Search Results For: sweden

Bitcoin Sweden regulation: the blockchain to record property deals

A new project for Bitcoin Sweden regulation has moved to its second phase. In fact, the Sweden’s land registry authority, the so- called Lantmäteriet, wants to use the distributed ledger tech with the main goal of recording property deals.

This project was conducted by the blockchain startup called ChromaWay and the consultancy group Kairos Future, that are also working in partnership with two banks: SBAB and Landshypotek.

Talking about the project’s potential, ChromaWay CEO Henrik Hjelte commented:

“It could be a great benefit for economic growth”.

Also, he said that Sweden is the ideal country to test a distributed ledger system for land titles, because trust in public authorities is higher than elsewhere and it could influence other countries to do the same in the next future.

Thanks to this system, a buyer and seller would open a contract where banks and the land registry can view the workflow of the deal, such as due dates for payments.

“In the blockchain confirmation of each step in the workflow is made with a hash, like the blockchain normally. Everyone has the same information and you can check it yourself,” said Magnus Kempe of Kairos Future.

Another use case for this project is the potential verification of an IOU issued by the bank to its property buyer.

“That part is going to be hidden for the others in the contract. You will only have the hash confirming from the bank that the IOU has been signed,” commented Kempe.

That said, SBAB Bank explaind it has no imminent plans to implement the blockchain:

“Our reason to participate in the project has not been to actually implement the solution in our current processes. But rather an opportunity for us to get a better understanding of the blockchain technology and how it might possibly fit in our future products/offerings.”

Bitcoin Sweden regulation: what is the EU doing?

Recently, the EU passed a directive that puts more weight behind digital signatures; a similar bill has been proposed in Arizona too.

Click here to read more about EU regulation related to bitcoin and blockchain.

A the moment, this land registry project is looking at new ways for working at this issue.

“Actually, the land registry today, they don’t receive much physical paper, they get PDFs of the contracts which are signed electronically so they don’t store the physical contracts. What we are thinking of is, you can actually sign the contract digitally in the blockchain to the land registry, they can award the land titles and then you can throw away the paper so you’re not dependent on the physical archive.”

According to ChromaWay’s Henrik Hjelte, the use of blockchain could be disruprive in order to manage ownership of property and improving transparency in real estate sales.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Sweden Digital Currency: a new Bitcoin?

Today I want to talk about the new Sweden Digital Currency project.

Sweden’s central bank, in fact, is considering the possibility of issuing its own national virtual currency, but the technology behind it is yet to be revealed.

According to an article published today by The Financial Times, Riksbank wants to create the new virtual currency because of a strong decline in domestic cash use. In fact, according to a report, the amount of notes in circulation has declined 40% since 2009.

Sweden Digital Currency and other solutions

Deputy governor Cecilia Skingsley commented that the central bank wants to test various technologies. Although she did not mention blockchain drectly, the Financial Times explained that the distributed ledger might be one of the options the Sweden bank could consider.

“We need to do the homework because it’s not an option for the public sector to stay on the sidelines and see the private sector cut off access to central bank money for individuals.”

Skingsley said that the digital currency could be issued together with banknotes and coins, but the Riksbank do not want to encourage illegal activity.

Tomorrow Skingsley will give a speech and he might explain more details about the Sweden Digital Currency project.

With this announcement, Sweden will become the latest country to have its own central bank considering to issue a new digital currency, an idea that for the greatest part of nations meant doing several reseatches related to blockchain-based cryptocurrencies.

During the latest few months, the Bank of England has started to discuss and test issuing its own digital currency using the blockchain; and the People’s Bank of China is investigating the idea too.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Blockchain Properties: bitcoin tech to verify property transactions

One of the major use cases for the distributed ledger can be identified as “blockchain properties“, or the way to register and verify property transactions on the blockchain.

A few days ago, the first government to do so was Georgia that signed an agreement to use the blockchain to verify property transactions by using the well-known company BitFury services.

This is the first time that an American government uses the distributed ledger to prove and authenticate national operations using this disruptive technology.

Government on Blockchain

The private blockchain ledger that is an alter-proof ledger is also provable using the core bitcoin Blockchain that is in the public domain.

The Georgian National Agency of Public Registry and BitFury wrote a memorandum of understanding trying to find how to extend services to new land titles registration, property demolitions, mortgages, purchases and sales of land titles, rental and notary services.

There are a few other ideas focused on Blockchain land title services also in Sweden, Honduras and Cook County in Chicago which are being developed by ChromaWay, Factcom and Velox too.

Magazines also revealed that Peruvian Economist Hernando de Soto is involved with the Georgian Blockchain properties project too.

De Soto, in his book Mystery of Capital, estimates that there is “dead capital” of $20 trillion globally, consisting of buildings and lands without legal title.

Blockchain Properties on mobile

Tea Tsulukiani, Georgia’s Minister of Justice, commeted that she is very proud and happy that her country will work with the blockchain technology with the goal of having real estate quotations in a completely safe and secure system.

Also, chairman of the Georgian National Agency of Public Registry commented in a press release that he is “very pleased with the technical progress and looks forward to continuing their fruitful collaboration.”

