Search Results For: dao

Welcome to the Universal Wallet and Exchange, Digixdao.

If you thought about holding or exchanging DGD Token, now you can do so directly with your HolyTransaction Universal Wallet.

It’s now possible to add DGD wallet to your dashboard and use it to access and exchange 26 different crypto, instantly. Everything in one account.

Now you are free to store DGD on HolyTransaction, transfer them to any other wallet, and make crypto-to-crypto transfers from and to DGD. All HolyTransaction customers can create a new address for their own DGD Token Wallet.

DGD Wallet features

Just like Bitcoin and all the other 25 digital currencies supported, you can now:

• Send DGD Token to any address, even to addresses of other crypto, with instant conversion on the fly;

• Receive transactions;

• Exchange DGD Token with any supported coins;

• Make instant transactions between HT users;

• Get real time exchange rates on the website;

• Set OTP for additional protection.

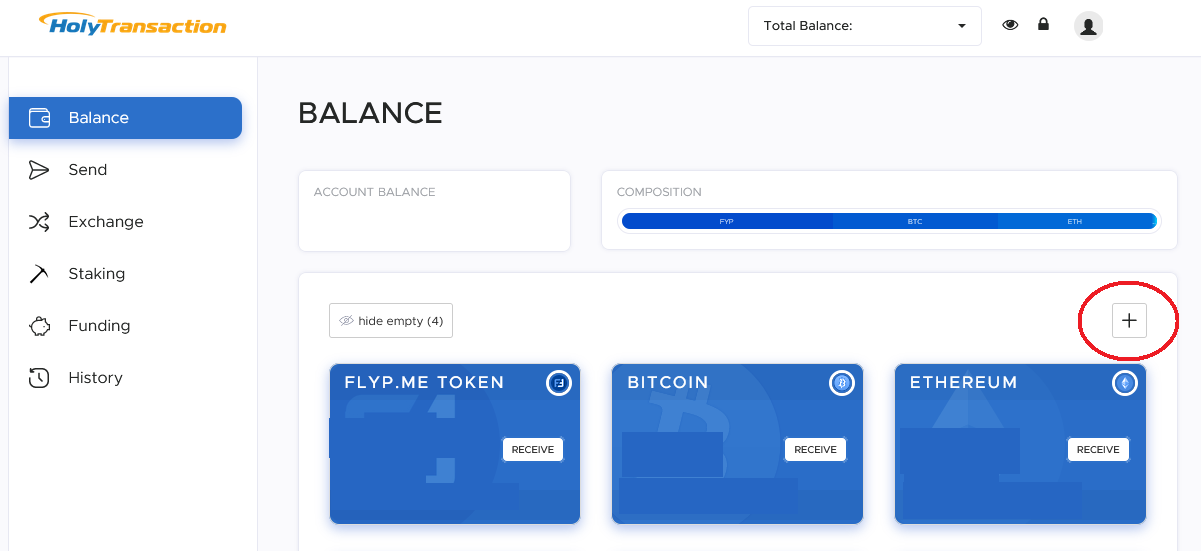

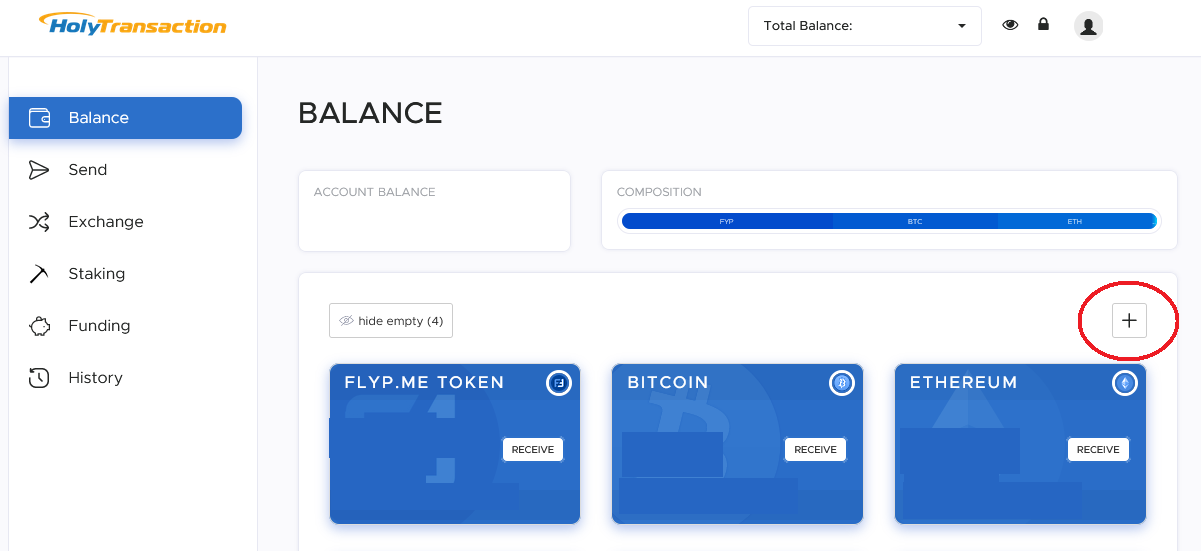

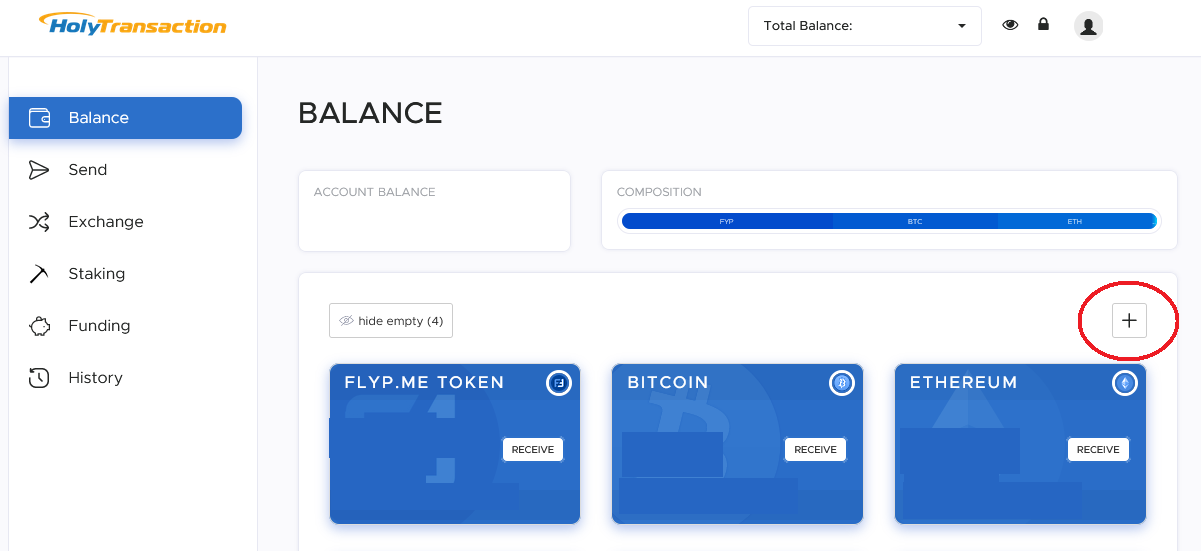

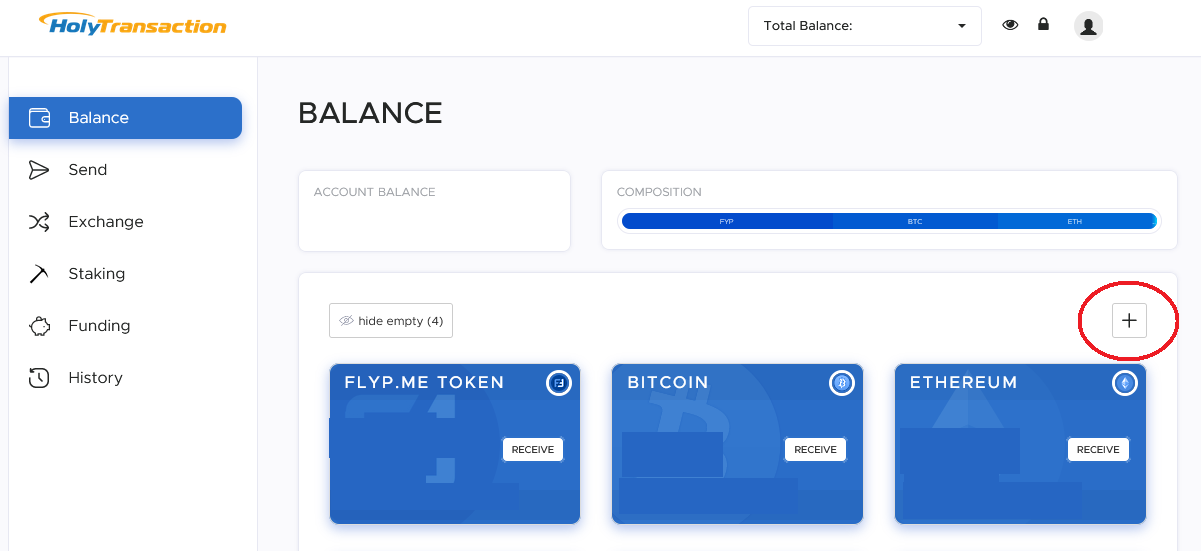

If you are not able to see your newest DGD Wallet, you just need to click on the “plus” button on the top right of the balance page, once you successfully login into your own wallet.

About DigixGlobal and DigixDAO:

DigixGlobal is the first organization built on Ethereum that tokenizes physical assets onto the Ethereum blockchain, specifically 99.99% London Bullion Market Association (LBMA) approved Gold bars through our Proof of Asset (PoA Protocol). They anticipate that synergies amongst all Decentralised Applications (DApps) on Ethereum will eventually lead to an increased volume of Digix Gold tokens.

