Search Results For: bank

The Role of Cryptocurrency in the Unbanking of the World

Introduction: The Financial Revolution of Cryptocurrency

The world is undergoing a transformative financial revolution, driven by the rapid rise of cryptocurrency. More and more people are beginning to question the traditional banking system’s ability to meet their financial needs, and they are turning to cryptocurrency as an alternative. With its decentralized and transparent nature, cryptocurrency has the potential to unbank the world and provide a more inclusive and autonomous financial system.

Autonomy and Control: Cryptocurrency’s Appeal over Traditional Banking

One of the primary reasons individuals are flocking towards cryptocurrency is the level of autonomy and control it offers. Unlike traditional banking, where transactions are intermediated by banks, cryptocurrency transactions are peer-to-peer, eliminating the need for intermediaries. This means that individuals have complete control over their funds without having to rely on a centralized institution. This is particularly valuable for those residing in countries with unstable or corrupt governments, where traditional banking systems may be unreliable or untrustworthy. Cryptocurrency empowers individuals by giving them full ownership and control over their finances.

Transparency and Financial Inclusion: Cryptocurrency’s Impact on Corruption and Accessibility

Transparency is another significant advantage of cryptocurrency. All transactions made on the blockchain are recorded and publicly visible, ensuring a high level of transparency. In contrast, traditional banking systems often operate behind closed doors, making it difficult for individuals to track and verify their transactions. The increased transparency facilitated by cryptocurrency has the potential to reduce corruption and increase financial inclusion by creating a level playing field where transactions can be easily audited and verified.

Financial inclusion is a critical aspect of the cryptocurrency revolution. According to the World Bank, over 1.7 billion adults globally lack access to formal financial services. Cryptocurrency offers a viable solution for these unbanked and underbanked individuals. It doesn’t require a traditional bank account or credit history, enabling even those excluded from the traditional banking system to participate in financial activities such as savings and investments. By leveraging cryptocurrency, individuals who were previously financially excluded can now access the benefits of a global financial system.

Cost Efficiency and Accessibility: Cryptocurrency’s Advantages for Underbanked Individuals

Moreover, cryptocurrency has the potential to provide financial services in a more cost-effective and efficient manner compared to traditional banking. Transactions conducted through cryptocurrency networks are typically faster and have lower transaction costs compared to traditional banking channels. This is especially crucial for individuals living in remote or underdeveloped areas with limited access to banking services. Cryptocurrency can bridge the gap by providing a means for these individuals to participate in the global economy without incurring exorbitant fees or enduring lengthy transaction times.

A More Inclusive Society: Cryptocurrency’s Role in Shaping Financial Autonomy

As cryptocurrency continues to gain momentum, it plays a pivotal role in unbanking the world and creating a more inclusive society. Its decentralized nature and borderless accessibility enable individuals to exercise greater financial autonomy and control. By circumventing the limitations of traditional banking systems, cryptocurrency empowers individuals to take charge of their financial futures.The unbanking movement facilitated by cryptocurrency not only empowers individuals but also has the potential to reshape the global financial landscape. As more people adopt cryptocurrency, the traditional banking system faces a significant disruption. The shift towards cryptocurrency challenges the established norms, providing an alternative financial system that is more inclusive, transparent, and accessible to all.

To conclude, the financial revolution brought about by cryptocurrency is unbanking the world and redefining the way we perceive and engage with money. With its decentralised nature, transparent transactions, and borderless accessibility, cryptocurrency offers autonomy and control to individuals, especially those in regions with unreliable traditional banking systems. Additionally, it promotes financial inclusion by providing services to the unbanked and underbanked populations while offering cost efficiency and global connectivity. The future holds immense potential for cryptocurrency to create a more inclusive society, fostering financial autonomy and enabling individuals to participate in the global economy on their own terms.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Tokenized Gold Tops $1 Billion Market Cap Amid Banking Crisis Concerns

Tokenized Gold Market Cap Surpasses $1 Billion

Tokenized gold has recently achieved a significant milestone, with its market capitalisation surpassing $1 billion amid growing concerns about the stability of the banking system and increasing interest in alternative investments. Tokenized gold refers to digital tokens that represent ownership of physical gold, providing investors with a way to trade and hold the precious metal in a digital format.

Alternative Investments Gaining Popularity

Investors have been seeking alternatives to traditional investments such as stocks and bonds, which have experienced significant volatility in recent years. As a result, they have increasingly turned to alternative assets such as cryptocurrencies and tokenized assets like gold as a means of diversification and hedging against market volatility.