BitFury CEO Valery Vavilov explained that the Georgian government is excited about the whole project and the methods used. Also, he continued by explaining that all the changes were executed for the citizens of Georgia, so they can track if a title is authentic when it is entered into the system.

The software is going to be completely operational during this year, he said.

“The big goal is to move the process to smartphones, so people can use it in any moments and all transactions are secured, transferrable and accountable.”

Applied on properties management, the Blockchain technology maintains agreements in a few ways: in blockchain-based entries, records are time-stamped and this system would allow members interested in a property to verify and establish the date of previous sales.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

France Bitcoin Tests by the Central Bank

France Bitcoin tests have been revealed by the French Central Bank last week.

The Banque de France published a press release on Friday where it talks about its technology tests for use in the management of SEPA Credit Identifiers.

According to the French central bank, one of the key participants in this project is the Caisse des Dépôts et Consignations, and the Paris-based startup called Labo Blockchain.

The project began in July 2016 and culminated in October with the creation of prototypes for creating and managing SEPA Credit Identifiers.

The central bank also explained how meetings were held with stakeholders as the project moved forward, indicating that more details about the project will be revealed in 2017.

France Bitcoin project and more central bank efforts

This is not the first time a central bank test the distributed ledger.

A few months ago, in fact, central banks in Japan, Sweden and Singapore launched similar projects.

Also, earlier this month, the US Federal Reserve published its first major research paper on the ledger you can read here.

Credits: Coindesk.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why governments should embrace the Blockchain

How governments should embrace the Blockchain

- Verification: licenses, proofs of records, transactions, processes or events.

- Movement of assets. E.g. Transferring money from one person/entity to another.

- Ownerships: the blockchain is a perfect ledger to custody any asset.

- Blockchain can be used to give e-identities to its citizens, enabling a safer kind of voting.

- Study the blockchain and explore its potential.

- Let people develop a blockchain strategy.

- Start experimenting with blockchain technology

- Develop new ideas to improve the quality of life of the citizens

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why the KnCMiners Bankruptcy might be a good news

Why KncMiners had to face Bankruptcy

Why the Bitcoin Mining Company KnCMiners Bankruptcy might be a positive news

Halving process to help Bitcoin rising

|

| Image Courtesy of Coindesk.com |

Open your free digital wallet here to store your cryptocurrencies in a safe place.

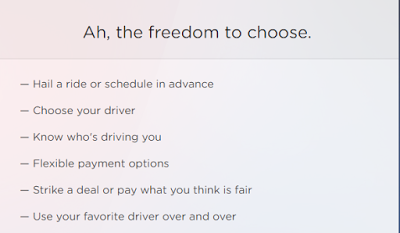

Ethereum and Arcade City could kill Uber

How it works

It works through the Ethereum Blockchain

Where can we move with Arcade City?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

EU’s Top Court Rules That Bitcoin Exchange Is Tax-Free

European Union’s top court said in a ruling that puts them on a more

equal footing with traditional cash.

sales levy — needn’t be applied because the business involves “the

exchange of different means of payment,” the EU Court of Justice in

Luxembourg ruled Thursday. The case was triggered by a dispute in

Sweden, where David Hedqvist set up a service for the exchange of

mainstream money for bitcoin and vice versa.

currency, introduced in 2008 by a programmer or group of programmers

under the name Satoshi Nakamoto, has no central issuing authority and

uses a public ledger to verify encrypted transactions. It has gained

traction with merchants selling legitimate products but also has been

used to facilitate illegal transactions because money can be transferred

anonymously.

to exchange traditional currencies for units of the bitcoin virtual

currency (and vice versa) constitute the supply of services” under the

bloc’s law “since they consist of the exchange of different means of

payment,” the court ruled. As such they are exempt from value-added

taxes, it said.

exemptions given to traditional exchanges “would deprive it of part of

its effects,” given that the exemption’s aim is to counter “the

difficulties connected with determining the taxable amount and the

amount of VAT deductible” in cases of taxation of financial

transactions, the court said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Swedish central bank acknowledges benefits of cryptocurrencies

(CoinDesk) Sveriges Riksbank, Sweden’s central bank, has published a brief economic commentary on the impact of digital currencies on the retail payments market.

(CoinDesk) Sveriges Riksbank, Sweden’s central bank, has published a brief economic commentary on the impact of digital currencies on the retail payments market.Take-up remains limited

“Households make daily payments using cards and cash totalling 8 million in volume and to a total value of over SEK 3 billion. Even if the use of bitcoin in Sweden were to be much larger than the average exchange value of just over SEK 266,000, this is a relatively low value in relation to other types of payment. At present, there only seem to be around 25 swedish companies accepting Bitcoin.”

Risky but innovative

“It can contribute to meeting new payment needs and to making payments cheaper and more secure. Those who choose to use a particular payment service can be expected to do so because it gives them an added value in relation to other payment services. This also applies to virtual currencies, which can for instance make some cross-border payments simpler, faster and cheaper. Another advantage is if the payer does not need to share sensitive information, such as card number or bank account number, with the payee.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.