized.

One of the primary advantages of blockchain technology is its ability to increase transaction trust and transparency. This is especially significant in the gaming sector, where concerns like fraud, cheating, and ownership and authenticity disputes are widespread. Blockchain technology allows for the creation of a tamper-proof and transparent record of all transactions, which makes it easier to assure fair and equal gameplay.

The collaboration between Square Enix and Polygon is also significant in terms of the potential for NFTs to establish new revenue streams for artists and creators. NFTs give a new opportunity for creators to monetise their work and establish an audience by producing unique digital assets that can be bought and traded on a blockchain.

The usage of NFTs in gaming is still in its early stages, but it has the potential to transform the industry by allowing players to interact with games in new ways and producers to monetize their work. The collaboration between Square Enix and Polygon is just one example of the numerous use cases that are emerging in the blockchain ecosystem.

We should expect more cooperation between established organizations and blockchain startups, as well as more new use cases for blockchain technology, as blockchain technology evolves and matures. The collaboration between Square Enix and Polygon is an exciting step in this quickly expanding field, and it will be interesting to see how the initiative evolves and what new prospects it generates for the gaming business and digital art.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Generation X vs. Generation Y | Adopting Cryptocurrencies

Generation X and Generation Y Adoption of Cryptocurrencies: A Comparison

The world’s financial institutions are currently observing a vast digital ecosystem being expanded with reports for new digital currencies akin to the likes of cryptocurrencies to be launched soon. While these CBDCs (central bank digital currencies) are proclaimed not to harm or replace cash and other forms of legal tenders, we cannot help but talk about the ones instigating the change.

Cryptocurrency became popular since the launch of Bitcoin back in Jan 3rd, 2009. Ever since then, cryptocurrencies have seen a rise in popularity amongst the masses.

According to a recent study by Tech Jury, the cryptocurrency market cap has reached $265.545 billion as of May 2020. By 2023, the global blockchain market is expected to reach $23.3 billion. Furthermore, Bitcoin alone accounts for $6 billion of daily online transactions.