Benefits of Tokenized Gold Over Physical Gold

Tokenized gold has gained popularity due to its ability to provide investors with exposure to physical gold without the logistical challenges of storage and transportation. Unlike physical gold, which requires secure storage and transportation, tokenized gold can be easily traded and held in digital wallets. This convenience makes tokenized gold accessible to a wider range of investors and removes many of the barriers to entry associated with investing in physical gold.

In addition, it also offers greater transparency and accessibility than traditional gold investments. Investors can track the movement of the underlying physical gold and verify the authenticity of the tokens, mitigating concerns around the integrity of the traditional gold market such as counterfeiting and price manipulation. This increased transparency and accessibility makes tokenized gold a more appealing investment option for investors looking for a more secure and trustworthy way to invest in gold. The recent surge in the market capitalisation of tokenized gold is also a reflection of concerns around the stability of the banking system amidst the ongoing global financial crisis. Governments around the world are injecting trillions of dollars into their economies to combat the economic fallout from the COVID-19 pandemic, leading to concerns about the long-term impact on inflation and the stability of the banking system.

Historically, gold has been viewed as a safe-haven asset during times of economic uncertainty, and tokenized gold offers investors a way to access the benefits of physical gold without the logistical challenges. In this sense, tokenized gold may be seen as a form of digital gold, providing investors with a means of diversification and hedging against the potential risks of inflation and financial instability.

Risk and Potential Downsides

However, as with any investment, tokenized gold carries its own risks and potential downsides. One of the primary concerns around tokenized gold is the potential for fraud and the lack of regulation in the industry. As with any emerging industry, there are risks associated with investing in tokenized gold, and investors should conduct thorough research and due diligence before investing.Another concern associated with tokenized gold is its correlation with the price of physical gold, which can be volatile in its own right. While tokenized gold may provide investors with exposure to physical gold without the logistical challenges, it is important to remember that it is still a speculative investment and subject to the same risks and potential downsides as any other investment.

Despite these concerns, the increase in the market capitalization of tokenized gold is a positive development for the broader digital asset market. It provides further evidence of the growing interest in digital assets as an alternative to traditional investments and highlights the increasing importance of tokenization in the financial industry. Tokenization has the potential to transform the way we invest and trade assets. By creating digital representations of physical assets, tokenization removes many of the barriers to entry associated with traditional investments and provides investors with greater transparency and accessibility.

Final Thoughts

To conclude, the recent surge in the market capitalization of tokenized gold is a reflection of the growing interest in alternative investments and the potential benefits of tokenization in the financial industry. While tokenized gold may not be suitable for every investor and carries its own risks, it represents a significant development in the broader digital asset market and highlights the potential for tokenization to transform the way we invest and trade assets. As the industry continues to mature and regulations are put in place, we are likely to see an increasing number of investors turning to tokenized assets like gold as a means of diversification and hedging against market volatility.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Blockchain Technology is Changing the Banking Industry Forever

By far the biggest threat to banking in, well, living memory, has been blockchain technology. More specifically, cryptocurrency, but we’ll focus on the technology as a whole since this is what has been driving the movement.

All the tech companies in the world have been using it, including Google, Facebook, Apple, and Amazon, and a vast number of FinTech services, which is why it’s being seen as such a threat to traditional banks, but why is this happening?

What’s so important about blockchain?

In today’s post, we’re going to explore how and why blockchain technology is making such a big difference to the traditional banking format, and how the future of this industry is looking.

Source: Adarsh Goldar

How Blockchain Technology is Changing Payments

First and foremost, and by far the biggest form of change that blockchain is bringing into the world, is how financial payments are made and the way modern-day payment systems work. Whereas traditional banks can take a few working days to make a payment, meaning some international payments can take a very long time, blockchain payments are instant.

Since all you need is an internet connection to make the transaction, most will be handled and completed in a matter of minutes. These transactions can happen across borders to anywhere in the world, are extremely secure (especially when compared to traditional methods) and happen pseudoanonymously.

Due to the nature of blockchain technology, the costs involved in these transactions are usually very small, typically only several cents per transaction. This means that sending money across to the other side of the world is far cheaper than traditional wire companies, such as Visa or Western Union.

In the same way, remittances are also changing. Whereas overseas remittances are expensive and long-winded, with high processing times and the fact the money can be stolen, taxed, or subject to legal issues along the way, a blockchain process basically eradicates all these issues. There are dozens of companies already set up and operating to offer these services.

