Search Results For: real estate

Real Estate Blockchain: houses on the ledger

The real estate blockchain is one of the most imporant use case for the distributed ledger as it is a secure and efficient data management system that enable buyers to rely on a live network.

The California-based Blockchain startup called Propy aims at simplifying real estate sales for investors and brokers by using the ledger.

At the moment Propy is available in Dubai, New York, San Francisco, Los Angeles, Miami and Moscow, so users can buy and rent houses creating a connection with the real estate broker on a blockchain platform.

Ethereum network

Propy exploits the Ethereum network, the blockchain network based on smart contract development.

Using Ethereum Propy can replicate the traditional process of real estate transactions by using a safer ledger.

The development team of Propy spent lots of time and effort in designing a smart contract project to be applied on this business.

Real estate Blockchain: how to use smart contract

Propy’s Andrey Zamovsky explained that the world lacks of “proper and robust electronic property registry”.

Some countries that have a digitalized registry to delete data manipulation issues, so Zamovsky said that a blockchain-based platform can be a very useful tool to eliminate corruption. Also, the lack of sophisticated and secure ledger makes the verification process more difficult for brokers.

To avoid this potential issues on data mismanagement, government agencies often take a few weeks to verify ownership transfers, but this is inefficient and expensive method for customers.

Zamovsky explained:

“A lot of developing countries still don’t have any kind of electronic property registry or have very inefficient ones – vulnerable to corruption, physical damage, hack attacks and fraud. The Blockchain database is replicated on thousands of servers worldwide, so it will be close to impossible to lose registry data.”

To read more about real estate blockchain, click here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin’s real value lies in the disruption it promises

The Bitcoin protocol, or any conceptually similar protocol, potentially simplify asset transfers. Most asset transfers require significant energy to execute. This is because of due diligence and compliance requirements, as well as vetting and validation by various parties. Purchasing cars, boats or houses from individual sellers often requires intermediaries performing due diligence and maintaining compliance with legal requirements.

Bitcoin protocols impact the structuring and implementation of contracts, bringing greater economic efficiency and legal transparency to otherwise opaque practices in specific markets. Lawyers draft contracts on a case-by-case basis, with significant energy devoted to the process: negotiation, development and enforcement.

One benefit is reducing legal fees, as these contracts could be standardised and distributed as open source templates. Financial markets would become transparent, as regulators and analysts could access the blockchain, without forcing the disclosure of specific positions.

There will be significant innovation and development centred around the Bitcoin ecosystem in the years to come. Much of this will initially revolve around payments, investments and financial systems. Its real value, though, lies in the decentralisation and disruption it promises.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Generation X vs. Generation Y | Adopting Cryptocurrencies

Generation X and Generation Y Adoption of Cryptocurrencies: A Comparison

The world’s financial institutions are currently observing a vast digital ecosystem being expanded with reports for new digital currencies akin to the likes of cryptocurrencies to be launched soon. While these CBDCs (central bank digital currencies) are proclaimed not to harm or replace cash and other forms of legal tenders, we cannot help but talk about the ones instigating the change.

Cryptocurrency became popular since the launch of Bitcoin back in Jan 3rd, 2009. Ever since then, cryptocurrencies have seen a rise in popularity amongst the masses.

