Search Results For: microsoft

Microsoft Blockchain Project for tracking products

A technology originally created for NASA communication now will be used by the new Microsoft blockchain project that will help tracking products worldwide.

Microsoft Blockchain’s Project called Manifest can also help to ensure the origin of the material used and the labor used to build the products, conforming them to company’s standards.

Thanks to a partnership with Mojix, Project Manifest uses Internet of Things (IoT) platform that is currently integrated with the Ethereum blockchain to help companies to track items using a radio frequency identification device (RFID).

This kind of implementation is able to inform each member of the supply chain about the history of a shipped product.

During a recent interview with Microsoft’s strategist Yorke Rhodes, he explained why this partnership was chosen:

“Project Manifest is actually designed to look at the challenges of visibility in the supply chain. One of the reasons why we worked with Mojix is because they already have technology and know-how in supply chains for scanning RFIDs.”

A new database to track products

An early version of the Microsoft blockchain solution now integrates Mojix’s platform, called ViZix, with a smart contracts and it was exhibited during an event held last week at the National Retail Federation in NYC.

The ViZix integration has been designed to exploit the rapidly growing rate that goods are being labelled with RFID, Bluetooth and GPS sensors.

“The consumer would like to be able to see where the goods are to make sure they’re not coming from slave labor and things like that,” said Yorke. “By way of giving consumers the ability to do that we’d like to push certain parts of the data to a public blockchain.”

Microsoft Blockchain creates new partnerships

In addition to the Mojix partnership, Project Manifest also includes work with a standards body and support from the academic sector.

In fact, Project Manifest confirmed that two professors and 10 students from Auburn University’s RFID lab will also participate to the group.

Also, the lab has been engaged with seven brands and three retailers for seeking to create new ways to deal with a recent growth in supply chain data.

This team is studying and testing electronic proof of delivery, vendor scorecarding, anti-counterfeiting, anti-grey market, and data exchange data.

And a report about these researches is expected by the end of 2017.

Read more about Microsoft Blockchain’s project here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin Excel Support among Microsoft projects

Microsoft officially announced its plans to add a Bitcoin Excel support in the upcoming release of its new version of Excel 2017,

This Bitcoin Excel Support will allow users to calculate, format and analyze bitcoin on the program.

Account executive at Microsoft, Martin Butler posted on Twitter:

“In 2017, Excel will be able to recognize, format, calculate and analyze numbers expressed in Bitcoin currency. The new feature will be available for Excel running under Windows 10, Android, Mac OS and iOS, and will include Excel Mobile versions as well.”

Bitcoin expert Alistair Milne first expressed his enthusiasm for the Bitcoin integration. and also the whole Bitcoin community reacted positively for this the company’s effort as it can help a massive adoption for Bitcoin.

“Bitcoin is a currency” for Bitcoin Excel Support

During the past few years, a few government agencies and financial institutions avoided the word “currency” in describing Bitcoin.

The official recognition of Bitcoin worldwide by tax authorities is still a minefield, even if Russia recently declared its decision to recognize Bitcoin as a foreign value.

By the end of 2016, investors and traders were considering Bitcoin as a worldwide currency and the only safe haven asset for its capacity and ability to prevent financial issues and economic problems.

Bitcoin has been crucial in protecting the wealth of most households and businesses in the past 12 months. Maybe it is for this reason that Microsoft coined Bitcoin as a currency for its global users who utilize Microsoft Execel every day.

Microsoft loves cryptocurrencies

Microsoft is heavily involved in the development and deployment of various Blockchain-based platforms, including Azure Blockchain-as-a-service (BaaS) platform, where businesses can use the distributed ledger to simplify the settlement of financial data.

The company also supported meetups about Ethereum and other blockchain-related companies, demonstrating their love for the cryptocurrencies industry development.

To read more about Microsoft and Bitcoin, click here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft Smart Contracts: a working group to improve security

Vitalik Buterin on Microsoft Smart Contracts

Microsoft Smart Contracts: a whitepaper with Harvard

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft BaaS to help Blockchain developers

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft to launch an identity platform through the blockchain

Identity Problem in the Digital World

- 1.5B people are without proper identification, that’s one-fifth of the world’s population.

- One in three children under the age of five does not officially exist because their birth has not been recorded.

- Cumulatively, 230M children under the age of five have no birth certificate; this number is growing.

- 50M children are born without legal identity, the size of the UK, each year.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft adds 5 blockchain partners to Azure and it still accepts Bitcoin

|

Microsoft still accepts Bitcoin payments

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft Opens to Bitcoin

Since the end of 2014 Microsoft Corporation has started to test the blockchain technology.

Its implications extend not only to bitcoin transactions, but it can be useful in various fields: from real estate to copyrights, from music to cinema, etc. In fact nowadays there is an increasing number of new startups that are working on innovative projects based on the blockchain with multipurpose uses and aims.

