The second half of 2019 was really difficult for Bitcoin. According to independent experts, the total volume of public digital assets has decreased by more than 50% – from $388 billion to $166 billion. However, there is other evidence. Yes, the cryptocurrency market really fell to the bottom if you look at these statistics, but let’s not forget that market conditions are dynamic. And the factor that means failure today may well mean success tomorrow.

There were periods of stabilization of the exchange rate, but for a long time cryptocurrency lost much in price. At one time, panic even started on the market, and Bitcoin was predicted to soon fall to zero. Against this background, the results of the year sounded quite unexpectedly: cryptocurrency turned out to be the most profitable investment. The coin rate rose from $4035 to $ 7344, providing investment growth by 82%.

This year will be great for Bitcoin, Wall Street analyst and Fundstrat founder Tom Lee suggested. The destabilization of relations between Iran and the United States is one of the reasons.

Plus, modern realities make it possible to add a supposedly modern coronavirus epidemic to these factors. However, at the moment there is no consensus among experts on how the coronavirus will affect the Bitcoin exchange rate. It is still unclear whether we are dealing with a real threat to people’s lives or is this another hype, a political company, or an attempt to distract investors from other, more important issues.

However, even those experts who believe that the disease can affect the main digital coin explain that this will happen only if the outbreak develops into a full-fledged epidemic.

Venture capitalist Tim Draper is also confident in the long-term growth in Bitcoin value. In an interview with FOX Business, he advised millennials to invest in cryptocurrencies, as they are on the verge of a new financial revolution. However, the explosion of the financial revolution will slow down due to the influence of the values of older generations and the obsolescence of the current banking system.

Bitcoin exchange rates are very unstable. Cryptocurrencies have already shown that it can rapidly fall and take off at a breakneck pace. Due to this state of affairs, bitcoin does not inspire confidence among many investors who would be happy to invest big money in the development of the blockchain, but fear for their savings. In 2020, we are unlikely to have to observe the strong influence of this factor, but we should not forget about it.

About the author: Gregory is passionate about researching new technologies in both mobile, web and WordPress. Also, he works on Best Writers Online the best writing services reviews. Gregory in love with stories and facts, so Gregory always tries to get the best of both worlds.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

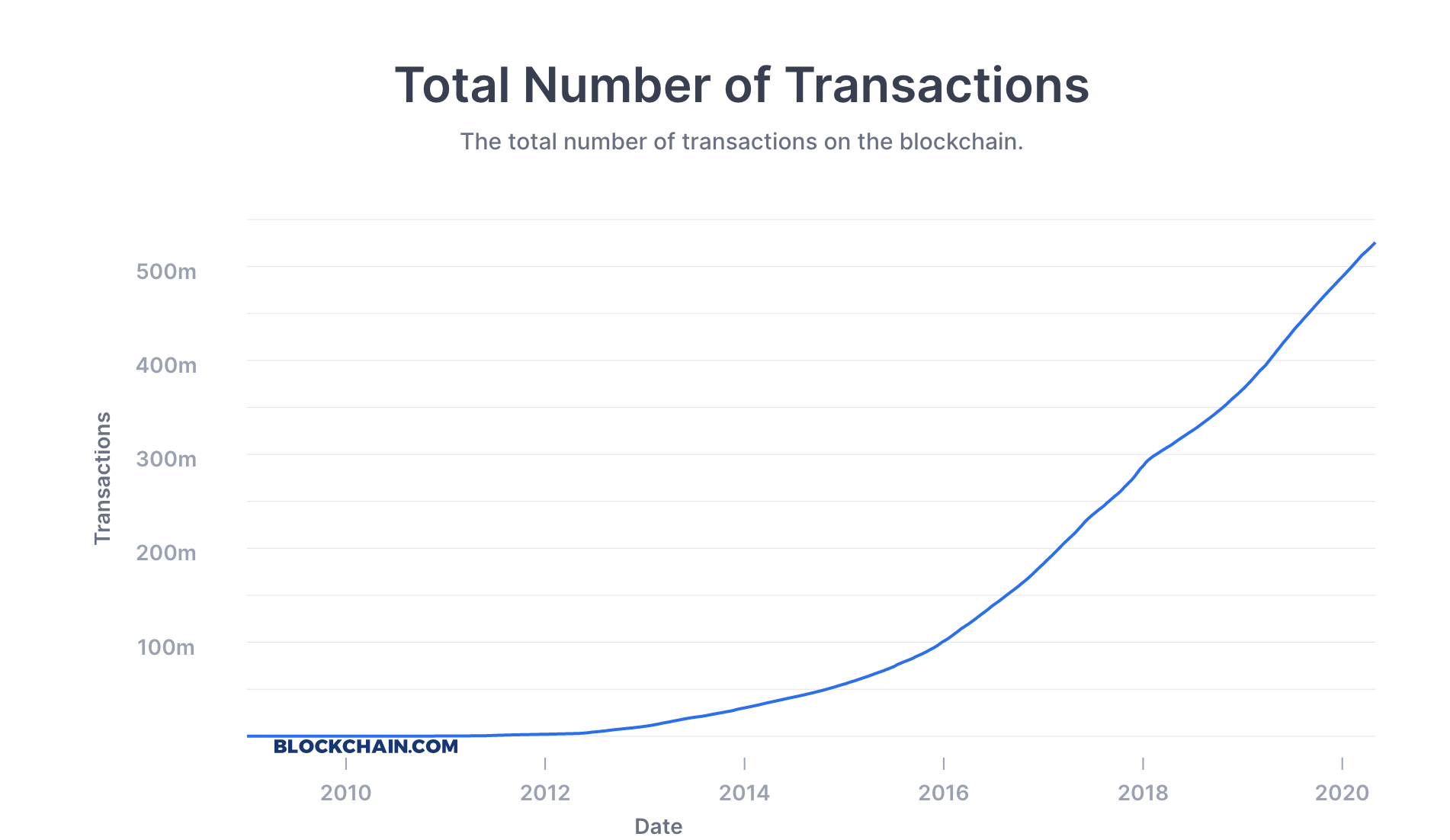

There appears to be no end to the growing popularity of cryptocurrency and its related technology. The real world uses and applications of crypto are increasing and blockchain technology has found use outside, instead of just being a basis for the recording of crypto exchange. More ICOs are in development and a wider range of working cryptocurrencies is becoming available to the growing crypto community. The advent of crypto technology is not just a trend that people are getting hyped up about, it is an actual breakthrough in technology.

Bitcoin, the first functioning cryptocurrency, was developed in 2009 by an anonymous party known as Satoshi Nakamoto. The main goal of this new “currency”? To function as an international currency, created with the hope of minimizing costs and increasing efficiency of exchange through the development and use of a decentralized public ledger that distributes the verified records. This makes it a permanent and immutable documentation of what has happened to each and every bitcoin that has been mined and exchanged.

The new concept of decentralization is one of the breakthrough innovations of bitcoin which has been put to use in many other ways. However, too much emphasis has been placed on the investment and earning potentials of bitcoins and other cryptocurrencies. Owed to how it was able to gain popularity as being the digital currency that bore millionaires from investments that were once worth a few pennies, there is a large majority in the worldwide community that know about Bitcoin but fail to comprehend what it is and why it was created in the first place. Alarmingly, there are quite a number of people who are so quick to join the bandwagon of investors, hoping to get in early, as profits are rising for those already investing in Bitcoin, but have not equipped themselves with the necessary know-how for managing their bitcoin. Aside from being a recipe for failure for these individuals investors, it also negatively impacts the real purpose of Bitcoin as a cryptocurrency as it is unable to function as an actual currency.