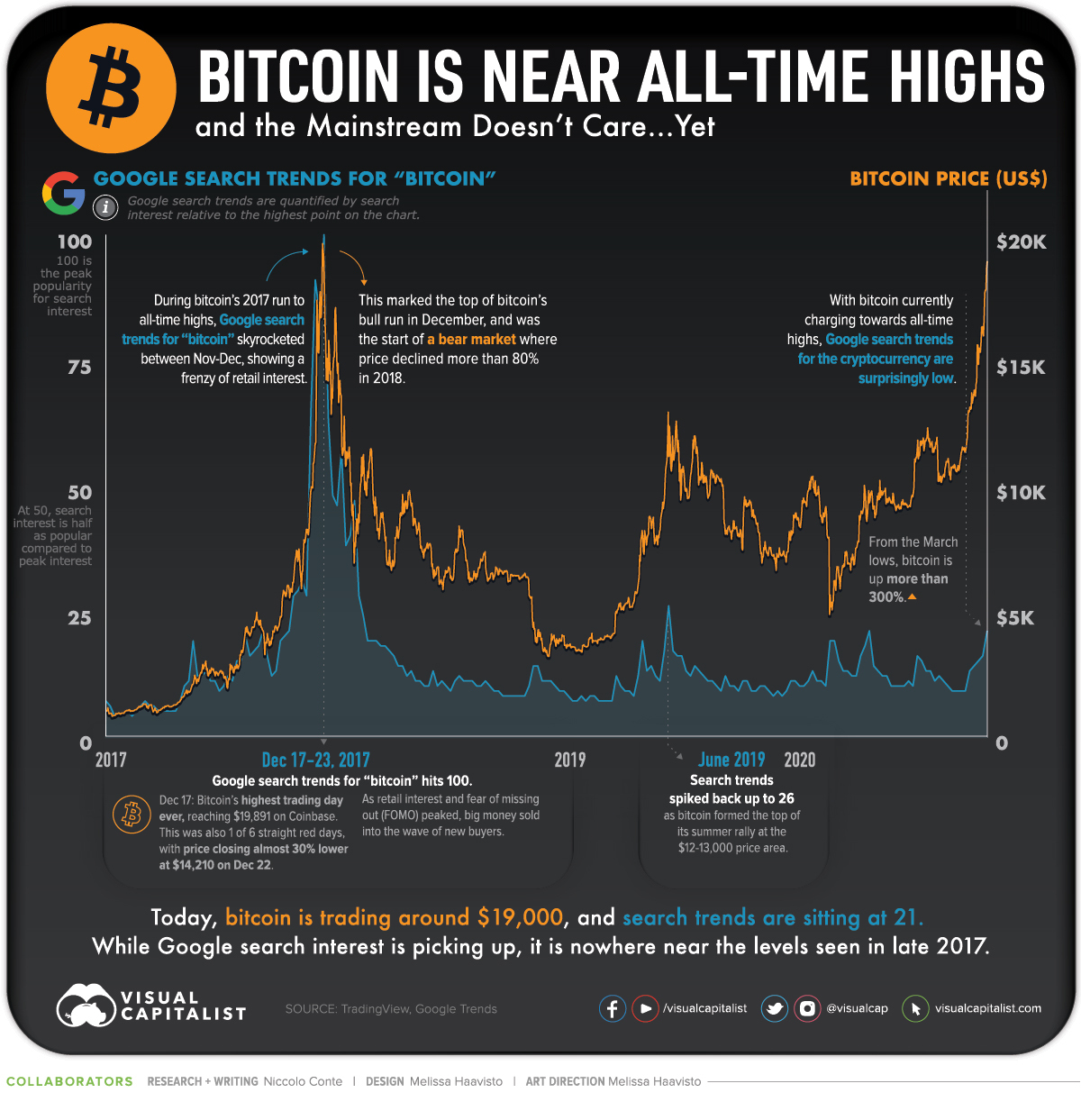

According to a recent study by Tech Jury, the cryptocurrency market cap has reached $265.545 billion as of May 2020. By 2023, the global blockchain market is expected to reach $23.3 billion. Furthermore, Bitcoin alone accounts for $6 billion of daily online transactions.

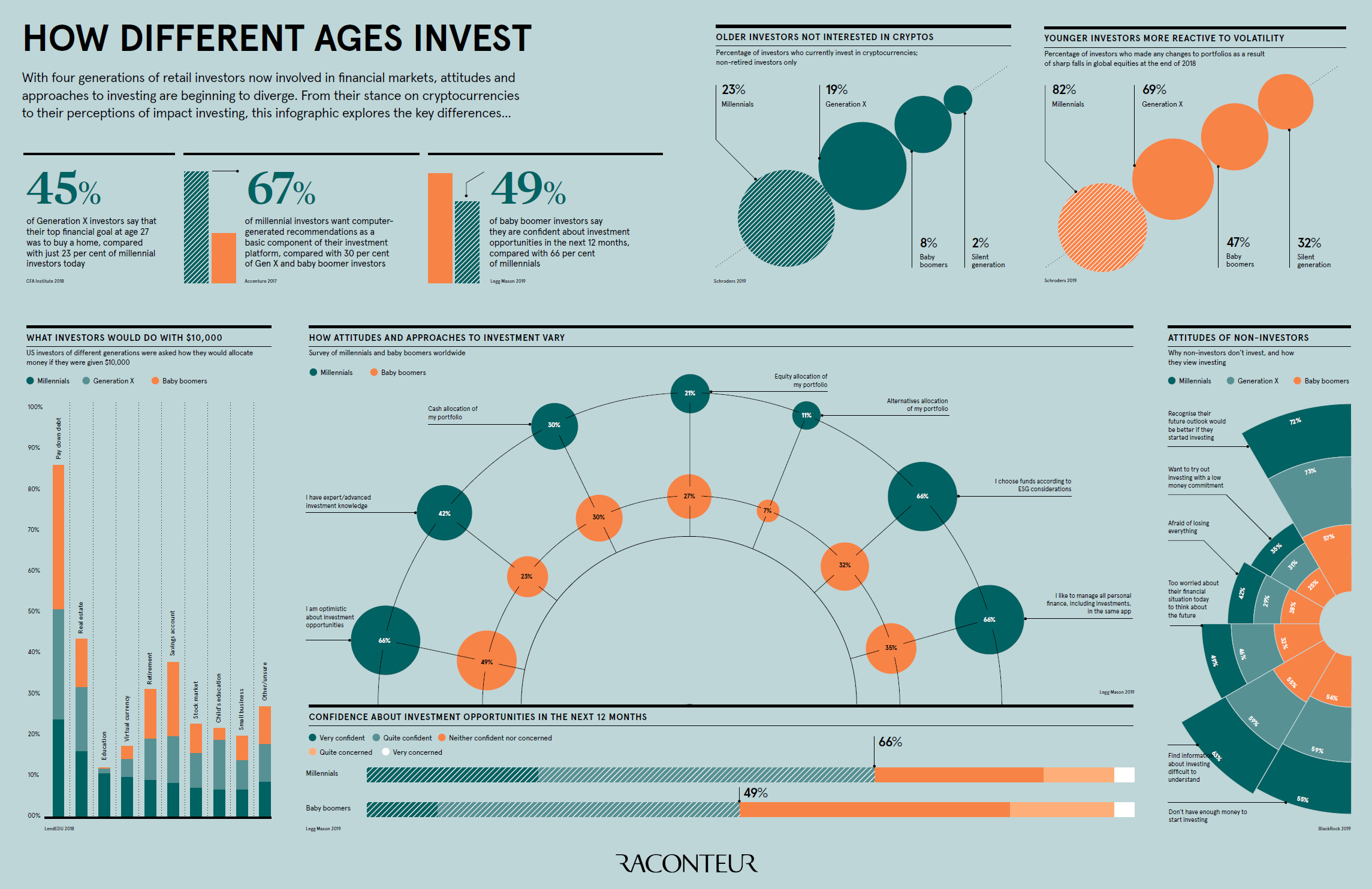

Moreover, cryptocurrency users have exceeded 40 million globally. In light, of this information, let’s take a quick look at how Millennials compare to Generation X when it comes to adopting cryptocurrencies.