Its implications extend not only to bitcoin transactions, but it can be useful in various fields: from real estate to copyrights, from music to cinema, etc. In fact nowadays there is an increasing number of new startups that are working on innovative projects based on the blockchain with multipurpose uses and aims.About the author: Amelia Tomasicchio is a writer and a journalist of Bitcoin-related news and articles. She started writing about Bitcoin in 2014 and she graduated in Rome with an essay about movie industry related to Bitcoin.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft to Sponsor the Ethereum DΞVCON1 Conference

“DΞVCON1 is very excited to work with Microsoft and we look forward to having them in London.”Microsoft’s head of US Technology Financial Services, Marley Gray, explained more specifically why Microsoft had taken an interest in this international and decentralized technology event:“Microsoft is excited to sponsor and attend Ethereum’s DevCon1. We find the Ethereum blockchain incredibly powerful and look forward to collaborating within the Ethereum Community. We see a future where the combination of Microsoft Azure and Ethereum can enable new innovative platforms like Blockchain-as-a-Service. This will serve as an inflection point to bring blockchain technology to enterprise clientele”.

Ethereum DevCon1 Is Bringing Interesting Companies and People Together… For a Better FutureAlready, it has been confirmed that not only will Microsoft be in attendance, but so will Nick Szabo. That is actually no surprise given that Szabo coined the term “smart contract” many many years ago and has become increasingly vocal on the internet as his pet idea has started to come to fruition. Smart contracts are a large part of Ethereum’s mainstream appeal, though the concept is still in the process of gaining momentum. The future prospects of robots and computers replacing humans for certain types of jobs has always been on the fringe of human imagination. The more you think about smart contracts, the more you realize that such a futuristic world couldn’t exist in a stable state without something like smart contracts. As panelists at the Money20/20 conference stated:

“Cryptocurrency is the most natural way for machines to pay machines.”

Bitcoin-inspired blockchain technology, of which Ethereum definitely is, has seen a lot of validation lately. Other Bitcoin-inspired blockchain technology like BitShares is also gaining traction, though not in the form of Microsoft sponsorships. Besides the fundraising and actual release of Ethereum’s Frontier alpha and a shaky first few days, the formation of a conference is a milestone that most “altchains” never achieve – not that there was any doubt that Ethereum would make it this far, anyways. After all, even Imogen Heap has even started using Ethereum, why wouldn’t Microsoft be next?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

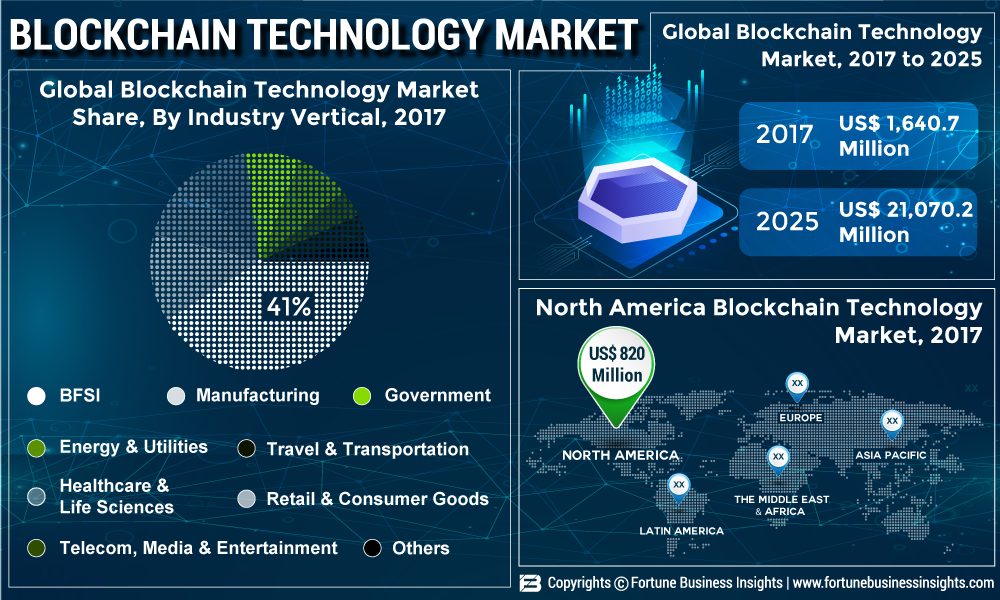

How is Blockchain Technology Market Going to Rise at High CAGR of 38.4% Till 2025?

The global Blockchain Technology Market is forecast to rise exponentially in the coming years. The market is expected to witness high demand from diverse industries, especially the banking, financial services, and insurance (BFSI) industry.

In terms of industry vertical, the banking, financial services, and insurance segment held the leading share of 41% in global blockchain technology market in 2017. The segment will gain further impetus following introduction of bitcoin. “Rampantly increasing cyber-attacks and frauds in the BFSI industry accounts for millions of dollars. This has become a global concern. To make the technology used in the industry safer and more secure, Deloitte and Microsoft Azure and other tech giants are offering blockchain services,” said a lead analyst.

