Search Results For: virtual credit card

Virtual Credit Card Bitcoin and its benefits

What is a Virtual Credit Card Bitcoin? How to create yours? And what are its major benefits?

Read the following article to receive all the answers you need to use and open your new Virtual Credit Card Bitcoin.

Virtual Credit Card Bitcoin: definition

First of all, a Virtual Credit Card Bitcoin is a unique credit card number generated to settle a specific transaction.

Of course, it can be filled with Bitcoin, so you can convert your cryptocurrency into euro to buy everything you need online.

So, it is not physical, but just a credit card number generated electronically via web.

5 top Benefits

Virtual Credit Cards Bitcoin are available for years, but many continue to ask: why should I use them?

Here a list of Virtual Credit Card Bitcoin benefits:

- Security: Typically a virtual credit card number is issued for the exact amount of the transaction (the same system of a check), reducing the possibility of fraud. The specific credit card number generated becomes invalid after the transaction is complete.

- Control: You can easily check all spending parametres. Your Virtual Credit Card can only contain 250 EUR.

- Low Fees: when you create a virtual credit card the 2% from the total value will be designated to provider fees.

- Versatility: you can use your Virtual Credit Card on every single e-commerce, website and platform where VISA is accepted. Its is also a simple way to convert and spend your Bitcoins.

- Easier Creation: To create your own Virtual Credit Card Bitcoin you just need to have 18+ years and an account on EntroPay.

HolyTransaction Trade

On the web you might find several services that allow you to create your own Credit Card, but only a few of them are really effective and safe.

To receive instantly your new credit card number in minutes, to have a good support and low fees, we suggest you to test our new platform HolyTransaction Trade

HolyTransaction Trade allows you to create your Virtual Credit Card Bitcoin in a very short time with only 2% of fees.

Click here to read a simple step-by-step guide to create your not physical credit card.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin virtual credit card: how to create it

Holytransaction Trade is a new service to create a bitcoin virtual credit card offered by the HolyTransaction wallet.

Holytransaction.trade to create a bitcoin virtual credit card

You would think that Holytransaction.trade is a service that can be found anywhere on the web to sell and buy bitcoins.

This is not true, because HolyTransaction.Trade allows you to do much more, such as creating a bitcoin virtual credit card, convert bitcoin into fiat currencies and pick them up in an HalCash ATM, etc.

If you have some digital currencies you can create a bitcoin virtual credit card to buy everything you want online.

So, HolyTransaction Trade is not only a platform where you can convert bitcoin into dollars or euro, but also vice versa: in Mexico, Greece and Spain you can convert fiat into bitcoins via PayNet, EasyPay and Teleingreso.

Also, among the options you can create a bitcoin virtual credit card.

This service is available and works in less than 10 minutes and it is also available on Google Play.

Please note that when you create a virtual credit card the 2% from the total value will be withheld as fees.

To use this service you must be either registered on Entropay.com or register after completing the process.

So if you need liquidity, you may want to transfer your bitcoin into a virtual credit card.

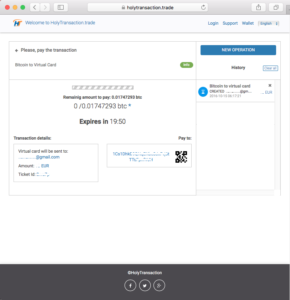

Follow these steps to understand how to create your bitcoin virtual credit card with HolyTransaction.Trade.

- In the first column on the right you need to select “Bitcoin” as an input and “Virtual Bank Card” on the left as the “output”. Then click on “Continue”.

- Select the amount and your email address to receive the virtual card’s information.

- In the following page, you’ll find an address on the bottom right, below the “Pay To”.

- Send your the exact amount you selected before to that address, so enter on your favorite wallet and do a transaction with that address as a recipient. You can transfer max 250 euro for each email address.

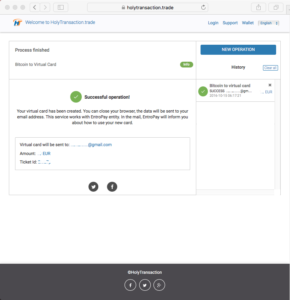

- Create or login to your account on EntroPay. You’ll receive all the info you need via email.