The value of Bitcoin is dependent on the interrelation of two things – supply and demand. Getting into where the supply of Bitcoin comes from would take too much discussion. The important thing to note, however, is that there is a finite supply of bitcoins and, because of the rise in its value late in 2017, there has been a rise in its demand. The seesaw between supply and demand markedly changes the value of Bitcoin, making it a volatile currency. This means that it’s value changes, not just every day but consistently throughout a day. As an investment or commodity, this makes it one of the favorites for many investors or traders since it provides a great opportunity for trading. With the rises and falls in the market, it provides great trading opportunities.

It’s not just Bitcoin that follows this trend, other crypto currencies are also very volatile. However, this has now defined the crypto world as being more of a world of trading than as one made of alternative currencies. Luckily, there are now a few cryptocurrencies with values are so closely linked with a fiat currency that they do not behave like the others. For a trader, these are the cryptos to avoid, as there is little to no growth in your investments, but, for the person looking for a way to store, instead of invest, their assets, these stablecoins provide the advantages of both fiat and crypto – stability and efficiency.

From their names alone, stablecoins are stable or not as volatile as other cryptocurrencies. They are “stable” in a sense that although there are still rises and falls to their market values, these are not as frequent or as big a change. As introduced earlier, these coins are linked to an existing fiat, which helps to steady and maintain their values.

Crypto “currency” also defines its purpose by name. It aims to function as a currency, a medium which can be used to exchange goods, services and the like. However, due to the volatility of a majority of crypto, using it as a mode of payment is difficult. There is a need to constantly update the prices on items, based on the value of a certain crypto. Purchases that are made over a span of a few days may seem cheap and affordable on the first day, but upon finalization of payment may turn out to be too costly. With a currency that has a value that changes at an hourly rate, would one really prefer to pay items through bitcoins?

The underlying technology that supports Bitcoin or any other cryptocurrencies – the blockchain – provides many advantages that still make it a good mode of payment. Not only is it a secure method, due to its decentralized system of verifying any transactions, but it is also a fast method of exchange, which can be done at a low cost. Saying that it is efficient is an understatement as it removes the need for costly transactions that have to be checked, confirmed and processed by a centralized body. Add to the fact that there is always room for error in these centralized systems and there has been not just one incident where issues on the management of finances have come up. Putting too much trust on a single company to handle your money may be what we have become used to, but having a public ledger which is immutable and secure surely changes things.

They are cryptocurrencies with fiat properties. They are both stable and efficient alternatives that provide wallet owners with the best of both worlds. Are you a trader looking to find a storage for your assets without having to transfer it into your bank or are you just someone who dislikes the centralized banking system but would prefer not to hoard cash at home? Storing your assets online as a stablecoin may be a great option.

Author Bio: Kim Hermoso is a content writer. Her articles are mostly guides and feature pieces on all things related to cryptocurrency, such as blockchain technology and smart contracts.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Investment opportunities are a dime a dozen in the digital world, but unsurprisingly, cryptocurrencies are among the most interesting prospects aspiring investors are looking at. Unlike their traditional counterparts such as gold, stocks, traditional currencies, and other, cryptocurrencies and the blockchain platform they reside on offer a chance at the big leagues for any investor that makes the right move at the right time. However, that doesn’t mean that established assets shouldn’t be ignored.

Bitcoin has turned eight years old this year, and the now mature digital asset has had a strong ROI rate throughout its life, fueled by its constant and steady adoption around the globe. With outstanding payouts that topple some of the most lucrative investment assets on the market, it’s time to take cryptocurrencies more seriously.

However, there are a number of factors that make shares a strong and secure investment opportunity that cryptocurrencies might not be able to match. Let’s consider the market trends and help you discern between shares and cryptocurrencies as viable investment prospects.

Through trial and error, through success and failure, Bitcoin has become a sound investment portfolio option. Out of the six previous years, Bitcoin has yielded a great return on investment and will only continue to rise in the months and years to come. With the computational networks becoming more secure and stronger than before, and with the coming of flexible and reliable wallet services, it only stands to reason that modern investors should look towards cryptocurrencies as viable investment opportunities.

Even though investors have had difficulties penetrating the market over the years because of the inherent volatility of the market and the unpredicted growth and fluctuations, modern market trends indicate a more secure investment arena for the upcoming period. The increase in market liquidity, regulatory oversight, and overall security is making Bitcoin and other cryptocurrencies more appealing to investors worldwide, as well as countries willing to adopt the cryptocurrency as a new method of payment in select instances.

The stock market is a veteran among investment assets and remains one of the most stable markets on the planet. Buying a share in a company that is operating profitably will grant you smaller or greater returns over a number of years, depending on the fluctuations in the market and the worth of the company’s stocks. You can choose to invest in a range of businesses varying in size and equity though a broker or an investment fund.

Over the last year, though, profitable small cap stocks have made a boom in the industry and created a lucrative investment arena that aspiring investors should take into consideration when planning their next big move. Even though major tech companies continue to garner the attention of the investment world, small cap stocks prove to be an easier way into a stable market and show a great potential for grand financial returns in the years to come. However, financial return should not be your only guiding star.

One of the greatest concerns for any investor is whether or not the market in question is safe and stable enough for storing assets without them vanishing into the abyss with no prior warning. It’s a well-known fact that the cryptocurrency market is not regulated by any traditional means, but rather is was envisioned and still serves as a public ledger that works as a decentralized data management system – a system where every transaction is stored.

This means that the cryptocurrency market is not regulated by any governmental body, nor is it recognized by legislature or financial institutions. As such, cryptocurrency transactions cannot be influenced, capped, reserved, or identified by third parties. However, this creates a possibly volatile investment environment the stock market is protected from.

The stock market is one of the safest investment markets in the world. The fact that it is extremely well-regulated by federal law and financial institutions ensures a higher level of security and accuracy, while the strict vetting process for participants from both sides ensures transparency for investors. All of this works together towards creating a safe investment arena, and it also helps make sound forecasts in terms of market fluctuations, giving more control to the investor.

With all of that said, it’s important to note that Bitcoin has never been hacked, nor is it likely to get hacked any time in the future. The projected amount of computing power and time needed to crack into individual transactions and wallets is almost impossible to replicate in real-life scenarios, and so blockchain stands tall as the most secure platform on the web.

While it is true that Bitfinex and Mt.Gox have been hacked in the past, nowadays the cryptocurrency game offers far more superior security options to its investors. With cryptocurrencies, the assets you store in your wallet are safe. This cannot be said for other investment assets, as every digital trading game has its set of liabilities and risks the hackers can exploit.

Investors are constantly looking for emerging opportunities and lucrative assets that will yield a high ROI over a specified number of years, and both the stock market and the crypto market offer a good chance of a high return on investment. That said, the stock market offers a more stable and well-regulated investment arena, whereas cryptocurrencies offer extreme returns to those who invest in the next big project.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

As technology continues to shift society, companies are quick to adapt to the digitised landscape. Everywhere, service providers are looking for new ways to enhance their performance, cut costs, and cater to customers more efficiently through new and evolving tech.

This is where cryptocurrency and blockchain come in. Initially, blockchain was designed to facilitate the transfer of bitcoins and other cryptocurrencies. But at its core, it’s a shared database containing multiple encrypted entries. This public ledger is capable of recording high volume transactions across the globe, with its decentralised nature lessening the risks of fraud.

That said, blockchain technology has a wealth of potential uses. It not only presents companies with a safer alternative, it also eliminates the need for tedious, paper-heavy manual processes, such as bookkeeping. Business Insider notes that its increasing popularity has proven useful in the world of finance, where the revolutionary sector known as Fintech is making strides. This advancement is providing technological solutions and simplifying complex mechanisms, as underlined on a previous article here on Holy Transaction. Beyond that, blockchain is poised to radically restructure many of the world’s most important industries. Here are four fields that this innovative technology is currently disrupting.