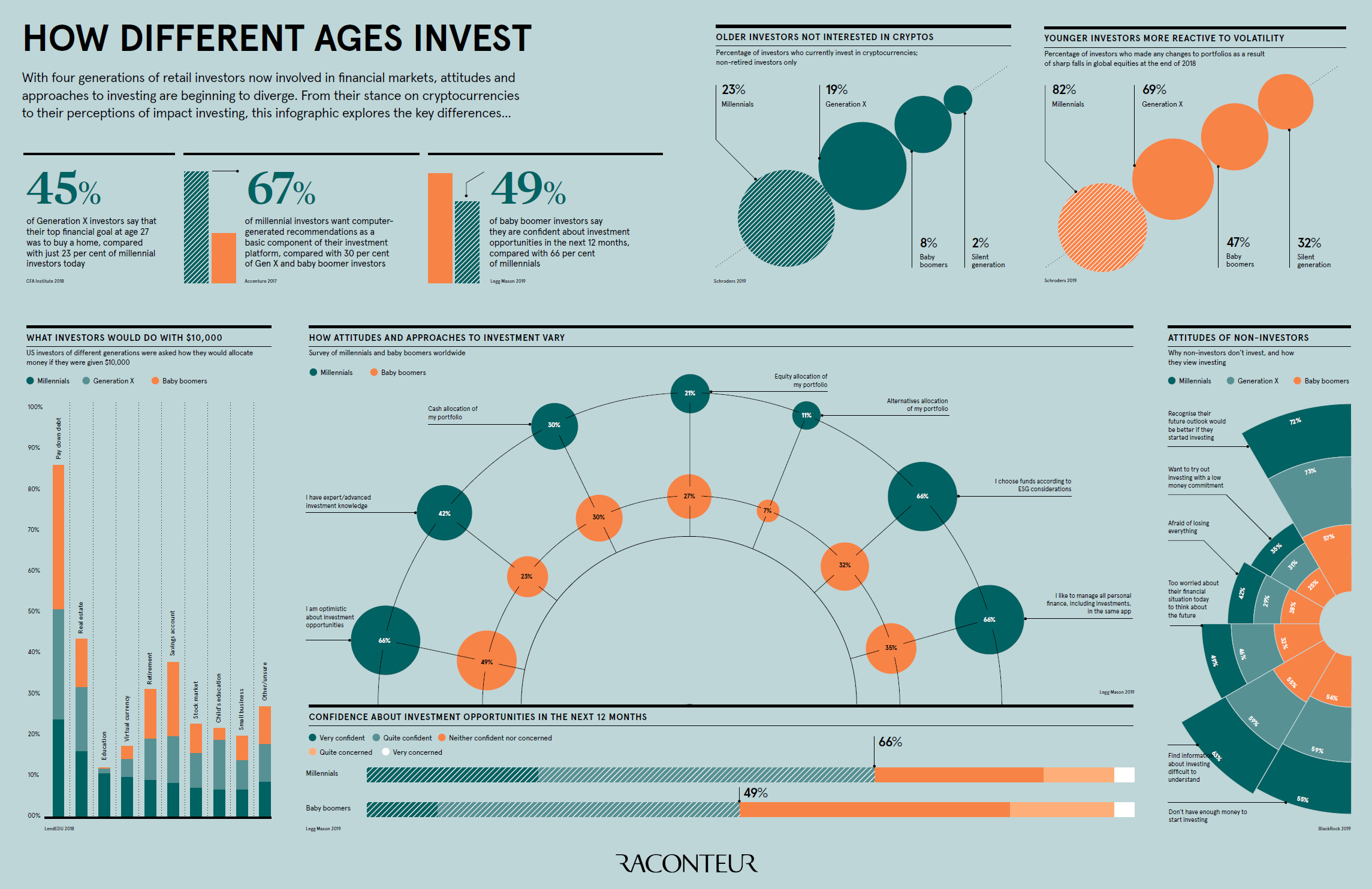

Moreover, cryptocurrency users have exceeded 40 million globally. In light, of this information, let’s take a quick look at how Millennials compare to Generation X when it comes to adopting cryptocurrencies.

Generation X

Generation X is widely regarded as the generation that followed Baby Boomers and preceded Millennials. Their age groups range from 40 to 55 years old as of 2020. Here is how Generation X is reacting towards cryptocurrency:

-

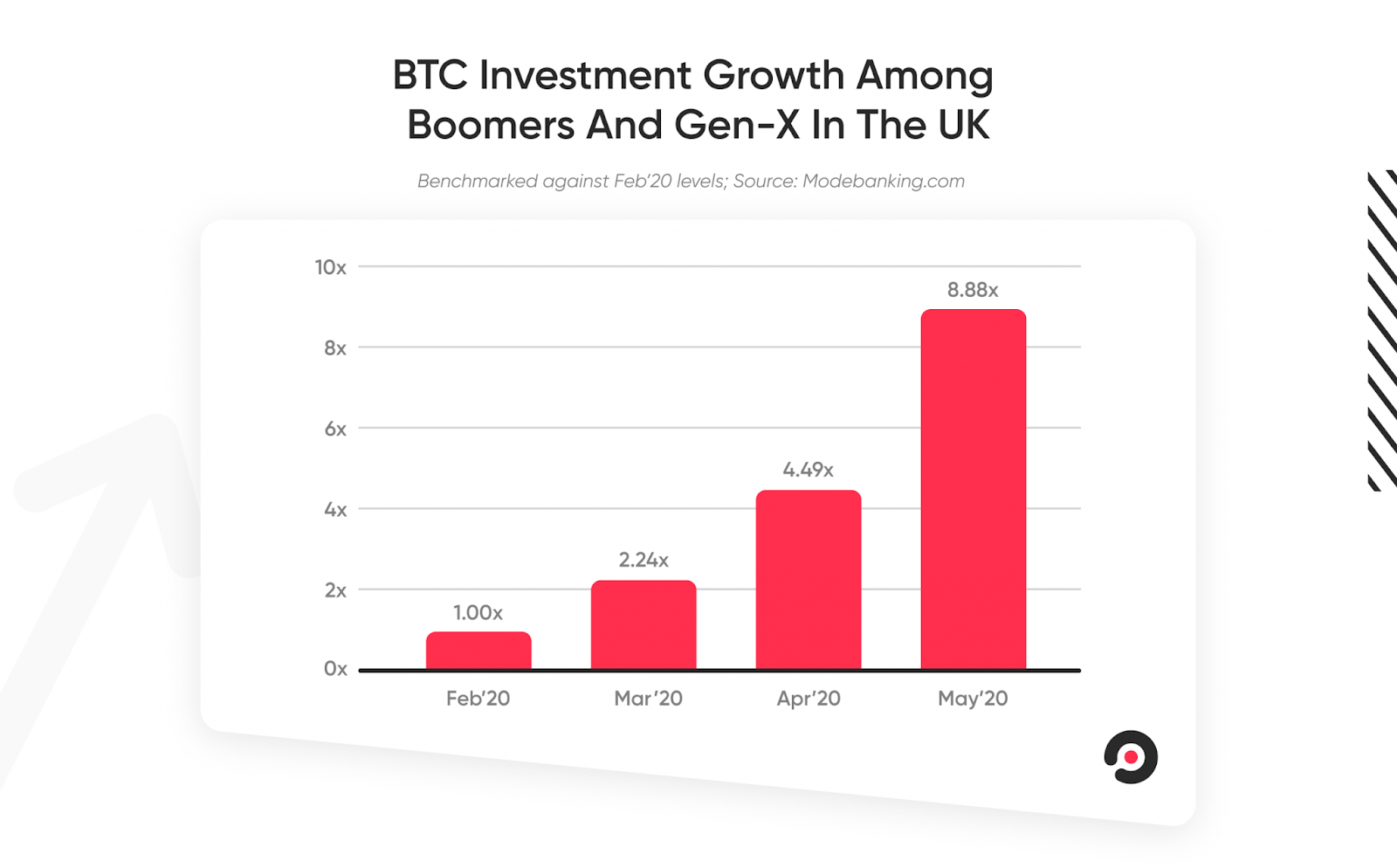

Investment Growth among Boomers & Gen X

While Millennials are regarded as the prime suspects for capitalizing on the crypto market, surprisingly both Baby Boomers and Gen X are being currently observed to closely follow the trends.

Hence in recent years, many sources have cited an increase in investment of cryptocurrency as both Boomers and Generation X take charge to close the gap. In some cases, they were also found to have more than doubled their investments.

-

Month on Month Growth

It seems like the word of mouth and awareness about cryptocurrency is spreading like wildfire as Generation X is seen to understand the value and find blockchain as a reliable security measure. Understanding the benefits of fast and instantaneous transactions, the group of disaffected people and entrepreneurs is already showing signs of crypto is affecting their thinking for the future.

Reports are coming in, showing an evident increase and Month on Month growth patterns. According to a study by Mode Banking, both Baby Boomers and Gen-X have shown a trend of increasing their investment in cryptocurrency by over 100%, especially during the COVID-19 pandemic.

-

Wealth Protection & Asset Diversification

With the current economy ridiculed by the pandemic, the growing fear for wealth protection has led Baby Boomers and those belonging from Gen-X to invest in resources that can allow for asset diversification. Cryptocurrency so far has been observed as the most favorable type of investment to safeguard personal wealth.

Generation Y

Otherwise known as Millennials, Generation Y is widely regarded as the generation succeeding Gen-X and Baby Boomers. Their age groups range from 24 to 39 years of age. Often regarded as the parents of Generation Alpha (like my darling son!) they were born into a world that as quickly becoming familiarized with the internet, mobile devices, and social media.