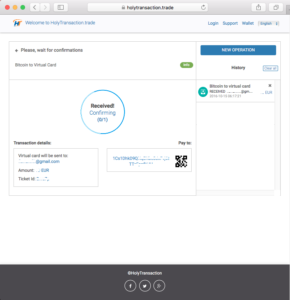

- Once the transaction is validated and written on the blockchain, within the next ten minutes the amount you selected will be sent to the beneficiary bitcoin virtual credit card.

- Operation Completed!

This is just one of the services available on the HolyTransaction.Trade platform to convert and send bitcoin worldwide.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

MasterCard lobbyist adds Bitcoin to list of topics

(Bloomberg) When MasterCard Inc. paid a team of

lobbyists about $70,000 earlier this year to promote the bank-card network’s views, a new topic made their list: bitcoin.

Washington-based Peck Madigan Jones had five of its

lobbyists, including Jeff Peck, who leads the firm’s financial

services and capital markets practice, work on subjects

including “bitcoin and mobile payments” in the House of

Representatives and Senate during the first quarter, according

to a regulatory filing. Other topics the firm handled for

MasterCard included data breaches, interchange fees and gift

cards.

As big financial companies dismiss bitcoin’s prospects, the

document shows MasterCard is at least talking with lawmakers

about the virtual currency, which entrepreneurs pitch as a cheap

alternative to established payment systems. Investors in bitcoin

businesses are working to head off burdensome regulation and

capture some of the combined $61.3 billion in annual revenue

generated by the four largest U.S. credit-card networks.

“We were gathering information in connection with recent

congressional hearings to better understand the policy issues

around virtual and anonymous currencies,” said Jim Issokson, a

spokesman for Purchase, New York-based MasterCard.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Shopping with Bitcoin: read the ultimate guide

Today I want to help you to start doing shopping with Bitcoin. Thanks to this method you can buy everything you want online, saving money and time.

Also, you will be able to avoid frauds that are very common on Internet, unfortunately.

First of all, you need a cryptocurrency wallet as a safe place to store your Bitcoin. You can open it now for free here.

Bitcoin Virtual Credit Card

To stard doing shopping with Bitcoin you can easily open a bitcoin virtual credit card on our new platform called HolyTransaction Trade.

Not all the e-commerce platforms you can find online accept Bitcoin, so this is an instant and cheap way to create a virtual credit card with Bitcoin and buy everything you want from your favorite online store.

You can use a virtual credit card everywhere a Visa credit card is accepted among the payment methods.

Also, to read more about all the benefits of a bitcoin virtual credit card, click here.

Shopping with Bitcoin on Purse and eGifter

As you can see on the HolyTransaction.com menu, you can directly open your Purse card from your HolyTransaction Wallet.

You just need to click on “Spend” and then on “Purse” or “eGifter”.

Purse is a fast way to do shopping with Bitcoin on Amazon, also saving from 5% to 15% on millions of products. To do so you just need to create an online gift card on Purse and start doing shopping.

eGifter is another way to do shopping with Bitcoin, buying from hundreds of gifts cards with your favorite digital currency. You can do it directly from our website, by depositing the bitcoins stored in your wallet on the eGifter website.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction Trade: opinions and news

HolyTransaction Trade is our new service to allow you to buy and sell your Bitcoin with low fees and instant conversion.

HolyTransaction Trade is a virtual exchange for users that want to convert their digital currency into fiat currency and vice versa, through Halcash ATMs, bank transfer, Bitcoin virtual credit card and more options available worldwide.

Click here to read more about HolyTransaction Trade and start converting from/to your favorite cryptocurrency.

We launched this service a few weeks ago and now we want to share with you a few articles written by magazines from all around the world about HolyTransaction Trade.

HolyTransaction Trade on magazine

We received a widespread of our press releases and news in Asia, America and Europe and we cannot be happier for the support we received in the latest days.

As you might know, we had a few issues during 2016, but this is a new year: all problems are disappeared and we are stronger than ever with a new service and more strength to improve our work and your experience with us.

Click on the image below to watch a recent video published on YouTube by the Russian KCN.