The Way Account Managing and Deposits are Handled

In the traditional way the world works, consumers tend to use banks to hold money in either their savings or checking accounts. Then, the bank will loan out the money being held to make money on top of the money you’re saving, and the cycle continues. This means when you look into your bank account, much of the money you have isn’t actually being held by the bank, but instead is out in other people’s accounts as loans.

If every customer of a bank went to the bank and withdrew everything they had, the bank would collapse. It’s a very fragile system that many consumers are unaware of. However, while this system isn’t going to change any time soon, blockchain technology can make the management of this system far more effective.

Due to the benefits that blockchain technology provides, these account ledgers are far more secure, far more reliable, and far more accessible. This means banks can accurately manage their ledgers to ensure that they aren’t taking out too many loans and will actively help reduce the risk of bank run, or the system crumbling.

A Reduction in Fraud

Fraud has always been a problem in the financial industry, and it costs people around the world billions of dollars every single year. However, for the similar benefits, we’ve spoken about above, blockchain is making things far more secure.

Since the vast majority of traditional banks are set up and organised around a centralised system, malicious people can target the centralised system to commit the acts of fraud. While there have been many measures to make the system as secure as possible, this isn’t fall-proof, and statistics show around 45% of all financial institutions are prone to fraud attempts.

Blockchain is a decentralised system, which means it’s everywhere and nowhere at the same time, which makes it incredibly difficult to fraud and theft to take place. There’s no single point of access like there is with a centralised banking system and trying to get into such a system means diving into layer upon layer of encryption, all spread out in hundreds of thousands of locations.

What’s more, every single change that takes place on the ledge is capable of being seen by every other person and system that has access to the ledger. This means if any fraudulent activity takes place, everyone can see it instantly and correct it. This will help protect people’s money and keep the system afloat.

Katherine Rundell is a finance writer at Academic Writing Services and Essay Writing Services. She writes about blockchain and banking and aims to help the world get educated about finances in a time where they can seem so out of control.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How to buy Bitcoin with bank account

How to buy bitcoin with bank accounts? Read this step-by-step guide to convert your fiat currencies into your favorite digital currency.

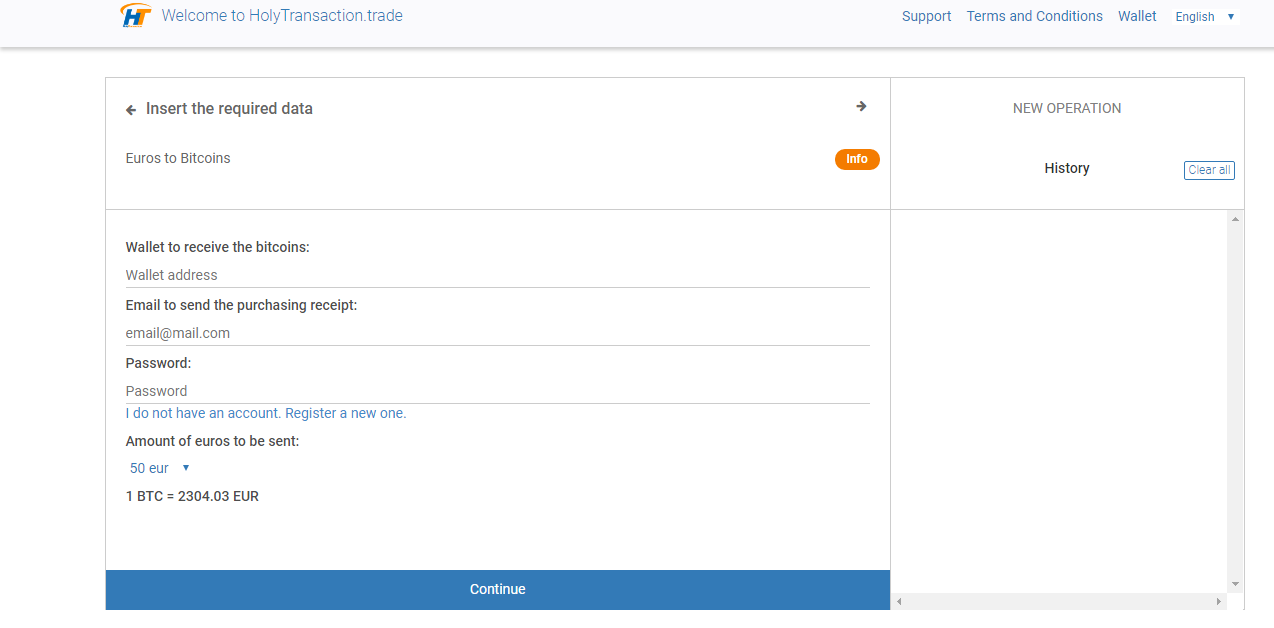

We recently opened a new service called HolyTransaction where you can buy and sell bitcoins.