Generation X

Generation X is widely regarded as the generation that followed Baby Boomers and preceded Millennials. Their age groups range from 40 to 55 years old as of 2020. Here is how Generation X is reacting towards cryptocurrency:

-

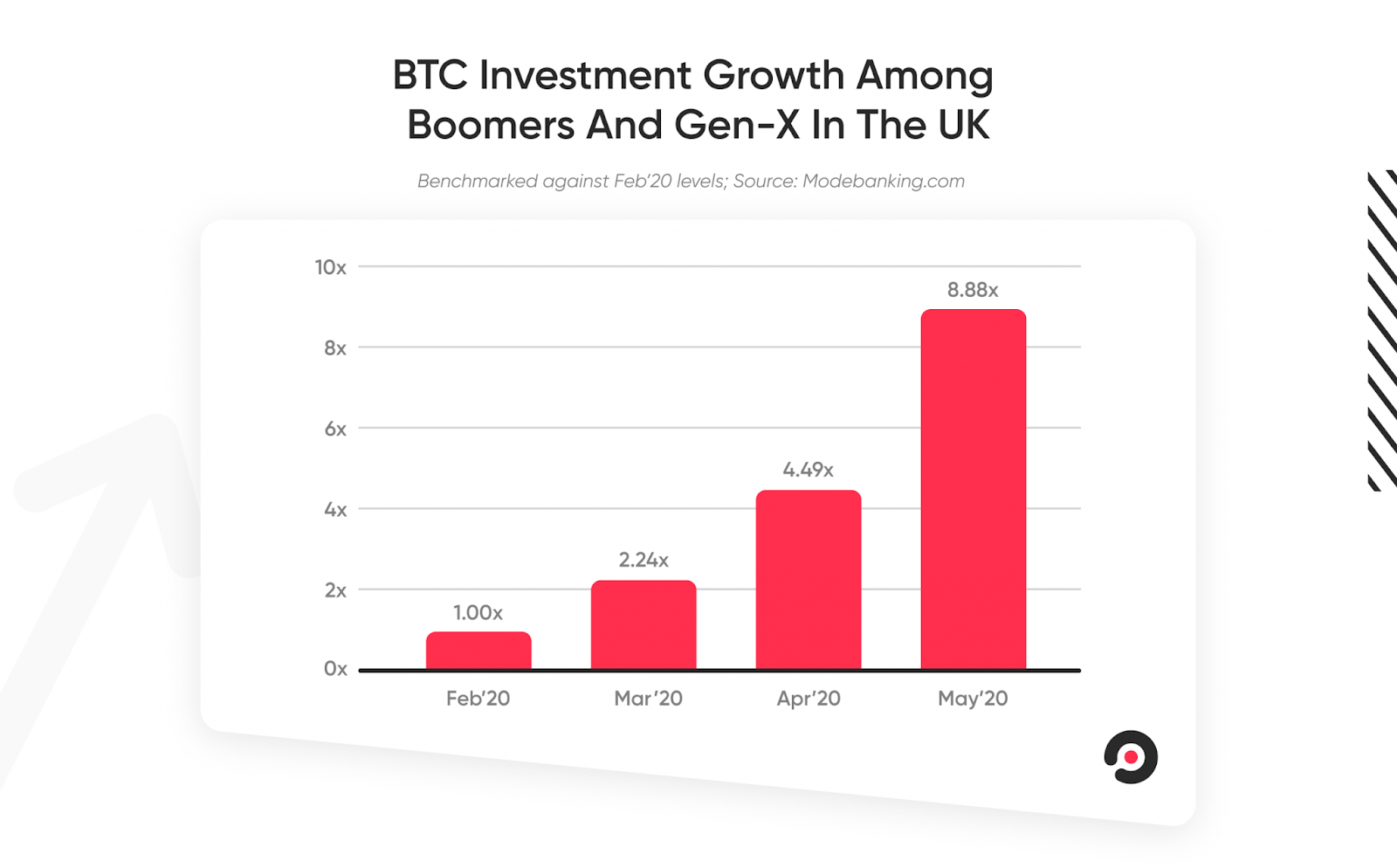

Investment Growth among Boomers & Gen X

While Millennials are regarded as the prime suspects for capitalizing on the crypto market, surprisingly both Baby Boomers and Gen X are being currently observed to closely follow the trends.

Hence in recent years, many sources have cited an increase in investment of cryptocurrency as both Boomers and Generation X take charge to close the gap. In some cases, they were also found to have more than doubled their investments.

-

Month on Month Growth

It seems like the word of mouth and awareness about cryptocurrency is spreading like wildfire as Generation X is seen to understand the value and find blockchain as a reliable security measure. Understanding the benefits of fast and instantaneous transactions, the group of disaffected people and entrepreneurs is already showing signs of crypto is affecting their thinking for the future.

Reports are coming in, showing an evident increase and Month on Month growth patterns. According to a study by Mode Banking, both Baby Boomers and Gen-X have shown a trend of increasing their investment in cryptocurrency by over 100%, especially during the COVID-19 pandemic.

-

Wealth Protection & Asset Diversification

With the current economy ridiculed by the pandemic, the growing fear for wealth protection has led Baby Boomers and those belonging from Gen-X to invest in resources that can allow for asset diversification. Cryptocurrency so far has been observed as the most favorable type of investment to safeguard personal wealth.