Also, please click on the images below to the read the full press release published on the major magazines about Bitcoin and the Blockchain, including Cointelegraph Espana, CryptoCoin News, Bitcoin.com, and more…

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Change Bitcoin Euro: how to sell crypto in Europe

People who decide to invest in crypto often have to change Bitcoin Euro, but the main problem is always the same: where? which platform should I use in order to have low fees and instant conversion?

We at HolyTransaction have found a solution for these issues and we have launched HolyTransaction Trade, an instant exchange that allows you to change Bitcoin Euro in a few steps.

Through our new service you can instantly convert Bitcoin into Euro and vice versa, buying and selling your cryptocurrencies at any time.

We have a few options to do so: Bitcoin to Virtual Credit Card, Bank Transfer, and Halcash ATM ( the latest one option is available in Poland and Spain).

Or Bitcoin to EasyPay, TeleIngreso and PayNet if you live in Greece, Mexico or Spain.

Change Bitcoin Euro: step-by-step guide

By clicking on the links below you can read step-by-step guides to change your Bitcoin into Euro:

Also, if you don’t know exactly how a Bitcoin Virtual Credit Card works and which benefits it has, you can read the insightful article below to understand why you might need a virtual credit card to do shopping online.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin in 2016: top news about the Blockchain

As the New Year’s Eve is coming, we decided to share with you the best moments of this year with an article about Bitcoin in 2016.

Involved in the best news about the distributed ledger technology, there are not only financial institutions and bank, but specially well-known companies related to countless sectors.

And his proves how the blockchain could be useful for a lots of use cases.

Microsoft and Bitcoin

For example, in 2016 Microsoft announced its involvement in blockchain projects related to security, identity management, and a tool for developers called Microsoft BaaS.

Also, the worldwide company decided to accept Bitcoin among its available methods of payment on its online shop.

IBM and Watson

IBM was another company who dedicated much effort in blockchain research and projects.

Earlier this year, IBM revealed its new blockchain cloud service for helping companies in developing and testing the distributed ledger.

Also, it announced its revolutionary project called Watson, that together with the distributed ledger are “two technologies that will rapidly change the way we live and work, and our clients in Asia Pacific are eager to lead the way in envisioning and creating that future,” explained Randy Walker, CEO at IBM for the Asian area.

Bitcoin in 2016: annual price high

Bitcoin in 2016 also reached its annual high; and as the year comes to the end, its price continues to test the $1,000 mark and it seeks to set a new three-year high.

HolyTransaction in News

You might now that our company had to face some issues earlier this year, but now we are strong than ever and we’re very happy to having developed a new virtual exchange platform called HolyTransaction Funding.

Thanks to this exchange you can buy and sell bitcoin worldwide with no registration required. This means you can instantly convert your digital currency into fiat currencies and vice versa, without sharing your personal data.

On HolyTransaction Trade you can also create a Bitcoin Virtual Credit Card to buy everything you want online.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How bitcoin can help you take control of your financial future

Bitcoin is a decentralized digital currency that has gained popularity in recent years for conducting online transactions. HolyTransaction is proud to offer our users the benefits of using this innovative digital currency, including security, low transaction fees, and greater control over one’s own cryptocurrencies.

One of the key advantages of using Bitcoin for online transactions is its decentralized nature. This makes it a secure option for conducting transactions and protects against the potential for a single point of failure. In addition, each transaction is verified by the network of computers that run the Bitcoin software, making it virtually impossible to forge or counterfeit.

Another benefit of using Bitcoin is its low transaction fees. Because there are no intermediaries such as banks or credit card companies involved in the process, transaction fees are typically much lower than they would be with traditional forms of payment. This can be especially beneficial for those who conduct a large number of transactions, such as small business owners or online merchants.

In addition to these benefits, using Bitcoin can also offer users more control over their own money. Because it is decentralized and not controlled by any one entity, users are free to store, send, and receive Bitcoin without interference from third parties. This can be especially valuable in countries where access to traditional financial services is limited.

Another potential benefit of using Bitcoin is its potential for growth. Because there is a limited supply of Bitcoins, and the demand for them is increasing, the value of the currency has the potential to increase over time. This makes it a potentially attractive investment option for those looking to grow their wealth.