DigixDAO is a suite of smart contract Decentralized Autonomous Organization (DAO) software created and deployed by DigixGlobal on the blockchain, and aims to work with the community to govern and build a 21st century gold standard financial platform on Ethereum. It wants to establish a standard in being an open and transparent organization using the power of Ethereum smart contracts, such that DigixDAO token holders can directly impact decisions dedicated to the growth and advocacy of the DigixCore Gold Platform. In return, token holders are able to claim rewards of transaction fees on DGX from DigixDAO every quarter on the Ethereum platform.

All raised Ethers will be kept in a publicly disclosed Ethereum address. The DAO will have a project pledging mechanism in place, where token holders are eligible to pledge their approval /rejection of project proposals suggested by DigixGlobal, before any of the raised ETH can be unlocked from the DAO’s multisignature contract wallet.

DigixDAO wants the community to directly influence the allocation of raised ETH in a transparent manner. All project proposals will be uploaded onto the InterPlanetary File System (IPFS) and is publicly available. Token holders will get to pledge their support for projects on the blockchain before any of the cryptocurrency raised can be released to DigixGlobal.

They predict that their product will revolutionize the digital gold industry by providing an open and transparent asset backed token on Ethereum.

A selection of key terms for understanding:

DigixDAO Token (DGD): DGD Token entitles you to pledge for project proposals at Digix and allows you to claim a reward on transaction fees collected on the system every quarter. They are divisible to 9 decimal placings and are transferrable.

Gold Asset Ownership Card: A digital Gold asset card issued to the purchaser of a Gold bar as listed on the Digix Web Application marketplace.

Pledging: Every DGD token automatically entitles the holder to pledge on proposals that are submitted by Proposers or Digix Developers. Your pledge significance is directly proportional to the amount of DGD tokens held in your ethereum address.

Proposer’s Badge: The Proposer’s Badge entitles the Proposer to formally propose a project or a feature he/she will like to see on the Digix platform. For example, it could be as simple as an add-on button feature, a live Gold visual chart or an additional product offering. Proposer badges also allow you to vet on other Proposer’s projects. Proposer badge significance is directly proportional to the number of badges you hold in your ethereum address. Proposer badges are different from pledging.

Number of DigixDAO (DGD) tokens in existence:

2,000,000 DGD tokens.. DGD Token ownership is transferable to anyone who has an Ethereum Wallet.

Source: https://bravenewcoin.com/assets/Whitepapers/digixdao-info.pdf

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ethereum Hard Fork to prevent another DAO collapse

A new Ethereum Hard Fork to prevent attacks

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why the Ethereum DAO collapse is good for the cryptocurrency

The news of the Ethereum DAO hacker attack is riding high and of course it brings lots of damages for the ethereum investors who stored about $150m of the cryptocurrency.

