Search Results For: proof of concept

Isle of Man Blockchain proof of concept project

How the Isle of Man Blockchain proof of concept project works

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Network security and Proof-of-Work: do we need an alternative?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

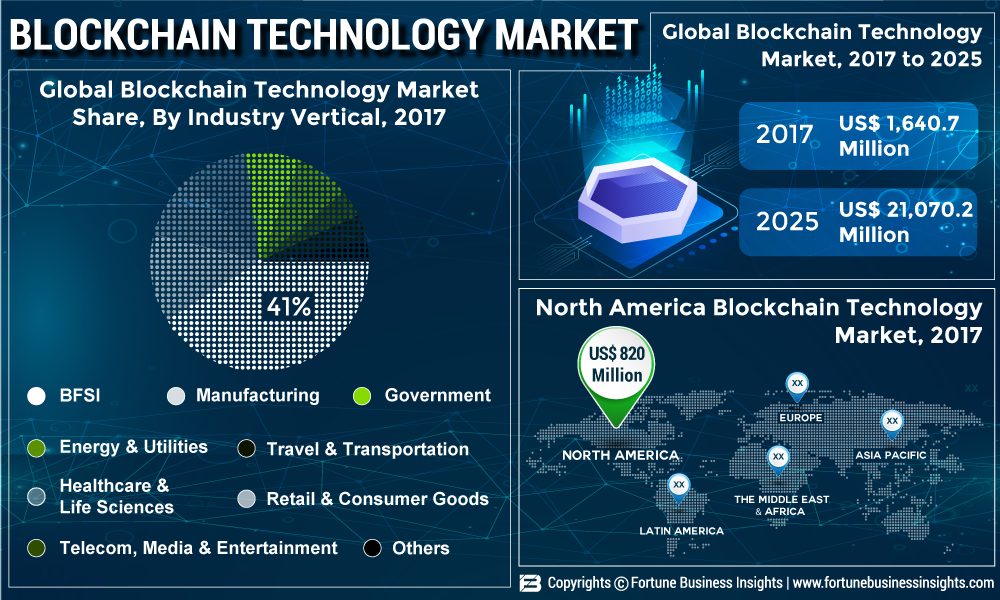

How is Blockchain Technology Market Going to Rise at High CAGR of 38.4% Till 2025?

The global Blockchain Technology Market is forecast to rise exponentially in the coming years. The market is expected to witness high demand from diverse industries, especially the banking, financial services, and insurance (BFSI) industry.

In terms of industry vertical, the banking, financial services, and insurance segment held the leading share of 41% in global blockchain technology market in 2017. The segment will gain further impetus following introduction of bitcoin. “Rampantly increasing cyber-attacks and frauds in the BFSI industry accounts for millions of dollars. This has become a global concern. To make the technology used in the industry safer and more secure, Deloitte and Microsoft Azure and other tech giants are offering blockchain services,” said a lead analyst.

In terms of deployment, the proof of concept segment is gaining traction and is expected to witness impressive growth during the forecast period 2018-2025. Growth witnessed in this segment is backed by high need of transparent transaction across industries such as healthcare, retail and BFSI.

Increasing Demand for Secure Blockchain Technology to Guarantee Growth at Promising Rate

“Government initiated awareness programs regarding benefits of blockchain technology among undeveloped nations is anticipated to fuel the demand in the global blockchain technology market“, said a lead analyst at Fortune Business Insights.

Increasing adoption of e-financial services and rapid adoption of the blockchain technology in developed nations are expected to drive the global blockchain technology market during the forecast period.

Increasing number of new blockchain products and their approval grants is also anticipated to act as a driving factor for the global Blockchain technology market.

Partnerships Among Key Market Players and Blockchain Developers Driving the Market in North America

North America emerged dominant in the global blockchain technology market in 2017. The North America market was worth US$ 820 Mn in 2017. The region will continue leading the market at a global level through the forecast period. Growth witnessed in the market is also attributable to recent collaborations between market players in the U.S. and blockchain service provides. Europe is also anticipated to witness impressive growth during the forecast period owing to high presence of blockchain technology developers.

In 2017, IBM was the leading organization in the global Blockchain technology market. Other companies operating in the global market are Oracle Corporation, Deloitte, Microsoft Corporation, IBM Corporation, The Linux Foundation, Chain Inc., Consensus Systems, Bits, Inc (Tendermint, Inc.), Schvey, Inc. (Axoni), VironIT, Altoros, and Fintech & Blockchain Software House.