-

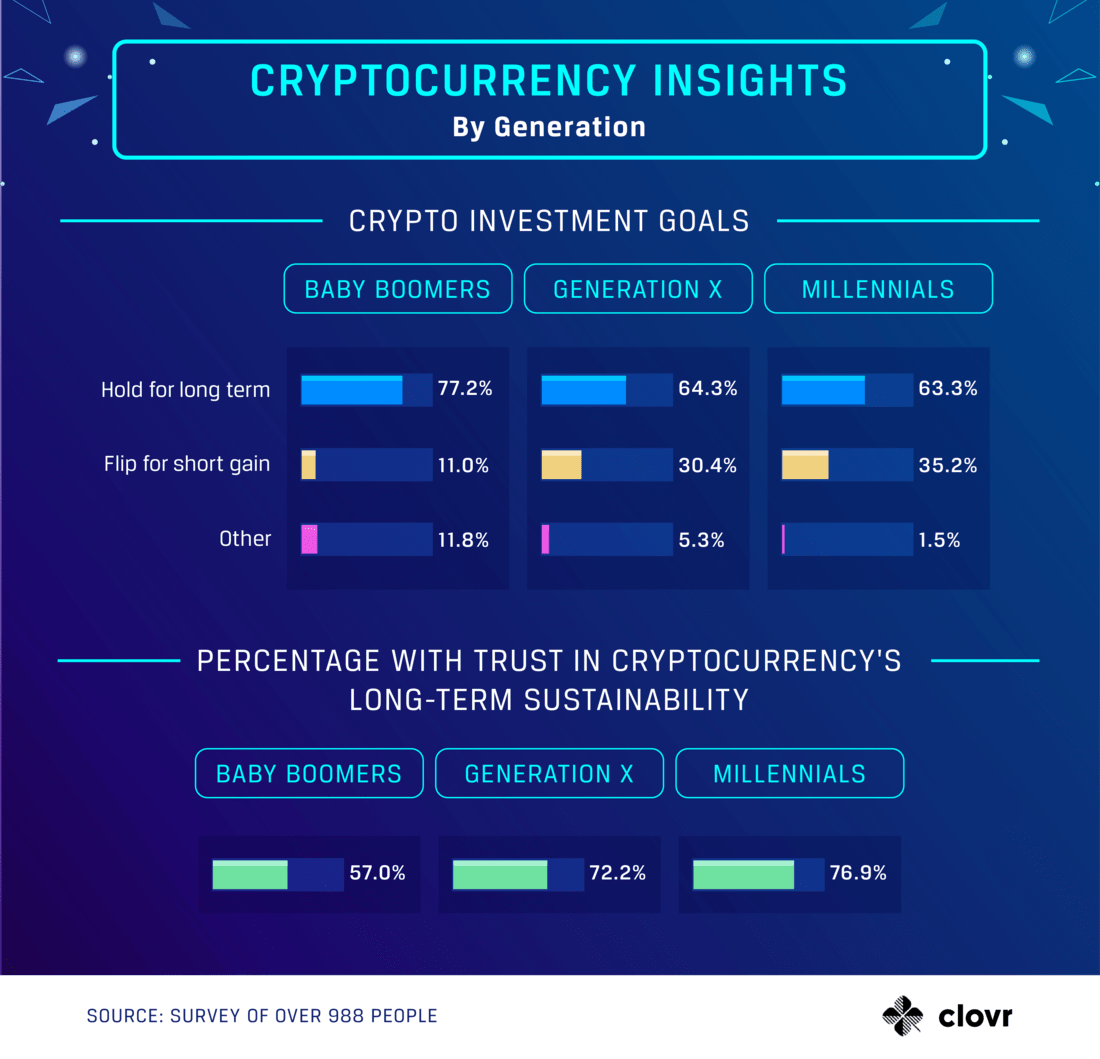

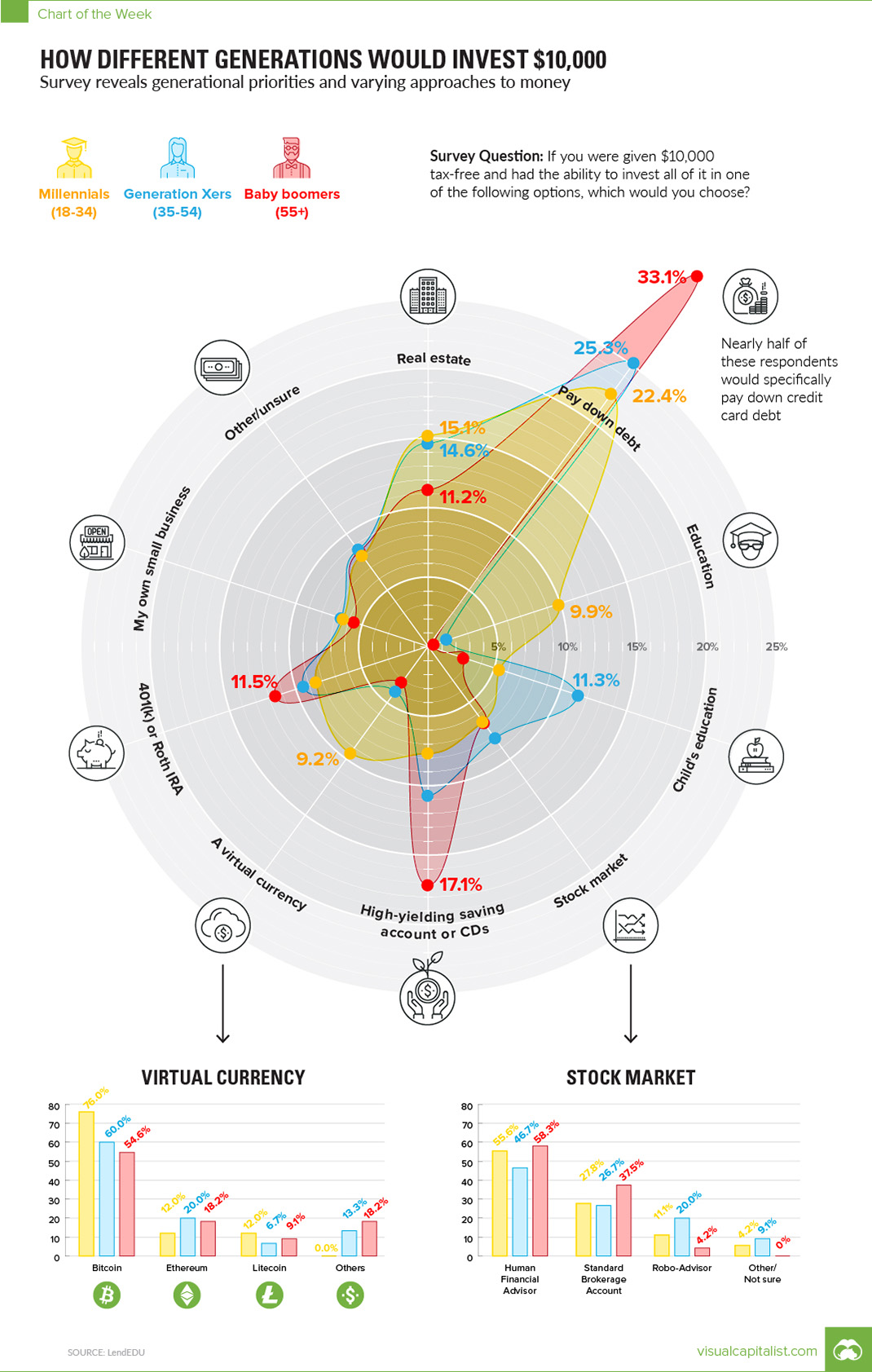

Growth of Alternative Asset

Millennials view of cryptocurrency is that of an alternative asset. Surprisingly not many of us want to invest in stocks and are more interested in assets that are backed by technologies. According to a recent study by Coin Telegraph, Millennials are three times more likely to invest in cryptocurrency as compared to Generation X. Furthermore, 9% of Millennials chose crypto as their long-term investment option.