This is an important feature when you need to buy or sell bitcoin immediately. You just need to create an account on HolyTransaction.

You just need to visit HolyTransaction and follow the process you can read below.

This guide will enable you to buy bitcoin with bank account.

- Visit the Funding page inside your account;

- Choose your method (bank transfer in this case)

- Click on the blue “Deposit” button;

- Fill the form with your information

5. Insert the amount that you want to transfer for your purchase and then click “Next”

6. Wait for the validation of your order. This process of verification will one or two minutes.

6. Then you will need to pay the amount of EUR you decided, so you need to order the bank transfer from your bank account. You will see the IBAN where you need to send the fiat currency to and you must include the reference.

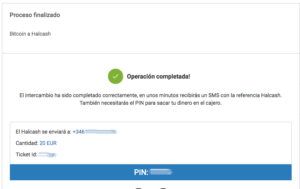

7. Then you will see a countdown that starts from 48h. At the end of that, the operation will be completed. You will see a similar image as shown below:

NOTE: the max amount you need to buy daily is 4500 EUR. Bank transfer needs 48h to be received.

Open your account on HolyTransaction here

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Kazakhstan’s Central Bank to use Blockchain for Debt Notes

The National Bank of Kazakhstan announced it is looking to test blockchain technology in order to sell short-term debt notes.

In an official statement published today, the Kazakhstan central bank revealed its plan to launch a new mobile app that to sell the short-term debt notes to investors– denominated in amounts worth 100 tenges (the national fiat currency) – without relying on third-party brokers.

At the moment, this app is being tested within the bank, and its launch is expected by the end of 2017.

In the long term, the Kazakhstan bank commented that the app could be used to make initial public offerings (IPOs) easier.

Also, the financial institution explains it wants to work with the country’s banking industry on possible future versions and uses.

“In this area, the project will continue to search for additional solutions, including the involvement of commercial banks,” the statement explained.

The Central Bank explained that it has been looking at the distributed ledger for potential applications since 2016.

A few months ago, regional news source called Tengri News reported that officials were studying possible blockchain use cases, especially those focused on payments.

Read more about blockchain-related projects developed by banks.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin Russia: a new law proposition by Russia’s Central Bank

The Bitcoin Russia saga is continuing to move on, as the Russia’s Central Bank is writing a new law focused on digital currencies.

Reports suggest that the Bank of Russia is looking to recognize digital currencies as digital goods, so they will be subjected to regular taxation.

Also, this law will include info on how the government will keep an eye on and regulate domestic marketplaces.

According to Bloomberg and RBC, in fact, deputy governor of the Bank of Russia, Olga Skorobogatova discussed her institution’s work on new legislation.

On May 25th, Skorobogatova explained that legislation could be introduced in the Russia’s national legislature – or the so- called Duma – in June.

Digital currencies “should be regulated, because volumes are increasing compared to the previous year. If people are engaged in this, they have to pay money for it, and we have to have a clear understanding of how to control this activity”, explained Skorobogatova, according to a recent report published by Bloomberg.

So, Russia is moving ever closer toward some kind of legislative framework for bitcoin and other digital currencies.

Initially, the government seemed to want to take a contrary stance on the creation of issuance of the money surrogates and Russian officials revealed their idea to ban bitcoin as illegal.

That position has changed during the recent months, and the enthusiasm on the blockchain started to increase among both officials from the Bank of Russia as well as the Russian government.

For example, Prime Minister Dmitry Medvedev pushed for research into public applications of the distributed ledger tech.

Read more about Bitcoin Russia regulation here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin regulation is necessary for its success, said Bank of Canada

According to a recent paper published by Bank of Canada, researches explain that Bitcoin regulation is necessary for it to reach worldwide success.

A paper published this week, in fact, suggests that digital currencies like bitcoin won’t succeed in the long-term without any government support.

To write this research, experts examinated the viability of virtual currency, looking to previous examples of Canadian currency such as the so-called “Dominion” as a guide.

This is not the first time Bank of Canada is involved in blockchain and bitcoin-related projects.

A few months ago, in fact, we saw Bank of Canada involved in the so-called “Project Jasper” to develop a prototype system for issuing a bank-backed digital currency and a payment system using the technology.

While we are still waiting to know more details about Project Jasper, the just released paper explains a common thinking among central banks on the topic of cryptocurrencies: bitcoin and other private digital currencies need goverment support to succeed.