Generation Y

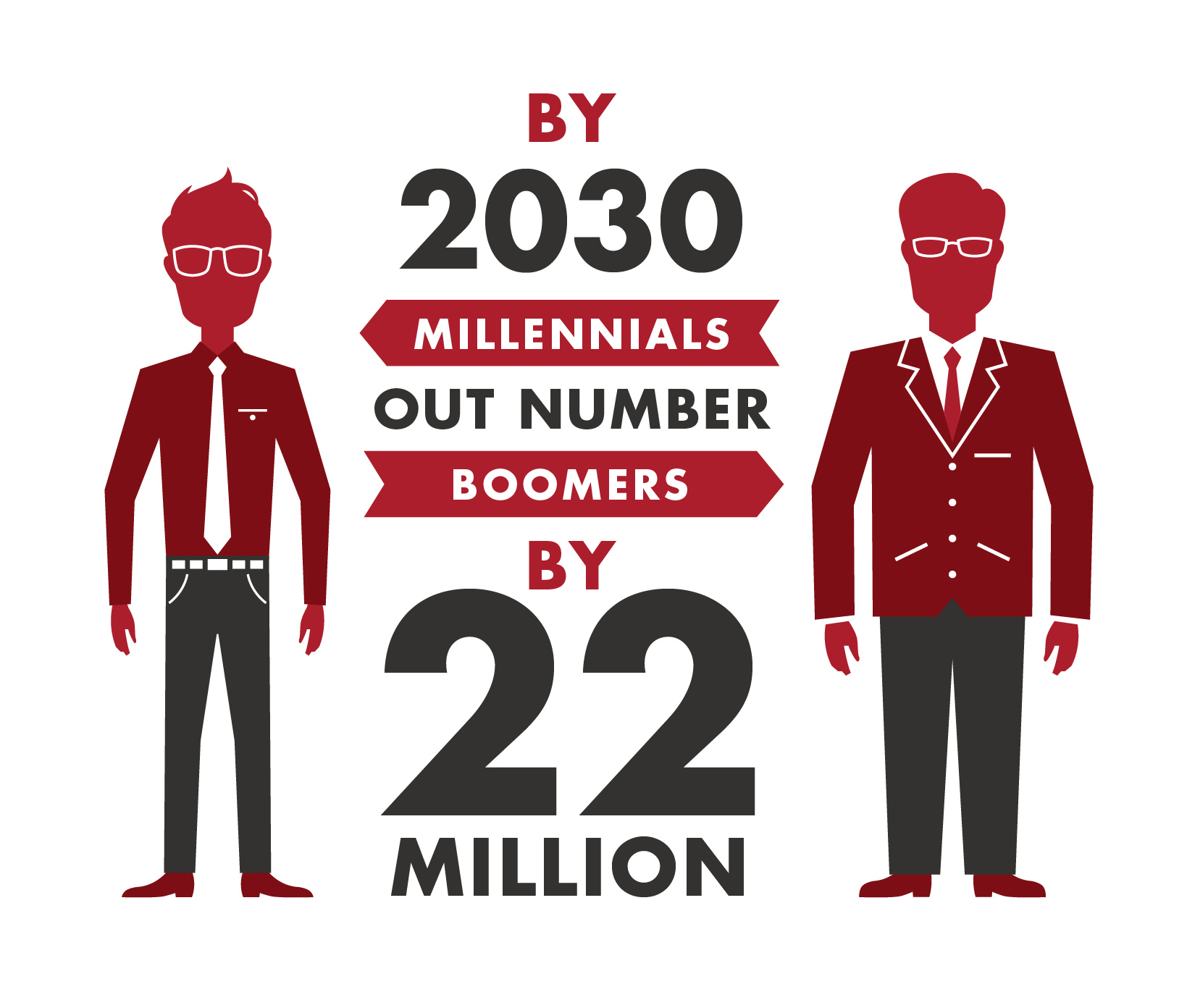

Otherwise known as Millennials, Generation Y is widely regarded as the generation succeeding Gen-X and Baby Boomers. Their age groups range from 24 to 39 years of age. Often regarded as the parents of Generation Alpha (like my darling son!) they were born into a world that as quickly becoming familiarized with the internet, mobile devices, and social media.