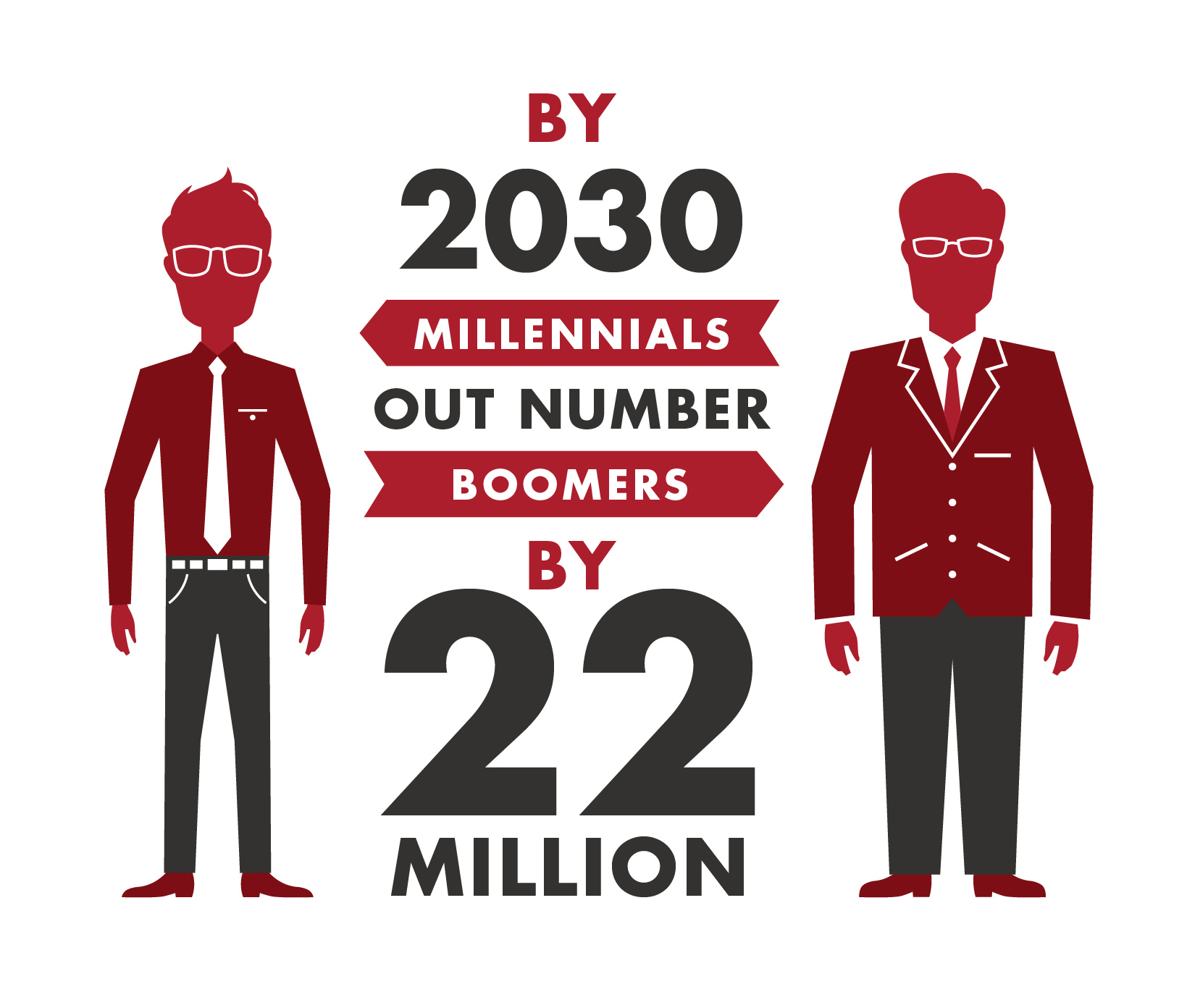

Students applying for and seeking dissertation assistance are also looking for ways to invest alternative asset that can help secure their personal wealth for the future. It is important to note here that while both real estate and stocks are also good options for Millennials, they are currently dominated by Baby Boomers in the present times.

-

Shifting Presence for Everything Digital

Studies from different financial institutions and digital currency markets are coming in showcasing Millennials as a driving force for the adoption of Bitcoin for years to come. Zac Prince, the CEO and founder of BlockFi, identifies a major trend for Millennials where they seek everything digital.

Furthermore, with Bitcoin reaching its all-time high and pushing over $23,000 per coin as of Dec 17, 2020, who can blame Millennials for making the right choice so far!

-

Wealth Transfer to the Young

There is a Japanese idiom that states the next generation as the actual king of the world. Come to think of it this world will always belong to the next generation that is how our life expectancy is all about. We may get to live 100 years, but eventually, the circle of life catches up to us. As we depart, the new generation takes to the throne.

For countless eras, this is how wealth has been passed down from old to the young. Currently, Millennials are in the process to take control and eventually move Boomers out to take their seat on the ruling chair. This transfer of power and wealth on a massive scale will indefinitely cause investment in cryptocurrency to rise by a tremendous rate.

Conclusion

Cryptocurrency is on the rise with Bitcoin riding the tidal wave in recent times. Not only digital assets and crypto are skyrocketing, but even the BIS (Bank of International Settlements) is also considering launching digital currencies with the help of IMF and 60 central bank members.

Someone really has to be blind enough to not see how things are rapidly changing and converging towards digital resilience. So far Millennials and Gen-X have shown their growing interest in adopting cryptocurrencies with Boomers lagging behind to catch up on the trend.

Author Bio

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ten Years Of The World With Bitcoin Living in a crazy-crazy crypto world.

Bitcoin rose from unknown to mainstream recognition largely thanks the incredulous surge in value it saw in 2017. But then the price went down, sparking yet another heated discussion about the volatile unpredictability of the bitcoin.

Nowadays, discussions are all at their all time hype, but worth just as long as the participants know what they are talking about; and the audience has at least some grasp of the matter. But it rarely happens, as the vast majority of experts are as clueless about the intricacies of the crypto markets as is the general audience.

The infographic below, provided by our friends at BitcoinPlay, will not make us all marketing gurus but will give you a much better understanding about the driving forces behind the world’s first cryptocurrency, how it came to be, who embraced it first and how countries are handling it.

Here’s a selection of our favourite ones:

- On May 22 2010 two Pizzas cost 10k bitcoins.

- In 2013 FBI made $48 million by selling on auction one seized 144,000 Bitcoins.

- 100$ invested in July 2010 is now 18.8 million.

- Since april 2017 Bitcoin is legal payment method in Japan.

- Blockchain ledger technology when used by top10 investment bank could save $8-$12 billions.

- Chinese Mining Pool control approximately 81% of the Bitcoin network’s collective hashrate.

- Overstock, Dell, Expedia, Dish and Microsoft accept Bitcoin payments.

- University of Nicosia, Cyprus was the first University to accept tuition to be paid in Bitcoin.

- Bitcoin is vat free in Switzerland.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin all time high: Read here the possible reasons

Today, on June 6th, a new Bitcoin all time high has been hit.

According to CoinMarketcap, in fact, the bitcoin price reached a value of $2,911.86, surpassing the previous bitcoin all time high of $2,791.69 set less than a month ago on May 25th.

Bitcoin began June with a price of about $2,500, trading at $2,300 on June 1st.

What are the reasons for this new bitcoin all time high?

As always in these events, many are the possible causes for this recent growth in the bitcoin price.

Here a quick report on what is happening in the bitcoin industry during these days.

Click on the link below to read more about that specific topic.