“We conclude that well designed and managed private digital currencies could circulate widely but only with appropriate government regulation to ensure their safety, soundness, and uniformity.”

Bank of Canada has already expressed its concern about digital currency, saying a few years ago that digital money popularity could reduce the effectiveness of monetary policy.

“A central bank can always get its digital currency into circulation, but its digital currency will not necessarily drive out existing private digital currencies,” wrote the authors of the paper.

Bitcoin regulation worldwide

From Poland to Denmark, from Switzerland and Japan, several countries all around the world are working on Bitcoin regulation projects.

Recently European Commission created also a task force to study and regulate digital currencies and the blockchain within the whole country.

Click here to read more about Bitcoin regulation in Europe and beyond.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Central Bank of Russia works on the Blockchain

Central bank of Russia is continuing to work and study blockchain applications, having announced the creation of a new FinTech group focused in part on the distributed ledger.

Officially formed on 28th December 2016, the Russian group includes representatives from several important Russian banks including Alfa Bank, Sberbank and VTB. Also, it includes payments processor Qiwi and the National System of Payment Cards (NSPK).

Earlier this week, the company said Qiwi CEO Sergey Solonin will be the association’s new chief.

In addition to the blockchain, Central Bank of Russia explained it will also investigate identification technologies and new payment system frameworks within the group.

Olga Skorobogatova, or the bank’s deputy governor, explained in an official statement:

“The Association’s key objectives will include the development and introduction of new technological solutions to ensure the development of the Russian financial market. It will also promote digitalisation of the Russian economy.”

This news reveals that Bank of Russia intends to play a leading role in the test and development of blockchain applications within the country and not only. Its interest in the technology is not a secret.

Recenlty, the Russian central bank has been undertaking a hands-on education into the ledger, announcing a new system for financial messaging called Masterchain back in October to improve its national payment system.

Also, the Russian government has been exploring the blockchain and it announced that Bitcoin is not an illegal method of payment.

Click here to read more news about Russia and Blockchain.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

France Bitcoin Tests by the Central Bank

France Bitcoin tests have been revealed by the French Central Bank last week.

The Banque de France published a press release on Friday where it talks about its technology tests for use in the management of SEPA Credit Identifiers.

According to the French central bank, one of the key participants in this project is the Caisse des Dépôts et Consignations, and the Paris-based startup called Labo Blockchain.

The project began in July 2016 and culminated in October with the creation of prototypes for creating and managing SEPA Credit Identifiers.

The central bank also explained how meetings were held with stakeholders as the project moved forward, indicating that more details about the project will be revealed in 2017.

France Bitcoin project and more central bank efforts

This is not the first time a central bank test the distributed ledger.

A few months ago, in fact, central banks in Japan, Sweden and Singapore launched similar projects.

Also, earlier this month, the US Federal Reserve published its first major research paper on the ledger you can read here.

Credits: Coindesk.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Saxo Bank Bitcoin Prediction for 2017

Today the Danish investment bank published its Saxo Bank Bitcoin Prediction for 2017, where it explains that wouldn’t be surprised if the bitcoin price will see huge growth during next year.

Saxo Bank, in fact, recently published its annual “Outrageous Predictions for 2017”, a list of speculations that represent its effort to get financial industry think about more possibilities and revolutionary projects for the next year.

In addition to the prediction that UK will not actually leave the European Union (EU) and that Italian equity prices will soar thanks to the European Union led bailout, Saxo Bank affirmed that the bitcoin price will reach a value of more than $2,100 by the end of 2017.

Among its reasons the prediction explained that the American President’s administration might cause turbulence in the American economy, so this can be a good reason for people to invest in digital currencies like bitcoin.

Saxo Bank Bitcoin prediction explains:

“If the banking system as well as sovereigns such as Russia and China move to accept bitcoin as a partial alternative to the USD and the traditional banking and payment system, then we could see bitcoin easily triple over the next year going from the current $700 level to +$2,100 as the block-chains decentralised system, an inability to dilute the finite supply of bitcoins as well as low to no transaction costs gains more traction and acceptance globally.”

Altough this Saxo Bank prediction doesn’t represent an official position, it is not the first bullish indication the bank has made during its career.

In 2014, then-current CEO Lars Seier Christensen explained his personal interest in bitcoin, describing it as a great opportunity for worldwide investors.

At the time, Christensen had also mentioned about early testing of the technology within Saxo bank, although later he explained that liquidity problems at the time were keeping banks on the sidelines.

Source: coindesk.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.