In terms of deployment, the proof of concept segment is gaining traction and is expected to witness impressive growth during the forecast period 2018-2025. Growth witnessed in this segment is backed by high need of transparent transaction across industries such as healthcare, retail and BFSI.

Increasing Demand for Secure Blockchain Technology to Guarantee Growth at Promising Rate

“Government initiated awareness programs regarding benefits of blockchain technology among undeveloped nations is anticipated to fuel the demand in the global blockchain technology market“, said a lead analyst at Fortune Business Insights.

Increasing adoption of e-financial services and rapid adoption of the blockchain technology in developed nations are expected to drive the global blockchain technology market during the forecast period.

Increasing number of new blockchain products and their approval grants is also anticipated to act as a driving factor for the global Blockchain technology market.

Partnerships Among Key Market Players and Blockchain Developers Driving the Market in North America

North America emerged dominant in the global blockchain technology market in 2017. The North America market was worth US$ 820 Mn in 2017. The region will continue leading the market at a global level through the forecast period. Growth witnessed in the market is also attributable to recent collaborations between market players in the U.S. and blockchain service provides. Europe is also anticipated to witness impressive growth during the forecast period owing to high presence of blockchain technology developers.

In 2017, IBM was the leading organization in the global Blockchain technology market. Other companies operating in the global market are Oracle Corporation, Deloitte, Microsoft Corporation, IBM Corporation, The Linux Foundation, Chain Inc., Consensus Systems, Bits, Inc (Tendermint, Inc.), Schvey, Inc. (Axoni), VironIT, Altoros, and Fintech & Blockchain Software House.

Source: https://www.fortunebusinessinsights.com/industry-reports/blockchain-technology-market-100072

Open your free digital wallet here to store your cryptocurrencies in a safe place.

4 Places Where Bitcoin Can Actually Be Used

Bitcoin has transitioned into a stage of its evolution at which it is viewed almost entirely as a commodity. We discuss how to store it, compare it to gold, consider its long-term value, and generally treat it as a financial asset – even, to some extent, like a stock. This is perfectly appropriate given that the cryptocurrency’s volatility, as well as constantly wavering government positions on regulation, have kept it from being adopted as a widely used currency. The argument is over as to whether it is “more” currency or “more” commodity. It is the latter.

What sets bitcoin apart in some respects though is that it never did have to be one or the other. Consider the comparison to gold again. You may hold a stash of gold as a long-term protection of a chunk of your assets, and with the hope that it will appreciate in value. But you can’t exactly buy something online by chipping off a piece of gold (which in most cases you don’t even hold in a physical sense) and handing it over. This is true of most major investable commodities – but it is not true of bitcoin. As you’re likely aware, there are still places that it can be used like ordinary money, even though it is best viewed as a long-term vehicle.

For those interested, the following are among the most noteworthy places you can actually use the cryptocurrency for practical purposes.

1.) Travel Booking Websites

Bitcoin made something of a loud entry into the travel booking business when it was accepted by Expedia and Air. These were among the biggest or at least best known companies to embrace cryptocurrency early on, and even though Expedia has since renounced cryptocurrency, the notion of using bitcoin for travel-related costs caught on. Travel platforms accepting bitcoin or other cryptocurrencies still include various air travel and hotel booking companies, which means people are free to address what are often some of their biggest expenses in a given year via cryptocurrency.

2.) Microsoft Gaming

Fairly early on in bitcoin’s expansion to the mainstream, it was attached to video games, not necessarily through Microsoft so much as Steam. An online service that allows people to download a gigantic range of games, Steam was in some ways a perfect vehicle for purely digital transactions. However, the services topped accepting bitcoin due to volatility. In the meantime, Microsoft kept right on accepting cryptocurrency and is now one of the more significant companies doing so. In particular, Xbox-related purchases through Microsoft platforms can be conducted via bitcoin.

3.) Gaming

gaming is an interesting category, because it is almost like its own separate gaming industry. It’s comprised of and table games, digital slot arcades, roulette, and more, and in some cases a site will also have an included sportsbook. Payment options vary greatly, with some sites requiring credit card information and others using payment processors; in some cases, games are presented for free play as well. However, there is now a small but growing list of online sites that do take cryptocurrency deposits, and which also issue crypto payouts. It’s not a stretch to say that in short time bitcoin could be the norm for this particular form of entertainment.

4.) Shopify

Shopify is a more specific mention here, but feels like one of the more significant areas for bitcoin adoption, simply because it represents a busy, peer-to-peer marketplace. The fact that bitcoin can be used to buy goods via Spotify indicates that in some cases people prefer it when dealing with other people, rather than companies, and opens the door to all kinds of potential crypto marketplaces in the future.

Open your free digital wallet here to store your cryptocurrencies in a safe place.