Supply Chain and Logistics

The supply chain and logistics industry is full of opportunities for human error. Multiple factors such as time delays and high costs can create a ripple effect that is felt throughout the entire process. With blockchain technology, every transaction can be documented and stored in a permanent database — from manufacturing to point of sale. The reliability and integrity brought about by blockchain is an advantage that many global companies such as Unilever and Dole are now beginning to take advantage of in their respective supply chains.

In truth, blockchain technology is just one of the many ways the supply chain and logistics industry is taking advantage of continuing innovation. Truck platooning, for example, is already being hailed as the future of transportation. Meanwhile, a recent mandate for the use of Electronic Logging Devices (ELDs) from the U.S. Department of Transportation also leverages the latest technology to make highways safer and driver tracking more efficient. Verizon Connect highlights how ELDs can be used to optimise driving routes, thus maximising mileage and movement. The use of these ELDs by thousands of trucking companies has allowed them to automatically time driving hours, monitor engine time, and look in-depth into information routes. The regulation was implemented in the U.S. just last December, and other countries are expected to follow suit in the future. With these innovations, along with blockchain technology’s assurance of more secure and transparent transactions, the growth possibilities across the supply chain are endless.

The Property Market

Purchasing or selling properties comes with a bottomless pit of paperwork and the hassle of going through various middlemen. Blockchain is turning the real estate industry on its head by driving power back to homeowners and buyers themselves. One company at the forefront of this shift is Deedcoin Inc. Deedcoin’s mission is to provide much-needed transparencybetween all involved parties and improve their relationship, which they are doing by tokenising the process and eliminating any middlemen. Moreover, this cryptocurrency-powered platform is putting an end to frustrating agent commission rates, making home ownership more feasible for a greater number of people. Meanwhile, Holland is gearing up to implement a blockchain-based system for their national Land Registry.

Healthcare

For years, the healthcare industry has been calling for a long overdue update when it comes to storing medical research, billings, and records. Because the industry is practically drowning in data, it opens up a lot of potential for mistakes, fraud, and displacement. This has bred distrust between patients and healthcare providers, but as John Halamka of Beth Israel Deaconess Medical Center has shared, “Now is probably the right time in our history to take a fresh approach to data sharing in healthcare.”

By securely storing medical records that can be accessed by authorised personnel only, blockchain technology is able to aid in restoring the trust between patients and doctors. In the future, it will also help to identify patients. Here in the EU, the Innovative Medicines Initiative is also working to implement a blockchain-enabled healthcare program that helps patients gain faster access to life-saving medication. The tech will also work to check the authenticity of drugs and put an end to the counterfeit medication market, which is estimated to be worth 160 billion Euros.

Gaming

Even gaming isn’t exempt from the tech touch. Many players and investors are already acknowledging the mountain of opportunities that blockchain brings to the table. Gamestatix co-founder Dean Anderson stated that there was previously no feasibly way to financially compensate players for co-creating games. However, blockchain technology has paved the way for a model that guarantees financial rewards for all. Gamers will be rewarded with cryptocurrency for test-driving and reviewing games, providing valuable feedback to developers, and promoting games across social media. By providing monetary incentives, it puts an end to free labour, thus encouraging better quality of games.

For more articles on cryptocurrency or information about crypto exchanges, be sure to explore the Holy Transaction website.

Article produced for holystransactoin.com

By: Hannah Wright

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Living in a world of technology, where news through social media and live broadcasting is at our fingertips; it would be foolish to presume that the readers are oblivious of the word “cryptocurrency.”

All of us must have heard this word cryptocurrency on the media and if not there, then at dinner parties surely. But unfortunately, just knowing the word doesn’t mean you can interpret or pick what it is and how does it work.

No worriment, you are not all alone, despite the hype and press releases there is an overwhelming majority of people who have insufficient knowledge about cryptocurrency including bankers, finance dealers etc. Now let’s discover what the fuss is all about, reading the article will end up providing you the information more than most of the people.

Cryptocurrency a digital asset

“Cryptocurrency will do to banks what email did to the postal industry”

The comprehensible definition of cryptocurrency: “A cryptocurrency is a digital or virtual currency.” but why it is called “Crypto” currency because it uses cryptography for security.

Or it is a digital medium of exchange that uses encryption to secure the process involved in the transaction. The encoding process makes it impossible to counterfeit the cryptocurrency; therefore making the fund transfer safer between two parties.

You can easily find more than 800 digital currencies in the market and Bitcoin is just one of them. Need to mention it as many people think that cryptocurrency and Bitcoin is the same thing with two different names. Like cryptocurrency is a whole tree and Bitcoin is just a branch of it.

Although, Bitcoin is the world’s oldest and well-known cryptocurrency, like any other digital currency it is not regulated or backed by the government. Sir Richard Charles said, “There will be other currencies like it that may be far better, but in the meantime, there is a big industry around Bitcoin.”

You might have heard the words Etherium or Litecoin, just other names of Cryptocurrency. Moreover, the name, symbol, and the price of the cryptocurrencies can be different depending on its end goal. When bitcoin first arrived, they were intended to be a way for the world to break away from banks.

The use of cryptocurrency

Other than just an increase in value, many other reasons make it imperative for users to own it. It bestows the possibilities that no other currency allow. For example, the following

Conclusion

The market for cryptocurrency is rapid, vast and wild. Every day it takes a new twist and turns; the new currencies pop up, an old one dies, early adopters get rich, and investors suffer losses. But the fact is that people all over the world are buying cryptocurrencies, investing in it as they are sure that cryptocurrency is here to stay and change the world and that’s an undeniable truth.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

After the success of the very first cryptocurrency, Bitcoin, many investors are now looking for the next big opportunity to invest in. Bitcoin opened the market for more cryptocurrencies and newest blockchain technologies to develop and grow. Nowadays, Bitcoin has seen better days, while there are over a thousand different digital currencies on the market. That being said, Ethereum is taking the lead on the market with their cryptocurrency called Ether and their newest blockchain technology development and implementation.

However, investors can’t sit and wait for years until a new company with their innovative idea starts to grow on the market. Instead, they are trying to predict the next important opportunity and invest in the initial coin offering (ICO) behind that opportunity. That way, they don’t only get to be the first to support the next revolutionizing cryptocurrency, but they also get to earn a considerable return on investment. Still, that’s easier said than done, due to the market’s volatility and unpredictability. Therefore, here are a few things to consider before investing in ICO in 2018.

Initial coin offering, or ICO, is a way for companies to attract investors by offering their cryptocurrency tokens in exchange for support and funding. Simply put, it’s a fundraising method for companies to finance their new projects, by offering their tokens in exchange against other cryptocurrencies, such as Ether and Bitcoin. ICO are also similar to initial public offerings otherwise known as IPOs.

Companies sell their stocks to the public, in order for their shares to be traded on the stock exchange market. However, IPOs offer stock to the public with a security exchange, whereas ICOs are still unregulated and there are no procedures that can validate a company’s or their token’s credibility. That’s why it’s important to take your time to plan out your investments and consider your options carefully.

Before you decide to invest in any ICOs, you have to conduct thorough research first. As mentioned before, ICOs are highly unregulated so far, which means that a bad call can cost you your entire investment. The popularity of the digital currency market has made it possible for various companies to promote their own projects and their unique cryptocurrencies. This trend has led to over a dozen ICOs being offered each day.

However, not all companies have their own blockchain technology like Ethereum. As a matter of fact, many new projects are based on existing blockchain technologies. This makes it difficult for investors to spot out good projects with the potential for considerable ROI. That’s why you must plan your investment and research the ICOs available on the market. For instance, you can check out reliable sources, such as The Blockchain Review, which can offer the latest information about the current ICOs on the market and their overall performance.