Universal Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why the Ethereum DAO collapse is good for the cryptocurrency

The news of the Ethereum DAO hacker attack is riding high and of course it brings lots of damages for the ethereum investors who stored about $150m of the cryptocurrency.

Ethereum DAO: what happened?

Universal Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction supports five new crypto assets

HolyTransaction has added five new crypto assets to the platform: USDC, MANA, ENG, ANT, and LINK.

USD Coin (USDC) is a fully collateralized US dollar stablecoin. It is an Ethereum powered coin and is the brainchild of CENTRE,

Decentraland (MANA) defines itself as a virtual reality platform powered by the Ethereum blockchain. In this virtual world, users purchase plots of land that they can later navigate, build upon, and monetize. Decentraland uses two tokens: MANA and LAND.

Enigma (ENG) is a crypto platform that’s trying to solve the problem of privacy on the blockchain by giving access to data storage and privacy while remaining scalable. Enigma aims to extend Ethereum Smart Contracts by introducing secret contracts.

Aragon (ANT) is a decentralized platform built on the Ethereum network that offers a modularized way to create and manage dApps, cryptoprotocols, and decentralized autonomous organizations (DAO). The ANT ERC-20 token will enable its holders to govern the Aragon Network.

Chainlink (LINK) connects decentralized peer-to-peer networks and smart contracts to real-world data, events, and payments. Since blockchains cannot access data outside their network, oracles (a defi instrument) are needed to function as data feeds in smart contracts.

To create your web wallet you don’t need to have a bank account, so you can set it up in just one minute.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet Maker: MKR token is available on HolyTransaction

As of today, you can instantly purchase MKR on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet MKR and more than other 30 cryptocurrencies.

MakerDAO it’s a prime example of Ethereum’s smart contract platform.

Maker is a decentralized autonomous organization on which the MKR token and DAI operate, and it is built on Ethereum. Essentially, it exists to reduce the price volatility of the Dai against the US Dollar. MakerDAO’s native cryptocurrency token is MKR, which can be stored on HolyTransaction now.

Dai and MKR are dependent on each other to operate, Dai offers stability, while MKR offers involvement and potential on MakerDAO.

As the technology and methodology behind MakerDAO continues to progress the future of stablecoins and DAO are certain to bring interesting evolution to the cryptocurrency economy.

All HolyTransaction customers can create a new address for MKR and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

- Send MKR to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange MKR with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

To add Wallet Storj just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the STORJ community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, STORJ, Monero and MakerDAO among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet Monero: how to store XMR

As of today, you can instantly purchase Monero on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet Monero and more than other 30 cryptocurrencies.

Monero (XMR) was released in April of 2014, it was originally called BitMonero and launched as a preannounced and fair launch of the CryptoNote reference code. Since its original launch, Monero has migrated the blockchain to another database structure, improving flexibility and efficiency. The developers also set minimum ring signature sizes to make all transactions private, and RingCT was added. Almost every improvement made so far has made Monero easier to use or enhanced its security and privacy. The cryptocurrency was founded by Riccardo Spagni alongside 6 other developers, 5 of whom have decided to remain anonymous till date, but more than 240 have contributed to the code.

All HolyTransaction customers can create a new address for XMR and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

- Send XMR to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange XMR with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

To add Wallet Monero just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the XMR community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, STORJ and Monero among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet Storj: STORJ token joins HolyTransaction

As of today, you can instantly purchase Storj on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet Storj and more than other 30 cryptocurrencies.

The Storj project provides for a decentralized cloud storage facility and is originally pronounced as “storage“.

Storj’s main aim is to rent a space on the secondary storage devices of the members of its network and pay them in cryptocurrency, for their service they provide. Therefore, Storj’s native cryptocurrency token is STORJ, which can be stored on HolyTransaction now.

“The main difference between Storj and other decentralized cloud storage platforms is that Storj only uses blockchain to manage payments and not to store data. This is due to the high cost and slow speeds found in blockchains. For example, even the fastest blockchains process data/payments in seconds. Meanwhile, traditional cloud storage solutions, like Amazon S3, can store files in milliseconds – many orders of magnitude faster than even the fastest blockchains.”

Shawn Wilkinson (Founder of Storj)

The Storj platform offers online storage similar to Dropbox or Google Drive, but does so over a distributed network. Renting out unused extra space on our hard drives is referred to as, Farming, for instance. The process as simple as downloading a client from the network, choosing the amount of space to be rented, and a wallet address to store the incentives received in the form of cryptocurrency.