Of course, there are also risks associated with using Bitcoin. The value of the currency can be volatile, and there have been instances of large-scale attacks on Bitcoin exchanges. However, these risks can be mitigated by taking steps to protect your Bitcoin wallet.

At HolyTransaction, we are committed to providing our users with a reliable platform for buying and selling Bitcoin. With a user-friendly interface and low fees, HolyTransaction is the perfect place to start your journey with Bitcoin and take control of your financial future.

In addition to our exchange services, we also offer a range of other tools and resources to help our users make the most of their Bitcoin experience. Our educational materials and support team can provide guidance and assistance for beginners, while our user-friendly trading options are ideal for those just starting out with Bitcoin.

We are constantly working to improve and expand our services to meet the needs of our users. This includes the addition of new cryptocurrencies and features, as well as ongoing efforts to enhance security and user experience.

At HolyTransaction, our goal is to make Bitcoin accessible and easy to use for everyone. Whether you are a beginner looking to get started with Bitcoin or just want an easy and secure way to buy and sell the digital currency, we have something for you. Join us on our mission to help you take

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Benefits of Using Bitcoin for Online Transactions

Bitcoin is a decentralized digital currency that has gained popularity in recent years for conducting online transactions. Unlike traditional currencies that are controlled by central banks, Bitcoin is not subject to the whims of any one entity, making it an attractive option for those looking to conduct transactions online.

One of the key benefits of using Bitcoin for online transactions is its security. Because it is decentralized, there is no central point of failure that attackers can target. In addition, each transaction is verified by the network of computers that run the Bitcoin software, making it virtually impossible to forge or counterfeit.

Another benefit of using Bitcoin for online transactions is its low transaction fees. Because there are no intermediaries such as banks or credit card companies involved in the process, transaction fees are typically much lower than they would be with traditional forms of payment. This can be especially beneficial for those who conduct a large number of transactions, such as small business owners or online merchants.

In addition to these benefits, using Bitcoin for online transactions can also offer users more control over their own money. Because it is decentralized and not controlled by any one entity, users are free to store, send, and receive Bitcoin without third parties.

Some other potential benefits of using Bitcoin for online transactions include:

Faster transaction times: Because Bitcoin transactions are processed on a decentralized network, they can be completed much more quickly than traditional bank transfers or credit card payments. This can be especially useful for people who need to make or receive payments quickly, such as when making an emergency purchase or receiving payment for a time-sensitive project.

Immutability: This means that once a transaction is recorded on the Bitcoin blockchain, it cannot be altered or deleted. This provides a high level of security, as it ensures that transactions cannot be tampered with or reversed without the consensus of the network. This feature also helps to prevent fraud, as it makes it difficult for someone to modify or falsify records. Overall, the immutability of the Bitcoin blockchain provides a level of trust and security for users of the network.

Greater global accessibility: Because it is decentralized and not tied to any specific country or currency, Bitcoin can be used for online transactions anywhere in the world. This can be especially helpful for individuals and businesses in countries with unstable economies or limited access to traditional financial institutions.

Overall, the use of Bitcoin for online transactions offers a number of potential benefits, including security, low transaction fees, and greater control over one’s own currency. As more businesses and individuals begin to recognize the potential of this cryptocurrency, its use is likely to continue to grow. In fact, the use of Bitcoin is already starting to become more widespread, with many online merchants and small business owners choosing to accept it as a form of payment.

One final note about using Bitcoin for online transactions is its potential environmental benefits. Because it uses a decentralized network of computers to verify transactions, it does not require the same energy-intensive processes as traditional money transfer services. In fact, many of the computers that run the Bitcoin network are powered by renewable energy sources, which can help to reduce its carbon footprint. This is in contrast to traditional financial systems, which often rely on fossil fuels and other sources of pollution. In this way, using Bitcoin for online transactions can not only provide security and convenience, but also contribute to a cleaner and more sustainable world.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Visa is working on a secure and scalable Blockchain

Job Description

Visa partners with Chain

The blockchain is no longer a choice

Open your free digital wallet here to store your cryptocurrencies in a safe place.