-

Growth of Alternative Asset

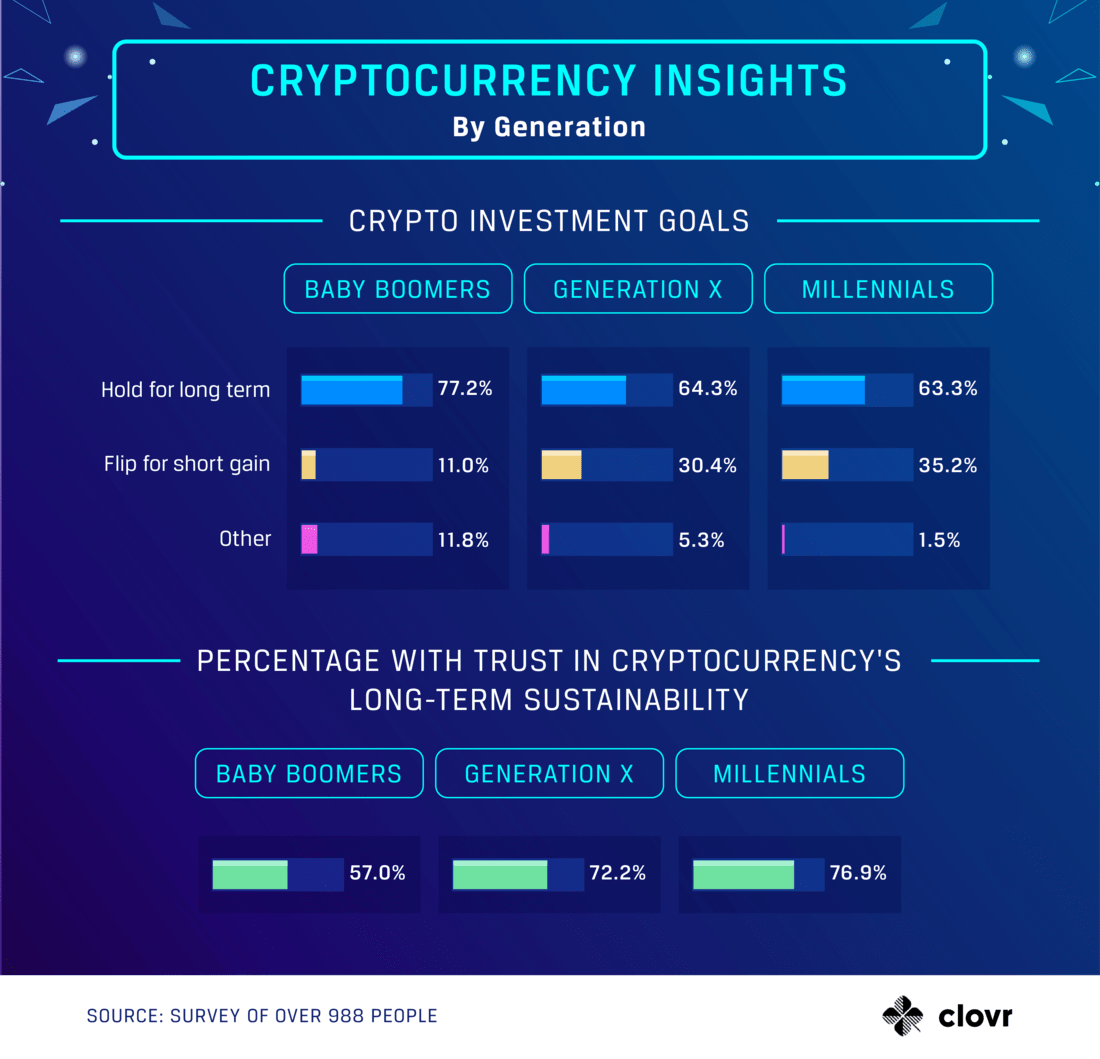

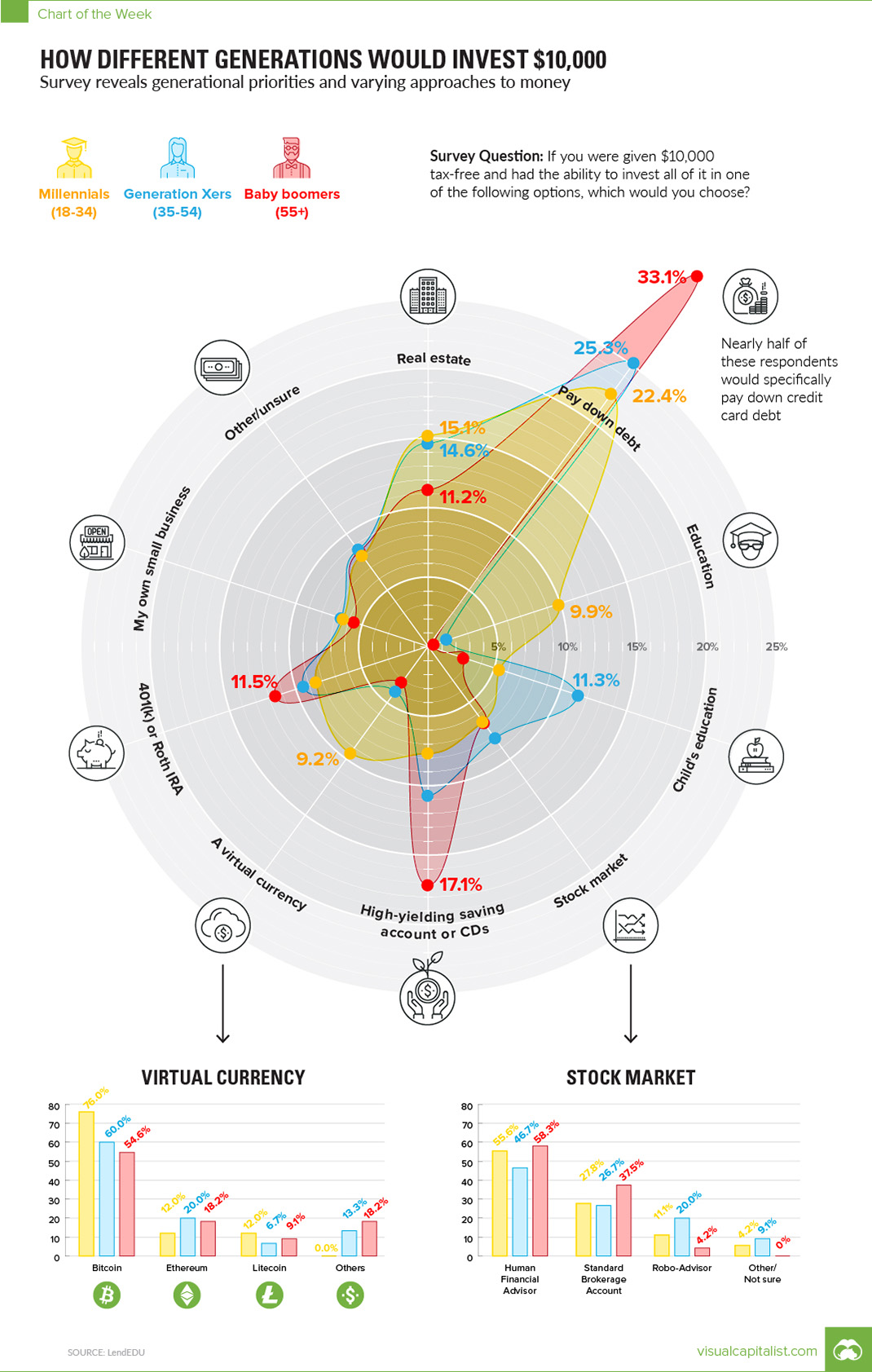

Millennials view of cryptocurrency is that of an alternative asset. Surprisingly not many of us want to invest in stocks and are more interested in assets that are backed by technologies. According to a recent study by Coin Telegraph, Millennials are three times more likely to invest in cryptocurrency as compared to Generation X. Furthermore, 9% of Millennials chose crypto as their long-term investment option.

Students applying for and seeking dissertation assistance are also looking for ways to invest alternative asset that can help secure their personal wealth for the future. It is important to note here that while both real estate and stocks are also good options for Millennials, they are currently dominated by Baby Boomers in the present times.

-

Shifting Presence for Everything Digital

Studies from different financial institutions and digital currency markets are coming in showcasing Millennials as a driving force for the adoption of Bitcoin for years to come. Zac Prince, the CEO and founder of BlockFi, identifies a major trend for Millennials where they seek everything digital.

Furthermore, with Bitcoin reaching its all-time high and pushing over $23,000 per coin as of Dec 17, 2020, who can blame Millennials for making the right choice so far!

-

Wealth Transfer to the Young

There is a Japanese idiom that states the next generation as the actual king of the world. Come to think of it this world will always belong to the next generation that is how our life expectancy is all about. We may get to live 100 years, but eventually, the circle of life catches up to us. As we depart, the new generation takes to the throne.