After you’ve found a company with an ICO worthy of investing, you should take time to read their whitepaper. The main reason is that many companies haven’t even started their project yet and their whitepaper is the only thing that describes the company and their undertaking. The company itself

might appear interesting enough to invest in, but you must be sure that it’s not, in fact, a scam. That’s why you should take your time to read their whitepaper thoroughly. The better you understand the company and their goals, the more you’ll know about whether to invest or not.

The key points you should be on a lookout for are company’s description and main information, the problem they wish to approach with their project and the solution they offer for that particular problem. Also, make sure you check out their product description and how they plan to implement, as well as commercialize, their tokens. What’s more, you need to keep an eye out for their token value and its distribution, as well as how their tokens differentiate from others on the market. Most importantly, check out their legality and how they use the funds obtained from their ICO.

Doing your research and reading whitepapers is only the beginning. You have to be absolutely certain that the company you’re about to support with your investment is worth it and that you’ll actually profit from your investment. That’s why you need to learn as much as you can about the company you’re about to deal with. For starters, check out their website. You must evaluate every aspect ranging from the website design and security all the way to information a company has available on their website.

In addition, check their online activity and their presence, in order to determine how much effort a company is placing in promoting themselves. Moreover, check out their partners. That will give you insight into which system is a company using, as well as which electronic platforms they are partnered with. Checking out the legitimacy and credibility of a company demands time and effort. However, it will help you minimize the economic risks and ensure your investment is not in vain.

Investing in ICO can prove to be a lucrative strategy for investors. There are various ICOs on the market, but not every one of them has the potential to be the next big cryptocurrency. That’s why it’s important to do your research well and take time to consider all the important factors before you make an important decision.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