- Bitcoin regulation in Japan that lead more merchants to accept the digital currency;

- Uncertain administration by Donald Trump. A dubious politic always lead investors to take their money in a “Safe Heaven”;

- Growing demand in Asia;

- ICOs used as a faster way to raise funds

Do you think there are more reasons for this bitcoin all time high?

Comment the news with us!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin demand in Asia is more active than in the US

Back on May 31st, one the major Bitcoin exchanges in China called OKCoin returned to help improving the Bitcoin demand withing the Chinese exchanges after a period of suspension of transactions.

As a result, more bitcoin investors are recovering their interest in bitcoin and they are driving the demand for the digital currency.

So, thanks to the activation of withdrawals, bitcoin is now trading at a premium rate in China.

Also, the Chinese press that talks about bitcoin as digital gold is pushing the recent growth of the bitcoin demand for local traders.

On Friday, bitcoin price was about $2,340 in China. A value that was $50 higher than the US rate.

Of course, there are several other major factors that are driving bitcoin price. For example the legalization of the digital currency in Japan, and the use of ICOs in raising funds.

Experts believe that the increasing demand in Asia is pushing the recent growth in the bitcoin price.

South Korea

In South Korea, Bitcoin price increases up to $3,100 when the price on the US exchanges was about $2,400, so $300 higher than the US.

A few startups are also using bitcoin for sending remittances since it works better and faster than traditional money.

For example, one of these startups is called Bluepan, located in South Korea. This company provides an easy way to send money from overseas workers to their families.

In 2 years, Bluepan has processed payments worth $65 mln and for the past year, they recorded a five-time increase in transactions.

Why in Asia?

That said, it is clear that Bitcoin demand in Asia is increasing and its driving prices, while North America shares only a small amount of all users in any sector.

For example, there are fewer customers in North America who use money transfers than in Asia.

This is maybe due to the fact that the worldwide financial system is based on the US dollar, so remittance transactions are easier between dollars and non-dollar currencies compared with transactions that involve two non-dollar currencies.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Would you ever trust people who said “Bet on Bitcoin” in 2010?

If you had bet on bitcoin in 2010, now you would be a millionaire.

In fact, according to a recent video shared by the CNBC, if you purchased $100 in bitcoin back in 2010 now y0u would have something like $75 mln.

During a relatively short period of 7 years, bitcoin price rose from $0.003 to its all-time high of $2392, so return of 796,000%.

The greatest part of mainstream media experts argues that bitcoin price is speculative because investors purchase bitcoin only because they expect a massive return in the next future.However, as Cointelegraph previously reported, prominent investors including GoldSilver.com founder Mike Maloney are encouraging investors to hold Bitcoin as a mandatory asset to hedge against inevitable global economic uncertainty and financial instability, not just as a large return investment.

However, as Cointelegraph previously reported, major investors suggest people hold bitcoin as a mandatory asset to hedge against inevitable global economic uncertainty and financial instability, so not just because of a large return investment.

Bitcoin is digital cash

In Japan bitcoin finally became a legal method of payment with more and more retailers and airlines that are starting to accept the digital currencies for payments.

Maybe it is for this reason that Japan is becoming the first country to invest in bitcoin, increasing the demand for the digital currency and driving its price.

On the other hand, bitcoin is seen as a “risky investment” because of its non-traditional nature by a few important magazines and media including the Washington Post.

Bet on bitcoin as a “Safe haven”

As revealed by a recent study published by Cointelegraph, a $10,000 investment in bitcoin back in 2010 is now worth $200 mln, while the same investment in gold led to a negative return of $9,900.

That said, I suggest to dedicate much effort to building a time machine, so we would be able to buy bitcoin at $0.003.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin all time high: more than $2000

While I’m writing this article the bitcoin all time high reached a value of $2,019 for the first time in its history.

By reaching a value of more than $2,000, bitcoin’s price grown of about 100% this year and nearly 125% since the annual low of $891.51 bitcoin hit back in March.

Experts agreed that bitcoin’s price recent growth could lead to reaching significant attention from the media and maybe also major financial media outlet would cover bitcoin.