For countless eras, this is how wealth has been passed down from old to the young. Currently, Millennials are in the process to take control and eventually move Boomers out to take their seat on the ruling chair. This transfer of power and wealth on a massive scale will indefinitely cause investment in cryptocurrency to rise by a tremendous rate.

Conclusion

Cryptocurrency is on the rise with Bitcoin riding the tidal wave in recent times. Not only digital assets and crypto are skyrocketing, but even the BIS (Bank of International Settlements) is also considering launching digital currencies with the help of IMF and 60 central bank members.

Someone really has to be blind enough to not see how things are rapidly changing and converging towards digital resilience. So far Millennials and Gen-X have shown their growing interest in adopting cryptocurrencies with Boomers lagging behind to catch up on the trend.

Author Bio

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Digital Token Development: the Future of Finance?

The last five years have seen an incredible development in the blockchain industry. Because of its fast development, new and innovative ways of implementing blockchain technology and accepting cryptocurrency have emerged in the business world. One of the most promising developments is that of digital tokens. The idea of digital tokens has its roots in data security. Its scope in the financial field is fast-tracked on the path of transforming the way businesses handle their finances and specifically, secure their assets. Even though it is still a new development, the advantages of digital tokens are already taking the business world by storm. Among these, include accessibility at a lower cost and increased liquidity and security. Businesses who want a competitive advantage are increasingly looking hire C# coder teams with experience in implementing digital token development, to transform their financial processes to include digital tokens.

What Is Digital Token Development?

To understand digital token development, you have to understand what digital tokens are. Just like a coupon can benefit you with a product of a certain value at a grocery store, digital tokens work in the same way. A digital token is a unit of cryptographic information that can be used to facilitate different transactions, which includes trading, redeeming or assigning to another party.

Digital tokens can either be inherited or constructed using the software. Some of the most common examples of inherited digital tokens are Ether and Bitcoin.

Token development exists to represent assets of value which can be traded. This can include basic commodities and cryptocurrencies, such as Bitcoin. With token development, a standard template on a blockchain is followed to develop new tokens. Because it is emerging so quickly, choosing the best token development service provider is important when entering the blockchain technology field.

When Can You Use a Digital Token Development?

Recently, digital tokens have gained a lot of popularity with businesses, specifically because it offers secure transactions. But it has many other uses. Let’s explore a few ways digital token development can be used:

-

Payment between parties

Many businesses are accepting digital tokens as a form of payment. This makes it convenient for two parties to securely trade without involving cash. Some examples of leading businesses and industries that are already using digital tokens include:

-

-

Internet Services Providers (ISPs)

-

The hospitality industry

-

The e-commerce industry

-

-

Digital asset ownership

The process of digital asset tokenization includes the act of breaking a large asset, for example, a real estate investment, into small chunks. Furthermore, each broken chunk of that asset is individually represented with a specific token, and the ownership of that asset is recorded on a ledger system that resembles a blockchain.

Those specific tokens can then be traded in the open market casually, making the broken chunks of the larger asset tradable.

-

Rewards

Some businesses offer digital tokens as rewards to clients or customers. This is typically to encourage people to shop online and can be a valuable award for individuals who invest in digital currencies.

-

Donations

Some organizations are embracing digital tokens as a form of donations. It is a safer and faster way of donating.

-

Investments

Many are realizing the value of digital tokens and are starting to use it as an investment possibility. Instead of investing money in banks, stock markets, mutual funds or investment bonds, investing in digital tokens is faster and much more secure.

As the interest in blockchain and cryptocurrency increases, businesses are slowly starting to adopt the use of digital tokens. Compared to traditional ways of managing finances and transacting, digital token development generally provides both an alternative and more secure currency instrument and a convenient payment infrastructure. Transforming to digital tokens can be complicated for businesses and they generally require expert developers to implement it into their infrastructure. As a result, the C# programmer demand is also increasing. C# programmers are typically experienced in blockchain technology and successful digital token development.

The Emergence of Token Technology Platforms in the Blockchain Ecosystem

Fast-developing blockchain technology combined with the existing finance ecosystems produces new business model opportunities every day. One of the most innovative models is the idea of each finance ecosystem developing its own digital currency. Ever since Bitcoin came into being, it became more attractive for businesses to invest in blockchain technology.

The typical process of blockchains is storing data in different blocks that are interlinked with each other in a way that portrays the entire path of transactions in chronological order. Due to a blockchain’s distributed and transparent nature, people can transfer ownership from one party to another while eliminating the necessity of a trusted intermediary.

An experienced C# coder can develop structures to help businesses invest in token development. With the help of the C# programmer framework, businesses can develop digital tokens that can be used for safe and secure financial transactions.

Why Are Tokens a Big Deal in the Future of Finance and How Can They Be Used in the Field of Finance?

As businesses are embracing the modern world and cutting-edge technology, the field of finance is also changing. Specifically, businesses in the financial field must take the opportunity of implementing digital tokens to gain a competitive advantage. The benefits include:

-

Enhanced liquidity and accessibility

Liquidity means how quickly a business or individual can get access to assets. Digital tokens allow stakeholders to access specific assets which are seldomly traded almost immediately.

-

More transparent transactions

The transactions conducted with digital tokens are much more transparent. Both the seller and the buyer know their rights and are aware of exactly who they are trading with.

-

Lower transaction fees

Because they work on blockchain tech, the administrative cost involved in transacting with digital tokens is much more cost-effective compared to traditional financial functions that involve third parties or legal entities.

Considering this, it is important to keep in mind that bringing the culture of digital currencies in the financial field can be a complex task. Developing and implementing a blockchain can take time because it requires thorough design and consideration. To launch an idea successfully, it is crucial to rent a coder team with experience in the field.

The Bottom Line

With the benefits digital tokens offer, more and more businesses and individuals are adopting it as an alternative to traditional financial processes. With the growing number of things that can be done with cryptocurrencies, it is clear that the world is slowly transforming into a more digital way of doing business.