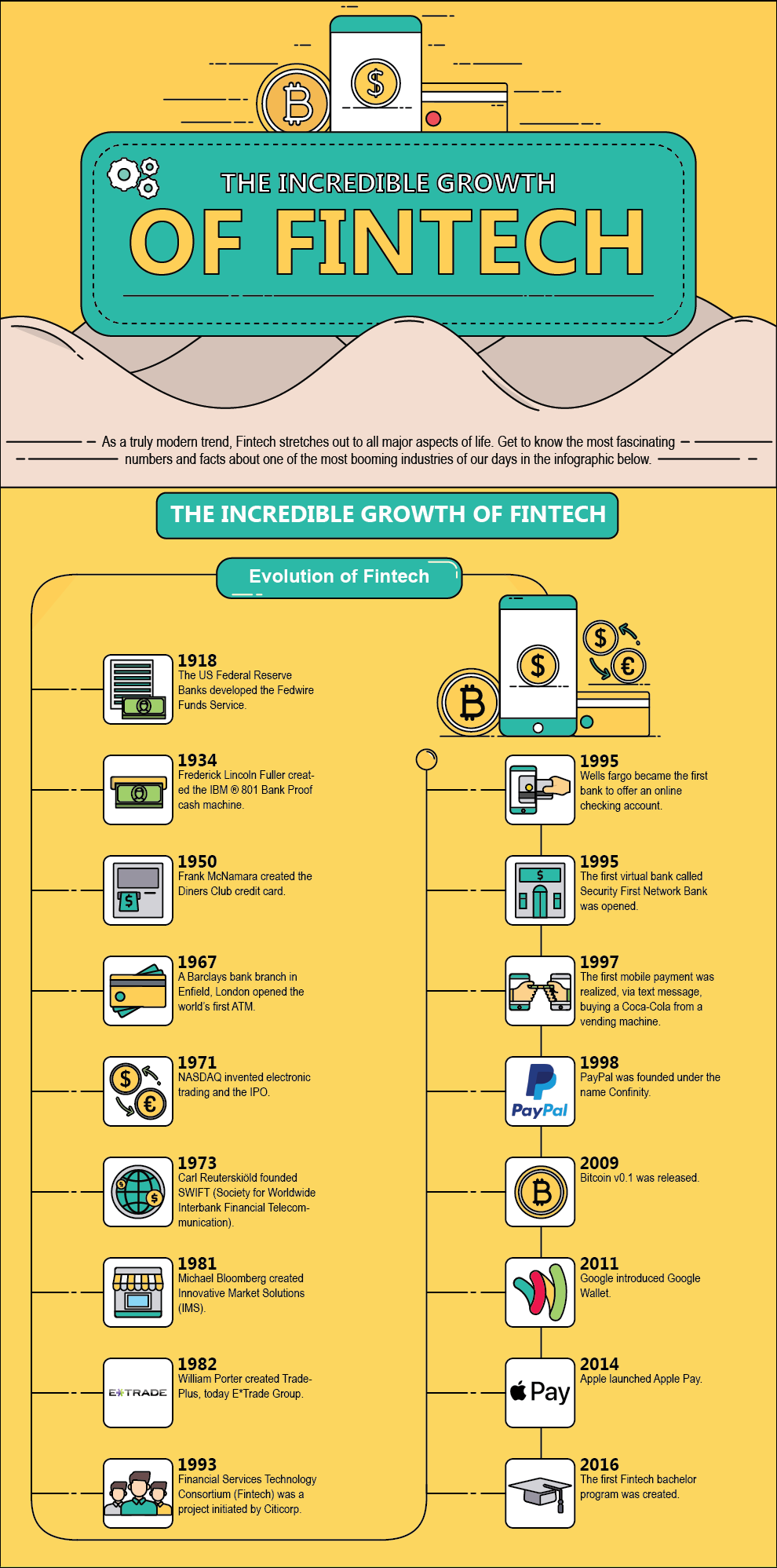

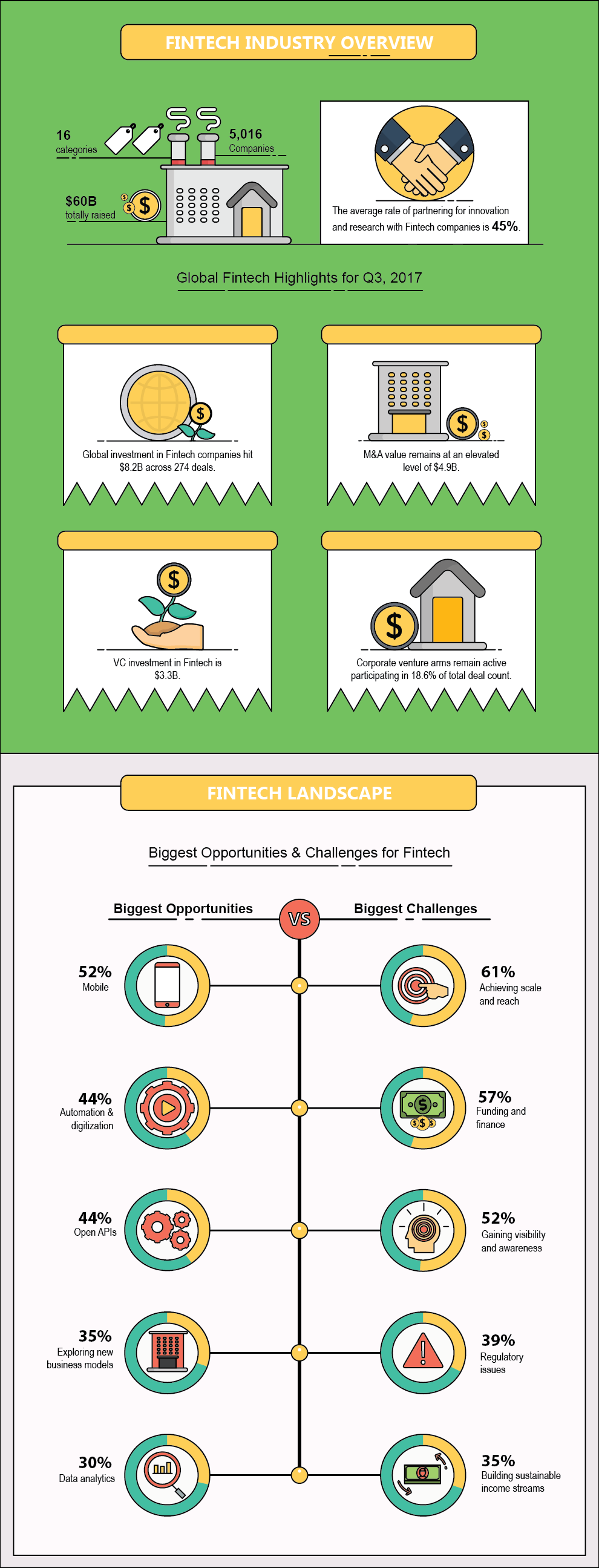

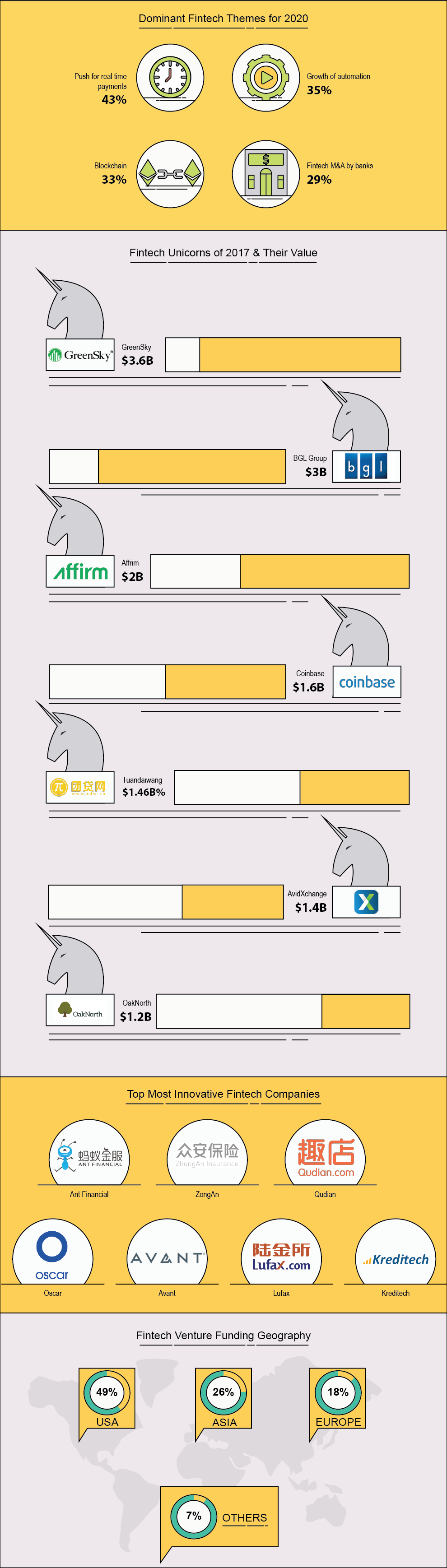

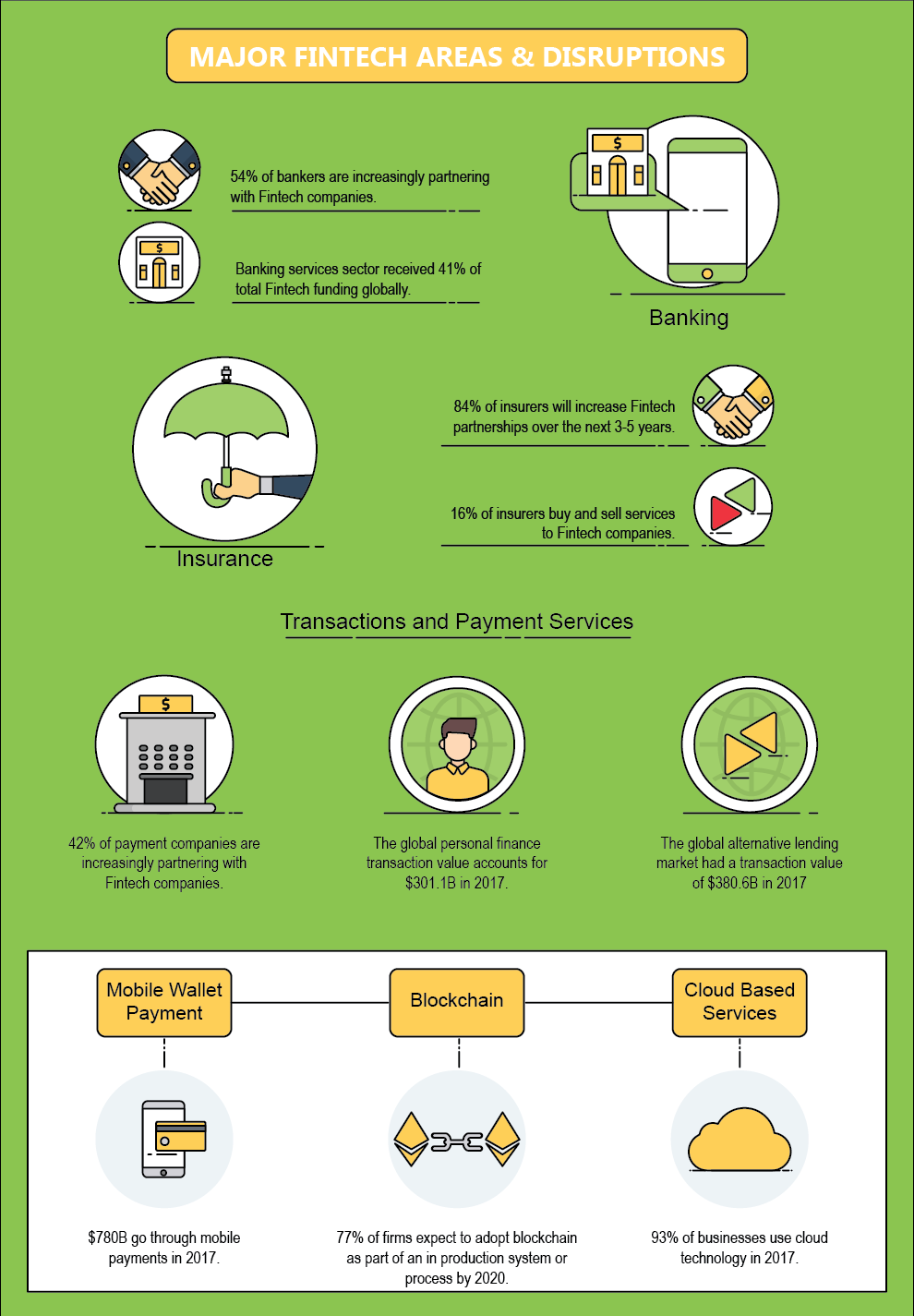

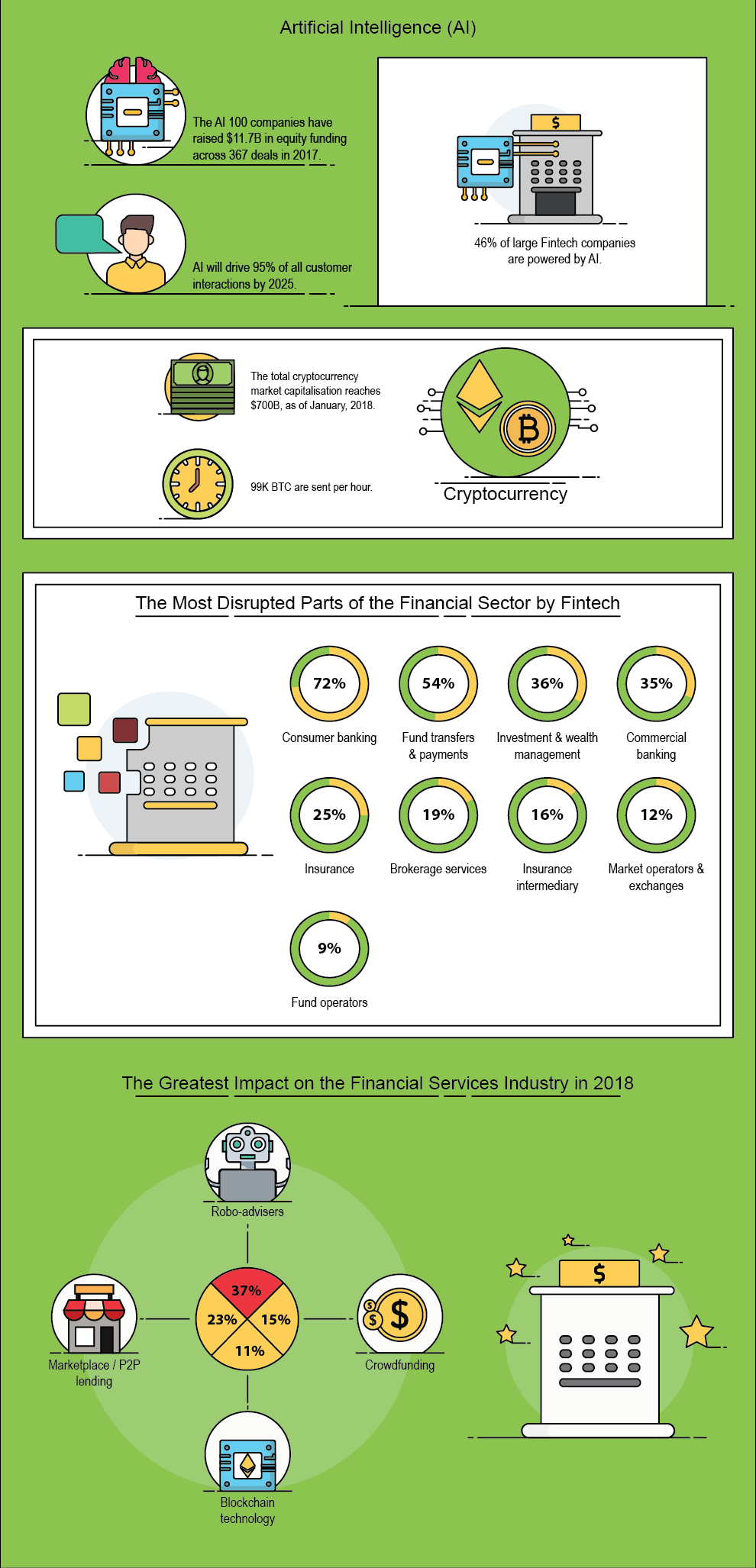

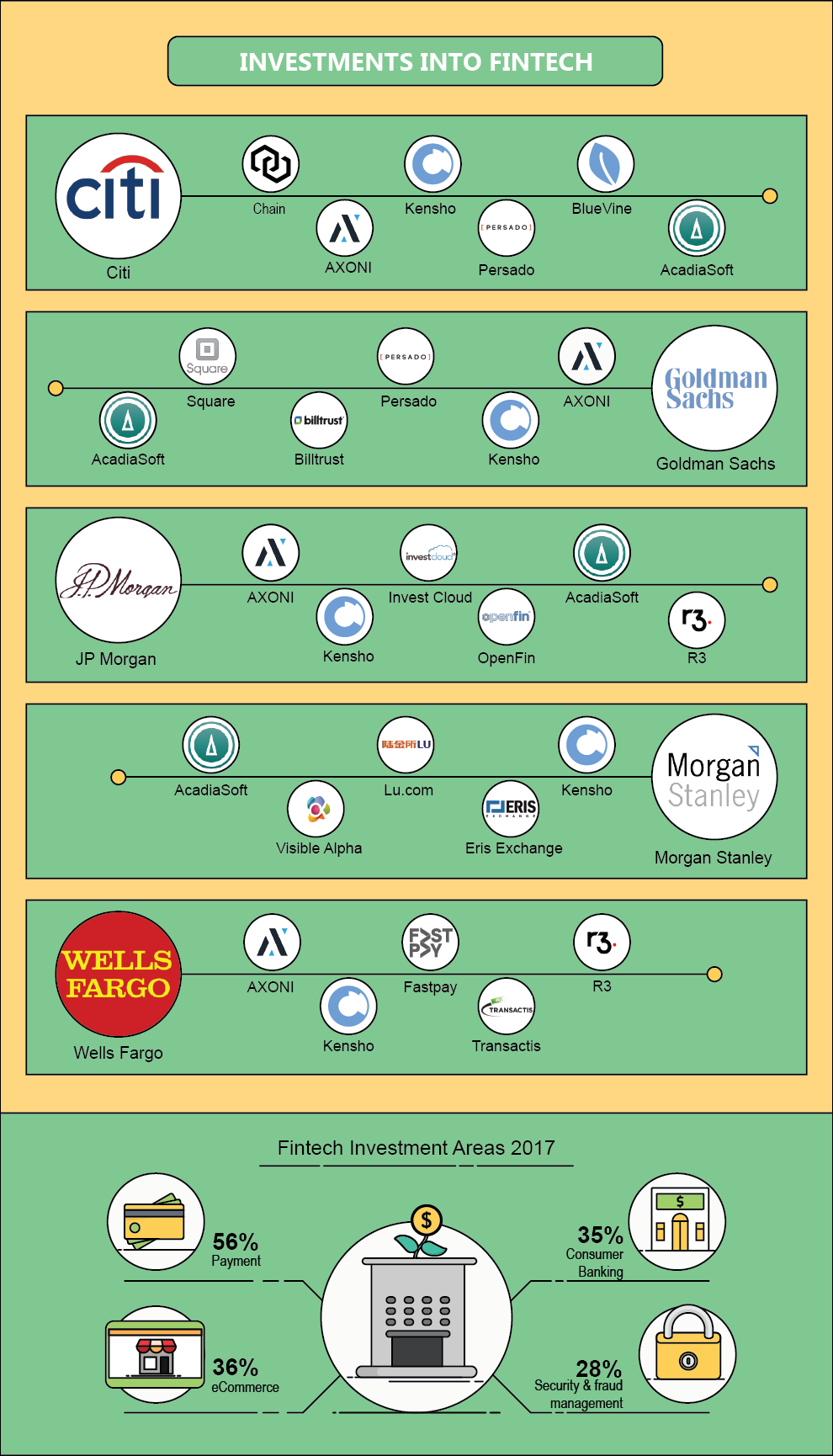

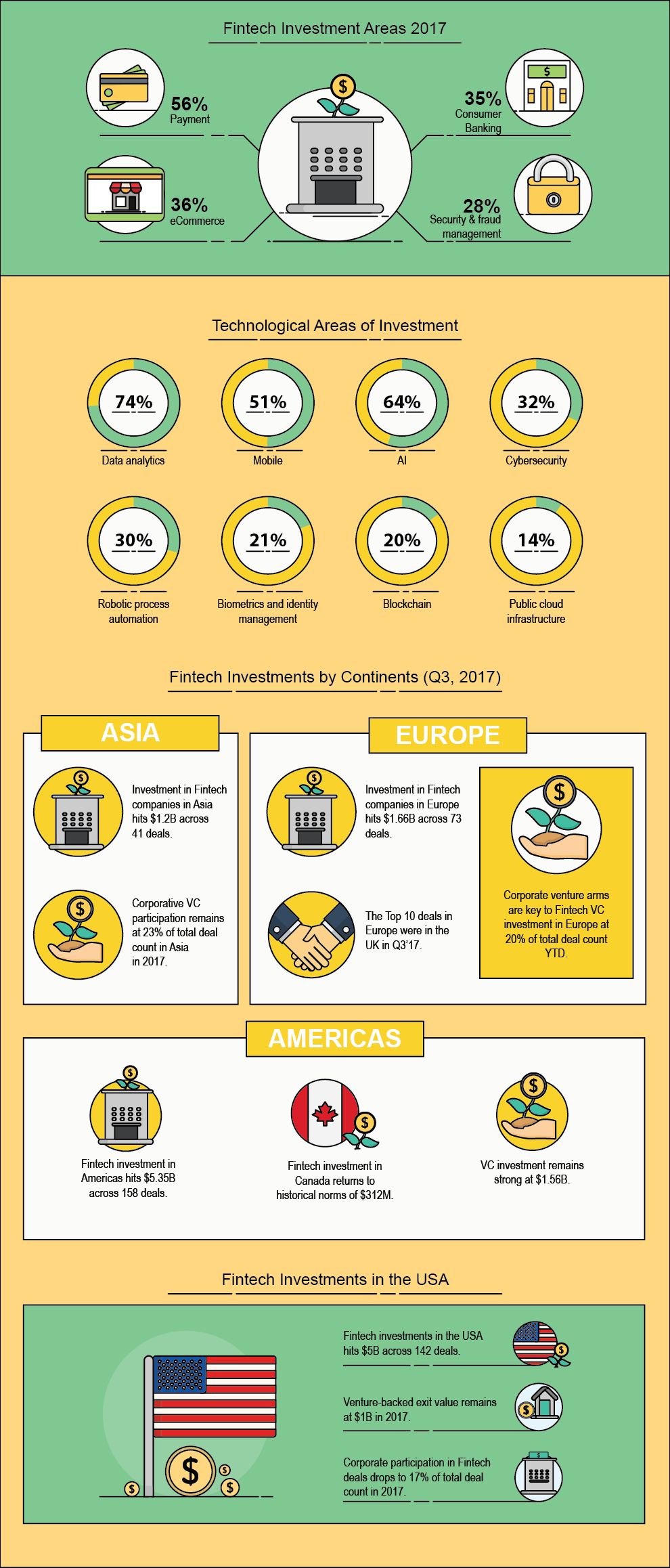

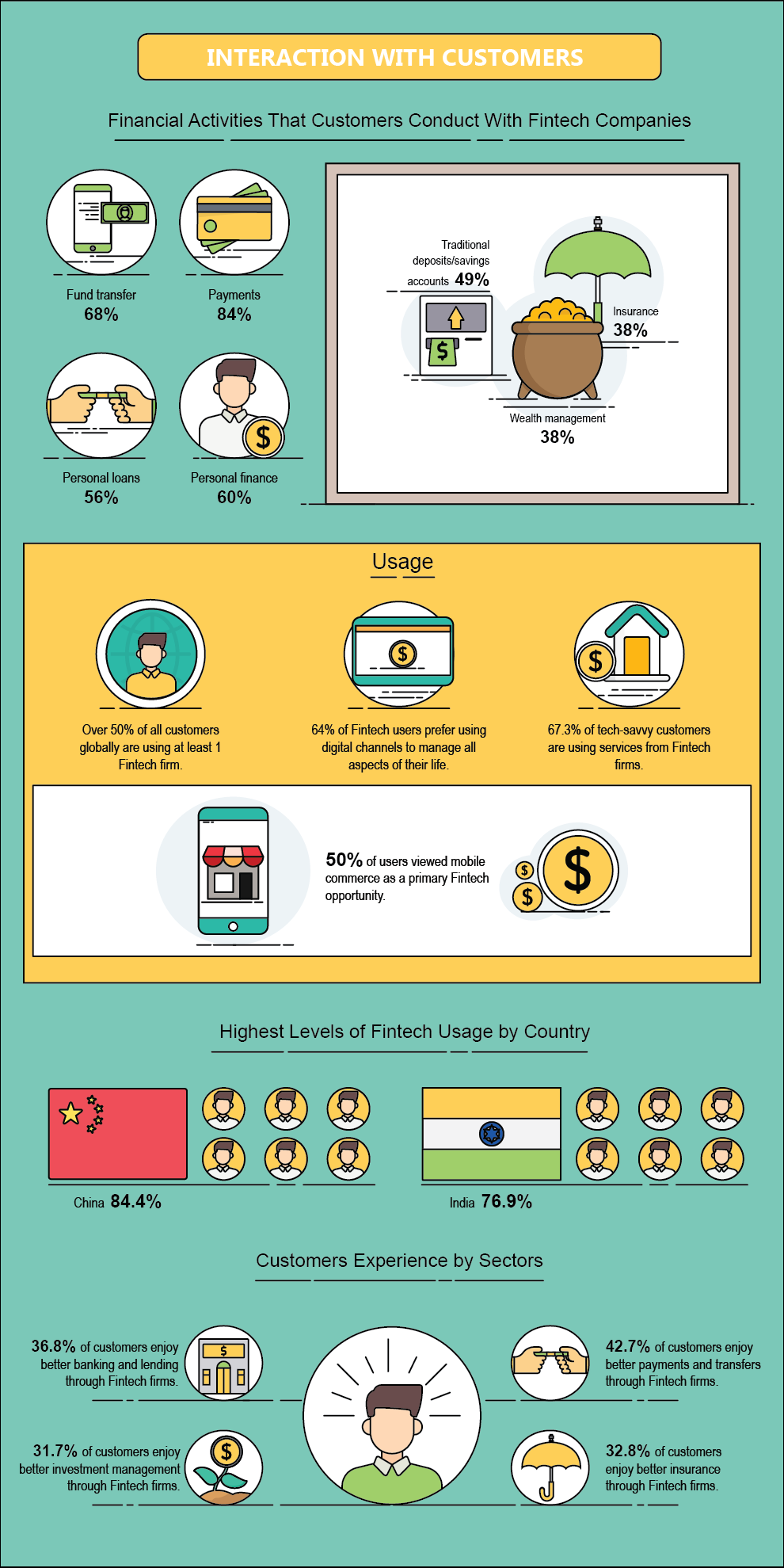

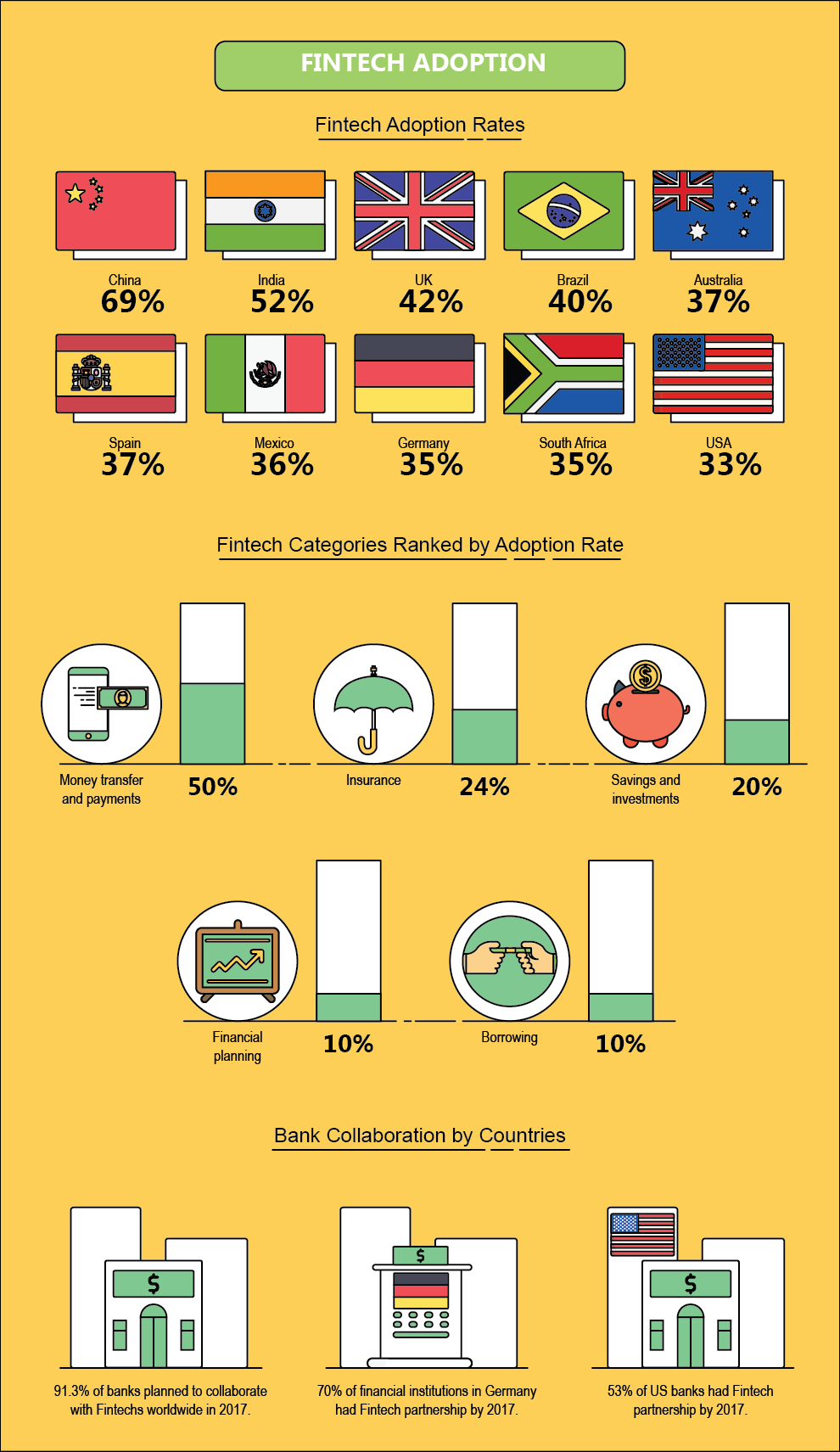

When technology put its fingers in the financial services, Fintech was born. And now with this word we refer to mobile payment, transfers, fundraising and , of course, cryptocurrencies!

Fintech is a very revolutionary sector which has allowed the development different new companies through its technology support. It gave impulse to the whole financial industry because of its technological solution which simplifies complicated mechanisms.

As always, traditional player felt threatened by it; but its development has ben unstoppable and experts usually call it … Future.

Our good friend of 16best.net provided us an awesome infographic which explains some incredible facts on the incredible growth of fintech in the last couple of decades.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

For people who have traced the movements of Bitcoin since its inception, it’s hard to believe that it has only been around for less than a decade. As discussed here on HolyTransaction, the world’s first cryptocurrency has had a wild ride so far, from the downright bizarre (two pizzas for 10,000 BTC) to the extremely exciting. As of the start of the year, Bitcoin’s market cap was valued at $280 billion (€226 billion), with cryptocurrency like Ethereum following at impressive valuations of $90.4 billion (€73 billion).