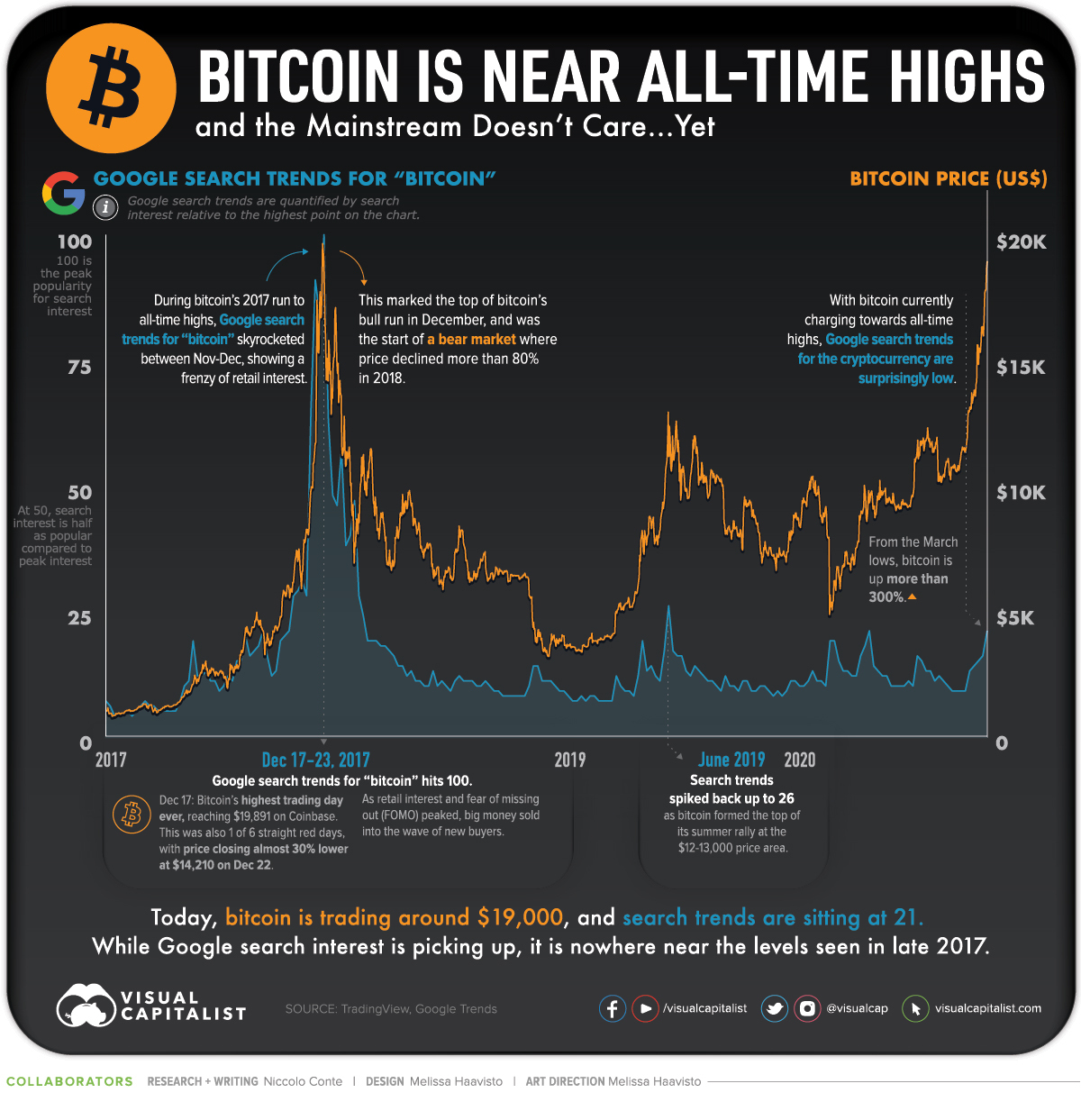

Google Trends data showed that the search for “bitcoin” have still not reached its all-time high they set back in December 2013, but it is getting closer (right now it has a score of 85/100).

That said, the reasons that drove the bitcoin all time high are difficult to identify.

Growing interest by investors

Surely, one reason is the increase in interest from investors and traders, as reported by the major exchange platforms.

Another factor that helped bitcoin to reach its current all-time high is the growing influence of Japan, a country where the technology is now regulated: from April 1st, in fact, bitcoin became a legal method of payment.

The Japanese yen is the single largest currency being exchanged for bitcoin, accounting for more than 45% of the money flow into bitcoin at the time of the report, according to CryptoCompare data.

The Japanese yen is the greatest currency being exchanged for bitcoin: currently, almost 45% of the money flow into bitcoin.

After the yen, there is US dollar that makes up 30% of the money flowing into bitcoin.

Block size debate

Bitcoin price grew in spite of the current block size debate, an issue related to the transaction capacity and the blockchain speed to validate a transaction.

Bitcoin developers are talking about this issue in order to address it and there are a few proposals such as the so-called SegWit or Segregated Witness that would increase blocks capacity.

Read here why you should hold Bitcoin and how.

Open your free digital wallet here to store your cryptocurrencies in a safe place.