All HolyTransaction customers can create a new address for STORJ and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

- Send STORJ to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange STORJ with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

To add Wallet Storj just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the STORJ community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, and STORJ among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet Cardano: how to store ADA

We are excited to announce our new Wallet Cardano.

Cardano is a cryptocurrency with a different infrastructure-level design than Bitcoin and Ethereum. In addition it benefits from having (IOHK), a fully-funded development team led by Charles Hoskinson.

The organization behind the project is the Cardano Foundation that selected a well-known think-tank to to enhance the research program of the Protocol of Cardano and Ada. As a result, Cardano did not begin with a comprehensive roadmap or even an authoritative white paper. Cardano is a project that involved feedback from hundreds of the brightest minds inside and outside of the cryptocurrency industry.

You can instantly purchase ADA with more 30 cryptocurrencies in your HolyTransaction wallet and send them to any HolyTransaction’s user for free.

Therefore, HolyTransaction’s customers can create a new address inside their account and use HolyTransaction Wallet to send, receive transactions and to instantly convert them to any other supported cryptocurrency.

Just like Bitcoin and the other 30 cryptocurrencies we currently support, you can now:

- Send ADA to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange ADA with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

To add your ADA address, click on the “plus” at the top right of the balance page. You can use the “plus” to select the wallets you want to see in the dashboard, for instance:

We are honoured to be part of this new community!

NOTE: HolyTransaction Web Wallet can store more than 25 digital currencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD and Cardano, among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Welcome to the Universal Wallet, DAI Stablecoin.

If you thought about holding or exchanging DAI Stablecoin, now you can do so directly with your HolyTransaction Universal Wallet.

It’s now possible to add DAI wallet to your dashboard and use it to access and exchange 24 different crypto, instantly. This is just one of the many recent adoptions, which brought the number of cryptocurrencies accepted on our platform to 24.

Now you are free to store DAI on HolyTransaction, transfer them to any other wallet, and make crypto-to-crypto transfers from and to DAI. All HolyTransaction customers can create a new address for their own DAI Wallet.

DAI Wallet features

Just like Bitcoin and all the other 23 digital currencies supported, you can now:

• Send DAI to any address, even to addresses of other crypto, with instant conversion on the fly;

• Receive transactions;

• Exchange DAI with any supported coins;

• Make instant transactions between HT users;

• Get real time exchange rates on the website;

• Set OTP for additional protection.

If you are not able to see your newest DAI Wallet, you just need to click on the “plus” button on the top right of the balance page, once you successfully login into your own wallet.

About DAI:

DAI is a cryptocurrency that is price stabilized against the value of the U.S. Dollar. DAI is created by the Dai Stablecoin System, a decentralized platform that runs on the Ethereum blockchain.

With DAI, anyone, anywhere has the freedom to choose a money they can place their confidence in. A money that maintains its purchasing power.

MKR holders govern Dai

Maker is a decentralized autonomous organization on the Ethereum blockchain seeking to minimise the price volatility of its own stable token — the DAI — against the U.S. Dollar.

Maker smart contract platform controls and sells Dai. Indeed, decentralised and trustless, the Maker platform stabilises the value of Dai to one U.S. dollar using external market mechanisms and economic incentives.

Eliminating the necessity to trust a centralised organisation and the hassle of third-party audits, Maker offers a transparent stablecoin system that is fully inspectable on the Ethereum blockchain.

Maker’s Dual Coin System

The Maker Platform has two coins: Maker (MKR) and Dai (DAI).

Maker – A token with a volatile price that is used to govern the Maker Platform. Maker DAO is a decentralized autonomous organization within the Ethereum blockchain. Maker works to minimise the volatility of DAI, its stable token, compared to the U.S. dollar, with holders of MKR tokens governing DAI.

DAI – A price stable coin that is suitable for payments, savings, or collateral. With DAI, the team at MKR hopes to overcome the extremely volatile prices of cryptocurrency. The team at Maker DAO feels that stablecoins are necessary to let blockchain technology reach its full potential. Because of this, it introduced DAI, which is backed by ETH collateral.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

” width=”400″ height=”232″ border=”0″ />

” width=”400″ height=”232″ border=”0″ />