These figures make investing in cryptocurrencies incredibly tempting, but also quite daunting. With such a young market, there aren’t a lot of set rules or trends that can help guide you on your investment journey. This is where looking at similar trading commodities like gold and other precious metals come in. After all, FXCM explains that gold trading is simultaneously one of the oldest and most exciting ways to invest in global markets, and this remains true whether in times of war and turmoil or peace and prosperity. With the right focus and lots of discipline, there’s plenty of wisdom to be uncovered from looking at the history of gold trading.

Whether you’re a beginner looking to dip your toes into the cryptocurrency pool or an experienced trader hoping to build your wisdom in Bitcoin investing, here are five golden lessons for today’s cryptocurrency investors.

Diversify, diversify, diversify!

This tip seems basic, but focusing on a single trading commodity remains one of the most common mistakes investors make. A conservative position in gold investing means a maximum of 10% gold in your portfolio, and this is something that you can keep in mind when investing in cryptocurrencies. This can not only protect you from unexpected Bitcoin price dips, but can also open up better growth opportunities with lower risks and good returns. From the over 1,300 different cryptocurrencies in existence, This is Money recommends looking into altcoins like Litecoin, Monero, and Dash this 2018.

Stay calm in the face of volatility.

Gold can easily swing by a hundred pips and reverse every few minutes, which means trading in gold requires a certain degree of thick skin and steel-like determination. These are also very handy when trading cryptocurrencies, which are infamous for their volatility. In crypto-speak, be ready to “HODL”, or hold on for dear life (your coins), even when everyone else is panicking.

Set a loss limit.