Businesses who want to achieve better competitiveness by tapping into the liquidity, transparency and accessibility offered by tokenization, should implement digital token development. It appears that it is fast becoming the future of finance. The right way to go about it is to hire senior programming teams with experience in blockchain and digital token development to ensure successful implementation, from start to finish.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

4 Industries Crypto and Blockchain are Disrupting — Aside from Finance

As technology continues to shift society, companies are quick to adapt to the digitised landscape. Everywhere, service providers are looking for new ways to enhance their performance, cut costs, and cater to customers more efficiently through new and evolving tech.

This is where cryptocurrency and blockchain come in. Initially, blockchain was designed to facilitate the transfer of bitcoins and other cryptocurrencies. But at its core, it’s a shared database containing multiple encrypted entries. This public ledger is capable of recording high volume transactions across the globe, with its decentralised nature lessening the risks of fraud.

That said, blockchain technology has a wealth of potential uses. It not only presents companies with a safer alternative, it also eliminates the need for tedious, paper-heavy manual processes, such as bookkeeping. Business Insider notes that its increasing popularity has proven useful in the world of finance, where the revolutionary sector known as Fintech is making strides. This advancement is providing technological solutions and simplifying complex mechanisms, as underlined on a previous article here on Holy Transaction. Beyond that, blockchain is poised to radically restructure many of the world’s most important industries. Here are four fields that this innovative technology is currently disrupting.

Supply Chain and Logistics

The supply chain and logistics industry is full of opportunities for human error. Multiple factors such as time delays and high costs can create a ripple effect that is felt throughout the entire process. With blockchain technology, every transaction can be documented and stored in a permanent database — from manufacturing to point of sale. The reliability and integrity brought about by blockchain is an advantage that many global companies such as Unilever and Dole are now beginning to take advantage of in their respective supply chains.

In truth, blockchain technology is just one of the many ways the supply chain and logistics industry is taking advantage of continuing innovation. Truck platooning, for example, is already being hailed as the future of transportation. Meanwhile, a recent mandate for the use of Electronic Logging Devices (ELDs) from the U.S. Department of Transportation also leverages the latest technology to make highways safer and driver tracking more efficient. Verizon Connect highlights how ELDs can be used to optimise driving routes, thus maximising mileage and movement. The use of these ELDs by thousands of trucking companies has allowed them to automatically time driving hours, monitor engine time, and look in-depth into information routes. The regulation was implemented in the U.S. just last December, and other countries are expected to follow suit in the future. With these innovations, along with blockchain technology’s assurance of more secure and transparent transactions, the growth possibilities across the supply chain are endless.

The Property Market

Purchasing or selling properties comes with a bottomless pit of paperwork and the hassle of going through various middlemen. Blockchain is turning the real estate industry on its head by driving power back to homeowners and buyers themselves. One company at the forefront of this shift is Deedcoin Inc. Deedcoin’s mission is to provide much-needed transparencybetween all involved parties and improve their relationship, which they are doing by tokenising the process and eliminating any middlemen. Moreover, this cryptocurrency-powered platform is putting an end to frustrating agent commission rates, making home ownership more feasible for a greater number of people. Meanwhile, Holland is gearing up to implement a blockchain-based system for their national Land Registry.

Healthcare

For years, the healthcare industry has been calling for a long overdue update when it comes to storing medical research, billings, and records. Because the industry is practically drowning in data, it opens up a lot of potential for mistakes, fraud, and displacement. This has bred distrust between patients and healthcare providers, but as John Halamka of Beth Israel Deaconess Medical Center has shared, “Now is probably the right time in our history to take a fresh approach to data sharing in healthcare.”

By securely storing medical records that can be accessed by authorised personnel only, blockchain technology is able to aid in restoring the trust between patients and doctors. In the future, it will also help to identify patients. Here in the EU, the Innovative Medicines Initiative is also working to implement a blockchain-enabled healthcare program that helps patients gain faster access to life-saving medication. The tech will also work to check the authenticity of drugs and put an end to the counterfeit medication market, which is estimated to be worth 160 billion Euros.

Gaming

Even gaming isn’t exempt from the tech touch. Many players and investors are already acknowledging the mountain of opportunities that blockchain brings to the table. Gamestatix co-founder Dean Anderson stated that there was previously no feasibly way to financially compensate players for co-creating games. However, blockchain technology has paved the way for a model that guarantees financial rewards for all. Gamers will be rewarded with cryptocurrency for test-driving and reviewing games, providing valuable feedback to developers, and promoting games across social media. By providing monetary incentives, it puts an end to free labour, thus encouraging better quality of games.

For more articles on cryptocurrency or information about crypto exchanges, be sure to explore the Holy Transaction website.

Article produced for holystransactoin.com

By: Hannah Wright

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin Sweden regulation: the blockchain to record property deals

A new project for Bitcoin Sweden regulation has moved to its second phase. In fact, the Sweden’s land registry authority, the so- called Lantmäteriet, wants to use the distributed ledger tech with the main goal of recording property deals.

This project was conducted by the blockchain startup called ChromaWay and the consultancy group Kairos Future, that are also working in partnership with two banks: SBAB and Landshypotek.

Talking about the project’s potential, ChromaWay CEO Henrik Hjelte commented:

“It could be a great benefit for economic growth”.

Also, he said that Sweden is the ideal country to test a distributed ledger system for land titles, because trust in public authorities is higher than elsewhere and it could influence other countries to do the same in the next future.

Thanks to this system, a buyer and seller would open a contract where banks and the land registry can view the workflow of the deal, such as due dates for payments.

“In the blockchain confirmation of each step in the workflow is made with a hash, like the blockchain normally. Everyone has the same information and you can check it yourself,” said Magnus Kempe of Kairos Future.

Another use case for this project is the potential verification of an IOU issued by the bank to its property buyer.

“That part is going to be hidden for the others in the contract. You will only have the hash confirming from the bank that the IOU has been signed,” commented Kempe.

That said, SBAB Bank explaind it has no imminent plans to implement the blockchain:

“Our reason to participate in the project has not been to actually implement the solution in our current processes. But rather an opportunity for us to get a better understanding of the blockchain technology and how it might possibly fit in our future products/offerings.”