Source: https://www.fortunebusinessinsights.com/industry-reports/blockchain-technology-market-100072

Open your free digital wallet here to store your cryptocurrencies in a safe place.

BNP Paribas Blockchain used for live transactions

A well-known worldwide seller and another important firm partecipated to the first live transactions using the BNP Paribas Blockchain service, as revealed today by the bank itself.

According to BNP Paribas, in fact, payments were processed between the Italian sports collectible firms Panini Group and the Australian packaging firm called Amcor.

The payment transactions were managed in a few minutes – the bank explained in the official press release – using different currencies to make transactions easier between bank accounts located in Germany, Netherlands and England.

Panini Group treasurer Fabrizio Masinelli commented in a statement:

“This proof-of-concept shows how powerful such technology can be and how it can be utilised as an effective and efficient response to the main issues that treasurers face on a daily basis.”

BNP Paribas Blockchain Proof of Concept

The transactions were managed by using the proof of concept called Cash Without Borders launched earlier this year after its incubation during a blockchain hackathon.

More Details about the size of the transactions will be revealed in the next future.

Also, the BNP Paribas blockchain service tested the so-called “mini-bonds” for small investments, as well as blockchain crowdfunding prototypes that might see the light next year.

According to the Panini Group’s official website, the company earned 751m euros in 2014 and employs 1,000 people worldwide.

Also, during the same year, Amcor earned $10b in sales and employs 29,000 employees.

To read more about the BNP Paribas Blockchain service click here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bank of Tokyo works on a Blockchain project with Hitachi

Bank of Tokyo works on a blockchain project with Hitachi

Universal Wallet for Digital Currencies

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Investigating the use of blockchain technology in digital identity management

Blockchain Technology and its Potential in Digital Identity Management

Digital identity management is a crucial aspect of our digital lives, as it enables us to prove our identities online and access a wide range of services. However, current digital identity management systems are often centralised and controlled by a few large corporations, which can lead to issues such as data breaches and lack of control over personal information. Blockchain technology has the potential to revolutionise digital identity management by creating a decentralised, secure, and user-controlled system.

Blockchain technology is a decentralised, digital ledger that records transactions across a network of computers. It is the technology behind the popular cryptocurrency, Bitcoin, but its potential uses go far beyond just financial transactions. One of the key features of blockchain technology is its ability to enable secure and transparent transactions, without the need for a central intermediary.

In digital identity management, blockchain technology can be used to create a decentralised system, where users have complete control over their personal information and can prove their identities without relying on a central authority. This would allow for greater security and privacy, as personal information would be stored on the blockchain and protected by cryptographic techniques. Additionally, the use of blockchain technology would increase transparency, as all transactions and changes to personal information would be recorded on the blockchain, creating an auditable and immutable record.

OpenTimestamp and Digital Identity

The importance of OpenTimestamp in digital identity management cannot be overstated. OpenTimestamp is an open-source protocol that enables secure and verifiable time-stamping of data in the blockchain. This means that it can be used to create a tamper-proof record of a user’s digital identity, making it more difficult for others to manipulate or alter the data. This added security and trust will further contribute to the success and widespread adoption of blockchain-based digital identity management systems.

Decentralised Identity Management

A decentralised digital identity management system would allow for greater control over personal information, as users would be able to store and manage their own personal information, rather than relying on a central authority. This would also increase security, as personal information would be stored on the blockchain and protected by cryptographic techniques. Additionally, a decentralised system would be more resilient to data breaches and cyber attacks, as there would be no central point of failure.One of the key benefits of a decentralised digital identity management system is that it would allow for greater interoperability between different systems and platforms. This would enable users to prove their identities across a wide range of services, without the need to create multiple identities or share personal information with multiple organisations.

Self-Sovereign Identity

Another potential use of blockchain technology in digital identity management is the concept of self-sovereign identity. This would allow users to have complete control over their personal information and use it to prove their identities across a wide range of services. This would be done through the use of digital identity credentials, which are stored on the blockchain and can be used to prove identity without the need for a central intermediary. The use of blockchain technology in self-sovereign identity would also increase transparency and trust in the digital identity management system, as all transactions and changes to personal information would be recorded on the blockchain, creating an auditable and immutable record. This would help to prevent fraud and manipulation in the digital identity management system, and increase trust among users.