Be sure to set acceptable loss limits for your investments and avoid buying too much. Financial Times reports that even a trusty commodity like gold has its own set of risks, which means it’s healthy to set stops for each individual trade for a maximum allowable loss that you are comfortable with. Invest only what you can stand to lose, and keep evaluating your trading strategies to learn which cryptocurrencies are best suited for you.

Keep your eyes on the prize.

Whatever your feelings are about shiny yellow metals or blockchain-enabled digital currencies, Forbes claims that these are still commodities that can be sold when prices are high and bought when prices are low. Focus on market trends and see where the prices are heading, and use these to inform your decisions. Pay attention to cycles, growth patterns, and market potential to make decisions, instead of which cryptocurrencies everyone else is buying.

Security and safety is a must.

Last but not least, invest only on trusted trading platforms and certified services. Millions of people have been victimised by gold-related scams and fraudulent brokers over the years, and it’s important to carry the same level of vigilance when carrying out cryptocurrency wallet transactions. Keep your money and investments safe with your free digital wallet here at HolyTransaction.

Do you have any other tips for cryptocurrency trading? Let us know in the comments below!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin rose from unknown to mainstream recognition largely thanks the incredulous surge in value it saw in 2017. But then the price went down, sparking yet another heated discussion about the volatile unpredictability of the bitcoin.

Nowadays, discussions are all at their all time hype, but worth just as long as the participants know what they are talking about; and the audience has at least some grasp of the matter. But it rarely happens, as the vast majority of experts are as clueless about the intricacies of the crypto markets as is the general audience.