Bitcoin Sweden regulation: what is the EU doing?

Recently, the EU passed a directive that puts more weight behind digital signatures; a similar bill has been proposed in Arizona too.

Click here to read more about EU regulation related to bitcoin and blockchain.

A the moment, this land registry project is looking at new ways for working at this issue.

“Actually, the land registry today, they don’t receive much physical paper, they get PDFs of the contracts which are signed electronically so they don’t store the physical contracts. What we are thinking of is, you can actually sign the contract digitally in the blockchain to the land registry, they can award the land titles and then you can throw away the paper so you’re not dependent on the physical archive.”

According to ChromaWay’s Henrik Hjelte, the use of blockchain could be disruprive in order to manage ownership of property and improving transparency in real estate sales.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Blockchain Properties: bitcoin tech to verify property transactions

One of the major use cases for the distributed ledger can be identified as “blockchain properties“, or the way to register and verify property transactions on the blockchain.

A few days ago, the first government to do so was Georgia that signed an agreement to use the blockchain to verify property transactions by using the well-known company BitFury services.

This is the first time that an American government uses the distributed ledger to prove and authenticate national operations using this disruptive technology.

Government on Blockchain

The private blockchain ledger that is an alter-proof ledger is also provable using the core bitcoin Blockchain that is in the public domain.

The Georgian National Agency of Public Registry and BitFury wrote a memorandum of understanding trying to find how to extend services to new land titles registration, property demolitions, mortgages, purchases and sales of land titles, rental and notary services.

There are a few other ideas focused on Blockchain land title services also in Sweden, Honduras and Cook County in Chicago which are being developed by ChromaWay, Factcom and Velox too.

Magazines also revealed that Peruvian Economist Hernando de Soto is involved with the Georgian Blockchain properties project too.

De Soto, in his book Mystery of Capital, estimates that there is “dead capital” of $20 trillion globally, consisting of buildings and lands without legal title.

Blockchain Properties on mobile

Tea Tsulukiani, Georgia’s Minister of Justice, commeted that she is very proud and happy that her country will work with the blockchain technology with the goal of having real estate quotations in a completely safe and secure system.

Also, chairman of the Georgian National Agency of Public Registry commented in a press release that he is “very pleased with the technical progress and looks forward to continuing their fruitful collaboration.”

BitFury CEO Valery Vavilov explained that the Georgian government is excited about the whole project and the methods used. Also, he continued by explaining that all the changes were executed for the citizens of Georgia, so they can track if a title is authentic when it is entered into the system.

The software is going to be completely operational during this year, he said.

“The big goal is to move the process to smartphones, so people can use it in any moments and all transactions are secured, transferrable and accountable.”

Applied on properties management, the Blockchain technology maintains agreements in a few ways: in blockchain-based entries, records are time-stamped and this system would allow members interested in a property to verify and establish the date of previous sales.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft Opens to Bitcoin

Since the end of 2014 Microsoft Corporation has started to test the blockchain technology.

Its implications extend not only to bitcoin transactions, but it can be useful in various fields: from real estate to copyrights, from music to cinema, etc. In fact nowadays there is an increasing number of new startups that are working on innovative projects based on the blockchain with multipurpose uses and aims.

Its implications extend not only to bitcoin transactions, but it can be useful in various fields: from real estate to copyrights, from music to cinema, etc. In fact nowadays there is an increasing number of new startups that are working on innovative projects based on the blockchain with multipurpose uses and aims.About the author: Amelia Tomasicchio is a writer and a journalist of Bitcoin-related news and articles. She started writing about Bitcoin in 2014 and she graduated in Rome with an essay about movie industry related to Bitcoin.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction opens it’s doors to the world of crypto 2.0 with new Mastercoin WebWallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Give $250,000 in Bitcoin, get second citizenship

with a Las Vegas escort.

Bitcoin these days.

that sets clients up with citizenship to balmy Caribbean island-nation St.

Kitts and Nevis, payable in cryptocurrency. St. Kitts and Nevis has offered a

‘citizenship by investment’ program since 1984 that accepts investment into the

local economy in exchange for a spanking-new passport.

isn’t cheap. Wannabe citizens must either buy local real estate worth $400,000

or more, or donate at least $250,000 to the Sugar Industry Diversification

Foundation (SIDF) – on top of a nonrefundable application fee of about $60,000

per applicant plus an additional $30,000 for each one of his or her dependents.

holding a St. Kitts passport offers a number of benefits. Aside from the

stunning seas, sands, and climate offered by the Caribbean country, St. Kitts doesn’t

take any income, wealth, or inheritance taxes; citizens get visa-free travel to

140 countries and a 10-year multiple-entry visa to the United States.

countries or ones with invasive policies on individual privacy, the citizenship

process offers more abstract benefits: freedom and privacy.

stories from around the globe about upheaval, increased taxes, and governments

exerting more and more control over citizens’ freedoms and privacy,” the

Passports for Bitcoin website says. “Having a second citizenship and passport

in a stable country is now a must in order to hedge against governmental

intrusion and excessive taxation.”

home countries aren’t notified that their citizens have applied for or received

a second citizenship.

Kitts passport with Bitcoin isn’t clear. The website of the project’s parent company,

International Investments & Consulting, Ltd., says it has processed over

100 applications, though it does not specify how they were paid for.

popular amongst the rich and famous. Roger Ver, an American Bitcoin

entrepreneur and ‘angel investor’ in Bitcoin startups, has bought himself a

passport to St. Kitts, as has as the so-called “Most

Interesting Man on Instagram” millionaire/poker player/playboy Dan

Bilzerian.

ago as a hedge against possible world political turmoil which could negatively

affect the United States,” Bilzerian wrote in a testimonial

on the Passports for Bitcoin website. “I value freedom more than almost

anything else and a second or third passport provides me insurance just in case

the U.S. government decides to value security over freedom.”

St. Kitts citizenship last month after fleeing the country under pressure from

the government over data protection and privacy.

passport in Bitcoin.

Open your free digital wallet here to store your cryptocurrencies in a safe place.