Conclusion

Blockchain technology has the potential to revolutionise digital identity management by creating a decentralised, secure, and user-controlled system. This would allow for greater control over personal information, increase security and privacy, and enable users to prove their identities across a wide range of services. While the technology is still in its early stages, the potential benefits of blockchain technology in digital identity management are clear, and it will be interesting to see how it develops in the coming years.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

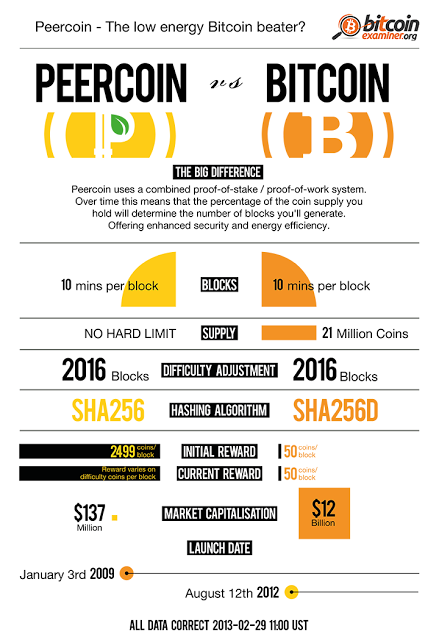

Staking PPC: Staking Peercoin on HolyTransaction Wallet

Staking Coins: Staking Peercoin

Bitcoin and many other early cryptocurrencies use a consensus model known as proof of work. This requires powerful computers to perform cryptographic problems that verify transactions on a blockchain. Peercoin originated an alternative to this that is used in many cryptocurrencies.

Proof of Stake Originator

Peercoin introduced the concept of proof of stake, an alternative to the proof of work consensus model. In its initial stages, proof of work played a large part in the consensus model since it was a fork of Bitcoin. But the original proof of work-dominated model has almost fully given way to proof of stake. This is more environmentally friendly, removes the need for purchasing expensive mining equipment and allows transactions to be performed a lot more quickly than on proof of work blockchains.

Stake Peercoin on HolyTransaction Wallet

HolyTransaction Wallet is excited to present to you the launch of our new staking service. You can now leverage Proof of Stake (POS) holdings to safeguard crypto networks while earning financial rewards. Staking PPC has become much easier with HolyTransaction!

How Does Coin Staking in Peercoin Work?

This act of generating a new block is called minting, however staking is a more popular term today. In Peercoin’s implementation of proof of stake, each node tries to find a new block each second. If the block is valid and backed by sufficient coinage (coins*days), it is accepted by the network. Nodes are only eligible to find new blocks when their coins have been in a wallet for 30 days. Their odds of finding valid blocks go up with the age of the coin until it reaches 90 days, at which point the probability is maxed out. Once a node finds a new block, new PPC are then minted and, for each new block, that node gets a block minting reward. After a new block has been minted, the age of the coins in the node’s address that are involved in the minting is reset. The address will then not be eligible to be chosen based on those particular coins until 30 days have passed. Staking your Peercoin assets does lock them up from being spent or moved. However, you can sell or spend the PPC at any time—you will just lose the opportunity to mint new blocks.

Advantages of Staking Coins with Peercoin

Why stake Peercoin and not other cryptocurrencies? The return on staking is lower with Peercoin than with most other proof of stake cryptocurrencies. Vast majority of economic studies shows that ideal inflation is 2-3%. However, Peercoin is serious about keeping inflation low, currently at 3.33%. Peercoin’s reliance on proof of stake means that it should not suffer from the same scalability problems that have plagued proof of work platforms like Bitcoin. This means quicker transaction times and an overall better experience for retail and vending applications—which means great potential for the coin’s success in the future. You can learn more about its ecosystem in the Peercoin Primer video series.

Conclusion

Peercoin was the originator of proof of stake in its whitepaper, even though it took some time for proof of stake to actually make its way into widespread use on the blockchain. Staking Peercoin and its minting process presents a great opportunity to earn coin that will, in turn, earn you more coin. All you need is just to deposit PPC to start staking on your HolyTransaction wallet.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin vs. Litecoin: What makes them different?