The infographic below, provided by our friends at BitcoinPlay, will not make us all marketing gurus but will give you a much better understanding about the driving forces behind the world’s first cryptocurrency, how it came to be, who embraced it first and how countries are handling it.

Here’s a selection of our favourite ones:

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What is a Virtual Credit Card Bitcoin? How to create yours? And what are its major benefits?

Read the following article to receive all the answers you need to use and open your new Virtual Credit Card Bitcoin.

First of all, a Virtual Credit Card Bitcoin is a unique credit card number generated to settle a specific transaction.

Of course, it can be filled with Bitcoin, so you can convert your cryptocurrency into euro to buy everything you need online.

So, it is not physical, but just a credit card number generated electronically via web.

Virtual Credit Cards Bitcoin are available for years, but many continue to ask: why should I use them?

Here a list of Virtual Credit Card Bitcoin benefits:

On the web you might find several services that allow you to create your own Credit Card, but only a few of them are really effective and safe.

To receive instantly your new credit card number in minutes, to have a good support and low fees, we suggest you to test our new platform HolyTransaction Trade

HolyTransaction Trade allows you to create your Virtual Credit Card Bitcoin in a very short time with only 2% of fees.

Click here to read a simple step-by-step guide to create your not physical credit card.

Open your free digital wallet here to store your cryptocurrencies in a safe place.