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

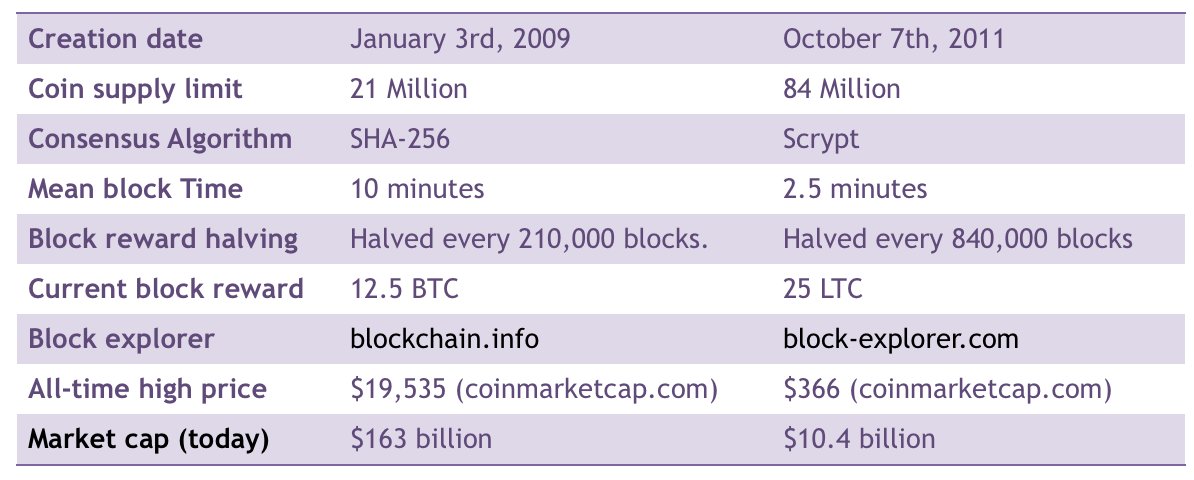

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Intesa Sanpaolo Blockchain: a new trial for recordkeeping

The newest Italian Banca Intesa Sanpaolo blockchain – related project has been tested with the main goal of validating trading data.

Thanks also to a partnership with Deloitte and the Italian startup Eternity Wall, Intesa San Paolo started to test a new proof-of-concept at the end of 2016.

Heart of the project is the open-source OpenTimestamps protocol, developed by Peter Todd, a Bitcoin Core contributor, that Eternity Wall moved to implement.

The Intesa Sanpaolo blockchain project uses the bitcoin distributed ledger to notarize transactions and create a publicly available database trail for future referral.

Information security officer for the bank, Carlo Brezigia explained:

“Relevant data has been hashed to produce a short unique identifier – a digest – equivalent to its digital fingerprint. This fingerprint has been associated to a blockchain transaction and hence registered on the blockchain: the blockchain immutability provides robust non-refutable timestamping that will always prove without any doubt the existence of that data in that specific status at that precise moment in time.”

According to a Deloitte statement, Intesa Sanpaolo tested this tool between October and February with tht idea of including support for other blockchains, potentially including also private ledgers.

This Italian blockchain trial shows the will of regulated financial institutions to test public blockchains.

In an official announcement, the bank’s retail innovation accelerator officer, Gianni Cavallina, explained the interest in experimenting these protocols beyond the main use case of digital currenciese:

“In particular, considering public blockchains, we are exploring the applicability of different use cases, abstracting from the value of its native digital currency. Notarization is one of the most interesting applications.”

Intesa Sanpaolo Blockchain projects– also member of the R3 distributed ledger consortium – also include tests on several blockchain use cases made during the previous years, including trade finance and digital identity.

Read more about previous Italian projects related to the Blockchain here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

WebJet Blockchain project for travel bookings

Microsoft is working on the newest Webjet Blockchain project to allow users booking travels through the distributed ledger.

Microsoft, in fact, is testing a blockchain proof-of-concept developed together with the Australian travel agency called Webjet for a pilot that will be ready during this year.

During a speech given at the CoinDesk’s annual conference titled Construct 2017, Cale Teeter and Eric Maino, or Microsoft senior software development engineer and technical architect, commented that they think that the project, which looking for make travel bookings easier by using a blockchain-based system, will reach its development status during the next few months.

“Webjet wanted to see, instead of everyone running their own proprietary systems, a system that connects companies they own. They’ve been running their real data through it and they’ve been finding interest discrepancies in the business, and they’re hoping to expand it out,” said Maino.

Revealed in November, the Webjet managing director John Guscic explained that the online booking system has become apt to be developed thanks to the several systems used for its business projects including the hotel room wholesaling.

“Between five and 10% of bookings can be impacted or, in other words, up to $10bn-worth of transactions,” Guscic explained in a previous statement.

Microsoft is not new to blockchain-based project. Earlier this year, in fact, the computer well-known company revealed its project called Manifest for tracking products worldwide. Read more by clicking here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.